This post analyses the prospects for trade and foreign direct investment (FDI) diversification, with a particular focus on the UK and Canada in the age of Brexit. Daniel Shapiro, Saul Estrin, Christine Cote, Klaus Meyer, and Jing Li examine the nature of trade in services using ideas developed in the international business and economic geography literatures to explore the interrelationships among multinational enterprises, global value chains and cities.

This post analyses the prospects for trade and foreign direct investment (FDI) diversification, with a particular focus on the UK and Canada in the age of Brexit. Daniel Shapiro, Saul Estrin, Christine Cote, Klaus Meyer, and Jing Li examine the nature of trade in services using ideas developed in the international business and economic geography literatures to explore the interrelationships among multinational enterprises, global value chains and cities.

The idea that developed economies like the UK and Canada should pursue diversification via trade in services is not new. For example, in a recent report HSBC and Oxford Economics (HSBC, 2016) documented the potential for expanded trade in services. Nevertheless, there are still doubts regarding the degree to which this is possible.[1]

In this article we pursue the nature of trade in services through a different lens. Based on our survey of the international business and economic geography literature we suggest that most trade in services occurs via Multinational Enterprises (MNEs) located in a relatively small number of global cities, and that the city element has for the most part been absent from both the international business literature and from the policy discussions regarding the possibility of trade diversification. We also discuss how cities and MNEs are connected through changes in global value chains (GVCs) such that high value-added activities such as R&D, marketing and financial services tend to agglomerate in a relatively small number of locations that minimize the costs of distance.

Image by kloniwotski, (CC BY-SA 2.0).

Cities and Services

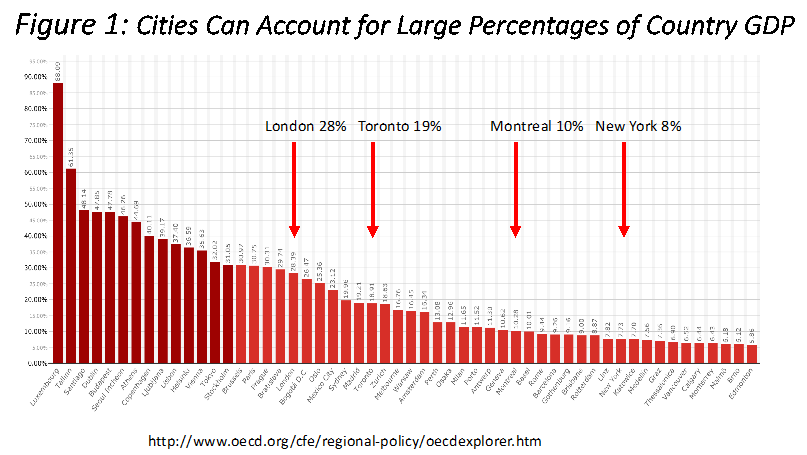

It is widely understood that both world population and economic activity are increasingly concentrated in cities and that cities represent important trade hubs (Berube and Parilla, 2012). However, the importance of cities relative to the size of national economies varies across countries. As indicated in Figure 1, London accounts for some 28% of UK GDP, while Toronto and Montreal account for about the same percentage of Canadian GDP.

Perhaps not surprisingly, these same cities attract significant amounts of FDI, most of it in services. For example, according to fDi Intelligence, a service of the Financial Times that collects data on greenfield FDI, from 2012-2017 London attracted far more foreign investments than any other EU city and the same number as the next three largest (Paris, Dublin, Berlin). The vast majority of these investments (over 80%) were in services, including software and IT services, business services and financial services.[2] Similarly New York was the primary recipient of projects in the Americas, but Toronto, was ranked fourth. Similar to London, Toronto attracted the majority of FDI to Canada (about one-third), and over 70% of those investments were in services.[3] It is also worth noting that Montreal increased its share of Canadian FDI from 6% to 13% over this period, largely because of an increase in investments from France, perhaps the result of the Canada-France Joint Action Plan for 2012-2013.[4]

MNEs are the vehicles through which this trade and investment occurs. In its World Investment Report 2013, the United Nations Conference on Trade and Development (UNCTAD 2013) estimated that some 80% of international trade was being organized by lead MNEs investing in cross-border production and, then, trading with suppliers and customers worldwide.[5] Thus trade and FDI are linked (Hoeckman, 2014). The World Bank (2017) suggests that some 30% (60%) of US exports (imports) occur through intra-firm trade. Moreover, a third of the world’s largest corporations are concentrated in only 20 major cities (McKinsey Global Institute, 2013), and this is expected to increase (KPMG, 2015).

