States are currently struggling to reach global agreement on the taxation of digital firms such as Apple and Google, suggesting that an international regime characterised by impressive coherence over a century may be beginning to fragment. While work on the politics of the international tax regime is still largely preoccupied with the US, a ‘great power’, this fragmentation largely reflects the US’s inability to prevent other countries from acting.

Perhaps the more significant, but largely untold, story in recent years is the disruptive influence of rising powers, especially China. This is a preoccupation of scholarship on other areas of international economic relations, such as trade, the monetary system and development assistance. Literature appears to be settling on a consensus that China is a cautious reformist rather than a supporter of more dramatic change. The international tax regime differs from these areas, however, because it is a cooperation regime characterised by strong incentives for states to find and follow multilateral agreement. In a new paper, we study how China has destabilised the long-held consensus around the Arm’s Length Principle, which underpins OECD-led international agreement on the distribution of multinational companies’ tax bases through transfer pricing.

Interests: Chinese exceptionalism

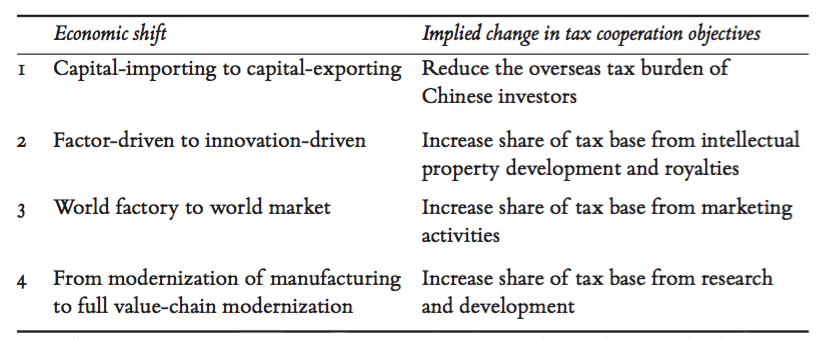

We begin with China’s interests. They align neither with developing countries, despite official rhetoric to that effect, nor with OECD countries. This is partly because China is undergoing an economic transition, summarised in table 1: its past, present and future interests differ from each other. In bilateral tax treaties, China has been able to manage this situation by adopting different negotiating stances with developing countries compared to developed countries. It faces more of a challenge in multilateral negotiations.

Table 1. Changes in China’s economic position emphasised by SAT officials

Source: The authors, based on Tizhong Liao and Li Hanli, ‘China: international taxation in the post- BEPS era’, in Sam Sim and Mei-June Soo, eds, Asian voices: BEPS and beyond (Amsterdam: IBFD, 2017), pp. 123–30.

Source: The authors, based on Tizhong Liao and Li Hanli, ‘China: international taxation in the post- BEPS era’, in Sam Sim and Mei-June Soo, eds, Asian voices: BEPS and beyond (Amsterdam: IBFD, 2017), pp. 123–30.

China’s interests are also different because of what it calls its location specific advantages (LSAs). As a tax administration document states:

China has a huge population and a fast-growing middle class that form a great market capacity and huge consumer groups. This factor is unique in the world and inimitable by other small and medium-sized developing countries.

By arguing that what the LSA firms obtain from operating in the Chinese market (roughly divided into location savings for manufacturing, and market premiums for retail) are unique to it, China avoids the need to choose between its old and new interests. It has simply begun to claim a larger share of multinational firms’ taxable profits. Take this quote from an article written by some staff of the law firm Baker Mackenzie:

Most multinationals do not realise that their strategy of allocating ‘routine profits’ to China is under severe attack. To quote a Chinese tax director who has negotiated extensively with the Chinese tax authorities, ‘[i]t became clear that the State Administration of Taxation believes China has unique factors, including location savings and market premiums, that are not addressed by the OECD Transfer Pricing Guidelines […]’.

Capabilities: often underestimated

China has a particularly strong position in international tax negotiations because the same economic transition that is changing its preferences is also strengthening demand from multinationals to access its markets. Previous work by Lukas Hakelberg and Wouter Lips has focused on absolute market size, where China lags behind the US and EU, but we think three other variables also matter:

- Growth. China is undergoing huge economic and social shifts that make it a uniquely attractive place to do business, whether measured by the exploding size of its middle class, or its ascendency towards the top of the patent registration league tables. China’s attraction to investors is thus about future potential as well as present performance.

- Profitability. Its fairly new and rapidly growing consumer market is relatively untapped in many areas, has a taste for foreign goods and services, and is more willing to pay a premium for higher-quality products.

- Value-chain positioning. Chinese manufacturing has become indispensable to the production of a huge proportion of products consumed in the West, most iconically the iPhone, and this position is becoming increasingly institutionalised.

