The proposed Universal Benefit is one of the coalition’s flagship policies, aiming to consolidate benefits and tax credits into one single payment, thereby reducing complexity and administration costs significantly. Claire Annesley and Fran Bennett of the Women’s Budget Group argue that a move to a single benefit would have disproportionate effects on women in low income families by reinforcing the ‘male breadwinner’ model, reducing their ability to budget and access to an income of their own.

The proposed Universal Benefit is one of the coalition’s flagship policies, aiming to consolidate benefits and tax credits into one single payment, thereby reducing complexity and administration costs significantly. Claire Annesley and Fran Bennett of the Women’s Budget Group argue that a move to a single benefit would have disproportionate effects on women in low income families by reinforcing the ‘male breadwinner’ model, reducing their ability to budget and access to an income of their own.

The Welfare Reform Bill 2011 sets out the Coalition government’s plans to introduce a Universal Credit from 2013, combining out-of-work, in-work and housing benefits/tax credits into a single means-tested benefit. The government describes this as simplifying benefits and increasing the incentives for claimants to move into (any) paid work, thereby promoting a culture of employment. The Women’s Budget Group (WBG), however, has concerns about how Universal Credit will affect progress towards gender equality.

Universal Credit amalgamates previously existing benefits/tax credits which have varying purposes, and are claimed by and paid to different people (sometimes individuals rather than couples), at different intervals, and withdrawn at different rates in order. It is proposed that Universal Credit will be claimed and owned by couples jointly, usually paid in full to one partner, probably monthly, and withdrawn at the same rate across all elements. This radical change raises issues which have gender implications.

Disincentives for second earners

While the Universal Credit will in many cases increase the financial incentive for one person in couple households to move into some form of employment, incentives for many second earners will be weakened in comparison to the current situation, as both government and independent evaluations confirm. This will particularly affect women as they are more likely to be the second earners in households and they usually earn less than men and do more informal caring work. Worryingly, the Government finds ‘that any such risk of decreased work incentives for women in couples is justified.’ (p. 19). The WBG’s concern is that this could mark the start of a return to a ‘male breadwinner model’ in which men do paid work and women stay at home to look after children and other dependants.

Managing household budgets

Currently families often get a mix of different benefits/tax credits, and child tax credit is paid to the ‘main carer’. Collapsing most of these into a single payment (probably paid monthly) to ‘mimic wages’, and paying it in most cases to one partner in couples, will affect gender equality in two ways.

- For many low-income families, money often runs out before the end of the week and a single monthly payment will make it harder for such families to budget. This will affect women in particular because they tend to manage the budget and do day-to-day spending.

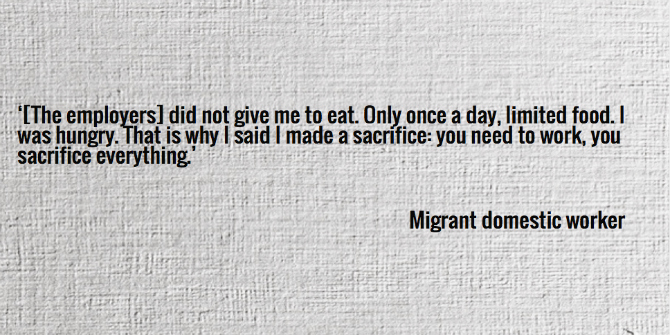

- The evidence is that when money is short, women often go without: women tend to be the ‘shock absorbers’ of poverty. Couple households will have to nominate who receives the payment, and it is likely to be split only in emergencies. This will be likely to affect many women’s access to an individual income for children and for themselves. There is no guarantee that money is distributed fairly within households.

We are seriously concerned about proposals which concentrate financial resources and power into the hands of one person, especially where this may exacerbate existing gender inequalities.

Financial Independence and Stable Relationships

The approach that the coalition government is adopting here indicates an ignorance or wilful blindness to gendered power inequalities and intra-household distribution. These are well-researched and long-established issues in the fields of policy making, politics and economics, and it is worrying that the UK government is not engaging with this work. Facilitating individual access to income should not be seen as a threat to family stability and mutuality, but instead as having the potential to strengthen it.

Paying Universal Credit in total to one partner could undermine the government’s aim of encouraging committed couple relationships, as it increases the risk involved in individuals’ decisions about family formation. Given joint assessment, joint claims and joint liability for Universal Credit, and the potential for the whole of Universal Credit to be paid to the other partner, a significant leap of faith would be required to contemplate life with a new partner. At the same time, the onus on claimants to report changes of circumstances (such as a new partner) in a timely way will increase.

