By Giulio Buciuni (Trinity College Dublin, left) & Gary Pisano (HBS, right)

By Giulio Buciuni (Trinity College Dublin, left) & Gary Pisano (HBS, right)

The increasing intersection of industrial clusters and regions and globally dispersed production networks has lately given shape to ‘hybrid’ forms of industrial organisation, where the local and global dimensions coexist, writes Giulio Buciuni (Trinity College Dublin) and Gary Pisano (HBS). This work aims to makes sense of the growing variety of Global Value Chains (GVC) by proposing four new categories of GVC organisation, each of which is marked by a distinct ‘degree of globalisation’ and present different leading firms’ governance. We draw on years of research in the pharmaceutical, furniture, bicycle and wine industries to illustrate how these four sub-models work and to discuss how distinct GVC architectures influence the way innovation is carried out and coordinated in global industries.

After twenty years of trade liberalisation and the pervasive diffusion of Global Value Chains (GVC), scholars, managers and policymakers have lately been questioning the social and economic sustainability of globalisation and seem to be turning local again. Yet a revamped interest for local clusters and regional economics doesn’t entail the end of GVC; rather it points to their transformation. The recent development of a new stream of studies focusing on the intersection of local and global dynamics illustrates how these two spatial dimensions should be understood as two sides of the same coin.

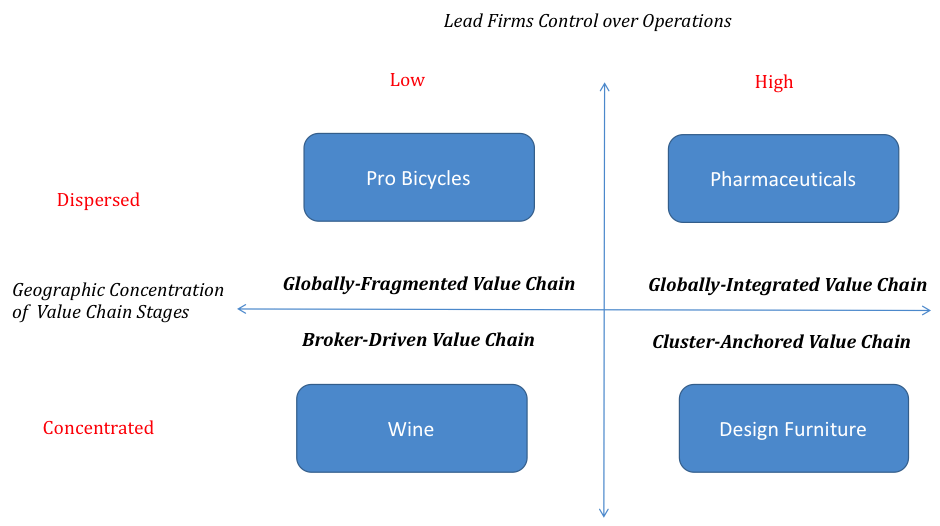

Acknowledging the growing interdependence between clusters and GVC, we argue that new ‘hybrid’ forms of industrial organisation are emerging, each of which is marked by a different ‘degree of globalisation’. We categorise this growing variety of GVC architectures into four different sub-models (Figure 1). Furthermore, we demonstrate that each of these four categories features distinct innovation dynamics and therefore suggest that innovation is best understood when the heterogeneity of GVC organisation is accounted for.

We built on several years of fieldwork in the pharmaceuticals, furniture, bicycle and wine sectors to discuss the co-existence of different models of GVC and illustrate how each of them entails distinct innovation dynamics. We first categorised the four models using a 2×2 matrix, where the two axes represent two distinct variables: (1) Lead firms’ control over operations (High and Low) and (2) the geographic distribution of value chain stages (Dispersed and Concentrated). The intersection of the two variables allowed to detect four different sub-models of GVC.

Figure 1: Variety of GVC architectures

In the second phase of the analysis we provided evidence of the distinct innovation dynamics marking each of the four models and used examples from different sectors to discuss them.

Globally-Fragmented Value Chain: In this type of GVC, lead firms have little or no control over global operations because of the low complexity of the production tasks and the production capabilities of independent contractors. A typical form of innovation in this GVC is marketing innovation, which refers to independent contractors upgrading from original equipment manufacturers (OEMs) to original design (ODMs) and even brand manufactures (OBMs). This type of innovation however is not common as it requires low-cost producers to develop or acquire new skills in ‘intangible’ functions like design and marketing. However, the professional bicycle sector provides an interesting example of how contractors from developing economies can take over innovation over time. Traditionally, leading brands competing in this market niche are Italian and American firms like Pinarello and Specialized. Most of these firms started outsourcing production offshore fifteen years ago when carbon fibre was introduced in the production of sports equipment. Taiwanese suppliers started specialising in this specific activity and in a decade became the providers of all the frames used by pro bikes brands. Thanks to a “learning by supplying” process, and by engaging with product development activities, Taiwanese suppliers moved from being suppliers to OEMs, ODMs, and eventually OBMs. Today, Taiwanese firms like Merida and Giant not only design and market their own bikes but compete against Western brands and are official providers for some of the teams racing in global competitions like the Tour de France.

