The Bank of England recently announced its decision to inject £75 billion into the economy in its second round of quantitative easing since 2009. Former Monetary Policy Committee member Charles Goodhart OBE FBA and Morgan Stanley’s Jonathan Ashworth argue that while there is still scope to boost the economy, the Bank’s aggressive policy is unlikely to dramatically improve confidence in the UK economy or spur bank lending, and could lead to upward pressures on inflation.

The Bank of England recently announced its decision to inject £75 billion into the economy in its second round of quantitative easing since 2009. Former Monetary Policy Committee member Charles Goodhart OBE FBA and Morgan Stanley’s Jonathan Ashworth argue that while there is still scope to boost the economy, the Bank’s aggressive policy is unlikely to dramatically improve confidence in the UK economy or spur bank lending, and could lead to upward pressures on inflation.

The Bank of England (BoE) has been more aggressive in its quantitative easing (QE) policy than had been expected, by moving earlier (in October rather than November, when it could have told a coherent story in the context of the Inflation Report) and buying more (£75 billion rather than £50 billion). Perhaps the BoE had become more concerned about the prospects for both the UK and the Eurozone, and felt that nothing much would be gained by deferring the decision by one month.

While on balance QE will be beneficial to the economy, we are somewhat less sanguine about its impact than the BoE is. In its 3Q Quarterly Bulletin, it discussed the design, operation and impact of QE, with Figure 1 showing the range of estimates for GDP and inflation under different modelling methods.

Figure 1: Estimates of the Macroeconomic Impact of QE (Peak Impact on the Level of output and inflation)

| Method | GDP (%) | CPI (pp) |

| SVAR (structured vector autoregression) |

1.5 | 0.75 |

| Multiple time-series models average impact | 1.5 | 1.25 |

| Monetary approach | 2 | 1 |

| Bottom-up approach | 1.5-2.5 | 0.75-2.5 |

| Range across methods | 1.5-2 | 0.75-1.5 |

Source: Bank of England

Below we list the main mechanisms through which the BoE suggests that asset purchases should boost the economy, and discuss the likely efficacy of each.

Policy signaling effects: With markets already expecting no change in interest rates until mid-2013 at the earliest, one suspects that there is little potential further boost from this channel – Governor Mervyn King said as much in the Q&A after the August Inflation Report. In response to a question on whether the BoE could mimic the American Federal Reserve (Fed) in signaling that rates are likely to remain low over the next couple of years, he suggested that implied market forecasts of interest rates in 2013 were almost unchanged from where they are now, despite the lack of a commitment.

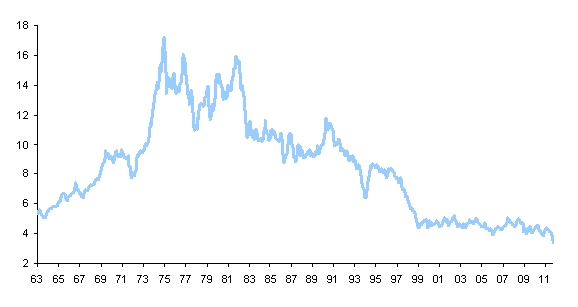

Portfolio balance effects: Undoubtedly, there is some scope to still boost the economy, but probably much less than in 2009. Yields are significantly lower than in 2009, across all parts of the curve. Lately, some Monetary Policy Committee (MPC) members have made the case that longer-maturity yields are not at historical lows, but as Figure 2 shows they are still at incredibly stimulative levels especially in real terms, after accounting for inflation.

Figure 2: UK 20-Year Gilt Yields (%)

Comparisons with the 1930s and 1940s are not appropriate, since the spectre of potential deflation still held sway then, whereas now there is much uncertainty whether trend inflation can be brought back to 2 per cent. In real terms official interest rates are now extremely low.

Moreover, in addition to reducing yields on the assets it buys, the BoE hopes that the sellers (preferably non-bank financial institutions) will use the funds to invest in riskier assets like corporate bonds and equities, reducing their risk premia. Towards the longer end of the curve, pension funds and insurance companies are significant owners of gilts, given their desire to match their long-term liabilities. Given the increased uncertainty and weakening economic outlook and the failure of the last round of QE to promote a sustainable recovery, one could seriously question the current appetite among these institutions to move up the risk curve into equities and corporate bonds. Furthermore the need to top up their existing defined benefit pension funds will damage the cash flow of many corporates, including some banks.

