Designing Investment Strategies

- About designing investment strategies

- Why is designing investment Strategies on the Investment & Human Rights Map?

- Focus area in designing investment strategies

- Connecting designing investment strategies with other activities on the Investment & Human Rights Map

About designing investment strategies

Business enterprises expand internationally for a variety of reasons, but the typical goal is economic growth or expansion of the business activity. When deciding to go abroad, businesses take strategic decisions regarding the best way to pursue their international venture. The designing of investment strategies refers to the internal processes and methodologies that business enterprises use to make plans about the entire life cycle of investments, including the determination of ways to identify and enter a target market, to develop the venture and eventually to exit the market.

A number of variables may influence the design of business strategies including conditions of the market; the foreseeable legal, financial and non-financial risks; the corporate culture and international experience of the firm; the managerial structure; and the functional and geographical division of activities.

These strategies therefore include commercial, operational, managerial and marketing decisions. Specifically, the business enterprise will make decisions about how to manage risks, including through legal and financial planning.

The development of legal strategies for investment involves decisions about what form the business should take in the new market, whether it be a partnership, a joint venture with other business enterprises or State-owned or controlled entities, a new special purpose company, an entity formed by a merger or an acquisition of an existing company, or a franchise. Businesses must also decide how to form and manage relationships with other entities for the purpose of realising their activities.

The financial strategies for investment refer to the choice of schemes and structures through which capital will be made available for carrying out the business activity. Financial strategies may involve a diversity of public and commercial actors, including institutional investors, export credit agencies and insurers and private banks. These institutions may facilitate investment in a number of ways, including through equity, debt and other complex financial arrangements.

Why is designing investment Strategies on the Investment & Human Rights Map?

The United Nations Guiding Principles on Business and Human Rights (“UNGPs”) set out the corporate responsibility to respect human rights, which applies to all companies operating in any context. The corporate responsibility to respect requires that business enterprises act with due diligence to avoid infringing on the rights of others, and that they address harms when they do occur. The responsibility to respect applies across all business activities, including investment-related activities, and extend to an entity’s business relationships with third parties — such as business partners, entities in the value chain and State agents.

The UNGPs invite a number of questions relating to the investment strategies adopted by businesses, regarding, for example, the adequacy of human rights due diligence in the context of mergers and acquisitions, and how human rights risks can be managed through joint-venture relationships, in particular with State-controlled entities. Questions also arise as to the role and extent of due diligence for investors, financial institutions and even the State when supporting and facilitating these strategies.

Although some attention has been given to human rights due diligence in the area of designing investment strategies, more research and innovation is needed. In particular, work is needed to assist small and medium-size enterprises to better identify human rights risks and integrate these into their investment strategies. Further consideration is also required to identify how to reflect the responsibility to respect human rights in the negotiation and drafting of contracts in the context of business relationships.

States may also have a role to play. Are there ways that States can support investment strategies that integrate respect for human rights? How might areas like corporate law be important to facilitating or incentivising consideration of human rights risks associated with the design of investment strategies?

There is an urgent need to better understand the relationship between the design of investment strategies and the avoidance of adverse human rights impacts in the context of investment. To contribute to research and innovation in this area, the Investment & Human Rights Map invites targeted consideration of how investment strategies connect with the protection of, and respect for, human rights.

Focus area in designing investment strategies

The Learning Hub’s work on ‘designing investment strategies’ will contribute to build understanding around investment strategies and human rights with a focus on legal and financial strategies. The emphasis will be on identifying effective methods to integrate human rights into investment strategy decisions and also into the legal and financial tools that support such strategies.

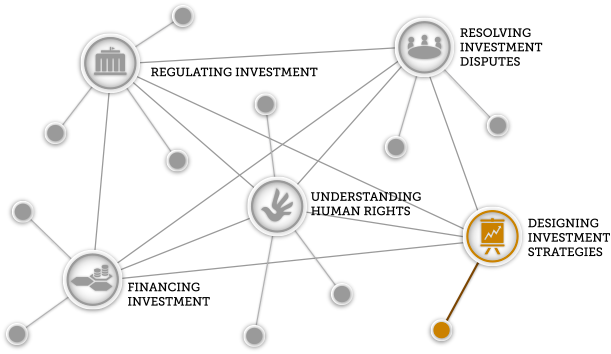

Connecting designing investment strategies with other activities on the Investment & Human Rights Map

The design of investment strategies is closely connected with other investment-related activities. For example, decisions about legal and financial strategies will involve consideration of the regulatory contexts of potential markets, the opportunity for investment protection from international investment agreements and the availability of dispute resolution mechanisms. Additionally, an investment strategy might involve the negotiation of a State-investor contract and engagement with export credit agencies or other public and private financial institutions to secure financing.