Theresa May has sent the Article 50 notification to the EU, setting out seven principles (presumably in a hierarchical order of importance), with the second being the protection of the working rights of EU citizens here and UK citizens in Europe. This confirms what Michel Barnier (the EU negotiator) considered as a major priority. This should be good news: both sides agree on the starting point of the negotiations and, as with economic/econometric models, when all sides set the same starting conditions, it is more likely than not that they will converge to a common outcome. At the same time, we have now officially entered a period of Britain-EU ‘divorce’ negotiations – and one of great uncertainty for the economy.

Greek philosopher and mathematician Pythagoras of Samos famously said that “number rules the universe”. For Brexiteers, this number was initially the (now) discredited £350 million supposedly sent by Britain to the EU on a weekly basis. Brexit supporters are now again relying on Pythagoras to talk the economy up: they are hinting that the ‘revised’ number to pay attention to is the 15% (or so) post-referendum depreciation of sterling’s exchange rate which will rebalance the economy towards export-oriented sectors and largely safeguard against Brexit ‘headwinds’. Their argument is backed by the latest Bank of England survey of around 700 British businesses which suggests that the weaker pound is boosting exports.

It is true that export-oriented businesses should benefit from the lower exchange rate and perhaps further access to non-EU markets. But then again, the EU remains a large trading partner of ours. Indeed, 44% of our exports of goods and services go to the EU and 53% of our imports come from the EU. On the other hand, ‘only’ 17% of EU exports arrive here. So we cannot really rely on favourable exchange rate movements to play ‘hardball’ during negotiations with our former partners over the next two years.In any case, a closer look at sterling’s trade-weighted historical movements suggests a much more alarming story.