Cities and Global Value Chains

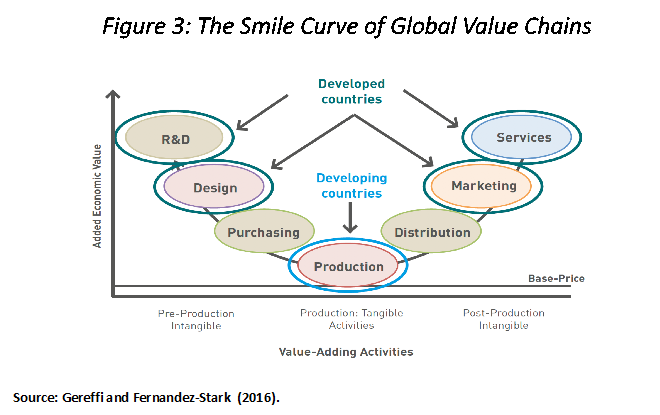

A feature of the global economy is the unbundling of activities along the global value chain (GVC) such that different activities are performed in different locations and traded internationally (Gereffi and Fernandez-Stark, 2016; Fu, 2018; Timmer et al, 2014). Thus countries, and in the case of services and intangible goods, cities, tend to specialize in some specific segment of the GVC. The nature of the division of activities across countries is often summarized in the “Smile Curve” (Figure 2), which suggests that higher value-added activities associated with R&D, design and business support services tend to be located in developed countries, and as suggested above, in cities. Furthermore, the diffusion of digital technologies has hastened this process (Autio et al, 2018).

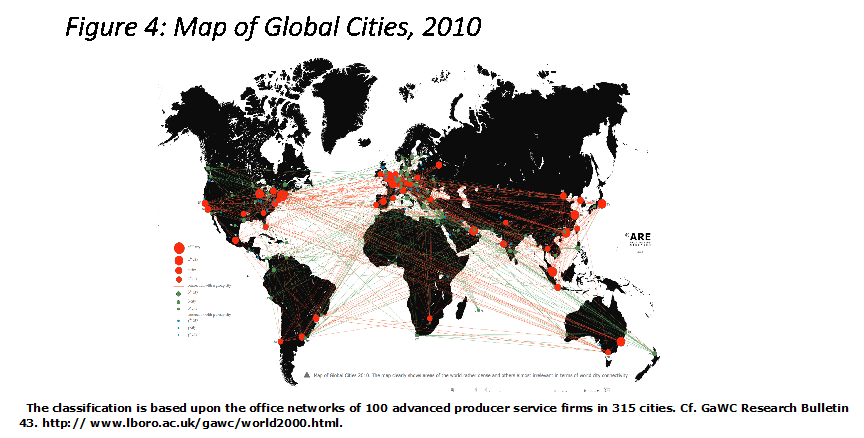

The link between the location of higher value added activities and cities occurs because cities can minimize the spatial transaction costs related to trade in knowledge-based services (Cano-Kollmann et al., 2016). Thus, one observes the emergence of world or global cities as providers of advanced knowledge-based services for the global economy (Sassen, 1991; 2012), a function enhanced by the degree of connectiveness among them (Taylor and Derudder, 2016). Indeed, one prominent approach to measuring global cities (Beaverstock, et al, 1999) builds on Sassen to use data on the presence of advanced producer services (service MNEs in advertising, law, accounting, finance) as the basis for ranking cities. A more recent version of the ranking is illustrated in Figure 4. It should be noted that there are alternative measures available, for example AT Kearney’s list of Global Cities[6] which uses an expanded set of criteria to rank cities. However, for our purposes it is sufficient to note that both rank London and Toronto among the top 20 global cities.

Empirical studies confirm that global cities are preferred locations for MNEs (Goerzen, Asmussen, and Nielsen 2013; Blevens et al, 2016; Belderbos, Du & Goerzen, 2017), and that peripheral cities are preferred locations if they are proximate to a global city (McDonald et al, 2018). Goerzen et al (2013) argue that global cities reduce the costs of distance, often referred to as the liability of foreignness because they agglomerate advanced service providers, facilitate knowledge flows within and between MNEs, and provide cosmopolitan environments that welcome the foreign presence. Some recent studies have also emphasized the R&D part of the smile curve, and the degree to which MNEs have begun to both internationalize their R&D activities, and to co-locate with other MNEs in specific locations (Belderbos et al, 2016). Importantly, Blevens et al (2016) suggest that these advantages may dissipate when institutions are harmonized across countries, and become more important when such harmonization is absent.

Thus we conclude that global cities reduce spatial transaction costs, which reduces the costs of distance, and favours them as locations for advanced knowledge based services. We therefore observe that trade in knowledge-based services is concentrated in large cities, and to some degree defines them. Together they define a network of cities among which services are traded and which encourage the location of MNEs.

