The COVID-19 pandemic increased remote working, online shopping, and telehealth, with important differences across socioeconomic groups in their ability to use such new technologies. Orkun Saka, Barry Eichengreen, and Cevat Giray Aksoy investigate past epidemics and find that they significantly increase the likelihood that individuals do their banking using the internet, mobile banks, and automated teller machines (ATMs). But inequality plays a role. Individuals who already have internet coverage are more likely to shift toward online banking during an epidemic.

Epidemics are frequently cited as inducing changes in economic behaviour and accelerating technological and behavioural trends. The Black Death, the mother of all epidemics, is thought to have sped up the adoption of earlier capital-intensive agricultural technologies such as the heavy plow and water mill by inducing substitution of capital for more expensive labour. COVID-19, to take a rather more recent example, is said to have increased remote working, online shopping, and telehealth.

But there may be important differences across socioeconomic groups in ability to utilise such new technologies. High-tech workers and workers in the professions have been better able to shift to remote work, compared to store clerks, custodians and other less well-paid individuals (Saad and Jones, 2021). Women have had more difficulty than men capitalising on opportunities to work remotely, given the occupations in which they are specialised (Coury et al. 2020). Individuals older than 65, being less technologically adaptable, find it more difficult to adjust to new work modalities (Farrell 2020). Small firms with limited technological capabilities have been less able to adapt their business models and stay competitive than their larger rivals, while residents of areas with limited broadband have experienced less scope for moving to remote work, remote schooling and telehealth (Chiou and Tucker 2020). COVID-19, it is said, has accelerated ongoing trends. If the increasing prevalence of the so-called digital divide was an ongoing trend before COVID, then the pandemic may have accelerated this one in particular.

The case of fintech

In a new paper, we study these issues in the context of fintech adoption. Specifically, we ask whether past epidemics induced a shift toward new financial technologies such as online banking and away from traditional brick-and-mortar bank branches. Online and mobile banking is a particularly informative context for studying the broader question of whether past epidemics induced the adoption of new technologies and, if so, by whom and where. Individuals have been using their computers and smartphones for banking applications for years. People in a variety of different countries and settings have available banking options that involve both in-person contact (such as banking via tellers in bank branches of a sort that may be problematic during an epidemic) and digital alternatives (such as banking via the internet or mobile phone app); these alternatives have been available for some time.

In contrast, analogous studies of telehealth would face the obstacle that physicians’ offices in many countries and settings did not, at the time of epidemic exposure, possess the capacity to provide such services remotely. Similarly, studies of remote schooling in the context of past epidemics would be limited by the fact that few schools and homes had available a flexible video conferencing technology, such as Zoom, much less the reliable internet needed to operate it.

Main findings

We combine data on epidemics worldwide with nationally representative Global Findex surveys of individual financial behaviour fielded in more than 140 countries in 2011, 2014 and 2017. The novelty comes from our ability to match each individual in the Global Findex dataset to detailed background information about the same individual in Gallup World Polls. This allows us to control for socioeconomic factors at the most granular level possible.

