Since 2010, Ireland, Portugal and Greece have all received financial rescue packages, or bailouts. But who supports and opposes these bailouts, and why? Using survey data from the UK, Stephanie Rickard finds that public support for bailouts tends to depend on the beneficiary country; there is greater support for bailouts for countries such as Ireland, which have closer economic links to the UK.

Since 2010, Ireland, Portugal and Greece have all received financial rescue packages, or bailouts. But who supports and opposes these bailouts, and why? Using survey data from the UK, Stephanie Rickard finds that public support for bailouts tends to depend on the beneficiary country; there is greater support for bailouts for countries such as Ireland, which have closer economic links to the UK.

Several highly visible international financial rescues have transpired in the wake of the recent European debt crisis. Ireland, Portugal and Greece have all received major financial rescue packages since 2010. These recent financial rescues (“bailouts” to detractors) have engendered fierce public debate in both borrowing and lending countries. Despite the prominence of public opinion in current debates over financial rescues, citizens’ preferences about rescue programs are poorly understood. Who supports and who opposes international financial rescues and why?

Results from two surveys conducted in an important lending country, the United Kingdom, shed new light on public attitudes towards bailouts. The first survey elicited responses from academics studying and/or teaching international politics in the United Kingdom. The survey of academics was conducted as part of a larger survey project on teaching, research and international policy (TRIPS) in 20 countries. By design, the survey of academics included three questions about international financial rescues identical to questions asked in a survey conducted by YouGov. The YouGov survey elicited responses from a demographically-representative sample of the general British public. Several important determinants of attitudes towards bailouts emerge from these two surveys, the main results of which are shown in Figure 1 below.

Figure 1 – Attitudes towards European bailouts

Source: Rickard (2012) “Lending a Helping Hand: Public Opinion towards International Financial Rescues” Working paper.

First, public opinion towards rescue programs depends crucially on the identity of the beneficiary country. Citizens are more supportive of rescues for countries with which their own country has strong economic ties. Britons, for example, are more supportive of financial assistance for Ireland than for other European countries, such as Spain. In Britain, both academics and YouGov respondents express greater support for Ireland’s rescue package than for loans to other eurozone economies, such as Spain. While 79 per cent of academics said that Britain should lend money to Ireland, only 63 per cent of academics said that Britain should lend to “other countries in the eurozone, such as Spain”. Public support for international financial recues fell by more than 70 per cent when British respondents were asked about countries other than Ireland. While 36 per cent of YouGov respondents said Britain should bailout Ireland, only 10 per cent said Britain should bailout other eurozone countries, like Spain.

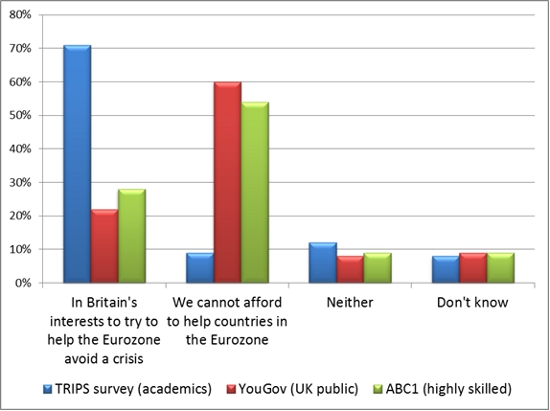

The close economic ties between Britain and Ireland may explain why respondents in both surveys were more supportive of financial assistance for Ireland than for other European countries, such as Spain. Public support for rescues to other eurozone countries more than doubled when respondents were prompted to think about Britain’s economic ties to Europe. Only 10 per cent of YouGov respondents supported rescues for European countries, such as Spain. However, 22 per cent of YouGov respondents expressed support for financial assistance to eurozone countries when prompted to think about Britain’s economic ties to Europe. More precisely, 22 per cent of all YouGov respondents said it is in Britain’s interests to try to help the eurozone avoid a crisis because Britain’s economy is “reliant upon exports to other countries and a financial collapse abroad could make Britain’s problems even worse”, as reported in Figure 2, below. While only 14 per cent of highly skilled individuals supported bailouts for European countries other than Ireland, support doubled when highly skilled respondents were prompted to think about Britain’s economic ties to Europe. Twenty-eight per cent of high skilled respondents said it is in Britain’s interests to try to help the eurozone avoid a crisis because Britain’s economy is reliant upon exports to other countries. These results provide suggestive evidence that economic interests play an important role in shaping public opinion over international financial rescues.

Figure 2 – Attitudes to bailouts when prompted to think about the UK’s economic ties to Europe

Source: Rickard (2012) “Lending a Helping Hand: Public Opinion towards International Financial Rescues” Working paper.

Second, more educated individuals tend to be more supportive of rescues. While 42 per cent of high skill (ABC1) respondents support Britain’s loan to Ireland, only 27 per cent of low skill (C2DE) respondents support the Irish bailout. Fourteen per cent of high skill respondents said Britain should lend to other European countries, such as Spain, while only 5 per cent of low skill respondents supported rescues for other European countries. One interpretation of these results is that among the general public, voters with higher levels of education tend to be more supportive of international financial rescues.

Finally, individuals with greater issue-specific knowledge are more supportive of rescues. On average, scholars of international politics were more than twice as supportive of the British government’s loan to Ireland as the general public. In fact, 79 per cent of academics said that the government should have lent to Ireland. In contrast, only 36 per cent of the general public said that the government should have lent to Ireland. Similarly, academics are more than six times as supportive of rescues for other eurozone countries, such as Spain, than the general public. While 63 per cent of academics said that Britain should contribute to bailouts for other countries in the eurozone, only 10 per cent of YouGov respondents supported such bailouts. One reason for the large difference in opinion about bailouts may be knowledge about international politics, the eurozone, and international rescue programs.

Academics may differ systematically from the general population in ways other than their knowledge of international politics. For example, academics may tend to have different partisan affiliations than the general public. If so, partisanship may explain some part of the observed difference between academics’ opinions and the opinions of the YouGov survey respondents. However, public support for the Irish loan is consistent across political parties.

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of EUROPP – European Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: http://bit.ly/WQysL0

__________________________________

Stephanie Rickard – LSE Government

Stephanie Rickard – LSE Government

Stephanie J. Rickard is an Associate Professor at the London School of Economics in the Department of Government. She earned her PhD at the University of California, San Diego and her BA at the University of Rochester. Her research examines the effects of political institutions on economic policies and appears in journals such as International Organization, The Journal of Politics,British Journal of Political Science, and Comparative Political Studies. Her current research includes a study of “buy national” procurement policies and an investigation into how national elections impact on IMF loan negotiations. She is a member of the International Political Economy Society’s steering committee and was recently elected to the Governing Council of the International Studies Association. She has appeared on BBC Radio 4’s flagship Today programme to discuss various events in the global economy, including the leadership contests at the WTO and IMF.