Cities and International Business

Although the importance of cities has been studied by economic geographers it has until recently been less prominent in the international business (IB) literature which viewed “location” from a country perspective (see Iammarino, McCann, Ortega-Argilés, 2018 for a survey). However, this has changed over the last few years, with an increasing recognition by IB scholars of the role of cities as essential components of the process of knowledge creation and diffusion across borders (Cano-Kollmann, Cantwell, Hannigan, Mudambi, & Song, 2016; Santangelo, 2018; Mudambi, Narula & Santangelo, 2018).

This recognition has been accompanied by a reconceptualization of the nature of the MNE. The MNE is reconceived as a global creator, organizer, and connector of knowledge networks across locations, rather than a simple vehicle for technology transfer from a given location, as was the case in the original theory (Beugelsdijk and Mudambi, 2013; Cantwell, 2017). The MNE is now seen as a connector of spatially dispersed knowledge sources (Cano-Kollmann et al. 2016), so that innovative and knowledge-based activities become both firm- and location-specific. Thus “the two processes of innovation and internationalization have become ever more interconnected as central drivers of development” (Cantwell, 2017: 41). In essence, the increased importance of knowledge-based activities to the MNE and the global sourcing of knowledge accompanying the emergence of global value chains (GVCs) have “linked localized innovation systems to IB and to international knowledge exchange” (Cantwell, 2017: 42).

This reconceptualization suggests that cities should not be viewed only as providers of advanced business services, but also as critical elements in the creation and global diffusion of knowledge, and that the MNEs can act as a possible orchestrator of knowledge flows via its global subsidiaries (Belderbos et al, 2016). This reconceptualization also places greater emphasis on cities and the location of R&D activities by MNEs (Castellani and Lavoratori, 2017); the international role of innovation clusters within cities (Turkina & Van Assche, 2018); and the role of cities as facilitators of entrepreneurship and new firm creation (Audretsch, Belitski & Desai, 2015; 2018), including those that are “born global” MNE (Knight & Liesch, 2016).

Public Policy

We conclude that the most promising prospects for international diversification that overcomes the costs of distance is in knowledge based activities and services, and that the location of these services is concentrated in subnational entities, mainly cities. Cities are seen as both innovation and service hubs, with connections among them linked to the activities of MNEs. Given the importance of cities, GVCs and MNEs in the structure of international trade and investment, the appropriate public policy must go beyond explicit trade policy to include measures that support the provision of knowledge based activities.

This discussion suggests (at least) three major public policy directions:

- The recognition that domestic policies to foster innovation and clusters in cities are a critical component of an international diversification strategy, because these investments can attract FDI and promote trade in knowledge based services. They should therefore be understood as the provision of trade-related infrastructure. These policies should fully understand and take account of the specific nature of “global” cities.

- An explicit attempt to coordinate the activities of the foreign investment promotion units already present in most large cities, and in particular to promote cross-border alliances among them, again with the recognition of the different global rankings of cities.

- Measures to include representation of cities and their interests in trade negotiations, particularly with respect to provisions regarding services, or at least to include cities as components of new cooperative and deliberative mechanisms (Hoeckman, 2014). There are proposals to create supply chain councils to reduce policy silos (Stephenson, 2016), and cities could well have a role in their design.

[1] See for example, “Why Brexiters confidence in trade in services trade may be misplaced”, Financial Times, 24 September 2018

[2] https://www.fdiintelligence.com/Locations/Europe/fDi-s-European-Cities-and-Regions-of-the-Future-2018-19-Cities

[3] https://www.fdiintelligence.com/Locations/Americas/fDi-American-Cities-of-the-Future-2017-18-New-York-triumphs-again

[4] http://www.canadainternational.gc.ca/france/bilateral_relations_bilaterales/program.aspx?lang=eng

[5] http://unctad.org/en/PublicationsLibrary/wir2013_en.pdf

[6] https://www.atkearney.com/documents/20152/1136372/2018+Global+Cities+Report.pdf/21839da3-223b-8cec-a8d2-408285d4bb7c

This post is based on ongoing research by By Daniel Shapiro, Saul Estrin, Christine Cote, Klaus E. Meyer & Jing Li. It represents the views of the authors and not those of the GILD blog, nor the LSE.

Daniel Shapiro is Professor of Global Business Strategy at the Beedie School of Business, Simon Fraser University, and co-editor, Multinational Business Review

Saul Estrin is Professor of Management at the London School of Economics.

Christine Cote is Senior Lecturer in Practice at the Department of Management (LSE).

Klaus E. Meyer is Professor of International Business at Ivey Business School.

Jing Li is Associate Professor of International Business at Beedie School of Business.

Thumbnail image: London Pano, picture by Kloniwotzki, via a BY-NC-ND 2.0 Creative Commons licence

References