By Przemyslaw Kowalski (CASE)

By Przemyslaw Kowalski (CASE)

Creating an environment where technology-intensive FDI occurs has become a key policy objective in most countries, writes Przemyslaw Kowalski (CASE). By reviewing best policies to maximise technology-related gains from FDI, my colleagues and I have found a wide variety of policy approaches to encouraging FDI-related technology transfer and a wide range of effects in terms of the actual transfer as well as international competition.

FDI and technology

Technology and innovation are key determinants of long-term per capita productivity and income growth. In the era of increasingly mobile and fragmented economic activity driven by multinational enterprises and FDI in global value chains, technology is also deemed a key source of a more sustained competitive advantage based on unique knowledge rather than competition on labour costs, offering the possibility to capture larger shares of value added.

FDI has long been seen as an important source of technology, not least because it offers access to knowledge developed abroad but also because this knowledge is often seen as superior to that involved in purely domestic contexts. If national economic agents can access foreign technology and successfully learn and absorb it into their production functions, this can result in higher incomes and precious ‘extra’ economic growth.

Why set additional technology transfer-related requirements for FDI?

Creating an environment where technology-intensive FDI occurs – where investors have the ability, incentives and necessary protections to transfer it to local partners and the local partners have the capacity to absorb the new knowledge – has thus become a key policy objective in most countries.

But views differ on how exactly such international technology transfer (ITT) policies should be designed. Many types of FDI-related transfers take the form of market transactions (e.g. technology licensing, joint ventures) but information and technology are also seen as particularly prone to market failures [1]. There are thus arguments for government intervention in the form of special regulation or requirements but also potential pitfalls related to the possibility of distorting – or even blocking – processes which might be better left to markets. In addition, certain forms of intervention (or lack thereof) carry also the risks of undermining or reversing the primary gains from FDI (and international commerce more generally) associated with realisation of comparative advantage and efficient global resource allocation.

What are countries doing?

Today, the question of the best policies to maximise technology-related gains from FDI is thus more important than ever but data on both policies and their effects continues to be scarce.

In a recent paper sponsored by the OECD, my colleagues and I try to fill in some of the information gaps with a view to laying the ground for future empirical research and policy dialogue. First, we classify policy measures related to international technology transfer and collect the associated related regulatory data, and, second, we review the literature on their potential to both promote ITT and distort economic incentives [2].

Policies implemented by FDI host countries are grouped into a number of categories covering a wide range of issues extending from absorptive capacity policies, through IPR protection, to various measures related to FDI and technology licensing. A list of “yes/no” questions about measures in place is devised for four categories of measures on which information seems currently particularly scarce. These include:

- FDI promotion measures;

- FDI restrictions and FDI screening;

- performance requirements;

- investment incentives.

The paper presents results for 24 developing and developed countries which are important actors in global FDI, technology and product markets. The questions are formulated so that the “yes” responses denote a country’s attempt at encouraging ITT. In order to also capture the competition-distorting aspects of these policies, questions are asked only about those measures which are technology, sector or product specific (for example if an investment incentive depends on technological features of investment).

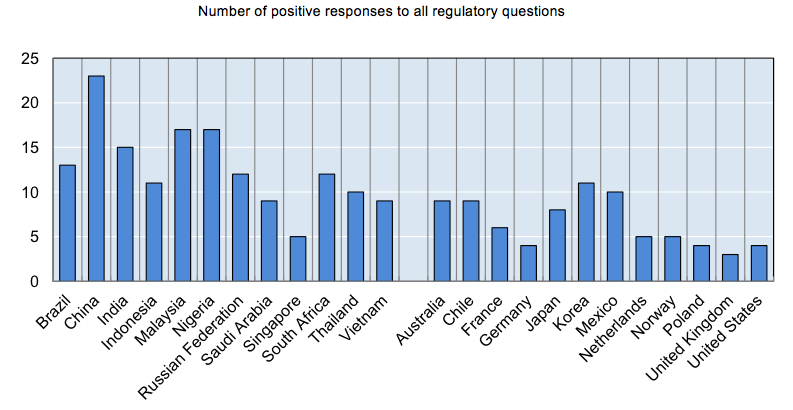

The results show that all countries studied maintain measures to encourage international technology transfer, although these are more frequent in developing countries (Figure 1). China is a particularly active user of such policies while countries such as the United Stated, the United Kingdom or Germany do not typically use such measures.

