The enormous variation in firm performance has become a focus of empirical and theoretical interest throughout the social sciences, including economics. The topic is both complex and fascinating. Firms are such multifaceted organisations — whether small regional players or large multinationals — where technological, social, institutional, historical, and human factors all interact. Within such a complex world, a recent trend in the literature is to focus on managers as the “conductors of the orchestra”.

Recent empirical studies have exploited the increasing availability of information on managerial practices and managers’ characteristics to establish a strong connection with firm — as well as country — productivity and other dimensions of performance. More specifically, Bloom and Van-Reenen (2010), Bloom et al. (2013), Bloom et al. (2016b), and Guiso and Rustichini (2011) among others, have established that better managers and managerial practices lead to better firm performance.

We believe the next question to be addressed in this literature is what happens when managers move from one firm to another. Does a firm hiring a good manager improve its performance? How much? If yes, is it due to the manager intrinsic capabilities or is it due to the knowledge and abilities the manager has learned in previous firms? What happens to the firm when the “good” manager leaves?

In Mion, Opromolla, and Sforza (2016), we provide answers to these questions. Our results are obviously important to understand a firm’s performance. They are also potentially crucial at the aggregate level — i.e., regional or national. The presence of knowledge flows means that policies directly affecting managerial skills and knowledge in some firms will sooner or later spill over to other firms.

There are two challenges we face in the paper: first, separating a manager’s intrinsic capabilities from the knowledge and abilities she has learned in previous firms; second, showing that such acquired knowledge and abilities impact current firm performance. In order to separate a manager’s intrinsic capabilities from the knowledge and abilities she has learned in previous firms we use information on whether the manager has worked in the past for firms exporting to a specific destination country or a specific product.

In order to show that such acquired knowledge and abilities impact current firm performance we relate the destination-specific or product-specific measure of acquired knowledge (e.g. experience in exporting shoes) to the current firm trade performance in these same specific destinations or products (e.g. the probability of exporting shoes).

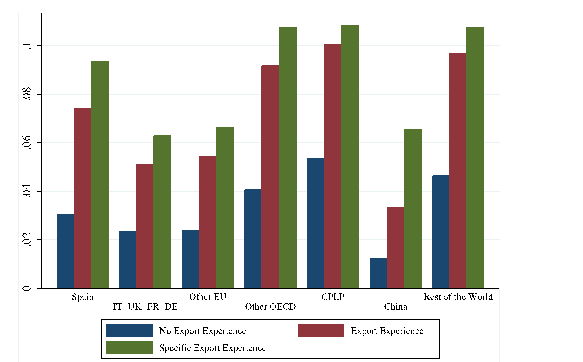

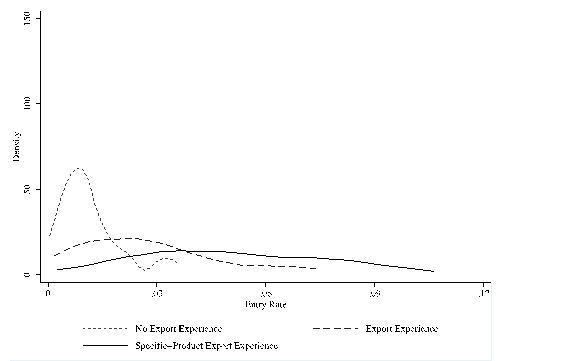

Considering the link between export experience and firms’ trade performance, Figures 1 and 2 show the probability of firms starting exporting to a given destination or a given product, in 2005, for three categories of firms: those without managers with export experience, those with at least one manager with export experience, and those with at least one manager with specific (to the destination or product) export experience.

In all instances, the presence of managers with export experience is associated with a higher probability to start exporting while at the same time having at least one manager with specific export experience is associated with an even higher probability. In the paper we report results from an extensive set of regressions — in some cases controlling for firm-year fixed effects — that confirm the patterns shown in the figures.

Figure 1: Export entry rate, experience in a destination, 2005

Figure 2: Export entry rate density, experience in a product, 2005

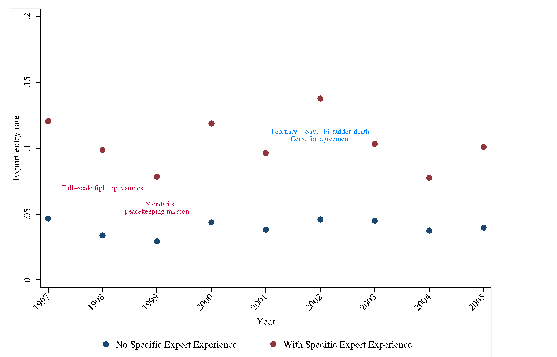

A more direct way of dealing with the causal interpretation of our findings is to consider the differential performance of firms with and without managers with destination-specific export experience in the wake of the sudden end of the Angolan civil war. Angola is a former Portuguese colony still having strong commercial ties with Portugal and belonging to the Community of Portuguese Language Countries (CPLC).

The war started many years prior to our observational period (1997-2005) and ended, suddenly, with the death of the rebels’ leader, Jonas Savimbi, on 22 February, 2002. As discussed in Guidolin and La Ferrara (2007), the event was completely unexpected and represents an exogenous conflict-related event. This means that, right after the shock, firms did not have the time to prepare themselves to take advantage of the opportunities offered by the new politically stable setting by, for example, hiring managers with export experience in Angola. Yet, some firms in 2002 already had managers with export experience in Angola while others had not.

