The UK is about to stop shareholders monopolising votes for company boards, with worker voice. Currently, asset managers control most shareholder votes in public companies. They have systemic conflicts of interest, because shareholder votes can influence companies to buy asset managers’ financial products (e.g. defined contribution pensions). But now this is changing. One small step, following government consultation, is that the Financial Reporting Council will write new ‘comply or explain’ rules in the UK Corporate Governance Code, so that listed companies introduce: (1) ‘a designated non-executive director’ responsible for employee engagement, (2) ‘a formal employee advisory council’ or (3) ‘a director from the workforce’.

Theory and evidence on votes at work

Without any credible evidence, a minority of corporate lawyers and economists still argue that worker voice will damage productivity. For example, Oliver Williamson argued shareholders make ‘firm-specific investments’ that cannot be protected without controlling boards. Others argued it is essential that every voting right ‘flows with the residual interest in the firm’. These arguments had no empirical basis, and even in their own theoretical terms, no factual basis. Shareholders, who exercise votes, are mostly asset managers and banks. They make no firm-specific investments at all. They bear no risk from insolvency. They appropriate votes on ‘other people’s money’. The true, ultimate investors are beneficiaries of pension funds, life-insurance policies or mutual funds: usually employees saving for retirement.

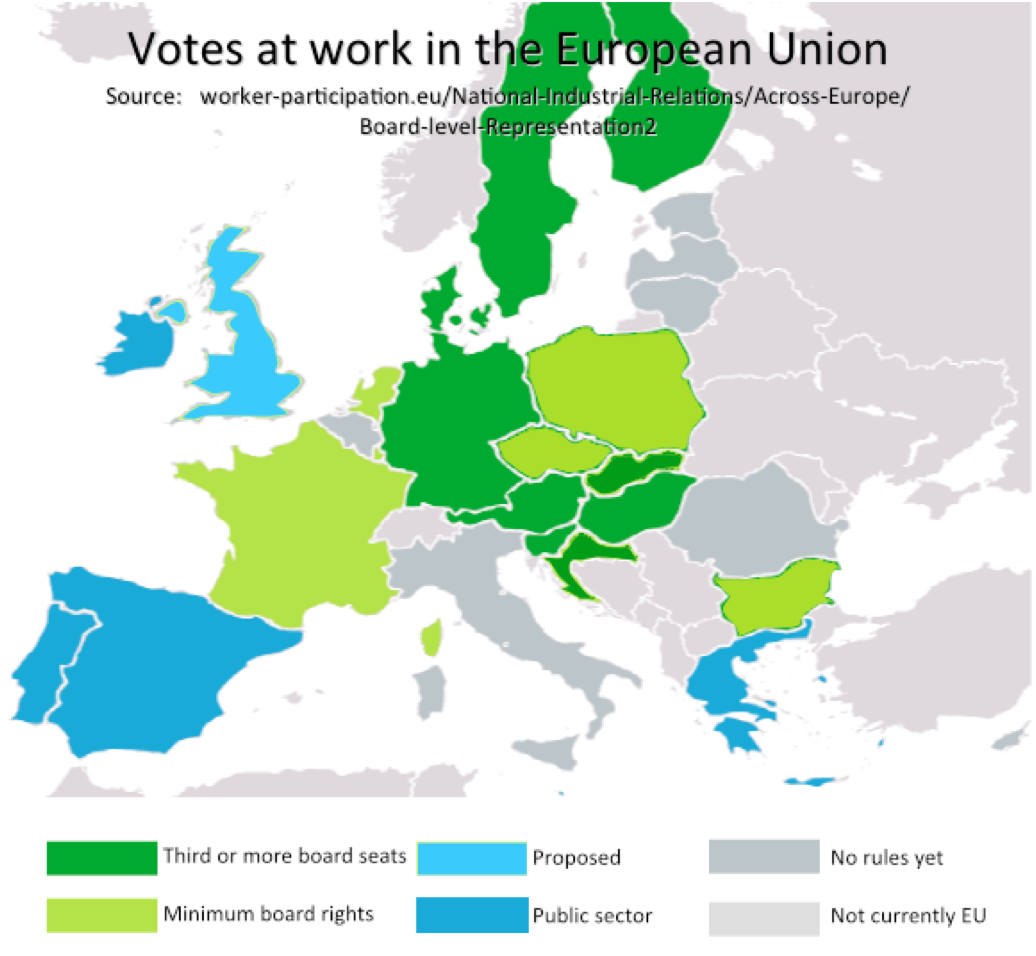

A second type of argument is that with multiple interests on boards, people will squabble and business will become slower. This theory was advanced in valuable work by Detlev Vagts and Henry Hansmann. But the same argument was used by Johannes Zahn, the Nazi banker and corporate lawyer who drafted the German Public Companies Act 1937. Zahn wanted banks and boards to control everything, so ‘democracy of capital will vanish just as it did in politics’. After WW2, the reverse happened: capital dispersed, and votes at work have spread, with a majority of OECD (and EU) countries now having some form of codetermination law.