Notes: This figure graphically summarises the regulatory information collected and presented in Kowalski et al. (2017). When interpreting, it should be remembered that the different measures can have very different impacts on technology transfer, the quality of such transfer and competition. Some measures may be more important than others. Therefore, the number of measures that a country has adopted is only a rough measure of that country’s commitment to attracting foreign technology and facilitating its spillover.

There is also considerable and interesting heterogeneity in emphasis on the different elements of technology transfer policies across countries and across countries at different levels of development.

For example, most studied countries have some forms of investment promotion policies which target technology-related investment in specific sectors. This is consistent with the findings from the literature which suggest that targeting investment promotion at technology-intensive sectors can be effective in terms of attracting additional FDI in these sectors although this literature also points to the lack of research and empirical evidence on the potential competitive distortions such targeting might cause.

Policies directly setting limits to FDI on the other hand are rare although a small number of countries maintain joint-venture requirements in technology-intensive sectors which also sometimes mandate transfer of technology to local partners. The literature reviewed suggests that joint-venture requirements are often ineffective because of reluctance to transfer the latest technology, a high risk of failure of such ventures, and possibility of exits. There are also some case studies that find positive technology transfer effects, but these usually do not address the associated economy-wide or competition impacts.

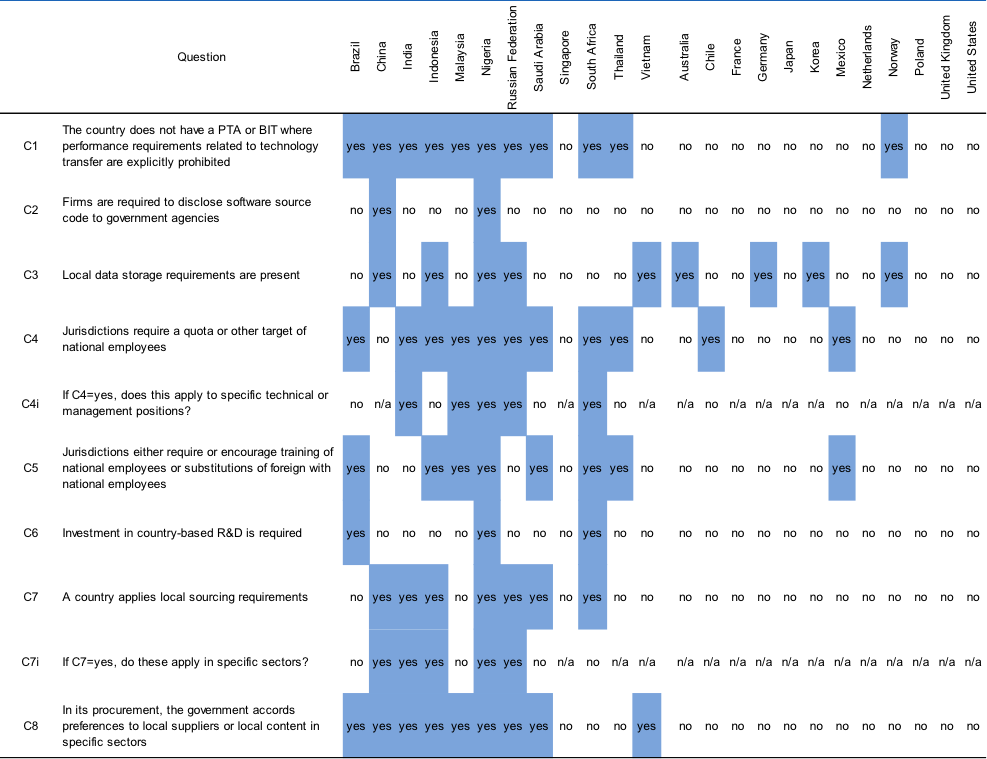

Performance requirements are used infrequently in developed countries (Table 1). This might reflect the higher level of technological development of these countries as well as the possibility that their policymakers have largely taken into account the deterrent effect of restrictions and performance requirements on FDI inflows and ITT documented in the literature. Local content requirements in government procurement, local employee quotas, and provisions setting training requirements and requiring substitution of foreign with national employees are, however, still relatively common in developing countries covered in our paper. Literature reveals that, in many cases, this seems to be explained by the size of local markets, low costs of labour or natural resource endowments which are deemed sufficient to compensate for the deterrent effects these requirements would otherwise have on investment and on trade.

