In December 2008, the financial crisis and the subsequent recession compelled the Federal Reserve to take unprecedented action to reduce the federal funds rate to its zero lower bound (ZLB). Hitting the ZLB was important because the Fed lost its ability to respond to negative economic events with its traditional policy tool. Recent research has shown that the ZLB constraint can have undesirable effects on the economy. Our research shows the constraint can also lead to greater uncertainty about the future economy as well as a much stronger relationship between uncertainty and economic activity.

The economics literature has focused most of its attention on how uncertainty affects economic activity. For example, uncertainty from unique events, such as natural disasters and terrorist attacks, or uncertainty about changes in policy can delay consumer purchases and business investment. This type of uncertainty is referred to as exogenous uncertainty. In our work, the causation runs in the opposite direction—the state of the economy caused the ZLB to bind, which increased uncertainty about the future economy. In this case, uncertainty is responding to an event that is endogenous to the economy.

To develop our analysis, we worked with a theoretical model that is often used to consider issues related to monetary policy and the ZLB. The model includes equations that describe how households choose to spend and save, how much labor they provide to the private sector, how firms decide to set prices, and how the Fed sets monetary policy. The equation that describes the behaviour of the central bank—often called a monetary policy or Taylor rule—determines how strongly the Fed responds to inflation and economic activity. We use a statistical procedure to estimate the model and ensure that it provides an adequate framework for thinking about the quantitative importance of the ZLB constraint. This procedure also allows us to generate a data-driven, forward-looking measure of macro uncertainty.

The measure of uncertainty in our model equals the expected volatility of future real GDP growth. To understand this statistic better, suppose someone was asked to predict how much the economy might grow next quarter. Someone who is fairly confident might predict growth between 1.5 per cent and 2.5 per cent, while someone more uncertain might say between 1 and 3 per cent. A wider average range implies higher expected volatility of real GDP growth and, hence, greater uncertainty about the future.

An important finding from our model is that uncertainty rises when the policy rate comes close to or hits its ZLB. Why does this happen? The Fed has a dual mandate to stabilize prices and maintain full employment. When the Fed is not constrained by its ZLB, it responds to unexpected negative economic events by reducing its policy rate, which dampens the effects of the lower demand. In situations when the Fed is constrained, like it was during the 2008 financial crisis, additional rate reductions are no longer possible. As a result, the economy becomes more sensitive to further declines in demand, which leads to lower real GDP than if the Fed was unconstrained. Uncertainty rises because people have more difficulty predicting future economic outcomes. Away from ZLB, the Fed is able to help stabilize the economy, so the range of plausible forecasts is relatively narrow. When the Fed loses that ability due to the ZLB, output is more sensitive to shocks that hit the economy so the range of forecasts is much wider.

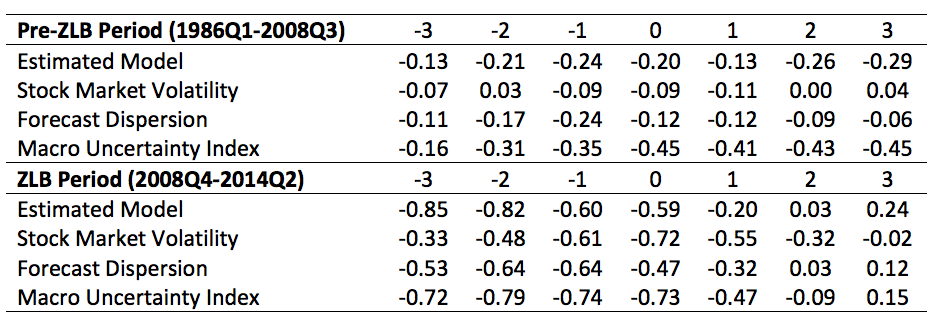

Our model also implies there is a much stronger and statistically more negative relationship between uncertainty and economic activity when the Fed is constrained by the ZLB. We find strong supporting evidence for this result in several popular measures of uncertainty (expected stock market volatility, forecast dispersion, and a recently developed index that incorporates uncertainty about a rich set of macro variables). In many cases, the contemporaneous correlation between uncertainty and economic activity was two to three times stronger during the ZLB period than it was before the Great Recession. Lags of real GDP growth were also more tightly linked with current uncertainty in the ZLB period, while the relationship with leads of real GDP growth were either weaker or unchanged. These results indicate that poor economic conditions drove uncertainty instead of exogenous events, as our theory predicts.

