© DesignRaphael Ltd

© DesignRaphael Ltd

In the United States, exploitation of shale gas resources through a technology called hydraulic fracturing (‘fracking’) started an energy revolution from the early 2000s onwards.

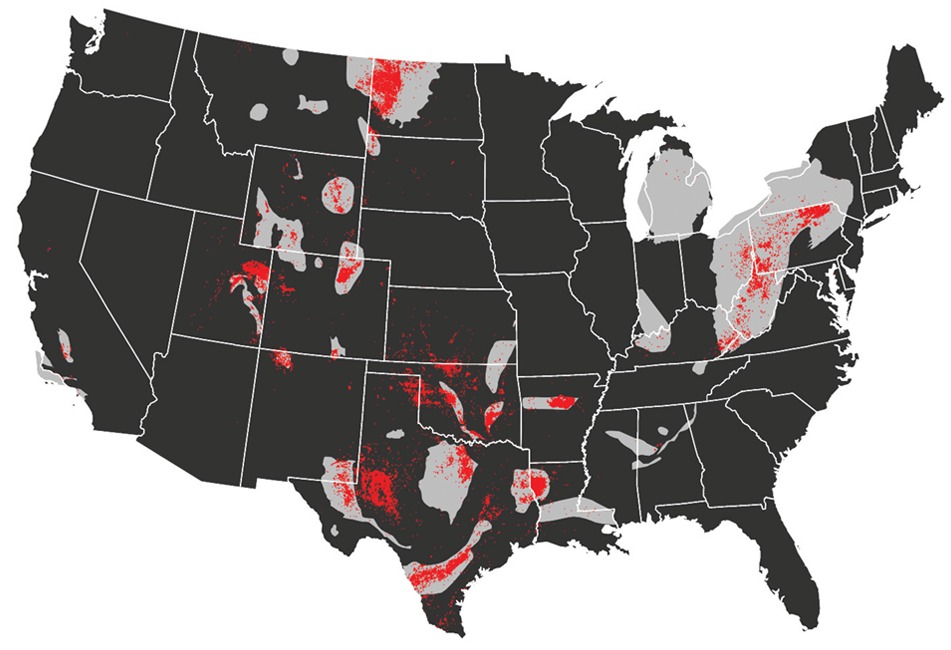

Fracking is now widely used across several major shale gas ‘plays’ (formations): most importantly, the Marcellus Shale of Pennsylvania, Ohio and West Virginia (see Figure 1). The surge in shale gas production has made the United States the largest natural gas producer in the world. What are the implications for US manufacturing?

Figure 1. Unconventional oil and gas wells across the United States (red dots) and shale plays (light grey)

Source: Fetzer (2014)

What standard trade analysis predicts

Our research starts from the premise that natural gas is predominantly used for energy production, so that the sudden increase in gas supply puts considerable downward pressure on energy prices. In an open economy, any such price differential vis-à-vis other countries would be arbitraged away through international trade in natural gas. But natural gas is not a normal commodity in this respect: its physical properties make transport exceedingly expensive over long distances.

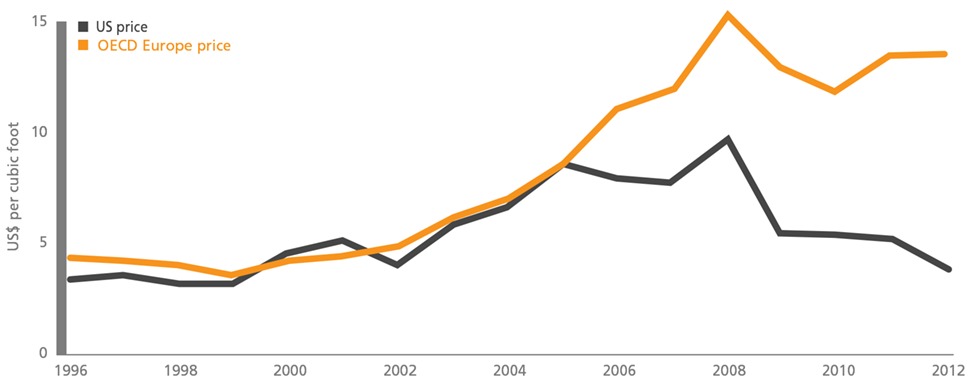

In addition, up until December 2015, the United States enforced an export ban on crude oil and natural gas. Consequently, any ‘buy-cheap-sell-dear’ activities were difficult. This has resulted in a dramatic drop in natural gas prices in the United States vis-à-vis other countries (see Figure 2).

