Ethan Ilzetzki and Jonathan Pinder examine the US economic woes since the beginning of the recession and the policy response aimed at fighting unemployment. They find that monetary or fiscal stimulus can help only if unemployment is cyclical and that unemployment (now at 7.8%) is indeed mainly cyclical. The examination of the US experience provides valuable insight for the UK experience, currently undergoing a tough austerity programme with an unemployment rate hovering at 7.9%.

Ethan Ilzetzki and Jonathan Pinder examine the US economic woes since the beginning of the recession and the policy response aimed at fighting unemployment. They find that monetary or fiscal stimulus can help only if unemployment is cyclical and that unemployment (now at 7.8%) is indeed mainly cyclical. The examination of the US experience provides valuable insight for the UK experience, currently undergoing a tough austerity programme with an unemployment rate hovering at 7.9%.

The US is still suffering from its most severe recession in seven decades. During the recession (officially dated from December 2007 to June 2009 by the National Bureau of Economic Research, NBER), the economy contracted by 5% and the stock market lost around half its value. President Obama cannot be blamed for the recession itself, but Republicans do blame him for the weak economic recovery (see Figure 1).

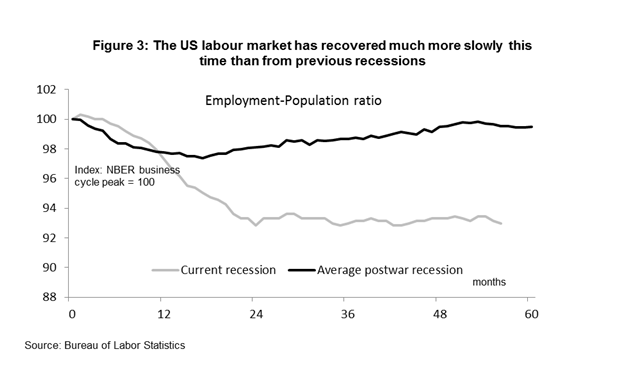

Job creation has lagged behind the growth of the workforce so that unemployment remains high (see Figure 2). Joblessness rose from 4.4% in 2006 to a peak of 10% in October 2009 and is currently 7.8%. This actually understates the weakness of the labour market as participation has declined. Compared with previous post-war recessions, the employment rate has hardly recovered in this recession (see Figure 3).

To add to these economic woes, house prices are still falling, two-thirds fewer new homes are being built than before the crisis and mortgage delinquencies are above 10%. The only good news is that US GDP performance is better than many other industrialised countries (the eurozone, Japan and the UK) and better than the 1929 collapse. But this is a low benchmark for the world’s largest economy to aim for.

…but it would have been much worse without the aggressive policy response

Monetary policy

The Fed’s response to the crisis was unprecedented in its magnitude and speed. Interest rates have been cut to under 0.25%. Starting in 2009, the Fed embarked on large-scale quantitative easing (QE1), purchasing more than a trillion dollars in private sector assets. In addition to QE1, in late 2012, the Fed purchased long-term Treasury bonds in an attempt to bring down longer-term interest rates (QE2), swapped short-term Treasury bills for longer-term bonds starting in September 2011 (‘operation twist’) and recently announced its intention to purchase $40 billion per month in mortgage-backed securities.

Although these policies have boosted the money supply, the money itself has mainly remained as reserves in private banks. The potential impact has been on longer-term and market-based rates beyond those directly controlled by the Fed.

Republicans, including their presidential candidate Governor Mitt Romney, have criticised the Fed’s expansionary policies for risking inflation. The Fed’s chairman, Ben Bernanke, has justified the moves by pointing to consistently low inflation, low US sovereign debt yields and the need to restore growth.

Fiscal policy

Days after his inauguration, President Obama passed a ‘stimulus bill’ (the American Recovery and Reconstruction Act), which was worth $787 billion, including tax cuts, aid to states and federal spending.

The majority view is that the stimulus kept unemployment lower than it would otherwise have been. For example, the non-partisan Congressional Budget Office (CBO) estimated that the stimulus added an extra 0.9 to 4.7 million full-time jobs in 2010 (for further evidence, see Wilson (2011) and the references therein). The effect may have been higher than in normal times because interest rates were at the ‘zero lower bound’ (Christiano et al, 2011); and because the relatively closed US economy was severely depressed (fiscal policy is more potent in recessions).[1]

There remain sceptics (for example, Barro and Redlick, 2011), including those who advance the notion of expansionary fiscal contractions (for example, Alesina and Ardagna, 2012). But evidence from the IMF (2010) and others suggests that fiscal austerity is unlikely to lead to export-led growth if the other countries are also experiencing a severe contraction.

Whatever the views on the merits of the stimulus, it was rather small in scale. President Obama chose not to push for a larger stimulus and was unable to enact his desired ‘second stimulus’ through a hostile Congress in 2011.

