If there is a vote to Leave on 23 June, minds will begin to focus on the UK’s commercial relationships with both EU and non-EU countries. Ruth Lea argues that EFTA trade agreements seem to be the best fit for the UK’s trading patterns, and appear to be superior to the current EU ones.

If there is a vote to Leave on 23 June, minds will begin to focus on the UK’s commercial relationships with both EU and non-EU countries. Ruth Lea argues that EFTA trade agreements seem to be the best fit for the UK’s trading patterns, and appear to be superior to the current EU ones.

There has been much speculation that the relationship with the EU could be, for example, the “Norwegian” option (staying in the Single Market), or the “Swiss” option (relying on bilateral trade deals), or the vanilla World Trade Organisation (WTO) option in which there would be no special deal with the EU at all. But it would be none of these options. I believe the UK would negotiate a bespoke British deal with its EU partners. I would venture that it would, at the minimum, comprise a tariff-free FTA with the EU, in order to avoid the EU’s Common External Tariff, and an agreement on “regulatory equivalence” for financial services, which would provide the City with access to the EU’s markets much as passporting does now.1 The Norwegian option, which involves the freedom of movement of labour, strikes me as a political non-starter. I would, moreover, expect such a deal to be agreed expeditiously. We would be negotiating as a completely harmonised EU member and, given our huge trade deficit with other EU countries, our EU partners would not want any disruption in their lucrative trade with us.

Brexit would, of course, change Britain’s commercial relationship with non-EU countries. One group would be those countries with which the EU currently has trade agreements though, as we discuss below, not many of them matter very much. These agreements could simply continue on after Brexit, providing all partners were satisfied. There would be no need to undertake tortuous trade negotiations. Another group would be countries with which the EU currently does not have trade agreements, including India, Australia, China and Japan. Doubtless the UK would start to negotiate bilateral agreements once out of the straightjacket of the EU’s Customs Union (which prevents us from bilaterally negotiating treaties now). But, I suggest, these negotiations would not be a matter of great urgency.

And, finally, there would be the European Free Trade Association (EFTA) which currently comprises Switzerland, Norway, Iceland and Liechtenstein. The UK was, of course, a founder member of EFTA in 1960, but left in 1973 on accession to the European Economic Community (EEC). It would be helpful to re-join EFTA after Brexit.2 Not merely would we have preferential access to EFTA’s markets, of which Switzerland and Norway are important, but there would also be access to EFTA’s trade agreements, providing all partners were satisfied, of which there are many. Crucially, as I discuss below, EFTA’s suite of trade agreements is almost certainly a “better fit” for the UK, given our trading patterns, than the EU’s. And they are arguably more comprehensive. The UK economy could be given a real boost by having access to these agreements.

The pattern of Britain’s export trade

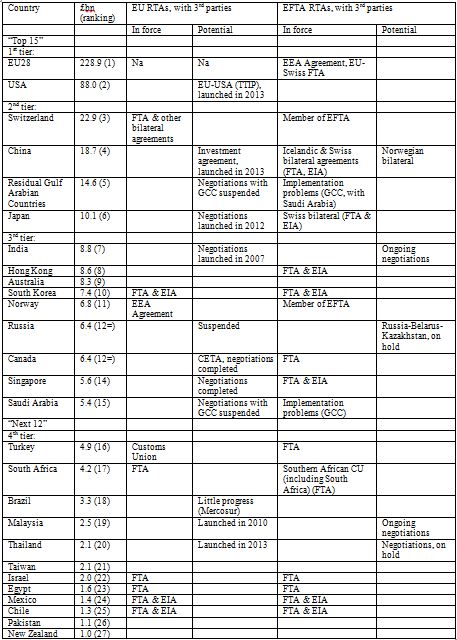

At this point it is instructive to note the pattern of Britain’s export trade. Table 1 shows that it is heavily skewed towards the EU (44.4% in 2014) and the USA (17.1% in 2014). Together they accounted for over 60% of Britain’s total exports. The next largest markets are Switzerland, China, the “Residual Gulf Arabian Countries” (as classified in the ONS’s Pink Book and comprising Bahrain, Iraq, Kuwait, Oman, Qatar, the UAE and Yemen, but excluding Saudi Arabia) and Japan. India, Hong Kong, Australia, South Korea. Norway, Russia, Canada, Singapore and Saudi Arabia comprise the next tier. These three tiers comprise the UK’s “top 15” of trading partners. And then there is a fourth tier from Turkey to New Zealand.

