My wife is a surgeon, and her field of medicine has been transformed by the ‘evidence-based’ approach. Every pill she prescribes is extensively tested and empirically validated. You will agree that this makes sense, since it directly affects our physical health.

However, when it comes to our financial health we are not yet that advanced. When somebody makes a profitable investment, it’s not so easy to explain whether it’s down to good luck or pure skill. Investors often quickly draw conclusions based on too little statistical evidence. Luckily, things are starting to change for the better. Evidence-based investing – applying thoroughly tested investment theories to portfolio construction – is on the rise.

Many years ago I stumbled upon a less known evidence-based investing strategy, one that still amazes me today: low-risk stocks beating high-risk stocks. This paradox of ‘High Returns from Low Risk’ is an ‘inconvenient truth’ for economics professors as it turns their models upside down. It also challenges conventional investment wisdom that says more risk should result in higher returns. However, does this linear relation between risk and return really exists?

It doesn’t. As I know that my answer might puzzle you and this article is about evidence-based investing, let me deliver you some proof. But first: what exactly is a high-risk stock? In the context of investments, risk applies to the potential negative scenarios in which some or all capital is lost. The volatility of an investment is a simple and powerful indicator of financial risk as it measures the price fluctuations of that investment in a standardized way. Volatility is quite persistent over time. In other words: a stock that displays a low degree of volatility will probably also remain a low volatility stock in the future. The same applies to high volatility stocks.

In order to find out whether portfolios of low-risk stocks perform better than portfolios of high risk stocks, I have used a well-known stock market database consisting of the largest 1,000 US stocks sorted into 10 portfolios based on their risk. Portfolio 1 (the low-risk portfolio) consists of the 100 stocks with the lowest volatility and portfolio 10 (the high-risk portfolio) contains the 100 most risky stocks at that moment in time. Starting in January 1929, the portfolios are rebalanced every quarter until 2015 resembling a replicable investment strategy. One would expect the high-risk portfolio to outperform the low-risk portfolio. Right?

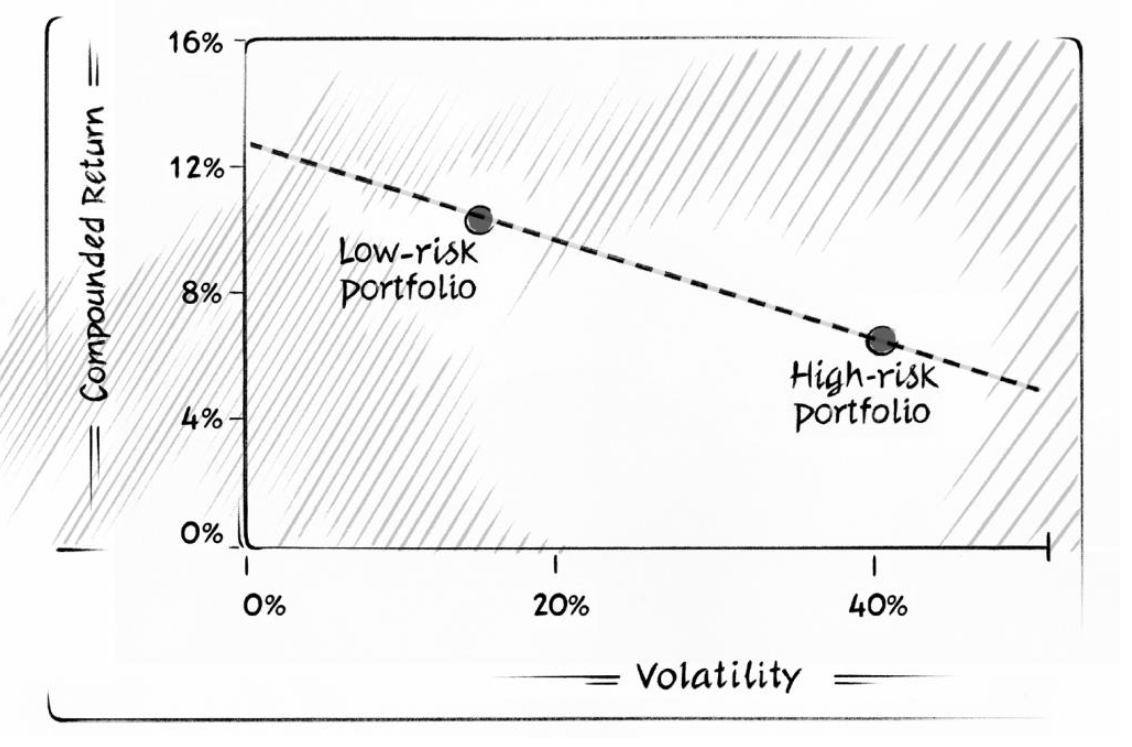

Figure 1. Compounded return of low-risk and high-risk portfolios 1929-2015

Source: High Returns from Low Risk: A Remarkable Investment Paradox, 2017 Wiley Publishers