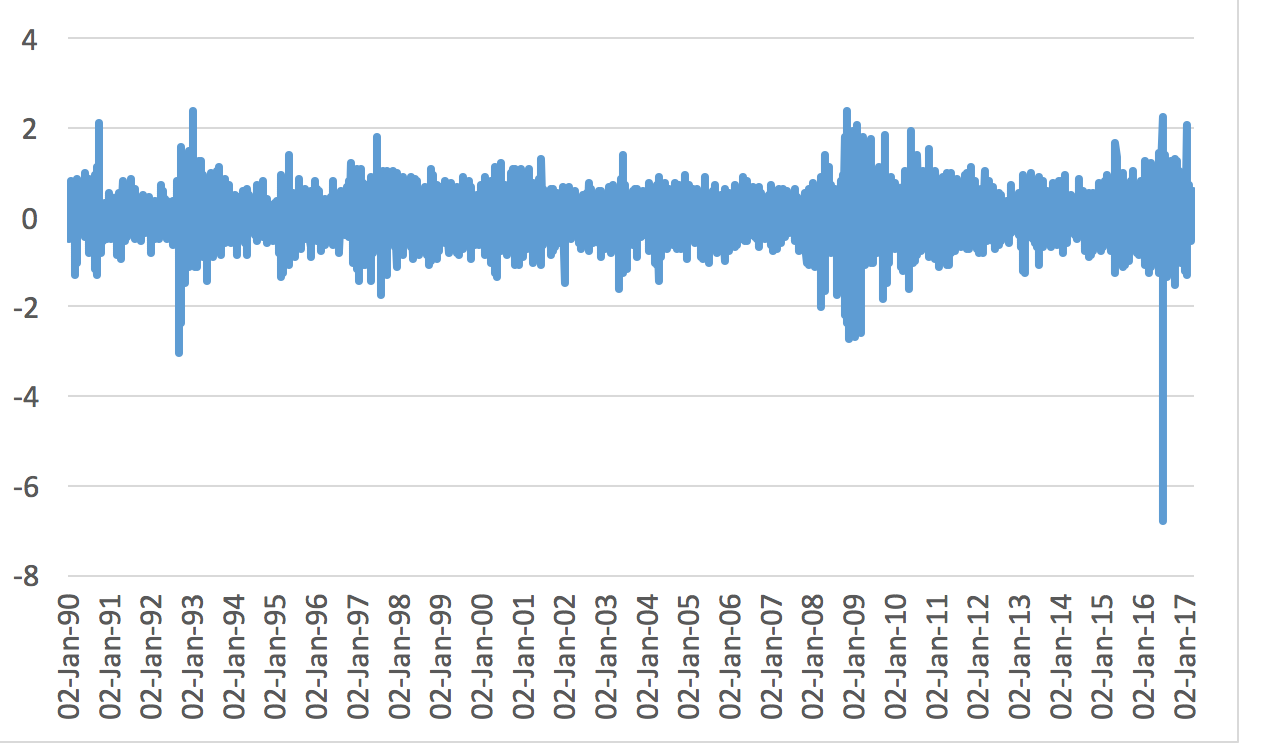

Figure 1. The daily growth of the effective Sterling exchange rate between January 1990 and March 2017

Source: Bank of England database

Following our humiliating exit from the European Exchange Rate Mechanism (ERM) on Black Wednesday 16 September 1992, Sterling dropped by ‘only’ 1.4% on that day and by ‘only’ 3% the day after. But, sterling’s losses the day after the Brexit referendum more than doubled to 6.8%. Yet what matters more is that the daily growth of the Sterling effective rate has witnessed a surge in volatility post-referendum.

