“In the long run we are all dead,” and firms and industries are no exception. America, Europe, and Japan once dominated the manufacturing of computers and electronics, but these activities had all gone to low-cost countries by the end of the 20th century. Should we ban offshoring and stop “shipping jobs overseas”? Many voters and politicians seem to think so. I’d say that’s a bad idea because that will kill the entire industry off your domestic soil.

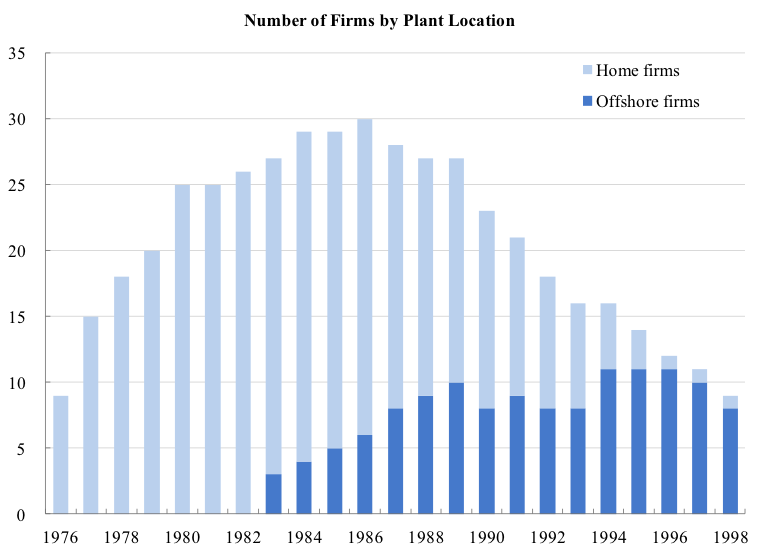

Figure 1 shows that the number of HDD (hard disk drive) manufacturers in the world peaked in 1986, but most of them died within a decade: sad. This kind of massive entry and exit is ubiquitous. Most of the new products and industries in history have experienced such “shakeouts” at some point, including car manufacturing, commercial banking, and pharmaceuticals, so I wasn’t surprised when I first saw this pattern in my data. It’s law.

Figure 1. Evolution of competition and offshoring in the HDD industry

What did surprise me was that this shakeout had hit those who stayed at home in the North (i.e., America, Europe, and Japan) almost exclusively. By contrast, all but one survivor had moved their factories to the South (Singapore, Malaysia, Thailand, Philippines, and China). Some firms started offshoring as early as 1983. Figure 1 indicates this movement with two different colors. A few firms in the light-blue bars switched to the dark-blue bars. Seagate Technology of California led this trend when it opened new facilities in Singapore and closed old ones in California. Its executives were complaining, “We have too many surfers and not enough engineers.” Some of its rivals followed suit, including Western Digital and Toshiba, but others didn’t and eventually died. When I visited LSE in 2013, I showed this picture to the authority of shakeout economics, Prof. John Sutton, who confirmed this phenomenon was new and interesting. So you don’t have to take my word for its importance.

Why did firms offshore? HDD manufacturing is not as labor-intensive as, say, the textiles and apparels industries, so you might wonder if it’s worth moving plants to low-wage countries. Like many other high-tech products, however, HDDs are homogeneous commodities. Once you meet the industry standards for quality and reliability, brutal cost-competition is the name of the game. So you’d have to operate in the lowest-cost location, and ship your products from there. According to Reggie Murray, the founder of MiniStor (another HDD maker in the 1980s), “Once someone starts offshore production, everybody has to do it or die.”

To capture all these pieces of reality in a mutually consistent manner, I first built a dynamic, game-theoretic model of life, death, and cost-reducing investment, and then fleshed it out with 23 years of data from the HDD industry. This way, I could run simulation experiments to try out “crazy” ideas, like a hypothetical government policy to ban offshoring, eliminate China, or prohibit all international trade. You don’t need an actual President of the United States to run a real-world experiment; I can do that for you, on the logical fantasy island of my mathematical model.

And here’s my three lessons: (i) offshoring breeds offshoring; (ii) if you can’t beat them, join them; and (iii) offshoring plays the role of drastic innovation. Let me explain exactly what I mean. First, offshoring breeds offshoring in the sense that, once your rivals start doing it and competing against you from the position of cost-advantage, you’ll be forced to offshore for your own survival. In other words, there’s “strategic complementarity,” which means you can’t get away from it by yourself, because you’re locked-in by these competitive forces. You have to either fly or die.