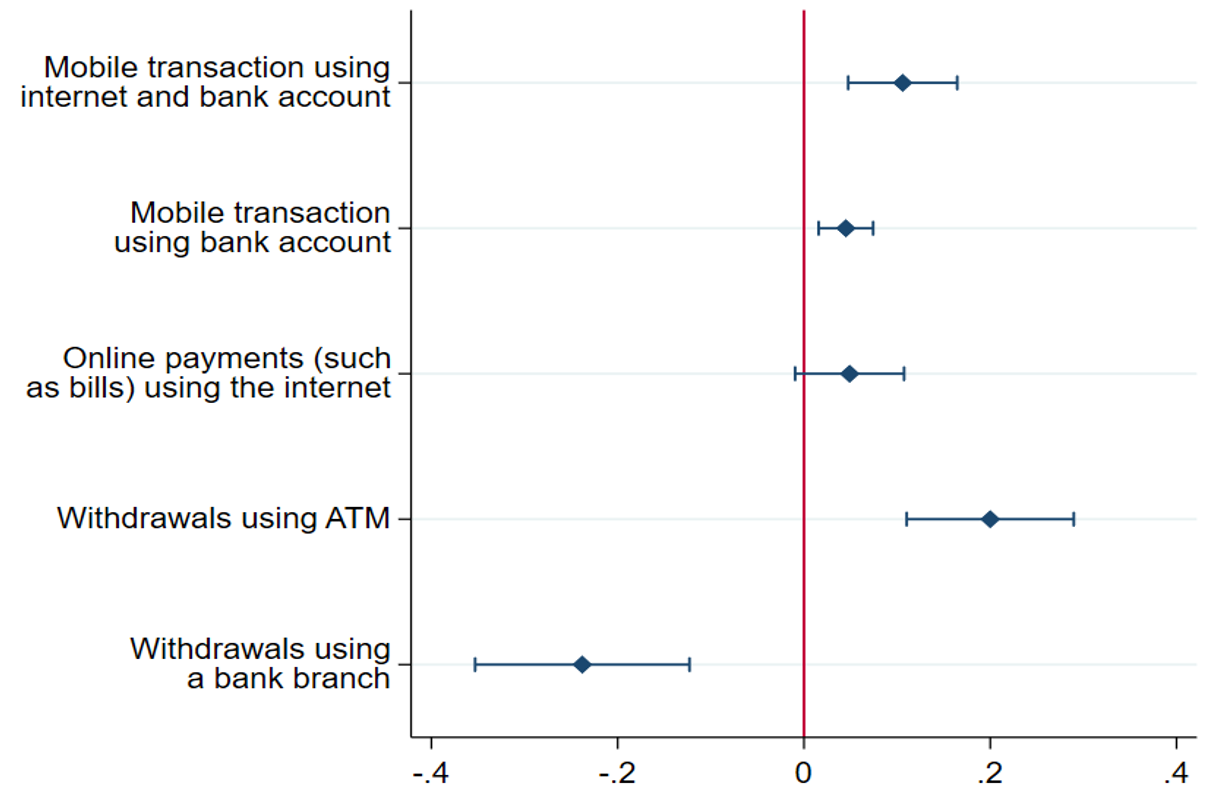

Figure 1. The impact of an epidemic on financial technology adoption

Source: Saka, Eichengreen and Aksoy (2021). Notes: Results use the Findex-Gallup sampling weights and robust standard errors are clustered at the country level. Estimates are reported with 95 per cent confidence intervals.

Holding constant individual-level economic and demographic characteristics and country and year fixed effects, we find that contemporaneous epidemic exposure significantly increases the likelihood that individuals transact via the internet and mobile bank accounts, make online payments using the internet, and complete account transactions using an ATM instead of a bank branch. Separate impacts on ATM and in-branch transactions almost exactly offset (see Figure 1). This suggests that epidemic exposure mainly affects the form of banking activity – digital or in person – without also increasing or reducing its volume or extent. While the limited time span covered by our data allows for only a tentative analysis of persistence, our results suggest that the impact of epidemic exposure is felt mainly in the short run rather than enduringly over time.

Using a machine learning algorithm, we then go on to identify the critical dimensions in the heterogeneity of our treatment effects. These turn out to be individual income, employment, and age. It is mainly the young, high-income earners in full-time employment who take up online/mobile transactions in response to epidemics, in other words. These patterns are consistent with previous research on early adopters of other digital technologies (Dedehayir et al 2017).