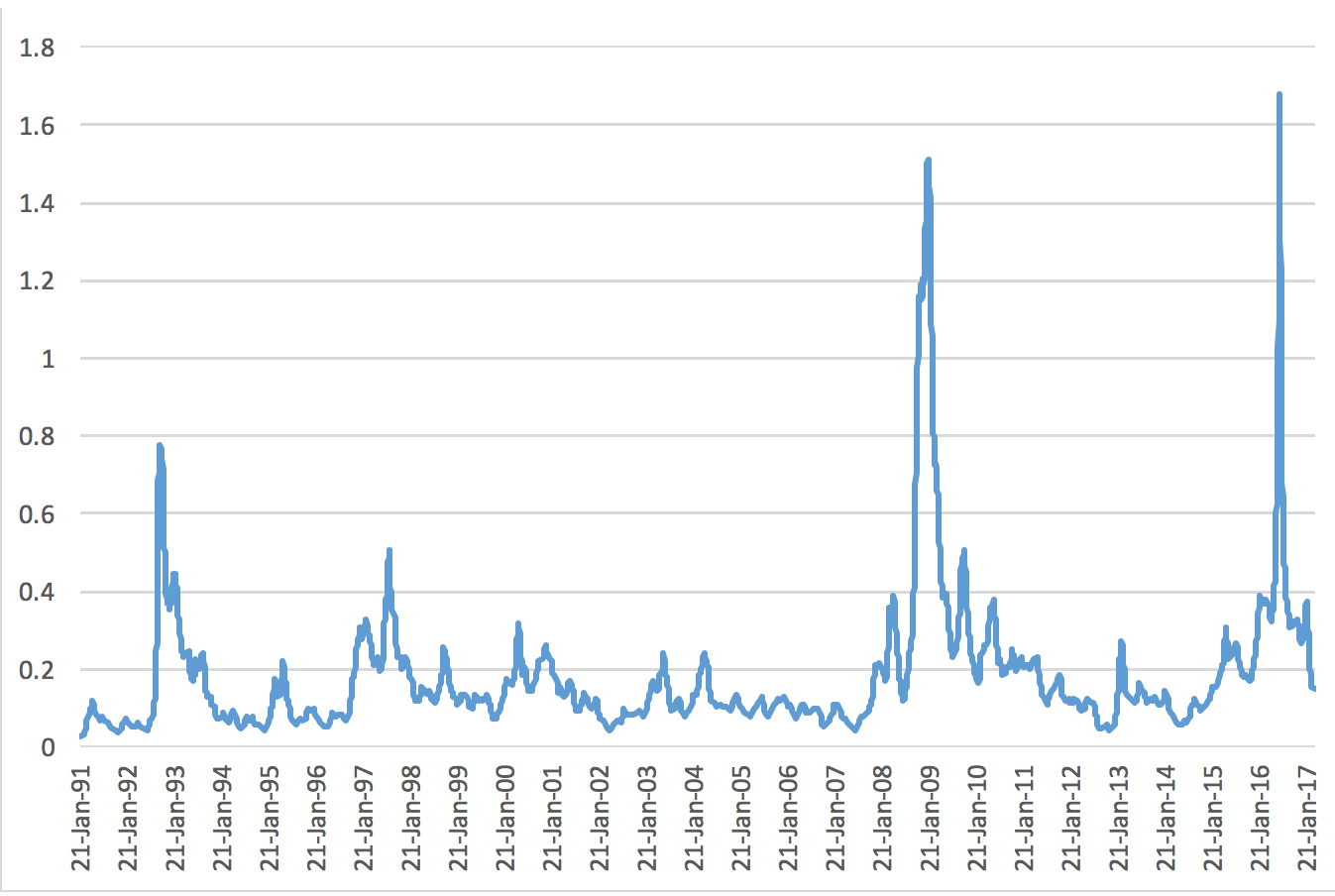

Figure 2. Daily exchange rate volatility from January 1991 to March 2017

Source: Estimates by the authors using a Bayesian time-varying parameter model with stochastic volatility.

The surge in daily exchange rate volatility following the referendum peaks at 1.68%; some 0.20 percentage points greater than the peak during the 2008-2009 financial crisis and almost 1 percentage point greater than Black Wednesday. Notably, exchange rate volatility was persistent for more than 12 months following the ERM exit. Faced with at least two years of possibly unsettling negotiations with the EU, post-referendum volatility looks set to be stubbornly higher and lengthier than what followed Black Wednesday.

Our estimate of exchange rate volatility has a relatively strong correlation with the UK economic policy uncertainty index which tracks uses of UK policy uncertainty from around 650 UK newspapers. This suggests that Sterling exchange rate volatility captures, to some extent, policy uncertainty in the UK – which will clearly increase without transparency on our strategy during negotiations.

This volatility surge is, in our view, the very number of Pythagoras to pave the way for future exchange rate uncertainty, and ultimately, rule the prospects of our export sector and wider economy. Indeed, the surge in exchange rate volatility poses a challenge for our exporters because it creates uncertainty for their earnings and future investments; even if firms manage to partly hedge against exchange rate risk.