Yet a third argument is that codetermination does not happen voluntarily, only by coercive law, because it is inherently inefficient. This is historically inaccurate. Elsewhere, I have explained how codetermination in Germany began with collective agreements, which only later were codified by law. But also, behavioural, qualitative, and quantitative empirical evidence strongly suggests votes at work are essential for productive companies.

First, behavioural evidence supports ‘the participation hypothesis’. That is, ‘changes in human behavior can be brought about rapidly only if people ‘participate in deciding what the change shall be and how it shall be made.’ Votes at work also empower people to ensure they are fairly paid. All modern behavioural evidence suggests that, unless people are fairly treated and paid, they lose motivation to work. The arguments of Ronald Coase or Easterbrook and Fischel, that distribution is unconnected to efficient production, are evidence-free.

Second, qualitative evidence supports worker voice, not least because conflicts need to be resolved, not suppressed. But also, multiple interest groups on boards can and do work well. In 1978, worker representation at the UK Post Office board was lauded in its own annual report as having ‘contributed much to the major decisions that have to be taken about the future’. Similarly, long experience in UK pension funds shows ‘on the whole they function as relatively harmonious bodies’. By contrast, there is no evidence beyond anecdote to show that codetermined boards do not work well.

Third, preliminary quantitative evidence suggests legal systems with votes at work are superior in productivity and economic development. Cambridge’s Centre for Business Research has compiled a Labour Regulation Index of 117 countries’ labour laws, and their change since 1970. Results are still in preliminary stages, but will probably confirm what behavioural and qualitative evidence has already said: votes at work are essential for long-term success of companies.

History of British codetermination

The fact that there is not already a general codetermination law in the UK is surprising because its corporations with the greatest long-term success – universities – have incorporated worker voice at least since the Oxford University Commission of 1852. Hardly a radical body, it was determined to reverse‘successive interventions by which the government of the University was reduced to a narrow oligarchy.’ Today almost all universities ensure staff have votes at work. The LSE does it for staff and students (see article 10.5 but see amendments). So why is there no general plan yet?

Two reasons have been (1) an old view that to get votes, people should invest property, by buying shares and (2) uncertainty in the labour movement. Both have now gone. Outside universities, the South Metropolitan Gas Act 1896 and the Port of London Act 1908 enabled worker representatives on boards. The Gas Act had depended on workers investing money through an employee share scheme. This reflected old prejudice that male ownership of property was a key to participation in public life. Yet the Port of London Act enabled worker votes solely by the investment of labour. After WW1, Lloyd George in coalition with Conservatives attempted to pass codetermination for Railways. But, as a previously secret memorandum shows, it failed against management opposition and unions who only wanted nationalisation.