Confidence effects: The theory behind the life-cycle hypothesis of consumption suggests that if consumers believe they have a permanent increase in wealth, they will increase current consumption. The failure of QE to deliver stronger and persistent growth last time further increases the risk that consumers view any increase in asset prices as fleeting, disappearing once policy-makers pull away the stimulus. It would be extremely surprising if businesses weren’t equally sceptical.

Liquidity premia effects: When financial markets are dysfunctional, central bank asset purchases can improve market functioning by increasing liquidity through actively encouraging trading. Asset prices therefore increase through lower premia for liquidity. Evidence from Japan, the UK and US certainly supports the efficacy of this type of intervention. However, at the current juncture, the UK’s asset markets are not particularly dysfunctional, and where there are problems these are emanating from the Eurozone.

Bank lending effects: By purchasing assets from non-banks, the BoE injects monetary base into the financial system, and these extra funds should end up in deposits at the commercial banks. Under normal circumstances, this would typically spur a surge in lending to households and corporates and subsequent gains in broader measures of money. However, the money multiplier (broad money/monetary base) is currently impaired, primarily due to an elevated desired reserve ratio among the banks (desired reserve ratio = [required reserves + excess reserves]/deposits). A number of well publicised factors are currently making banks refrain from lending (and accumulate excess reserves), and these factors are unlikely to abate in the foreseeable future.

Admittedly, though, the BoE has never been particularly optimistic about the efficacy of this channel in recent years either. Moreover banks borrow short and lend long, and so benefit from an upwards-sloping yield curve. This round of QE is intentionally aimed at flattening the yield curve, and so may actually harm bank profits. To the extent that bank profits/capital are the constraint on bank leverage and lending, (rather than cash or liquidity), this round of QE will not do any more, than the last one, to stimulate new bank lending.

Meanwhile, the factors likely to reduce the efficacy of the different mechanisms described above suggest that the benefits from a US-style Operation Twist would also be quite limited (at the September meeting, the BoE suggested that further asset purchases were preferred at the current juncture).

Another Round of QE Poses Significant Risks to BoE Credibility

There was a drumbeat of support from government officials and some business leaders for the BoE to resume QE. Given the coalition government’s fiscal mandates, it may have very little wiggle room to ease discretionary fiscal policy to bolster growth. Indeed, the risk is that intentional fiscal slippage could undermine its fiscal credibility and fuel a sharp jump in borrowing costs. Hence, the onus falls on the monetary authorities to support the economy at the present time. However, we believe that one should not underestimate the risks posed to the BoE’s own credibility by embarking on another round of QE. In a recent speech, MPC member Ben Broadbent suggested that, while the UK inflation-targeting regime looked robust, “That’s clearly not something that can, or should, be taken for granted. Credibility is earned, over time, by keeping inflation close to its target”.

Strikingly, the BoE is the first of the major developed central banks to start injecting money back into the economy (unsterilised), despite the UK having much higher inflation than its peers (see Figure 3).

Figure 3: CPI Inflation (%Y)

When the MPC initiated QE in March 2009, inflation stood at 2.9 per cent, and there had been a complete collapse in the outlook for growth and consumer prices. In contrast, inflation is likely to reach 5 per cent in the coming months and the growth slowdown has not yet been dramatic. Any further policy-induced weakening in the currency could fuel further upward pressure on inflation. The BoE expresses confidence that inflation will fall back, even below target, in 2012/13, but if the main effect of QE were to come via a sharp fall in the exchange rate, such confidence (once again?) could turn out to be misplaced.

In our opinion, much of the perceived ‘safe haven’ status of the UK during the recent financial crisis has been due to investor confidence in a combination of the country’s fiscal and monetary policies. The risk is that, thinking in terms of the simplistic Uncovered Interest Rate Parity model, foreign investors may begin to demand higher interest rates to compensate for fears of further sterling depreciation. We have already seen a sharp decline in net gilt purchases by foreigners in the last couple of months (they turned net sellers in August). These data can often be quite volatile, so one should not read too much into it just yet, but it certainly suggests to us that policy-makers should proceed with caution.