Industries differ significantly in their inherent technological energy intensities. For example, around 10% of the overall input costs for ‘chemical manufacturing’ and ‘primary metal manufacturing’ constitutes energy costs, while the nondurable consumer goods energy cost share is less than 5%.

As a consequence, firms that manufacture energy-intensive products experienced a much more substantial cut in production costs and, hence, a boost to their competitiveness. We therefore expected that both input (employment and capital) and output shares of these industries would increase relative to their ‘low-energy’ counterparts.

Turning to international trade, we hypothesised that this differential cost shock would give US firms an edge over their international competitors: energy-intensive industries should expand their exports more than low-energy ones.

Figure 2. Industrial use natural gas prices in dollars per cubic foot in Europe and the United States

Evidence on the impact of fracking

To elicit the causal impact of fracking on our various outcomes of interest, we compare the development of industries that are similar and differ only in their energy intensity – providing us with ‘treatment’ and ‘control’ groups – as measured by their energy cost shares derived from US input-output tables.

We verify that our two groups behaved similarly prior to the shale gas boom, which gives us confidence in the validity of this comparison. In addition, we are able to rule out a range of alternative explanations, which leaves us confident that our estimates capture the causal impact of fracking on our main outcome: exports in energy intensive output.

The focus of our study is the indirect effect of the shale gas production boom on industrial activity (operating through natural gas prices), as opposed to the direct stimulus effects due to the drilling activity and the associated local income and employment gains that have been studied elsewhere. Throughout our empirical analysis, we exclude direct effects by focusing on areas of the United States that do not lie right on top of or near to shale plays.

We document that output in energy-intensive sectors expands significantly with the widening of the natural gas price gap. Consistent with that observation, we show that the energy-intensive sectors absorb more capital (measured by capital expenditure decisions as a proxy) and labour (captured by employment) in order to produce this additional output.

Turning to trade, the main focus of our study, we document that the increase in the price gap is associated with a significant expansion in exports of energy-intensive goods. The effect operates at both the ‘intensive margin’ (more exports in an industry-destination pair that had already been engaged in trade) and the ‘extensive margin’ (emerging trade in an industry destination pair that had not previously engaged in trade). Contrary to the theoretical prediction, we find no consistently significant reduction in imports.

The example of chemical manufacturing

The case of chemical manufacturing serves well as an illustration of the effects we estimate. This industry has an energy cost share of roughly 8% (the overall industry average is 5%) and constitutes a significant part of the US economy: on average, between 2006 and 2012, chemical manufacturing accounted for almost 20% of overall manufacturing GDP.

For every dollar increase in the price gap of natural gas between the United States and Europe, output in chemical manufacturing increased by 1.6%. In the face of nearly a $10 gap by the end of our sample period, this baseline result is large. Moreover, we find that employment and gross capital expenditure increased by 0.6% and 3.3%, respectively, for every dollar price difference.

The shale gas boom provided energyintensive industries with a cost advantage over their international competitors. We estimate that the value of exports by chemical manufacturing rose by 1.6% for every dollar increase in the natural gas price gap.

Cross-sector average effects

Using the average sector level employment together with average energy intensity, we can arrive at an overall estimate of the employment gains: total manufacturing sector employment increased by around 356,000 jobs up to 2012. A comparison with previous research (Feyrer et al, 2015) suggests that, for every two jobs created in direct relation to fracking, this indirect effect adds more than one additional job elsewhere in the economy.

Even though the United States is considered to be a relatively closed country, it plays an important role on the international stage as one of the largest exporters. Given that the price gap widened to $10 by 2012, we find that average manufacturing exports have expanded by roughly 10% due to the shale gas boom. This amounts to roughly 4.4% of the overall value of exports of goods and services from the United States in 2012.

Our results suggest that the cost advantage due to the shale gas boom may have helped the US economy recover significantly faster than it would otherwise have done after the financial crisis of 2007/08.