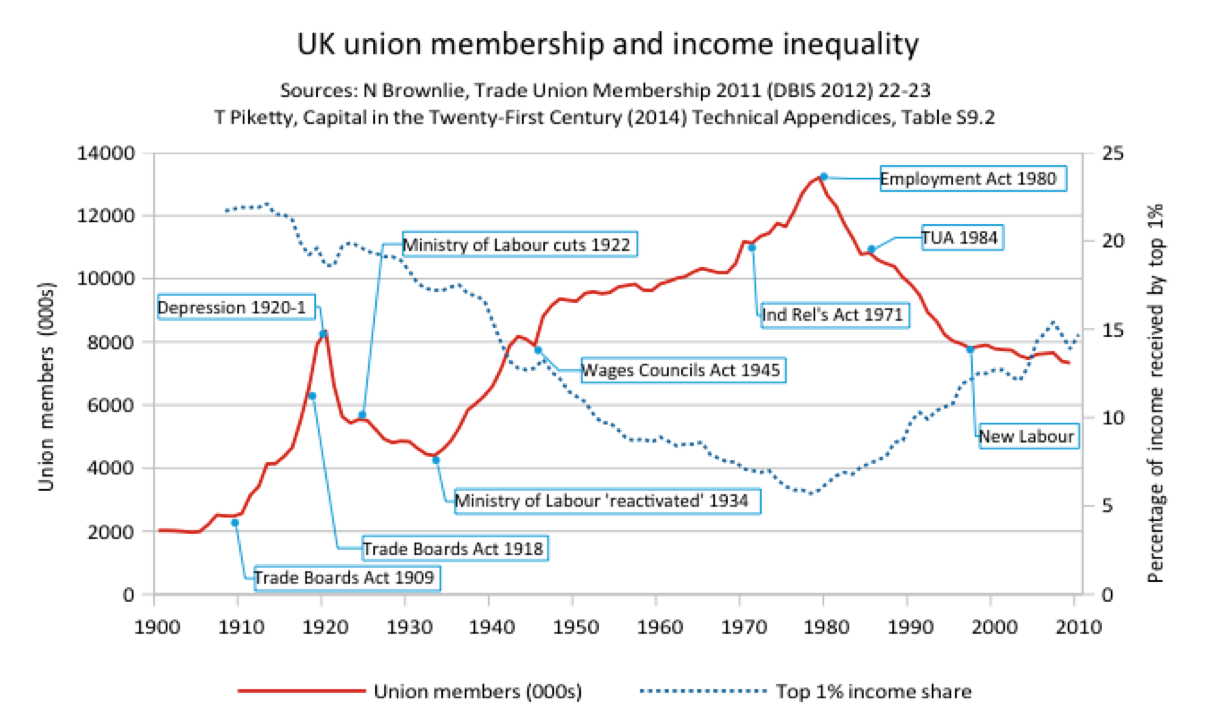

Why did organised labour not bargain hard for votes at work? First, employee share schemes had given worker representation a bad name: workers were told to save in an Enron-style undiversified portfolio, and given no meaningful voice. As LSE founders Sidney and Beatrice Webb said, employee share schemes were advocated ‘by the most reactionary persons’. Second, it was recognised by the Webbs after WW1 that worker representation, purely by investment of labour, could be ‘a real social gain’. But Sidney Webb was also writing the UK Labour Party’s clause IV, committing to ‘nationalisation of the means of production’. The drive for public ownership was conflated with worker voice, as if socialisation of ownership was necessary for socialisation of power. At the same time, British labour with government support, had substantial influence (if not real votes) through strong union membership, collective bargaining, and strikes. Voice at work with collective bargaining created prosperity and a more equal society. But it was all destroyed from 1979. Unions’ decline and soaring inequality were a mirror image:

Over the mid-20th century, through labour policy documents, trade unions were a ‘single channel’ of voice, and there were many codetermination experiments. The Iron and Steel Act 1967, the Industry Act 1975, and the Post Office Act 1977 all required worker directors. The Bullock Report of 1977 proposed a general Act, but it divided all sides. Half the board would be worker representatives, half shareholders, and a government representative would break any deadlock. Such detailed plans, rather than minimum standards, could not command enough consensus. After the government flipped its proposals to a two-tier board structure, and its White Paper flopped, the 1979 election seemed to be the end.

Or not quite ‘the end’. Universities still had codetermination. Moreover, collective agreements for pension plan management ensured codetermination in worker capital. After a scandal of pensions being stolen by Robert Maxwell, the Conservative government passed the Pensions Act 1995, for one third representation in all pensions unless firms positively opted out. The Pensions Act 2004 removed the opt-out. The Secretary of State may require one-half by statutory instrument. It is not the world’s best system: Australia, Belgium or Sweden do better. But, surprisingly, British codetermination in pensions supports more worker voice than in Germany. Far from an alien tradition, British codetermination has among the richest histories in the world.

Proposals today

This leads to the essential question: how should companies, employees, and unions build votes at work today? It is essential to keep in mind that if Labour regains office, corporate governance will reform further. At Labour’s 2016 conference, policy ‘Composite 4’ committed to reform. This means, said the Shadow Chancellor, adopting the Manifesto for Labour Law. This says every ‘board must have worker directors’ and that workers ‘should have a minimum percentage of the vote in general meetings of the company’. This is what British universities have done for centuries. The need for votes at work are a new political consensus in Britain: the question is not so much ‘if’, but ‘how’.

So, how should companies and trade unions approach the Financial Report Council’s options? Given the social and economic benefits from embracing employee voice, the most advisable approach for corporate boardrooms would be to get ahead of the curve. They can look to successful competitors across Europe – in the Netherlands, Denmark, Sweden, Norway – for advice. There are three further points to consider.

First, by far the simplest option will be that the workforce elects at least one director. Two worker directors will bring diversity and mutual support. Trade unions may well bargain to choose the board representatives, so it is important to understand there are many alternative models. For instance, trade unions already nominate many pension trustees, but also many have workforce ballots and unions put up candidates. Abroad, employees may delegate votes to their union, or their vote can be automatically delegated unless employees opt to send instructions.

Second, there is a choice about the range of employees to include. Again, the simplest option is to ensure employees of the corporate group (readily defined for group accounts and tax) are included in ballots for the board. A successful company will see every reason to include workers from its subsidiaries overseas. All voting can be arranged electronically with simple, safe software.

Third, a union’s support will be essential in ensuring good communication with the workforce. One of the best reasons for voice on boards has always been the reduction of industrial conflict. The overwhelming experience is that worker representatives will genuinely seek to defend employees’ interests, but do so in a cooperative way. Employees and unions will want meaningful progress. So will member nominated trustees in pension funds. If it can be done – and there is every indication it can – worker voice will promote the success of all companies.

♣♣♣

Notes:

- This blog post was originally published at British Politics and Policy. It is based on the author’s paper Votes at Work in Britain: Shareholder Monopolisation and the ‘Single Channel’, Industrial Law Journal, October 2017, free to read on SSRN.

- The post gives the views of its authors, not the position of LSE Business Review or the London School of Economics.

- Featured image credit: Cabot Square, Canary Wharf, by Diliff, own work, under a CC BY-SA 3.0 licence

- When you leave a comment, you’re agreeing to our Comment Policy.

Ewan McGaughey is Lecturer in Private Law at King’s College London, and Research Associate at the Centre for Business Research, University of Cambridge.

Ewan McGaughey is Lecturer in Private Law at King’s College London, and Research Associate at the Centre for Business Research, University of Cambridge.