Table 1 The UK’s main trading partners, exports of goods & services (2014, £bn)

Sources: (i) ONS, “Pink Book, 2015 edition”, October 2015, table 9.3 (see also annex tables 3a-3c for the trade data), (ii) WTO website on RTAs, (iii) European Commission website, “Overview of FTA & other trade negotiations”, and (iv) EFTA website on trade agreements. Note: (i) FTA=Free Trade Agreements (goods), (ii) EIA=Economic Integration Agreements (also cover services), (iii) GCC= Gulf Cooperation Council, comprising Saudi Arabia, Bahrain, Kuwait, Oman, Qatar & the UAE.

EFTA’s RTAs: a “better fit” for Britain than the EU’s

Table 1 also lists the Regional Trade Agreements (RTAs) relating to Britain’s main trading partners.3,4 They are listed for both the EU and EFTA.5 Concerning the EU’s RTAs, it is apparent that most of them do not matter very much to the UK. The RTAs relating to Switzerland, South Korea and Norway are the only ones relating to the UK’s “top 15” of trading partners already in force, though negotiations have been completed for Canada and Singapore (but both agreements have yet to be ratified). Negotiations have been launched with the US, China, India and Japan but if/when they will be concluded is uncertain. Most worryingly, the EU-US Transatlantic Trade and Investment Partnership (TTIP) is making disappointingly slow progress.6 Meanwhile, negotiations have been suspended with the GCC and Russia and there are no RTA negotiations with Hong Kong and Australia (all in the UK’s “top 15”). But the EU’s deals are not without merit and, as already indicated, would probably continue on Brexit.

Turning to EFTA’s RTAs, there are agreements with Hong Kong, South Korea, Canada and Singapore in the UK’s “top 15” and, of course, if the UK re-joined EFTA there would be free trade with Switzerland and Norway. EFTA also has an RTA with the Gulf Cooperation Council, which entered into force in 2014, though there have been some difficulties with implementation.7 EFTA has ongoing negotiations with India whilst Russia-Belarus-Kazakhstan is “on hold” and there are no RTA negotiations with Australia. But, all in all, EFTA’s trade agreements are an encouragingly close “fit” vis-à-vis the UK’s current trading patterns and, therefore, of significant potential economic benefit.

EU and EFTA trade agreements: final remarks

Not merely do the EFTA trade agreements appear to be more comprehensive and a “better fit” for the UK’s trading patterns than EU ones, but there are also arguments that favour EFTA’s approach to the EU’s.

EFTA states are much less likely to be constrained by diverging interests than the EU so they can reach agreement between themselves quickly in negotiations, whereas diverging interests in the EU can lead to both delay and dilution. The Economist, for example, has commented that “…trying to satisfy all 28 of its Members means that the EU often takes years to negotiate free-trade agreements”. Unsurprisingly, EFTA has concluded trade deals relatively quickly compared with the EU in several cases.8 And on dilution, France, for example, insisted on the exclusion of the audio-visual sector, as a “cultural exception”, from TTIP.

The article gives the views of the author, and not the position of BrexitVote, nor of the London School of Economics. Image: Attribution 2.0 Generic (CC BY 2.0).

Ruth Lea CBE is Economic Adviser at the Arbuthnot Banking Group.