Figure 3 shows export entry rates for firms with at least one manager with specific export experience in Angola and firms without such managers. In line with our previous results, entry rates for the former group are always larger than for the latter group. Crucially, there is a sudden spike in export entry rates for firms with at least one manager with export experience in Angola in 2002. The situation is then a bit mixed after 2002, which can be understood with other shocks taking place as well as firms having had the time to adjust to the new situation. Regression results reported in the paper confirm that, even controlling for firm-time covariates and year dummies, the presence of a manager with experience in exporting to Angola increases the likelihood that the firm will start exporting there by 2 percentage points (with respect to firms without such a manager).

Figure 3: Export entry rates in Angola

In the rest of the paper we present additional results regarding the arrival and departure — as opposed to presence and absence — of managers with export experience, consistent with the view that managers bring in new export knowledge and, in some cases, this knowledge remains in the firm even after managers leave. We also show that export experience is more valuable to firms selling more differentiated products — i.e., products whose attributes are more difficult to observe — and products needing more financing — for example because of longer production processes and larger mismatch between investments and profits thereby requiring more managerial effort and expertise. Finally, we find that employing a manager with export experience can help firms keep exporting to foreign markets characterised by rising import competition from China.

Authors’ note: The opinions expressed represent the views of the authors, and not necessarily those of the Banco de Portugal or the Eurosystem.

♣♣♣

Notes:

- This blog post is based on the authors’ paper The Diffusion of Knowledge via Managers’ Mobility, LSE’s Centre for Economic Performance (CEP) Discussion Paper No 1458 December 2016.

- The post gives the views of its authors, not the position of LSE Business Review or the London School of Economics.

- Featured image credit: Building, by Demi Kwant, under a CC0 licence

- Before commenting, please read our Comment Policy.

Giordano Mion is Professor in International Trade, Department of Economics, University of Sussex. He is also affiliated with the Centre for Economic Performance (CEP), the Centre for Economic Policy Research (CEPR), and the Center for Economic Studies and the Ifo Institute (CESifo). The main focus of his research is on international trade (productivity, firm heterogeneity, and gains from trade), on regional economics (agglomeration, externalities, and local institutions) and on labour economics (sorting, matching, and managers). He earned his PhD in Economics at Université Catholique de Louvain, Belgium, has been a post-doc and FNRS Fellow at the Center for Operations Research and Econometrics (CORE), Belgium and previously taught at the LSE and the University of Surrey.

Giordano Mion is Professor in International Trade, Department of Economics, University of Sussex. He is also affiliated with the Centre for Economic Performance (CEP), the Centre for Economic Policy Research (CEPR), and the Center for Economic Studies and the Ifo Institute (CESifo). The main focus of his research is on international trade (productivity, firm heterogeneity, and gains from trade), on regional economics (agglomeration, externalities, and local institutions) and on labour economics (sorting, matching, and managers). He earned his PhD in Economics at Université Catholique de Louvain, Belgium, has been a post-doc and FNRS Fellow at the Center for Operations Research and Econometrics (CORE), Belgium and previously taught at the LSE and the University of Surrey.

Luca David Opromolla is a Principal Economist at the Economics and Research Department of Banco de Portugal. He performs research in international trade, labour economics and banking. His research focuses on firm dynamics and the size distribution of firms; firms’ decision to export vs. to open a plant abroad; the type and size of trade costs; the role of managers in determining firms’ international activities and in transferring export knowledge across firms; the internal organization of firms and their productivity; and the quantification of the effects of reductions in migration and trade costs. Opromolla is a Research Fellow of CEPR and CESifo, and UECE. He was a Visiting Professor of Economics at the University of Maryland in 2014 and 2016, and his research receives support from the Fundação para a Ciência e a Tecnologia. Ph.D. New York University.

Luca David Opromolla is a Principal Economist at the Economics and Research Department of Banco de Portugal. He performs research in international trade, labour economics and banking. His research focuses on firm dynamics and the size distribution of firms; firms’ decision to export vs. to open a plant abroad; the type and size of trade costs; the role of managers in determining firms’ international activities and in transferring export knowledge across firms; the internal organization of firms and their productivity; and the quantification of the effects of reductions in migration and trade costs. Opromolla is a Research Fellow of CEPR and CESifo, and UECE. He was a Visiting Professor of Economics at the University of Maryland in 2014 and 2016, and his research receives support from the Fundação para a Ciência e a Tecnologia. Ph.D. New York University.

Alessandro Sforza is a PhD student at the Centre for Economic Performance (CEP) at the London School of Economics. His research focuses on firm behaviour in relation to credit shocks and the implication for firms organisation and wage inequality, the role of managers in determining firms’ international activities and in transferring export knowledge across firms, and the effects of international migration on the labour market

Alessandro Sforza is a PhD student at the Centre for Economic Performance (CEP) at the London School of Economics. His research focuses on firm behaviour in relation to credit shocks and the implication for firms organisation and wage inequality, the role of managers in determining firms’ international activities and in transferring export knowledge across firms, and the effects of international migration on the labour market