By and large, broader issues such as these are not captured in the gender section of the Universal Credit Equality Impact Assessment. Individual financial security is a better basis for achieving flourishing relationships, whereas financial dependence can put a strain on them; and more flexible gender roles are more likely to result in family stability and equality within couples.

Yet some proposals in the Bill point instead towards greater economic dependence of one partner on the other, and the reinforcement of a ‘male breadwinner’ model. In our view, this is not compatible with either the government’s duties on equality or its other social goals.

A detailed analysis of the gendered impact of the Universal Credit can be found in written evidence to the Select Committee Inquiry from Fran Bennett, Ruth Lister and Sue Himmelweit (for the WBG) http://www.publications.parliament.uk/pa/cm201011/cmselect/cmworpen/743/743we01.htm and WBG (2011) Welfare Reform Bill: Women’s Budget Group Evidence to Public Bill Committee, http://www.wbg.org.uk/RRB_Reports_6_3769269156.pdf

Please read our comments policy before posting

I would have thought that having a male breadwinner was a positive thing and this is not what I have read previously about UC. I am living with my SO and 3 and half month old daughter. We are on a low income and living in a council flat. If anyone is working, it won’t be me. I’m too busy with my daughter, who is, and rightfully so exclusively breastfed. I also do all the cooking and cleaning and run all the errands. Studies show that women in work even part time do more work than men when you combine both paid and unpaid work. If you support women’s and children’s rights at all you will be for the male breadwinner rather than against it. Unfortunately from what I know about universal credit it aims to give Mothers of young children even more incentive to work outside the home, which is not a positive thing.

Not being stupid

Has any one else made the assumption other that the femanists that it would be men making the claim in the womens names?

I am sure any reasonable person will assess their own situation themselfs and work out if they are the main child carers or hearts of the household. And work out for themselfs is they have a stream of transiant father figger (boyfriends) then they would be the first claimant not the transiant partner.

Or posibbaly have these femanists ever hurd of joint banking? Give a woman accsess to household money all by themselfs automaticaly and not have to ask a man for any help?

Any woman in my opinion that has no skills and has to wait to be given their own/childs money need someone to look after it for them.

I am NOT a femanist I am a independant woman of 32 with what seems a broader mind on the old fasiond style femanist attitudes. I have a husband, I have addopted the role of mother and housewife, I will not be employed in paid work again because the home is my place and where my heart is. And yet I have a more focused grasp on what is real equality. My husband is my equal, not by my demand and shouts for femanisme but becasue we both have mutual respect each other.

ps I know my spellings are terrable please read the intended content not the errors.

Firstly…the word is femInist. Secondly, I too am an “indipendant woman”, and am astonished that any woman can claim to “not be a femanist(sic)” whilst undoubtedy enjoying the miriad benifits that feminism has endowed.

Seriously, does anyone doubt for a second that universal credit is another weapon in this egregous government’s fight to regress this country back to “Downton Abbey” times?

IF men absolutely never controlled and bullied women financially, then why, for example, is Child Benefit paid to the mother, by default?

Or was the government that recognised THAT fact as deluded as us “femanists”?

The double-think here is astounding:

“Paying Universal Credit in total to one partner could undermine the government’s aim of encouraging committed couple relationships, as it increases the risk involved in individuals’ decisions about family formation…” [Really? Since when is any government REALLY interested in committed couple relationships and family formation? For the past 70 years, under the watchful eye of the One (aka the U.N.) and its thousands of NGO tentacles, governments around the world have been destroying families via social engineering programs; the family is the only thing that will truly stand between a person and the force of government.]

“..Given joint assessment, joint claims and joint liability for Universal Credit, and the potential for the whole of Universal Credit to be paid to the other partner, a significant leap of faith would be required to contemplate life with a new partner.” [But, wait! I thought the authors just stated that the “aim” is to have committed couples who form families. How can that happen when people contemplate life with a new partner?]

“..At the same time, the onus on claimants to report changes of circumstances (such as a new partner) in a timely way will increase.” [Well, boo-hoo; such a terrible “onus” to have to tell the social services the name of the “new partner” in order that the redistribution of wealth may continue.]

The last paragraph ticks off “government’s duties on equality” and its “other social goals.” [Hmm..should government REALLY be involved in morality—and do you REALLY trust government with “social goals”??? Sounds like the proverbial downward slope into tyranny. Can anyone shake off the cobwebs and wake up?

Wouldn’t it be better for people to be paid fortnightly, one example of US practice being quite sensible.

Another benefit of that is that mortgage payments are spread across 26 not 12 periods and this cuts down the interest too.