The value premium

When a firm is listed on the stock market, the value of shareholders’ equity can be measured using both accounting and market-based methods. Accountants compute the book value of equity from the firm’s balance sheet. Since the stock is also continuously traded on the exchange, the market value of equity can be obtained by multiplying the stock price by the number of shares outstanding.

One of the long-standing puzzles in finance is that the stocks of firms with high book values proportionately to their market values (value stocks) tend to earn higher returns on average than stocks with the opposite characteristic (growth stocks). The difference in performance between value and growth stocks, called the value premium, is high in most markets, including the United States and the United Kingdom (Fama and French 2001). The value premium is generally of the same magnitude as, and often exceeds, the average performance differential between broad stock market indexes and short-term government bonds.

Possible origins of the value premium

The magnitude of the value premium has sparked an active debate about its possible origins among academics and practitioners over the past three decades. Two polar views have emerged.

- Risk-based explanation: The value premium is a compensation for forms of risk (other than general stock market risk) to which value stocks are more exposed than growth stocks, as in equilibrium models of state risk (Merton 1973).

- Behavioural explanation: Investors are irrationally exuberant about the prospects of innovative growth companies or have strong taste for these companies. As a result, they pay high prices for growth stocks, which end up being poor investments.

Earlier research on these mechanisms has been limited by the fact that traditional datasets lack data on individual portfolio holdings and therefore do not permit researchers to assess the determinants of investor decisions. In his 2013 Nobel Prize lecture, Professor Eugene Fama concludes an extensive discussion of the value premium as follows: “To what extent is the value premium in expected stock returns due to ICAPM* state variable risks, investor overreaction, or tastes for assets as consumption goods? We don’t know.” (Editor’s note: ICAPM = Intertemporal Capital Asset Pricing Model)

Inspecting the portfolios of retail investors

Our paper overcomes these difficulties by investigating value and growth investing in the individual portfolios of retail investors. We use a highly detailed administrative panel which contains the disaggregated holdings and socioeconomic characteristics of all Swedish residents between 1999 and 2007. This investigation delivers new insights that help clarify the debate about the value premium.

The patterns we document are overall remarkably consistent with risk-based explanations of the value premium. Household decisions to invest in value stocks result primarily from a rational balancing of the risk and return trade-off from these stocks.

Three main determinants of value/growth investing

We show that a household’s decision to select a value or growth tilt is empirically best explained by three components of its risk profile.

- A risky job tilts the household’s portfolio of risky financial assets away from value firms. This empirical finding is consistent with the view that value stocks are highly correlated to aggregate labor market risk and are thereby unattractive to households already exposed to aggregate risk through their job.

- A sound balance sheet (high wealth, low debt) tilts the financial portfolio toward value stocks. This empirical finding is consistent with the general prediction of financial theory that more financially secure households are in the best position to absorb the higher risks of the value stocks and go after the higher returns.

- A short investment horizon tilts the financial portfolio toward value stocks. This is consistent with a general prediction of portfolio theory that older investors with shorter investment horizons have smaller hedging needs. This could either come from the high exposure of value stocks to labor income risk or high exposure to other risks documented in the literature.

The value ladder

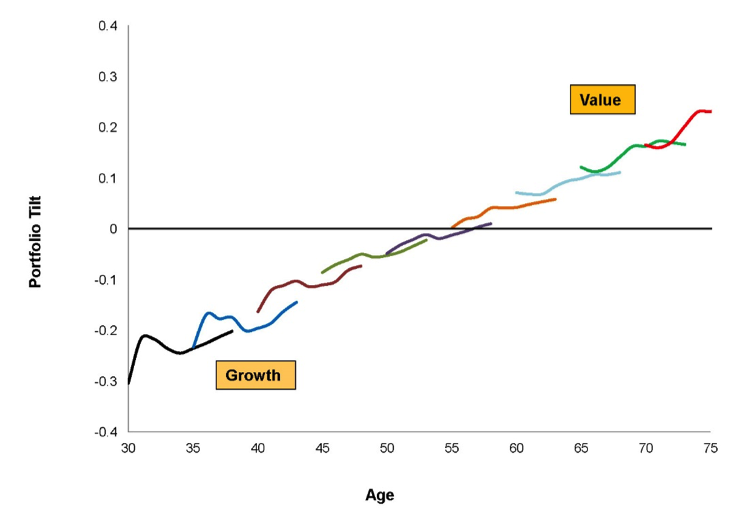

We document a striking migration from growth to value investing over the life cycle, which we call the value ladder. This migration is well explained by the three risk-based determinants of the value tilt: households progressively migrate from growth to value investing as they depend less on their human capital, as their balance sheets strengthen, and as their horizons shorten. We document that households actively rebalance their portfolio to enable this migration.