The figure delivers the counter-evidence. The low-risk portfolio beat the high risk portfolio, with much less risk. The low-risk portfolio generates an annual return of 10.2 per cent, while the high-risk portfolio generates a return of only 6.4 per cent. To put those numbers into perspective: assume that we put USD 100 into both portfolios on New Year’s Day 1929 and reinvested any capital gains for 86 years until New Year’s Day 2015. The low-risk portfolio’s final value would be USD 395,000, while the high-risk portfolio’s final value is only USD 21,000. Low risk beats high risk by a factor of 18!

The graph demonstrates that the rule ‘more risk equals higher returns’ does not hold up in the long-term. Investors aren’t rewarded with additional return when they seek out a higher risk in their portfolios. The graph shows a very big investment paradox: low risk gives high returns. This puzzling and perhaps counterintuitive fact has been documented not only for US stocks, but for equities from all around the world by different academics in numerous academic papers. Despite the abundance of empirical evidence investors still seem to fall for the singing sirens in the form of high-risk stocks. Why?

This is a question which I’ve asked myself many times in my life. There are some explanations, which I also wrote down in a Journal of Portfolio Management article with David Blitz and Eric Falkenstein. Here is an important explanation which is based on rational behavior. Professional investors are paid by their clients to take risk in order to beat benchmarks. They have a clear incentive to chase high-risk stocks and overpay for them. These professional investors are not making mistakes, but since they do not invest their own money they chase high-risk stocks to reach their objective. In general, low-risk stocks are not grabbing much attention, receive less analyst coverage and do not have the ‘lottery-ticket’ element which excites many investors.

Over ten years ago I convinced some investors to rethink their perspective on risk and return. At Robeco, the investment firm where I work, we started our Conservative Equities funds for them in 2006. These strategies are based on an extensively tested and empirically validated investment approach. Today these multi-billion funds are still based on this prudent investment paradox. Low risk gives you surprisingly high returns. With my colleague Jan I’ve written more about this fascinating topic in my new 2017 book published by Wiley: High Returns from Low Risk: A Remarkable Stock Market Paradox.

♣♣♣

Notes:

- This blog post is based on the author’s book High Returns from Low Risk: A Remarkable Stock Market Paradox, Wiley, 2017

- The post gives the views of its authors, not the position of LSE Business Review or the London School of Economics.

- Featured image credit: Rope bridge, by Pixelschubser99, under a CC0 licence

- Before commenting, please read our Comment Policy.

Pim van Vliet, PhD, is the Founder and fund manager of the multi-billion dollar Conservative Equity funds at Robeco and the author of the book High Returns from Low Risk: A Remarkable Stock Market Paradox. This book combines the latest research with stock market data going back to 1929 to prove that investing in low-risk stocks gives surprisingly high returns, significantly better than those generated by high-risk stocks. The book helps you to construct your own low-risk portfolio, select the right ETF or to find an active low-risk fund in order to profit from this paradox. And it explains why investing in low-risk stocks works and will continue to work, even once more people become aware of the paradox. It’s also a personal story, one that links our human nature and behavior to a prudent and successful investment formula. For more information: www.paradoxinvesting.com

Pim van Vliet, PhD, is the Founder and fund manager of the multi-billion dollar Conservative Equity funds at Robeco and the author of the book High Returns from Low Risk: A Remarkable Stock Market Paradox. This book combines the latest research with stock market data going back to 1929 to prove that investing in low-risk stocks gives surprisingly high returns, significantly better than those generated by high-risk stocks. The book helps you to construct your own low-risk portfolio, select the right ETF or to find an active low-risk fund in order to profit from this paradox. And it explains why investing in low-risk stocks works and will continue to work, even once more people become aware of the paradox. It’s also a personal story, one that links our human nature and behavior to a prudent and successful investment formula. For more information: www.paradoxinvesting.com