Families face several solutions to provide for the costs of long term care for elderly family members, should the need arise: public or private insurance, savings or family financing. Joan Costa Font argues that the prevalence of this family financing in the UK and the EU is likely to ‘crowd out’ other types of insurance, and that the government can increase take-up of insurance by offering a ‘benchmark’ level of public financing that families can then supplement.

Families face several solutions to provide for the costs of long term care for elderly family members, should the need arise: public or private insurance, savings or family financing. Joan Costa Font argues that the prevalence of this family financing in the UK and the EU is likely to ‘crowd out’ other types of insurance, and that the government can increase take-up of insurance by offering a ‘benchmark’ level of public financing that families can then supplement.

As the baby-boom generation approaches retirement age, there are enormous policy implications for long term care- i.e. coverage for the costs of personal care for elderly dependent individuals. Long term care (LTC) financing alternatives can be classified into three main types:

- personal (e.g. savings or self-insurance),

- non-personal (e.g. tax systems)

- interpersonal (e.g. social or voluntary insurance).

Interpersonal financing schemes allow risks to be pooled over a large number of people, and in general, are a more efficient alternative to self-insurance. Despite this, insurance for LTC has been markedly underdeveloped and is less common, compared to insurance for health and longevity risks, especially in Europe. This is puzzling because the costs associated with LTC are high but there is a relatively low probability that LTC will be needed due to dependency and a need for care; one should expect such a contingency to meet the required insurability conditions as the chances of and losses associated with dependency can be identified and estimated easily by insurers.

One line of thought is that public insurance crowds out private insurance. Some scholars argue in the context of the US that the expansion of public subsidization for LTC fuels concerns about private insurance being crowded out by public LTC insurance programmes . However, empirical evidence does not appear to confirm this phenomenon.

One particular feature of LTC is the importance of the uncertainties and risks it imposes on people as they grow older, which might refer not only to a loss of assets but also to a loss of income. Precisely because the risk of needing LTC is unpredictable, highly variable, and unevenly distributed, it is an ideal policy area for social provision. Given the underestimation of LTC risks, there are few incentives for political officials to tackle this problem. On the other hand, there exist substitutes for LTC financing in the form of private pensions and other alternative financial products that would permit the coverage of LTC costs if the need occurred. However, even in countries where LTC insurance is relatively more developed, such as the United States (US), a majority reveal incorrect knowledge about the coverage of LTC.

In European countries, it has been recognized that the feasibility of LTC funding depends on the public attachment to the system of public funding. Of all EU citizens aged 15 and over, 48 per cent believe that they will finance their own LTC if this requires payment, 32 per cent expect that public authorities or social security will pay for it, while only 15 per cent expect private health insurance to pay.

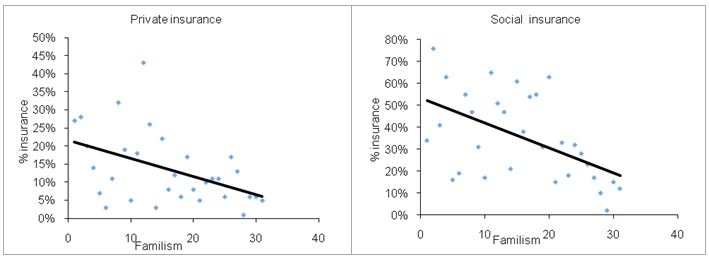

The alternative to market and state financing is family financing. The downside of this alternative is limited risk pooling, which implies large sunk and administrative costs in the event of an individuals needing of long-term care. It is important to note that even when different forms of insurance are available, as is the case in the US, the family is still the main LTC provider. In the US, a country exhibiting high LTC Figure 1 plots expectations of private and public LTC insurance coverage in different European countries against a measure of familism, namely the closeness to children. Similarly, I have suggested that family ties reduce the likelihood of individuals expecting both public and private insurance coverage of LTC.

Figure 1: Familism and (private and public) insurance expectations in the EU

Source: Costa-Font (2010)

Attitudes towards self-insurance and family provision can be found in the 2007 special Eurobarometer survey. It reveals that 30 per cent of Europeans believe that the best option for elderly parents is to live with one of their children; 27 per cent believe that elderly individuals should stay at home and receive regular care visits, from either a public or private care-service provider, and about one-quarter of the sample believe that children themselves should provide the care.

LTC insurance is possibly the only programme which, in an era of austerity, still shows some development in Europe, and in part this is the result of population ageing, leading to a larger demand for care, as well as to the simultaneous process of the weakening of the family. If families are choosing to avoid insuring for LTC to preserve the bequests for their children, changes in inheritance tax rules should translate into changes in the demand for LTC.

In the light of the evidence we can conclude that a stable contract by government to fund and promote LTC equilibrium should attempt to circumvent both public and family (or social) crowding out, finding the right balance between the family and government provision. This is precisely what was proposed by Julian Le Grand, and then endorsed by the 2005 Wanless Report Securing Good Care for Older People. That is, the state should aim at providing a certain level of provision and individuals are encouraged to fund extra care themselves with matched government funding up to the ‘benchmark’ level of public financing. Insurance contracts need to be designed in conjunction with the prevalent social values; keeping in mind the importance of family LTC provision.

Please read our comments policy before commenting.