Figure 1. Migration from growth to value investing over the life cycle

We verify that the value ladder is not driven by financial market experience or the age of firms.

Aggregate impact of rational and irrational behaviour

We show that the risk-based determinants of the value tilt have remarkable explanatory power once we aggregate households by birth year. Even though behavioural biases may have important effects on household portfolios, their aggregate effects are therefore limited. We also show that the calculated selection of a value/growth tilt is especially pronounced among wealthier investors who own the bulk of the stock market and as a result have the greatest influence on asset returns. This finding further reinforces the view that the value premium represents a rational compensation for forms of systematic risk faced by investors.

♣♣♣

Notes:

- This blog post is based on the authors’ paper Who Are the Value and Growth Investors?, The Journal of Finance, February 2017

- The post gives the views of its author, not the position of LSE Business Review or the London School of Economics.

- Featured image credit: Stock market quotes in newspaper, by Andreas Poike, under a CC-BY-2.0 licence

- Before commenting, please read our Comment Policy.

Sebastien Betermier is an Associate Professor of Finance at McGill University. His research seeks to understand the relationships between risk and return and how these drive investors in their investment decisions. He holds a PhD in Finance from the Haas School of Business at the University of California at Berkeley.

Sebastien Betermier is an Associate Professor of Finance at McGill University. His research seeks to understand the relationships between risk and return and how these drive investors in their investment decisions. He holds a PhD in Finance from the Haas School of Business at the University of California at Berkeley.

Laurent E. Calvet is a Professor of Finance at EDHEC Business School. He is an engineering graduate from Ecole Polytechnique (1991) and Ecole Nationale des Ponts et Chaussées (1994) in Paris and holds a Ph.D. in Economics from Yale University (1998). He has served as the John Loeb Professor of the Social Sciences at Harvard University (1998-2004), an HEC Foundation Professor at HEC Paris (2004-16), and a Professor and Chair in Finance at Imperial College London (2007-8). His contributions to household finance, asset pricing, and multifractal risk modeling have appeared in leading economics, finance, and statistics journals. Prof. Calvet pioneered with Adlai Fisher the Markov-switching multifractal model of financial volatility, which is used by academics and financial practitioners to forecast volatility, compute value-at-risk, and price derivatives. He is a Research Associate of Goethe University Frankfurt’s Center for Financial Studies, a Founding Member of the CEPR Household Finance Network, and an editorial board member of several academic journals, including Journal of Fractal Geometry.

Laurent E. Calvet is a Professor of Finance at EDHEC Business School. He is an engineering graduate from Ecole Polytechnique (1991) and Ecole Nationale des Ponts et Chaussées (1994) in Paris and holds a Ph.D. in Economics from Yale University (1998). He has served as the John Loeb Professor of the Social Sciences at Harvard University (1998-2004), an HEC Foundation Professor at HEC Paris (2004-16), and a Professor and Chair in Finance at Imperial College London (2007-8). His contributions to household finance, asset pricing, and multifractal risk modeling have appeared in leading economics, finance, and statistics journals. Prof. Calvet pioneered with Adlai Fisher the Markov-switching multifractal model of financial volatility, which is used by academics and financial practitioners to forecast volatility, compute value-at-risk, and price derivatives. He is a Research Associate of Goethe University Frankfurt’s Center for Financial Studies, a Founding Member of the CEPR Household Finance Network, and an editorial board member of several academic journals, including Journal of Fractal Geometry.

Paolo Sodini is Professor of Finance at the Stockholm School of Economics. He is the director of the Swedish House of Finance National Data Center and one of the founders of the European Network of Household Finance. His research focuses on Household Finance and in particular the empirical investigation of which theories better describe household behavior in financial markets. He has explored how households take financial risk, how they diversify and rebalance their portfolios and how their return on capital varies with wealth. He holds a Phd in Economics from the Massachusetts Institute of Technology.

Paolo Sodini is Professor of Finance at the Stockholm School of Economics. He is the director of the Swedish House of Finance National Data Center and one of the founders of the European Network of Household Finance. His research focuses on Household Finance and in particular the empirical investigation of which theories better describe household behavior in financial markets. He has explored how households take financial risk, how they diversify and rebalance their portfolios and how their return on capital varies with wealth. He holds a Phd in Economics from the Massachusetts Institute of Technology.