For these reasons, China can afford not to take too seriously any threats from multinational companies and foreign governments if it differs from international tax norms, giving it the kind of autonomy that only the US was thought to possess.

Strategies: Janus-faced

Location-specific advantages allow us to analyse how China has interacted with the established institutions of global tax governance. We conclude that its approach is neither conciliatory nor confrontational, but both, simultaneously. China adopts a rhetoric of common cause with developing countries, but pursues an agenda that is designed to maximise only its own share of the tax ‘pie’. It flirts with outside options such as the United Nations, while enjoying a privileged position within the G20-OECD complex at the heart of international tax rule-making, and diverging from existing rules when it finds this to be in its interest. “China needs to strike a balance between conforming to international conventions and acknowledging its unique situation in transfer pricing legislation and practice,” wrote Chinese officials in a United Nations document in 2017. In practice, however, its actions have been more aggressive than this might imply.

In particular, China’s implementation of location-specific advantages chips away at a core norm of the international tax regime, the Arm’s Length Principle (ALP). OECD rules require that the ALP be applied to each subsidiary of a multinational in isolation, in comparison to a locally owned independent enterprise. By contrast, the Chinese position is that:

With more and more companies poised to conduct business as groups, economic activities are more and more likely to take place in the inner circle of MNE groups. It is nearly impossible to take out one piece of a value chain of an MNE group and try to match it to comparable transactions/companies

This has ruffled some feathers, as can be seen in this quote from the United States’ former international tax negotiator, Robert Stack:

The OECD countries all ascribe [sic] to the arm’s-length standard and to what they call the basic OECD principles. Other countries have not signed on to the full implementation of the arm’s-length standard and the OECD guidelines, even countries that are in the G-20. And the reason this is very important is the question of market premium and intangibles that relate to markets and things like location-specific advantages that are specifically talked about in the OECD guidelines … [China should] not pick a rifle-shot issue that favors a large-market country and try to gerrymander the debate from that narrow issue.

The destabilising effect of China’s actions could lead to one of two outcomes, we suggest. In the first scenario, China would behave very much like the United States, throwing its lot in with the G20-OECD complex. Its growing influence would allow it to use a combination of incremental changes at global level and selective unilateralism to adapt as its place in the global economy evolves. In the second, by design or by accident, China’s approach could destabilise the core norms of the international tax regime. By opening cracks in the existing system, LSAs may induce other countries—perhaps led by other large emerging markets—to seek their own accommodations, thus placing increasing strain on the multilateral foundations of the international tax system. It remains to be seen whether China’s successful challenge to the ALP will similarly prompt subsequent challenges from elsewhere.

♣♣♣

Notes:

- This blog post is based on the authors’ paper China’s challenge to international tax rules and the implications for global economic governance, International Affairs (2018).

- The post gives the views of its authors, not the position of the institutions they represent, LSE Business Review or the London School of Economics.

- Featured image credit: Photo by buihuy89, under a CC0 licence

- When you leave a comment, you’re agreeing to our Comment Policy.

Martin Hearson is a fellow in international political economy at LSE. Martin’s research focuses on the politics of international business taxation, and in particular the relationship between developed and developing countries. He teaches courses on political economy and global financial governance. Before joining LSE, he worked in the NGO sector, most recently on international taxation. He continues to collaborate with civil society organisations in much of his work.

Martin Hearson is a fellow in international political economy at LSE. Martin’s research focuses on the politics of international business taxation, and in particular the relationship between developed and developing countries. He teaches courses on political economy and global financial governance. Before joining LSE, he worked in the NGO sector, most recently on international taxation. He continues to collaborate with civil society organisations in much of his work.

Wilson Prichard is an associate professor jointly appointed to the University of Toronto’s department of political science and the Munk School of Global Affairs and Public Policy. He is a research fellow at the Institute of Development Studies at the University of Sussex and is the research director of the International Centre for Tax and Development. He holds a PhD and MPhil from the Institute of Development Studies, and a BA from Harvard University. His broad research focus is in international development, with a particular focus on sub-Saharan Africa, and he has an interdisciplinary background in comparative politics, international political economy and economics.

Wilson Prichard is an associate professor jointly appointed to the University of Toronto’s department of political science and the Munk School of Global Affairs and Public Policy. He is a research fellow at the Institute of Development Studies at the University of Sussex and is the research director of the International Centre for Tax and Development. He holds a PhD and MPhil from the Institute of Development Studies, and a BA from Harvard University. His broad research focus is in international development, with a particular focus on sub-Saharan Africa, and he has an interdisciplinary background in comparative politics, international political economy and economics.