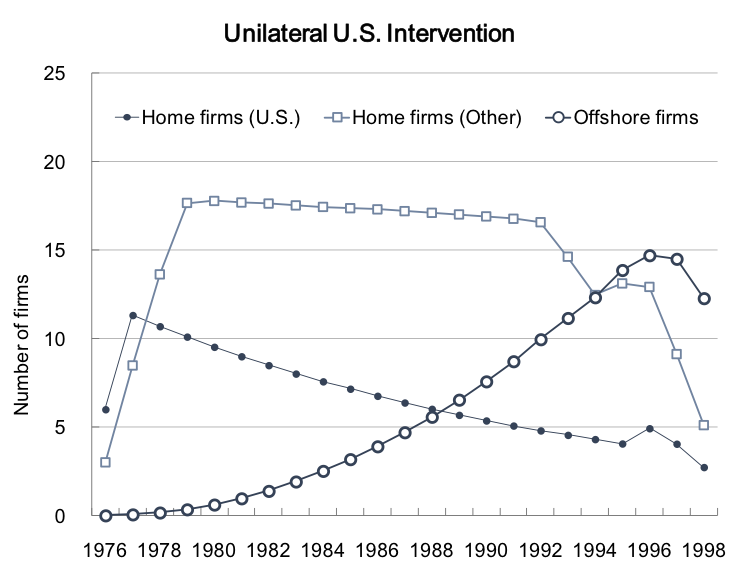

Hence my second message, “If you can’t beat’em, join’em.” This lesson applies to government policy at the country level as well. For example, if the United States bans “shipping jobs overseas,” American firms will be forced to compete from the high-cost location. Meanwhile, their foreign rivals from Japan and the U.K. will keep moving to better locations, win the game with lower costs, and wipe out the poor high-cost firms off the surface of the planet. That’s what my simulation shows in Figure 2. Competition is global, and you just can’t get away from it.

Figure 2. Simulation experiment of a ban on offshoring by the U.S. government

The third and the final lesson is that offshoring plays the role of “drastic” innovation over the course of a decade or two. It completely changes the industrial landscape on the supply side, while benefiting consumers on the demand side across the globe. Without Singapore or China, the entire HDD world would have been stuck in a high-cost structure and we’d be paying a lot for HDDs, personal computers, and servers. Cloud storage and cloud computing rely on the cheap and huge storage capacity of HDDs, so all these services like Gmail, Dropbox, and Amazon Web Services would have to be costlier. Similarly, we wouldn’t be able to enjoy as many songs, pictures, and videos as we do now. Imagine Google, YouTube, and Facebook with ten times more paid advertisements (so that these tech firms can afford expensive information storage).

So my bottom line is this: let’s not get stuck in debates about politics and job destruction when we talk about offshoring and globalization. That’s too narrow, myopic, and boring. Instead, our trained eyes should be seeing the big picture of industry-wide dynamics and creative destruction. That’s where the real drama is playing out.

Everything goes in the long run, so let’s appreciate what we have while we are still alive.

You may also like:

After the US elections, how do we return to a constructive debate about trade?

♣♣♣

Notes:

- This blog post is based on the author’s paper Industry Dynamics of Offshoring: The Case of Hard Disk Drives, forthcoming in the American Economic Journal: Microeconomics.

- A 50-minute presentation movie of this research is available here.

- The post gives the views of its author, not the position of LSE Business Review or the London School of Economics.

- Featured image credit: Seagate’s clean room (Wuxi, China), by Robert Scoble, under a CC-BY-2.0 licence

- Before commenting, please read our Comment Policy.

Mitsuru Igami is Associate Professor of Economics at Yale University and Visiting Associate Professor at the Massachusetts Institute of Technology. He studies the strategic industry dynamics of creative destruction, including innovation, mergers, and cartels. His full research portfolio is available here.

Mitsuru Igami is Associate Professor of Economics at Yale University and Visiting Associate Professor at the Massachusetts Institute of Technology. He studies the strategic industry dynamics of creative destruction, including innovation, mergers, and cartels. His full research portfolio is available here.