Policies to Reduce the Lending Spread Would Be Most Effective, but They Are Unlikely at the Current Juncture

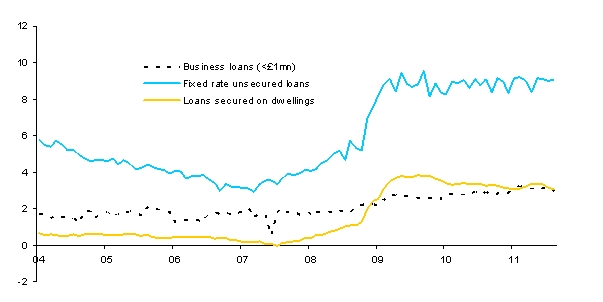

The key problem for the economy is the large spread of effective lending rates to households and corporates over the Bank Rate and the lack of provision of credit to key areas of the economy, such as small and medium enterprises and first-time homebuyers. As Figure 4 shows, the lending spread has increased sharply since the onset of the financial crisis (and this understates the true spread as it excludes all those that have been refused loans).

Figure 4: Lending Spreads over Bank Rate (%)

In the same August Inflation Report, the BoE highlighted the two key components of the lending spread, the rise in the cost of bank funding relative to the Bank Rate and the spread that banks add over their funding costs (reflecting a wide range of factors, such as credit risk charges to cover possible loan losses, lenders’ mark-up, etc.). A rise in the latter component (particularly for certain borrowers) was unsurprising, after the lax lending standards of the preceding years.

The main problem in terms of credit provision, however, is the former. Moreover, the ongoing crisis in the Eurozone is exacerbating the banks’ funding problems. Since the beginning of August, credit default swap premia (the cost of insurance against default for bondholders) for the major UK lenders have absolutely soared, signaling a further rise in the banks’ cost of funds and the future rates at which they lend to the wider economy.

In our opinion, increased gilt purchases by the BoE will do little to ameliorate this (even if they were of considerable size). We think that, in order to reduce the spread or to provide more lending to SMEs, the monetary authorities may at some point have to consider more aggressive quasi-fiscal-type measures. Adam Posen, in particular, has suggested a number of different schemes.

It appears from press reports that the Governor, Sir Mervyn King, has rejected proposals that the Bank take the initiative for introducing such quasi-fiscal measures, passing the responsibility for them back to the government. The Chancellor, George Osborne, has stated that the Treasury will announce some new credit easing (CE) scheme in the Budget. What form such a scheme might take, and how large it might be, are yet to be seen.

This article is a revised and extended version of part of a gilt edge paper issued by Morgan Stanley on October 3, 2011.

Please read our comments policy before posting.

Sirs,

Thank you for an interesting post.

Since the Bank of England announced the £75bn expansion of QE last Thursday:

• 2 year RPI expectations as indicated by the Gilt-inflation protected Gilt spread have increased by 0.24%. from 2.61% to 2.85%.

• The implied real yield on 25 year UK government debt has increased from 0.21% to 0.37%.

• The FTSE 100 is up 5.9%.

• The pound is down 1.27% against the Euro.

It is interesting to note that the change in inflation expectations have similar magnitude to the Bank of England’s estimates of the likely effects of QE on inflation. But it is hard to believe that a 0.24% increase in expected RPI puts the Bank’s inflation fighting credibility at risk.

The change in real yields and FTSE are promising.

The change in the Euro-Sterling exchange rate does not suggest a flight of foreign capital. For comparison a flight of capital occurred between Northern Rock’s bail out on 14th of September 2007 and the end of 2008 when Sterling fell 28% against the Euro.

Also, the authors are very quick to discount the risk of deflation, between 4th July 2008 and 2nd December 2008, two year RPI expectations in the bond markets fell from 3.95% to -3.55%. I.e. inflation expectations were much higher than they are currently, and collapsed. It is widely acknowledged that the looming European sovereign defaults have the potential to cause as large a macroeconomic shock as Lehman Brothers in 2008. Therefore, risking a mild increase in inflation, but keeping inflation expectations consistent with a 1-3% CPI inflation target in two years time, seems sensible.

Furthermore, if the Bank is wrong, or if future data revisions suggest the situation is different, then QE can always be reduced in the future.

I would be interested to read the authors’ views on:

1) European Central Bank’s monetary stance, specifically the two recent increases in interest rates.

and more generally:

2) Is it possible for monetary policy to be tight even when short term interest rates are zero?

3) The relative merits and practicability of nominal GDP targeting, price level targeting, a higher inflation target (e.g. as advocated by Rogoff and Mankiw) versus the current 2% CPI target.