Source: Kowalski et al. (2017)

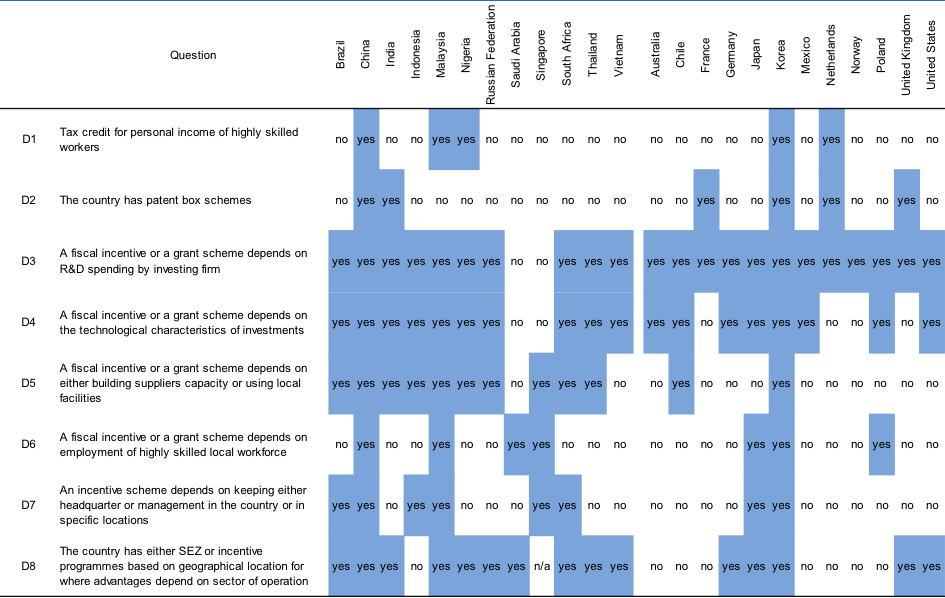

The FDI-deterring effect of performance requirements and restrictive regulation explain also the relative popularity investment incentives which face less strict disciplines at the international level and often depend on R&D spending or technological characteristics of investments. These are found to be used more equally by the studied developing and developed countries (Table 2).

Source: Kowalski et al. (2017)

The actual impact of these incentives depends on the context. The few specific studies that exist show that in many cases their effectiveness is limited but in a few cases they may generate positive externalities and thus support ITT. There are also indications that incentives provided only to industries or firms with certain technological characteristics may create unfair competitive advantages over non-subsidised companies and distort resource allocation. They also require leveraging public resources and their use by some governments may incite similar or more generous measures by others.

Going forward

The evidence presented in our recent paper reveals a wide variety of policy approaches to encouraging FDI-related technology transfer and a wide range of effects in terms of the actual transfer as well as international competition. A question is then to what extent should these policies be harmonised at the international level. Some performance requirements have been disciplined in international agreements such as the WTO TRIMS and some bilateral investment treaties (BITs) and preferential trade agreements (PTAs), and the trend appears to be in the direction of expanding the list of prohibited measures. However, inclusion of such disciplines remains uneven, particularly as far as agreements involving developing countries are concerned.

More data and empirical research into the effects of these measures and international regulations is needed to inform this policy debate. Future research could refine the classification of policy measures, extend them to other countries not covered in the recent paper and in time, and assess econometrically their economic impacts.

This post is based on the analysis developed while Mr Kowalski was with the OECD and which is presented in the paper “International Technology Transfer Measures in an Interconnected World: Lessons and Policy Implications” by Przemyslaw Kowalski, Daniel Rabaioli and Sebastian Vallejo, published as an OECD Trade Policy Paper (no.206), 2017. The OECD has intellectual property rights to the paper. This blog post represents the views of the author and not those of the GILD blog, nor the LSE.

Przemyslaw Kowalskiis President of the Management Board of CASE-Center for Social and Economic Research. Prior to joining CASE, he was a Senior Economist at the OECD.