Globally-Integrated Value Chain: Unlike the previous model, this type of GVCis marked by lead firms’ explicit coordination of global operations. Value chain activities are geographically dispersed and are generally performed in regions where MNEs have access to cheaper labour force, tax incentives or governmental subsidies. When production is outsourced offshore, leading firms are responsible for the specification of the production process and quality control. This is the case of most of GVC in the pharmaceuticals industry, a sector where the exploitation of context-specific advantages like cheaper cost of labour (e.g. Puerto Rico) and tax incentives (e.g. Ireland and Singapore) is key in patent holders’ business model. Leading firms’ high control over global operations is generally motivated by the complexity or value of the manufacturing process or by global suppliers’ low capabilities. The higher the complexity of operations, the higher the incentive for lead firms to coordinate them explicitly. In the case of pharmaceuticals, the discovery of a new drug is normally separated from the manufacturing process hence making it difficult for global contractors to learn how to generate innovation through a “learning by supplying” process. Even in cases where product development is ‘process-embedded’ (i.e. biologics), the discovery of a new drug is R&D intensive, which creates barriers for global contractors specialising in manufacturing. As a result, while actively partaking in the GVC, global contractors like Irish manufacturers have not been able yet to upgrade systematically.

Broker-Driven Value Chain: In this GVC model lead firms are brokers which buy natural resources or commodities from local providers and resell them globally. The buyer-supplier transaction is coordinated through the price mechanism. This type of GVC is typical of industries relying on natural resources like oil and gas and wine. Brokers operate as ‘knowledge gatekeepers’ and control incoming and outgoing transactions and knowledge flows. They are the firms which have access to market knowledge and control the innovation process. We found evidence of this type of GVC in the production of Prosecco, a sparkling wine produced only in North-eastern Italy. The rapid surge of the demand for Prosecco globally has recently appreciated the cost of the Glera grapes (the only grape that can be used to make Prosecco) which in turn has increased the final cost of Prosecco and forced brokers to seek for alternative solutions. One solution came from the use of different types of grapes in the fermentation process – i.e. the Trebbiano variety – which is a much cheaper grape but still suitable for sparkling wine production. While the use of this grape doesn’t allow brokers to use the label Prosecco in their new wine, this innovation has offered them the opportunity to fulfil the requirements coming from a price-sensitive market segment. As a result, new product development is controlled and coordinated by brokers while local producers have little or no participation in global innovation.

Cluster-Anchored Value Chain: Lead firms in this GVC have globalised their pre- and post-production functions while keeping operations locally. Production is controlled through internal operations and/or a network of clustered suppliers. Leading firms’ local outsourcing strategy is a key feature of this GVC and hinges on the technical and manufacturing know-how of specialised small producers. This type of GVC architecture is diffused in the production of upscale, small-batch items like and luxury women shoes or in those productions that require a high level of product personalisation, such custom motorcycles. This type of GVC architecture is widely diffused in the design furniture industry, particularly in the Italian clusters. In order to ensure a high level of customisation, lead firms had to break up the value chain locally and outsource specific value chain stages to specialised suppliers. Over time this strategy created numerous “short” and “dense” supply chains which prevented leading firms from outsourcing production offshore. While production remained local, lead firms have globalised their R&D and distribution activities and have developed cooperation with international designers and buyers. The development of new products can start outside the cluster, either from ideas of international designers or from the specific requests of global consumers.The importance production plays in product innovation and customisation explains leading firms’ high control over operations. At the same time, however, local leading firms need to tap into global pipelines for the collection of inputs on new design and market trends.

Our research sheds light on the existence of a plurality of GVC architectures and discusses how different ‘degrees of globalisation’ and alternative coordination structures profoundly influence the way innovation is carried out in global industrial sectors. By providing a more nuanced picture of the highly complex and ever-evolving GVC framework, we contribute to the understanding of how industries are organised and orchestrated globally and what are the effects on firms’ innovation.

This post is based on ongoing research by Giulio Buciuni & Gary Pisano. It represents the views of the authors and not those of the GILD blog, nor the LSE.

Giulio Buciuni is an Assistant Professor in Business and Administrative Studies at the School of Business, Trinity College Dublin. He is also a visiting scholar at the Center on Global Value Chains at Duke University. Giulio’s research focuses on global value chains, industrial clusters and upgrading strategies of firms.

Gary Pisano is the Harry E. Figgie Professor of Business Administration at the Harvard Business School. He is an expert in the fields of technology and operations strategy, the management of innovation, and competitive strategy.