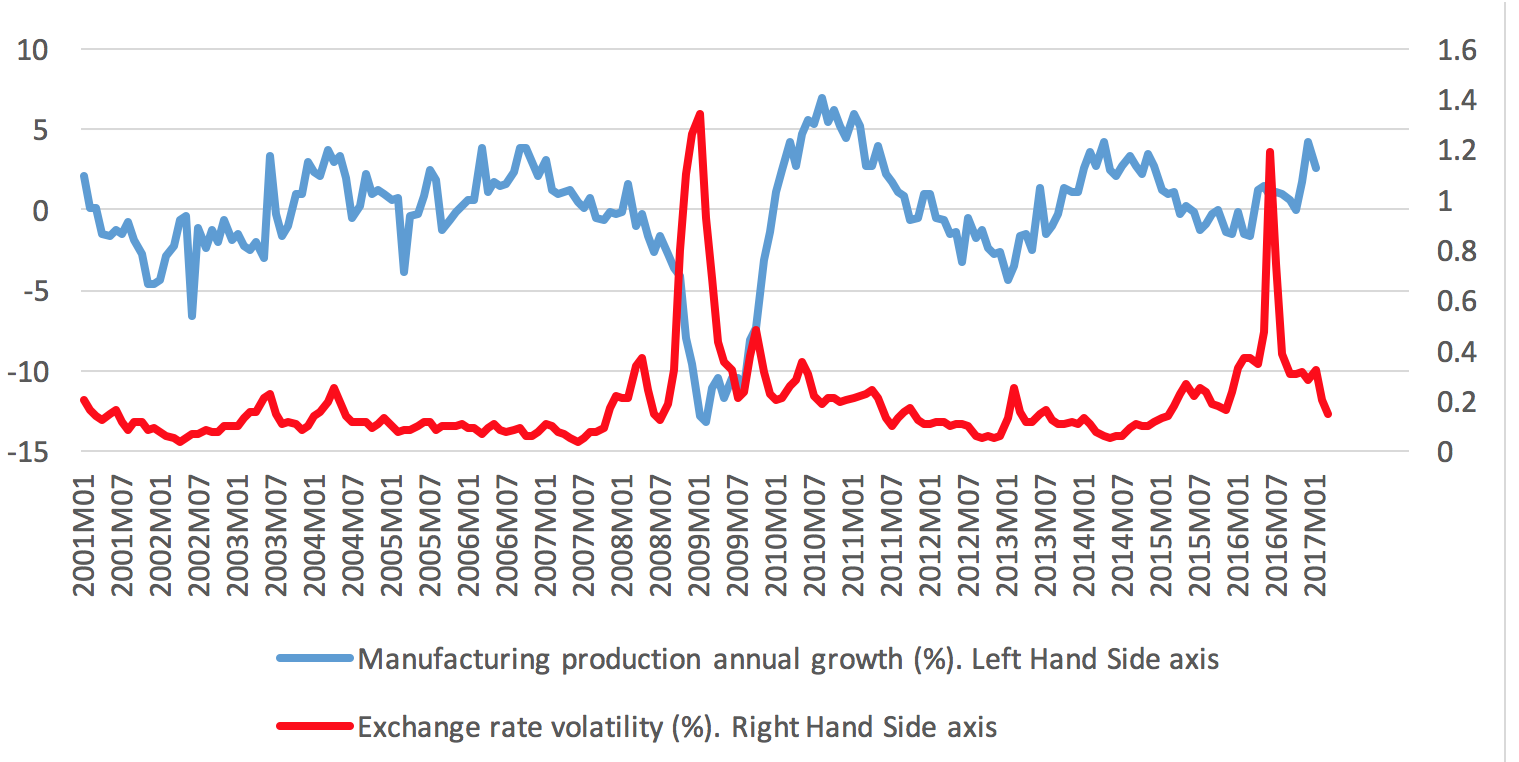

In fact, with Brexit negotiations kicking off now, and with their likely ups and downs over the next two years, it is quite likely that our exporters will consume themselves with desperately trying to hedge against exchange rate risk rather than seriously plan profitable investments in (say) the manufacturing sector.This is confirmed by Figure 3 which shows that the annual growth of UK manufacturing production correlates negatively with exchange rate volatility (the correlation is equal to -0.42).

Figure 3. Annual growth in UK manufacturing production (%) and exchange rate volatility (%). Monthly data 2001-2017

Source: UK manufacturing production comes from Datastream. Exchange rate volatility monthly average for each month is based on the daily data reported in Figure 2.

But even if our exporters are willing to overlook the surge in exchange rate risk, lengthy and cumbersome Brexit negotiations will add to the borrowing costs of our businesses, challenging that way their willingness to invest in the UK economy. Indeed, to keep buying UK government and private debt, investors will require a higher yield on UK bonds. Persistent exchange rate volatility and higher borrowing costs will postpone investment intentions and undermine the robustness of the wider UK economy. In this unsettling environment, rebalancing the economy towards export-oriented sectors risks proving a naïve myth.

UK companies are desperately in need of assurances about a ‘painless divorce’. They are also in need of a smooth Brexit transition, especially in terms of the future trade relationship between Britain and the EU, as well as the working rights of EU citizens in Britain (and vice versa). Only with these assurances can they take encouragement in investing to support existing jobs, create new ones, and boost our future living standards.

♣♣♣

Notes:

- This blog post was originally published by LSE Politics and Policy.

- The post gives the views of its author, not the position of LSE Business Review or the London School of Economics and Political Science.

- Featured image credit: Balance, by Mediamodifier, under a CC0 licence

- Before commenting, please read our Comment Policy.

Michael Ellington is Research Fellow, University of Liverpool.

Michael Ellington is Research Fellow, University of Liverpool.

Costas Milas is Professor of Finance, University of Liverpool.

Costas Milas is Professor of Finance, University of Liverpool.

EEC was about Economics, the EU diverted from this to be more focused on the political and abandon it’s primary focus.