The key takeaway from our work is that periods of high uncertainty do not necessarily mean uncertainty is exerting a major effect on the economy. Sometimes changes in uncertainty stem from unique events not directly linked to the economic activity. At other times, they are a byproduct of what is happening in the economy. Future research is aimed at quantifying the relative importance of these two effects.

Figure 1. Stronger correlations between economic activity and uncertainty in the ZLB period

Notes: Correlations between current uncertainty and real GDP growth in the same period (0), previous or lagged periods (–1, –2 and –3), and future or leading periods (1, 2 and 3). Source: Bureau of Economic Analysis; Survey of Professional Forecasters; Chicago Board Options Exchange; Jurado, Ludvigson, and Ng (American Economic Review, 2015); authors’ calculations.

Disclaimer: The views expressed in this document are those of the authors and do not necessarily reflect the views of the Federal Reserve Bank of Dallas or the Federal Reserve System.

♣♣♣

Notes:

- This blog post is based on the authors’ paper The Zero Lower Bound and Endogenous Uncertainty, The Economic Journal, 2017

- The post gives the views of its authors, not the position of LSE Business Review or the London School of Economics.

- Featured image credit: Zero, by PIRO4D, under a CC0 licence

- When you leave a comment, you’re agreeing to our Comment Policy

Michael Plante received his Ph.D. in economics from Indiana University in 2009 and joined the Federal Reserve Bank of Dallas in July 2010. He is currently a senior economist in the research department and the project manager of the Dallas Fed Energy Survey. His research interests include macroeconomics, energy markets, and the connections between energy and the economy.

Michael Plante received his Ph.D. in economics from Indiana University in 2009 and joined the Federal Reserve Bank of Dallas in July 2010. He is currently a senior economist in the research department and the project manager of the Dallas Fed Energy Survey. His research interests include macroeconomics, energy markets, and the connections between energy and the economy.

Alexander Richter joined the Federal Reserve Bank of Dallas as senior economist in May 2016. He received his PhD from Indiana University in May 2012. Prior to joining the bank, Richter was an assistant professor in the Department of Economics at Auburn University for four years. His research interests include monetary policy, fiscal policy, computational economics and Bayesian econometrics. His recent work focuses on the macroeconomic effects of uncertainty and the Fed’s zero interest rate policy.

Alexander Richter joined the Federal Reserve Bank of Dallas as senior economist in May 2016. He received his PhD from Indiana University in May 2012. Prior to joining the bank, Richter was an assistant professor in the Department of Economics at Auburn University for four years. His research interests include monetary policy, fiscal policy, computational economics and Bayesian econometrics. His recent work focuses on the macroeconomic effects of uncertainty and the Fed’s zero interest rate policy.

Nathaniel Throckmorton is an assistant professor of economics at the College of William and Mary. He joined the department in August 2014, after receiving his Ph.D. from Indiana University in January 2014. Prior to joining William and Mary, he was a visiting assistant professor at DePauw University and a visiting economist at the Joint Committee on Taxation for the U.S. Congress. His research examines the effects of various monetary and fiscal policies and the role of uncertainty in the economy.

Nathaniel Throckmorton is an assistant professor of economics at the College of William and Mary. He joined the department in August 2014, after receiving his Ph.D. from Indiana University in January 2014. Prior to joining William and Mary, he was a visiting assistant professor at DePauw University and a visiting economist at the Joint Committee on Taxation for the U.S. Congress. His research examines the effects of various monetary and fiscal policies and the role of uncertainty in the economy.