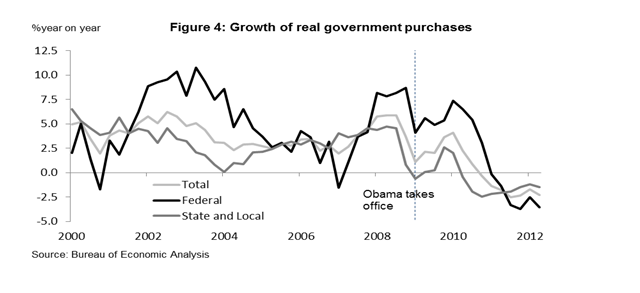

Although federal government purchases increased significantly in 2008-10 (growing by 14% in real terms – see Figure 4), their increase was not unusually large. For example, the increase in public expenditures in the mid-2000s, arising from the wars in Afghanistan and Iraq, was larger. And while federal purchases increased significantly in the first two years of the crisis, they have since decelerated and are currently declining at a faster rate than any time in the past decade.

Overall across all levels of government, public purchases increased to a smaller extent in the early part of the recession (growing by only 5% in 2008-10). Federal expenditures in part filled the gap opened up by states and municipalities, where public spending has declined, bound by rules on having balanced budgets.

Is high unemployment structural?

Monetary or fiscal stimulus can help only if unemployment is cyclical; otherwise, if unemployment is structural because of skills or geographical mismatches between jobs and vacancies, expansionary policies will lead only to inflation. Even prior to the crisis, jobs growth lagged behind population growth over the period 2000-07 (see Figure 5), possibly for reasons related to demographic shifts, healthcare costs and inadequate skills.[2] Nevertheless, the depth of job falls in the recession is too large to be explained by this secular decline. Careful recent analyses indicate that unemployment is mainly cyclical: US unemployment is normal for the particularly severe recession it is experiencing.[3]

This is the first part of two of the Centre for Economic Performance’s (CEP) US election analysis on Recession and Recovery: The US Policy Debate on Taxes, Spending and Public Debt. All of the papers in the series can be accessed here.

Note: This article gives the views of the author, and not the position of the British Politics and Policy blog, nor of the London School of Economics. Please read our comments policy before posting.

Ethan Ilzetzki is Assistant Professor in the Department of Economics at the LSE.

Jonathan Pinder is a PhD student at the LSE

[1] See Auerbach and Gorodnichenko (2012a, b) and Ilzetzki et al (2012). For an application to the effects of UK’s fiscal contraction see Bagaria et al (2012).

[2] Aaronson et al (2012) suggest that demographic patterns explain this pattern. Krueger (2011) compares the US with Canada to show that high employer health care costs are a large part of the explanation.

[3] See Lazear and Spletzer (2012); Daly et al (2012) find that the natural rate of unemployment has risen slightly to 5%, well below the current level of 7.8%.

Further readings:

Daniel Aaronson, Jonathan Davis and Luojia Hu (2012) ‘Explaining the Decline in the U.S. Labor Force Participation Rate’, Chicago Fed Letter.

Alberto Alesina and Silvia Ardagna (2012) ‘The Design of Fiscal Adjustments’, NBER Working Papers No. 18423.

Alan Auerbach and Yuriy Gorodnichenko (2012a) ‘Fiscal Multipliers in Recession and Expansion’, in Fiscal Policy after the Financial Crisis, NBER.

Robert Barro and Charles Redlick (2011) ‘Macroeconomic Effects from Government Purchases and Taxes’, Quarterly Journal of Economics 126(1): 51-102.

Lawrence Christiano, Martin Eichenbaum and Sergio Rebelo (2011) ‘When is the Government Spending Multiplier Large?’, Journal of Political Economy 119(1): 78-121.

Mary Daly, Bart Hobijn, Aysegul Sahin and Robert Valletta (2012) ‘A Search and Matching Approach to Labor Markets: Did the Natural Rate of Unemployment Rise?’, Journal of Economic Perspectives 26(3): 3-26.

Ethan Ilzetzki, Enrique Mendoza and Carlos Vegh (2012) ‘How Big (Small?) are Fiscal Multipliers?’, forthcoming in the Journal of Monetary Economics.

Alan Krueger (2011) ‘Understanding Differences in Job Growth in Europe, Canada and the U.S.A: What Went Wrong in the U.S.A.?’, mimeo, Princeton.

Edward Lazear and James Spletzer (2012) ‘The United States Labor Market: Status Quo or A New Normal?’, NBER Working Papers No. 18386.

Daniel Wilson (2011) ‘Fiscal Spending Multipliers: Evidence from the 2009 American Recovery and Reinvestment Act’, San Francisco Federal Working Paper No. 10-17.