Construction of a US-Mexico border wall was a cornerstone of Donald Trump’s election campaign. But with Mexico refusing to pay for it, his government has proposed to recoup the cost through a 20 per cent tax on Mexican imports. The reality is that this tax would be paid by US importers, raising costs for US consumers and businesses, writes Stuart Brown.

Construction of a US-Mexico border wall was a cornerstone of Donald Trump’s election campaign. But with Mexico refusing to pay for it, his government has proposed to recoup the cost through a 20 per cent tax on Mexican imports. The reality is that this tax would be paid by US importers, raising costs for US consumers and businesses, writes Stuart Brown.

When Donald Trump first proposed building a wall along the Mexican border, it was derided by many observers as a cheap campaign trick. If Trump did make it to the White House, the argument went, he would quickly realize that a wall spanning the Mexican border would be both impractical and prohibitively expensive.

But the prospect is now very real, with an executive order signed by the President mandating the start of construction. And quite apart from the issue of how effective the proposed wall would actually be at securing the border, the question of how the wall will be paid for has already worked its way to the centre of the political agenda.

During his presidential campaign, Trump famously declared that he would not only build the wall as President, but that Mexico would pay for it. With this offer yet to be forthcoming from the Mexican government, White House Press Secretary Sean Spicer indicated on 26 January that the cost of the wall could potentially be recouped from Mexican imports. This would entail a tax, perhaps around 20 per cent, applied to all imports entering the United States from Mexico.

Even at the most basic of levels there are some obvious problems with this strategy. As Erik Sherman notes, any such tax would presumably be paid by American importers, not Mexican businesses directly. It’s difficult to see how levying a new fee on a set of American companies constitutes ‘Mexico paying for the wall’ in anything more than the loosest of senses.

However, the more important concern is what a tax of this nature would actually do for the US economy and the many American businesses and consumers who currently pay for Mexican imports. If we assume that costs applied to Mexican businesses will in turn be passed on in some manner to the price of goods sold in the US, then these consequences could be fairly severe.

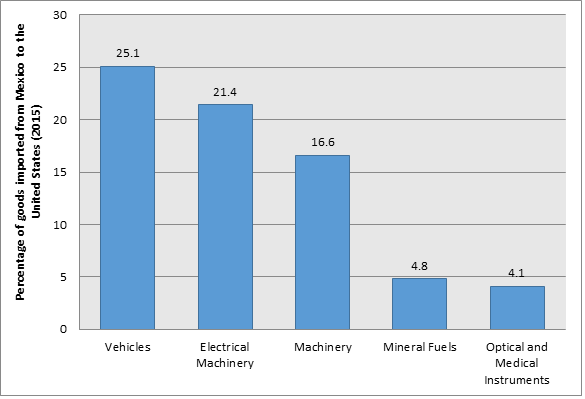

While the popular image of Mexican imports may be a truck laden with bottles of Tequila, goods imported from Mexico form an important part of the supply chain underpinning American businesses. As Figure 1 below indicates, among the roughly $300 billion of Mexican goods that make their way to the United States in a given year, the highest value categories are not luxury goods, but vital industrial components such as machinery. Indeed, the five categories included below accounted for over 70 per cent of all goods imported (by value) in 2015.

Some of the President’s supporters have reacted to these concerns by arguing that if Mexican imports become more expensive for American consumers and businesses, then it will be possible to simply buy alternative products from American suppliers. But this will be little consolation for a business that relies on sourcing its machinery from a given supplier if its costs significantly increase overnight. Overall, the 20 per cent import tax would imply somewhere around $60 billion of extra costs for American consumers and businesses, were it to be passed on directly to the price of goods in the American market.

Of course, this would also have a negative impact on Mexican businesses. If Mexican imports become more expensive, sales will fall, and it will damage the profits of exporters in the country. In some cases, businesses might take on some of the extra cost implied by the import tax and it would therefore not be passed on entirely to American consumers and businesses. The effects of the import tax would undoubtedly damage the Mexican economy and if one were being charitable, they might argue that the threat of implementing such a tax could act as leverage in negotiations between the United States and Mexico over future trading arrangements.

But as a funding mechanism for what is essentially a one off construction project, the consequences are likely to be curiously destructive for American businesses and consumers: two groups that the President has promised to defend in his efforts to rebalance the country’s trade policy. One might also argue that if such a policy actually made financial sense, it would be rolled out on a far grander scale, and in relation to far more countries than Mexico, rather than simply to pay for a border wall. Ultimately, who ends up footing the bill for the wall could prove a relatively minor issue when set against the implications for US trade policy more generally and the subsequent impact on the country’s trading partners.

Notes:

• The views expressed here are of the authors and do not reflect the position of the Centre or of the LSE

• This post was originally published at LSE USAPP

• Featured-image credit: cropped version of Patrick Hoesly (CC BY 2.0)

• Please read our Comments Policy before commenting

Stuart Brown – LSE

Stuart Brown – LSE

Stuart Brown is a Research Associate at the London School of Economics and the Managing Editor of EUROPP – European Politics and Policy.