The role of the digital divide

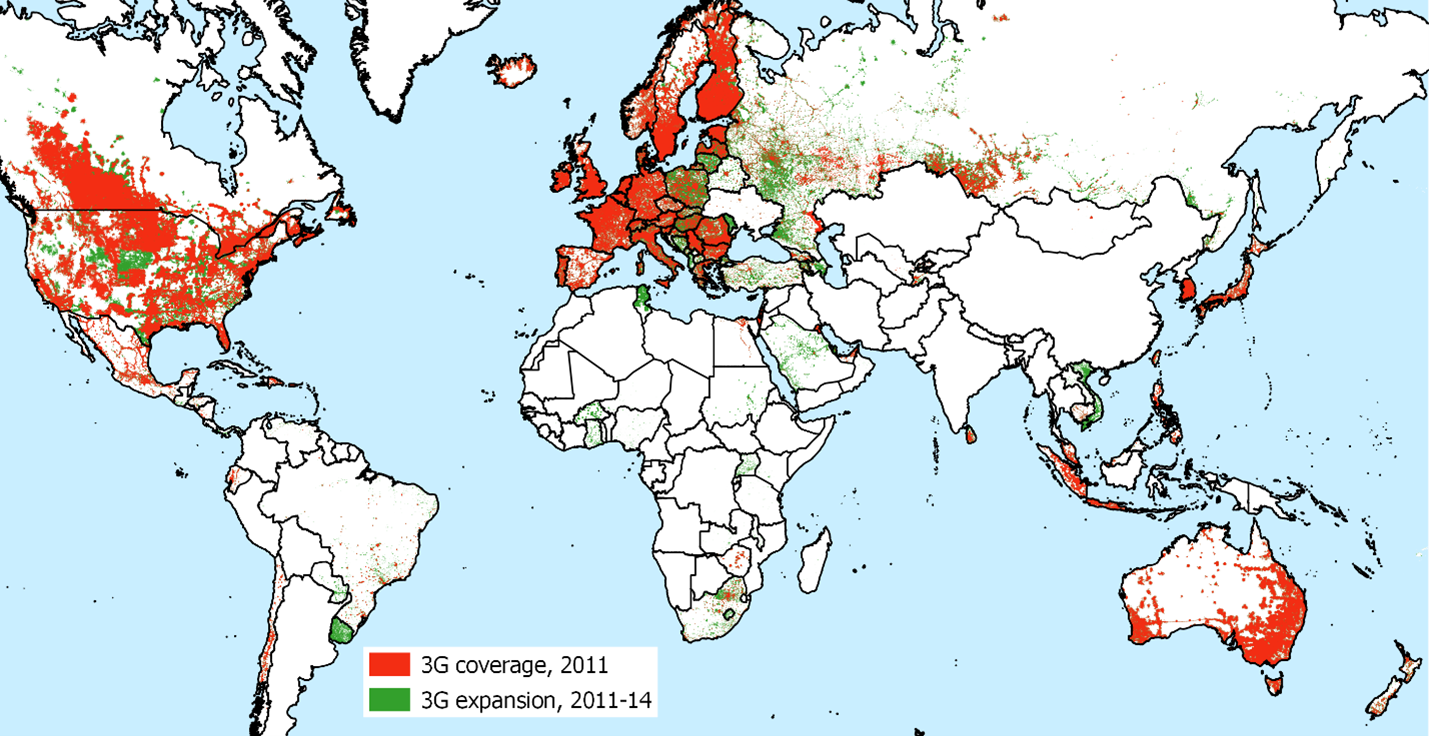

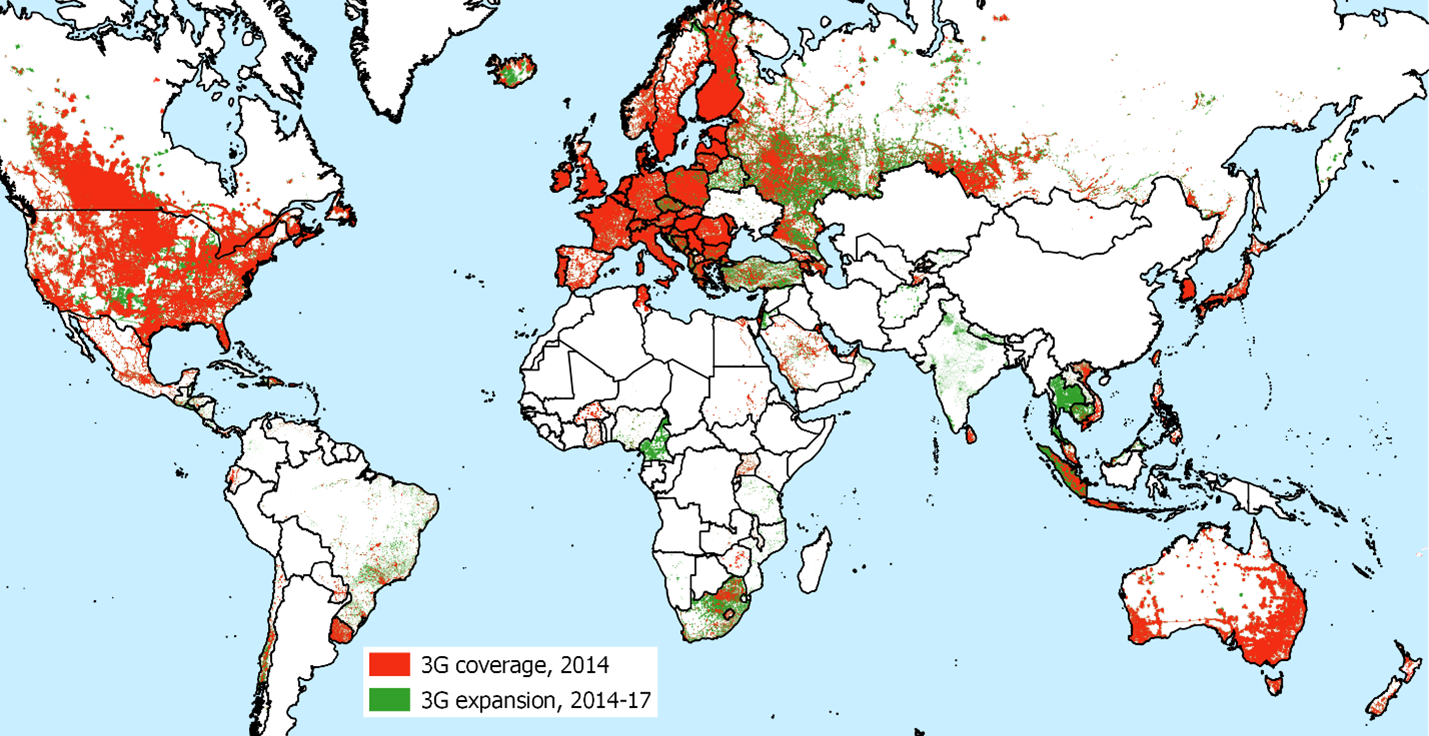

We further highlight the importance of the digital divide by investigating the role of local internet infrastructure in conditioning the shift toward online banking. We match 1km-by-1km time-varying data on global 3G internet coverage from Collins Bartholomew’s Mobile Coverage Explorer to the sub-national region in which each individual is located. These data are shown in Figure 2.

Figure 2. 3G mobile coverage and its expansion

Source: Saka, Eichengreen and Aksoy (2021). Note: Figures illustrate the 3G mobile internet signal coverage at a 1-by-1 kilometre grid level.

We find that individuals with better ex ante internet coverage are more likely to shift toward online banking in response to an epidemic. This finding still obtains when we employ a specification with country-by-year fixed effects that absorb all types of country-level variation in our sample, including the incidence of epidemics. Importantly, we fail to find any consistent effect for 2G coverage when this variable is included in the estimation side by side with our 3G measure, confirming our intuition that the relevant technology for the epidemic response is related to the internet and not to the overall mobile phone usage.

Conclusion

In sum, we find strong evidence of epidemic-induced changes in economic and financial behaviour, of differences in the extent of such shifts by more and less economically advantaged individuals, and of a role for IT infrastructure in spreading or limiting the benefits of technological alternatives. The results thus highlight both the behavioural response to epidemics and the digital divide.

♣♣♣

Notes:

- This blog post is based on Epidemic Exposure, Fintech Adoption, and the Digital Divide, EBRD Working Paper N. 257, European Bank for Reconstruction and Development.

- The post expresses the views of its author(s), not the position of the Bank of Italy, LSE Business Review or the London School of Economics.

- Featured image by Tumisu, under a Pixabay licence

- When you leave a comment, you’re agreeing to our Comment Policy

2 Comments