Implications for the UK

The UK is set to explore the potential of fracking technology in exploiting its shale gas resources. But it is important to highlight that there are substantial differences between the UK and the United States, which need to be taken into account when making any inferences based on our research.

Most importantly, the UK is currently reasonably well integrated into the European energy market, with millions of customers at its doorstep and infrastructure available to carry natural gas from the UK to continental Europe. Therefore, it is unlikely that a newly created UK gas supply would have a US-sized effect on natural gas prices – either domestically or in the European market.

♣♣♣

Notes:

- This article appeared originally on CentrePiece, the magazine of LSE’s Centre for Economic Performance(CE. It summarises the authors’ paper On the Comparative Advantage of US Manufacturing: Evidence from the Shale Gas Revolution, CEP Discussion Paper No. 1454

- The post gives the views of its authors, not the position of LSE Business Review or the London School of Economics.

- Before commenting, please read our Comment Policy.

Rabah Arezki is Chief of the Commodities Unit in the IMF’s Research Department. He has written on energy, commodities, international macroeconomics, and development economics. He has led and participated in various IMF missions in Africa, the Middle East, and Central Asia. Mr. Arezki is also a non-resident fellow at the Brookings Institution and at the University of Oxford. He has published widely in peer-reviewed journals, co-edited several books and special issues of academic journals. He is the Editor of the IMF Research Bulletin and an Associate Editor of Revue d’économie du développement. He obtained his M.Sc. from the Ecole Nationale de la Statistique et de l’Administration Economique in Paris, France, and his PhD from the European University Institute, in Florence, Italy.

Rabah Arezki is Chief of the Commodities Unit in the IMF’s Research Department. He has written on energy, commodities, international macroeconomics, and development economics. He has led and participated in various IMF missions in Africa, the Middle East, and Central Asia. Mr. Arezki is also a non-resident fellow at the Brookings Institution and at the University of Oxford. He has published widely in peer-reviewed journals, co-edited several books and special issues of academic journals. He is the Editor of the IMF Research Bulletin and an Associate Editor of Revue d’économie du développement. He obtained his M.Sc. from the Ecole Nationale de la Statistique et de l’Administration Economique in Paris, France, and his PhD from the European University Institute, in Florence, Italy.

Thiemo Fetzer is an Assistant Professor at the University of Warwick and a research associate in CEP’s urban programme. He mainly works in Development Economics and Political Economy, with a focus on resource economics and conflict. Twitter @fetzert

Thiemo Fetzer is an Assistant Professor at the University of Warwick and a research associate in CEP’s urban programme. He mainly works in Development Economics and Political Economy, with a focus on resource economics and conflict. Twitter @fetzert

Frank Pisch is a PhD candidate at the London School of Economics and Political Science. He received his B.Sc. and B.A. in Economics and Philosophy & Economics at the University of Bayreuth, his M.Phil in Economic Research at the University of Cambridge, and his MRes at the London School of Economics and Political Science. His research is focused on International Trade and Labour Economics. He’s an occasional research assistant at LSE’s Centre for Economic Performance.

Frank Pisch is a PhD candidate at the London School of Economics and Political Science. He received his B.Sc. and B.A. in Economics and Philosophy & Economics at the University of Bayreuth, his M.Phil in Economic Research at the University of Cambridge, and his MRes at the London School of Economics and Political Science. His research is focused on International Trade and Labour Economics. He’s an occasional research assistant at LSE’s Centre for Economic Performance.

In the case of the chemical manufacturing industry, this analysis leaves out a critical element. While energy cost can be significant for this industry, it is heavily outweighed by raw material costs. Low natural gas prices are accompanied by low prices and ready access to associated natural gas liquids, which are also chemical feed stocks (ethane, propane, butane, etc.) A 50% price difference on energy can yield a 4% price advantage when it is 8% of production cost. A 50% price difference on ethane feed stock can yield a 25% price advantage when feed stock is 50% of production cost. Ethane faces export costs similar to natural gas, but with much less existing infrastructure and almost no existing international market. This is why the US ethylene industry is growing to the detriment of Europe and Asia, and this price advantage carries forward to derivatives of ethylene (ethylene glycol, etc.) and other price-advantaged chemicals.