References

- House of Commons Library, “The economic impact of EU membership on the UK”, SN/6730, September 2013, said the EU average (trade-weighted) tariff is about 1%. And there are, of course, no tariffs on services (nearly 43% of UK exports of goods and services exports were services in 2014). But the CET on some products are still high. For example, they are nearly 10% for motor vehicles.

- EFTA membership does not, as such, give rise to any special access to the EU market. Trade relations between Switzerland and the EU are governed by an FTA (1973) and several subsequent trade related bilateral agreements. Trade relations between the other three EFTA Members (Norway, Iceland and Liechtenstein) and the EU are governed by the European Economic Area (EEA) Agreement. (The EEA comprises the EU28 as well as Norway, Iceland and Liechtenstein.) The UK would not be a party to or beneficiary of either set of agreements if Brexit.

- The WTO website defines regional trade agreements (RTAs) as reciprocal trade agreements between two or more partners. Preferential trade arrangements (PTAs) in the WTO are unilateral trade preferences. They include Generalized System of Preferences schemes (under which developed countries grant preferential tariffs to imports from developing countries), as well as other non-reciprocal preferential schemes granted a waiver by the General Council.

- RTAs include: (i) Customs Unions (goods), where there is no internal tariff, but a Common External Tariff (CET) is applied; (ii) Free Trade Agreements (goods, FTAs), where there is also no internal tariff, but external tariffs are decided at a national level by the members. The European Free Trade Association (EFTA) is an FTA. FTA members, therefore, retain the right to decide their own tariffs against third countries, and negotiate their own trade deals, whilst in a Customs Union they do not; (iii) Preferential Trade Agreements (PTAs) or Partial Scope Agreements (PSAs), which are trade pacts between countries which reduce tariffs for certain products (while tariffs are not necessarily eliminated, they are lower than countries not party to the agreement); (iv) Economic Integration Agreements (EIAs) which are any agreements (including basic PTAs) also covering services.

- Selected bilateral agreements by Switzerland, Norway and Iceland are also included. Switzerland has negotiated RTAs with China and Japan, Iceland has negotiated an RTA with China and Norway is negotiating with China.

- Economist, “The TTIP of the spear”, 17 October 2015, pointed out (i) as with the Trans-Pacific Partnership (TPP), eliminating tariffs is the smaller part of TTIP because there are few left to cut, so the emphasis is on non-tariff barriers, and (ii) the TTIP negotiations had slowed to a crawl; even the discussions on tariff elimination, which was supposed to be the easy bit, have dragged.

- EFTA website on trade agreements states “…Member States of the GCC have informed that the EFTA-GCC FTA is currently not being applied by their local authorities. Preferential treatment for products originating in the EFTA States is therefore not granted in the GCC States for the time being”.

- European Parliament, Directorate-General for External Policies, “Comparing EU and EFTA Trade Agreements: Drivers, Actors, Benefits, and Costs”, May 2016. This report also argued that “EU agreements are more elaborate, values-driven, political and comprehensive…EU agreements are closer to association and overall economic cooperation agreements, with trade investment as an important component.” But, as shown by the difficulties experienced in negotiating the TTIP, the political acceptability of such comprehensive deals is questionable.

The EFTA trade agreements with trade partners are bilateral. They all include clauses prohibiting new parties from joining them unless all agree. Given the size of the UK economy, this would effectively mean restarting negotiations from scratch.

Therefore EFTA trade agreements are effectively worthless to us.

Canada – Article 39 – Additional Parties

The Parties may invite any State to become a Party to this Agreement. The terms and conditions of the participation by the additional Party shall be the subject of an agreement between the Parties and the invited State.

Israel – Article 35

Any State, Member of the European Free Trade Association, may accede to this Agreement, provided that the Joint Committee decides to approve its accession, on such terms and conditions as may be set out in that decision. The instrument of accession shall be deposited with the Depositary.

Mexico – ARTICLE 82

Additional Parties Any State may, upon invitation by the Joint Committee, become a Party to this Agreement. The terms and conditions of the participation by the additional Party shall be the subject of an agreement between the Parties and the invited State