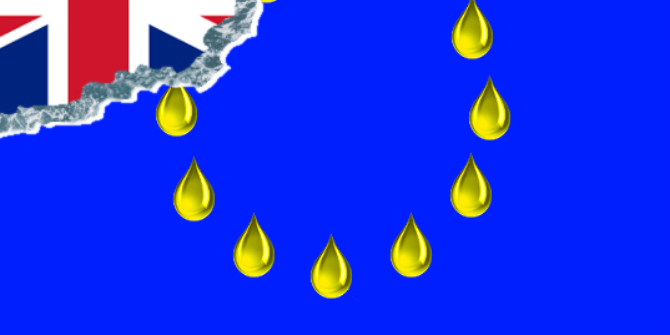

Brexit could easily spark disastrous deglobalisation. But it does not have to be that way. The experiences of previous Brexits suggest that Britain could emerge relatively unscathed. James Morrison explains that whether it does so depends on how well Britain plays its hand in each area of foreign economic policy: trade, finance, and migration.

Brexit could easily spark disastrous deglobalisation. But it does not have to be that way. The experiences of previous Brexits suggest that Britain could emerge relatively unscathed. James Morrison explains that whether it does so depends on how well Britain plays its hand in each area of foreign economic policy: trade, finance, and migration.

“There are few Englishmen who do not rejoice at the breaking of our gold fetters. We…have at last a free hand to do what is sensible,” wrote JM Keynes after Britain exited the gold standard in 1931. Previously, political, economic, and intellectual elites were virtually unanimous in predicting that this would bring catastrophe. In the event, Keynes was right.

Today, historians agree that this crucial first step enabled Britain to lead the world out of the Great Depression. Britain’s exit from the Exchange Rate Mechanism in 1992 followed a similar pattern: Sturm und Drang gave way to British resurgence. Should Britons similarly rejoice at the breaking of their EU fetters?

Following German unification, Gustav von Schmoller extolled mercantilism as the recipe for “state making and national-economy making at the same time.” The success of the European Coal and Steel Commission–predecessor to the EU–at both integrating markets and forging a new European community is remarkable. Schmoller was right: there are synergies between political and economic union.

This, however, is not the only way. It is certainly not the liberal way.

Adam Smith wrote the Wealth of Nations (1776) to challenge the principle that a country’s trade ought to follow its flag. He called on Britain to dissolve the empire and “accommodate her…designs to the real mediocrity of her circumstances.” Following Smith, the Shelburne government experimented with the former: the Americans were offered independence and a trade agreement. Britons, however, never contemplated the latter. Over the next century and a half, they integrated with friend and foe alike. With steps forward as well as back, Britain came to lead the world.

Indeed, Britain did not globalise the world because it was hegemonic. Britain became hegemonic because it globalised the world. Outside of the EU, Britain ought to think globally once again.

Recent events will affect investor confidence for some time to come. Three previously unconscionable things have happened. First, a Conservative government offered a referendum the possible results of which ranged from bad to worse. At best, the referendum would merely demonstrate the deep divisions within the United Kingdom. It could go further: dissociating and dismembering these isles. Second, Britons rebuffed the exhortations of the leaders in their parties, their industries, and their unions. When in history have the Conservative party and the British labour unions been found on one side and the voting majority on the other? Third, the Prime Minister, who is most responsible for this mess, has prematurely resigned with no clear successor. Suddenly, British hands do not seem so safe.

Earlier this year, Mark Carney, the Governor of the Bank of England, warned against relying on the “kindness of strangers” in the capital account to offset Britain’s current account deficit. Trading London’s prime real estate for imported consumption goods is probably unwise, and it is certainly unsustainable. Ideally, however, Britain’s economy would be rebalanced gradually rather than cataclysmically. Preventing capital flight requires bringing (ideally steady) hands back to the helm in Westminster.

“The City,” London’s financial district, can yet be saved. Previous Brexits brought autonomy and the ability to court investors. Compared to the EU, Britain has a lighter regulatory regime and lower tax rates on high earners. There is little doubt that the Conservative government–with the opposition in complete disarray–will do everything it can to keep “The City” in London.

At its worst, Brexit portends a retreat across the moat to the fortress that only Shakespeare’s John of Gaunt could celebrate–and one in which only his “breed of men” could be happy. Tragically, many Britons have fallen prey to the demagoguery of xenophobes. Lamentably, such small-mindedness was the sine qua non of the pro-leave victory.

Yet, it would be unfair to equate all “Leavers” with narrow-minded “Little Englanders.” The EU’s “four freedoms” laudably enshrine the right to live and work abroad. Ideally, this right would not be restricted. In a world of migration caps, however, the opportunities to migrate will always be scarce. The EU insistence that its members jump the queue cuts against the tradition of a UK that is as global as it is European.

Whatever the composition of sinners and saints in this congregation, British voters have demanded the right to restrict European immigration. Britain’s leaders cannot compromise on this without vacating the referendum and goading Britain’s nationalists. Britain will have to negotiate in Brussels hamstrung by this albatross.

Having one’s cake and eating it too? European leaders have criticised Britain’s desire to redefine its EU commitments a la carte. And for good reason: allowing this would invite further challenges that might unravel the union itself.

At the same time, however, the continent sells more to Britain than Britain sells to it. Thus, it cannot punish the UK without also prostrating itself.

Yet, it might be possible for Europe to have its cake and eat it too.

The EU should hold the line on the inviolability of the “four freedoms.” At the same time, European and British leaders should negotiate an alternative economic agreement as if the UK were outside of the EU–as if it were “merely” the world’s fifth largest economy. Proceeding on this basis would chasten those contemplating exit in Europe’s peripheries while still averting an acrimonious trade war. It would also have the advantage of treating Britons–who voted only narrowly to leave–with liberality.

The Brexit result is only the most recent reminder that, for many voters, politics trumps economics. A century ago, overconfident leaders overplayed their hands, riding waves of nationalism into the First World War. The global economy was the first, but hardly the last, casualty.

It is a pity that some British voters do not want an ever closer union with their neighbours. But this is not the first time Britain has exited. That history demonstrates that economic integration can extend beyond the bounds of political unions. It also shows that holding economic access hostage to political accession seldom ends well. With this in mind, Britain’s leaders should approach Europe with equal measures of confidence and conciliation.

This post represents the views of the author and not those of the BrexitVote blog, nor the LSE. It previously appeared on the Dahrendorf blog. Photo credit via Flickr @muffinn.

James Morrison is Assistant Professor in the Department of International Relations at the London School of Economics and Political Science, and a member of the Dahrendorf Working Group Europe and North America relations.