Naufal Yudiana

BSc Government and Economics

The rise of populism in many Western democracies has led to calls to rethink economic policy. In the UK, for example, greater market interventionism is now advocated across the political spectrum to address genuine societal woes. Whilst it is tempting to expand public services at times of growth, the case of Venezuela should give cause for caution.

Less than a decade ago, Venezuela was deemed an economic success story and a model to those seeking to buck the Washington economic consensus. Steady economic growth, low inflation and poverty rates acted as a cover for deep structural inefficiencies. This then motivated poor economic policymaking and a reliance on domestic consumption levels under Hugo Chavez and Nicolas Maduro. For Hugo Chavez and Nicolas Maduro’s governments, steady economic growth, low inflation and poverty rates hid deep structural inefficiencies and poor economic policymaking.

Admittedly, pre-Chavez Venezuela suffered an economic catastrophe cocktail of a banking crisis, spiralling inflation and epidemic poverty. Under Chavez the government pursued (according to Javier Corrales and Michael Penfold) a traditional mix of “classic statism and populism”, focused on “fiscal stimulus, expansion of state-owned enterprises, and income redistribution to support constituents”. Indeed, Chavez initially ushered in a period of relative economic stability. The average rate of GDP growth was 3.5% in 2000-2013 and relatively stable compared to the tumultuous decade of the 1980s.

Chavez gained much popularity on the back of his social policy projects – called the Missions – which were targeted at low income groups. Great progress was made by healthcare-focused Mission Barrio Adaptor, which reduced mortality rates and created a quasi-universal healthcare system. This was financed by a significant increase in public spending; public health expenditure jumped from $200 in 1999 to $873 in 2014. Overall, social spending levels per capita increased by 314% between 1998 and 2007.

The Chavez and Maduro governments steered industry towards fulfilling domestic consumption, failing to develop alternative export industries. Venezuela’s competitiveness suffered from a superficially high currency, which the government pegged above market rate to boost its oil incomes, symptomatic of the so-called ‘Dutch disease’. On a practical level, Venezuela subsidized import-purchasing to lower consumer goods prices for the poor through currency revaluation, a policy that proved disastrous when foreign exchange reserves were depleted.

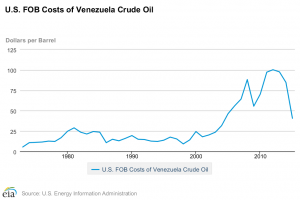

Furthermore, and paradoxically for a state-driven economy, Venezuela oversaw a dearth in investment in everything from industry diversification to the oil industry, resulting in the decay of public infrastructure. Private capital fled expropriation and business-unfriendly regulation, which Javier Corrales (2017) alleged was part of a plan to ‘choke’ private industry and later nationalize it to cement political control. Price and foreign exchange controls – introduced to stem capital flight – created between two and four official exchange rates and made the government a stakeholder in currency circulation. When the value of mineral product exports, accounting for 90% of the country’s total exports, shrank from $150 billion in 2012 to $60 billion in 2014, the government capped the amount of purchasable US dollar. In turn, imported essential goods quickly deserted supermarket shelves and prices skyrocketed, hitting the poor especially hard.

What can we learn from Venezuela’s mistakes?

The debate on Venezuelan economic policy is evermore important as a similar set of policy prescriptions enters the political mainstream across Europe and North America. Free higher education and direct cash-transfer programmes have become fashionable in some circles on both sides of the Atlantic. Although less drastic, some of these policies are not too far removed from those of the Chavez-Maduro regime and better fit 1970s Britain, which consisted of protectionist, labour-friendly laws and state-led industry.

There are several reasons why, just like in Venezuela, policies of this nature can be harmful. Firstly, a characteristic feature of Venezuela’s economic policy is a steep increase in public expenditure. Countries across Europe and North America are larger economies, with excellent credit ratings that permit them to borrow cheap and conceivably chart a similar fiscal path. Yet they tend to have relatively high public debt already, unlike 1990s Venezuela. Significantly increasing public spending would reverse a prolonged period of fiscal consolidation, without obvious ways to finance it other than steep tax increases (endangering economic recovery). Although large Western economies face much looser credit conditions, there must be a limit on the amount of debt these economies can credibly accrue before market conditions tighten.

More importantly, the new populism embraced by politicians in the West promotes the kind of protectionism and hostility to foreign capital that Venezuela pioneered under Chavez. Shielding obsolete industries from globalization and technology can only harm productivity in the long-run, as Venezuela is currently witnessing. Additionally, it would only delay the labour market-disrupting technological revolution to a future that is even less friendly for workers. Governments can and should undertake steps to address and prevent structural unemployment because of technological changes; they should also ensure fair competition and a robust protection of workers’ rights. Yet there is a significant difference between a healthy set of policy prescriptions which responds to challenges of globalization, and an irrational anti-globalization and anti-competition agenda, the latter of which is what Venezuela has pursued over the last two decades and should be avoided.

Conclusions

A solution for the Venezuelan economy must invariably include measures to liberalise economically, such as lifting currency and price controls. This will cause great economic pain for the population, eliminate savings and push inflation even further, but will not represent a significant deterioration compared to the current situation. If anything, the regime will pay the greatest price: a political one, and one which represents a surrender of their ideological doctrine. For the long-run, however, there must be a debate of how to avoid this crisis again in terms of investments in industry and encouraging manufacturing growth.

If there is a lesson to be learnt from Venezuela, it is that any sustainable economic policy cannot focus on boosting consumption levels. It must also include a coherent plan to expand aggregate supply, support innovation and private sector growth, and help the economy adjust to global economic trends. Venezuela failed to do this by prioritising poverty reduction and political control over all else, and is discovering the consequences at its own peril.

The information and views set out in this article are those of the author and do not necessarily reflect the official opinion of the LSE Undergraduate Political Review, nor the London School of Economics.