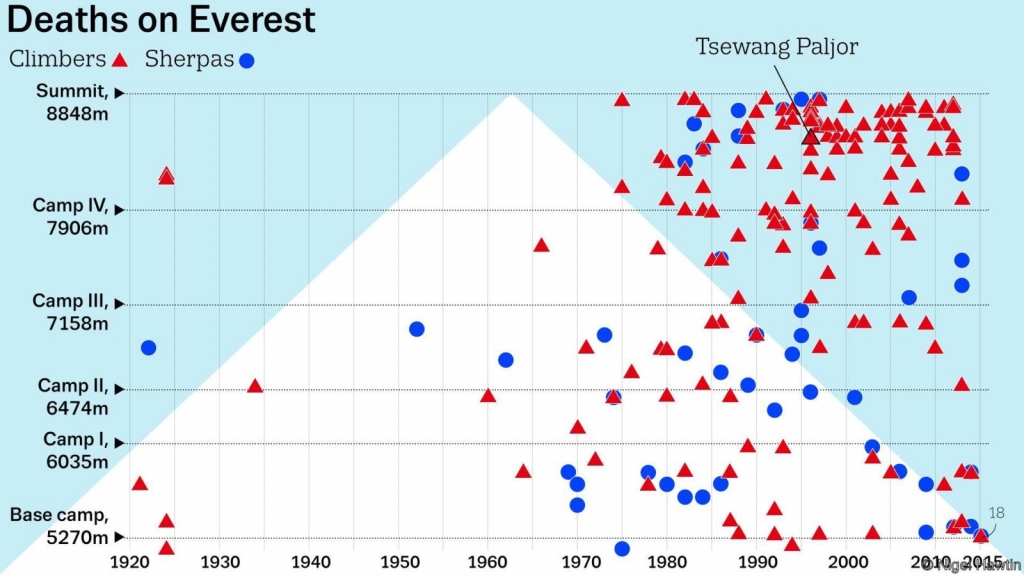

Recruitment: it’s a mountain of a dream and a mile high climb to the top.

No one wants to talk about doing applications late into the night, coming back from networking events so tired that there’s no energy left to eat dinner, or the terrible feeling of getting outright rejected from companies you thought you had connected with. Like climbing a mountain, the path is treacherous and the road gets steeper the further up you get.

Like climbing a mountain, having a good start increases your chance of success – welcome to the application stage. Beware of the traps.

Trap 1: treating LSE as a golden ticket

You might hear many variations of this during the first few weeks:

“You’re at LSE now, you’ve made it”

“Employers will see LSE and want to interview you right away.”

Don’t listen.

Why this is a trap:

The career office in LSE has one objective: to mold you into the perfect template candidate. And there is exactly one ideal archetype: hardworking, high-achieving, and enthusiastic individual who can showcase these attributes on their application. Over the years, LSE Careers have distilled this down to an art form. Unsurprisingly, the side effect is that LSE CVs end up look like carbon copies of each other.

Consider that the coveted graduate positions are well-known to all, and a dozen of your LSE-clonemates are applying to every job you are. Add in the LSE Economics undergrads, MSc Finance and Risk, MSc Finance and Economics, and MSc Economics students who are also joining the party, and we haven’t yet acknowledged that other schools also exist and are competing for the same few jobs. The point is, LSE on your resume looks good, but it’s not an immediate fast-track to interviews.

Overcome this trap by: doing other parts of the application instead of bolding and un-bolding LSE repeatedly on your resume.

There’s a basic applications workshop during the pre-sessional period. The women who gives this workshop has designed the application process for quite a few banks. Gold nugget from that workshop: applications are scored using a points-based system, and educational background is worth the same amount of “points” as one essay or cover-letter-type question. Meaning, if you decided to write 50 words in a 300-word essay question, you might as well have skipped your 16 years of education as far as the screen is concerned. It’s entirely possible that the skills that got you into the top school include the ability to write a killer essay, but don’t fool yourself into thinking that less effort is acceptable because the letters L-S-E are on the CV.

Trap 2: overdiversification

“In life, there are multiple gold medals. If you try to be the best at everything and better than everyone, you’ll be the best at nothing and better than no one.” – Reid Hoffman, co-founder of LinkedIn

Why it’s a trap

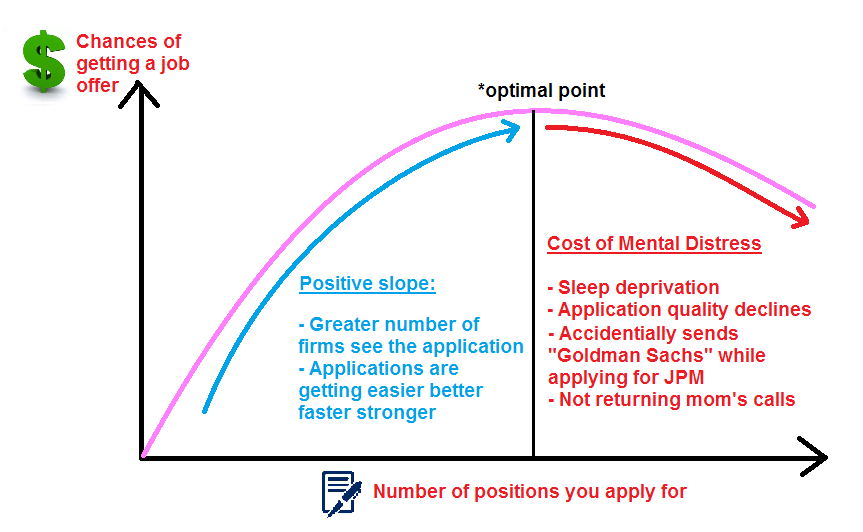

Yes, diversification is a good idea on paper, and you should definitely consider applying to more than one job. More applications aren’t always better though, and below I’ve summarized the relationship between your odds of getting a job offer and the number of applications sent.

As you can see, there’s a Goldilocks zone of job applications. Too little, and you’re at the mercy of the inherent randomness and low probability of success that characterizes the job hunting process. Too much, and there’s a trade-off between chances of landing your dream job vs. potentially having a few back-ups.

Unfortunately, while you threw in a risk management application “just-in-case” you don’t land that swanky trading role, there’s a person with very similar qualifications in MSc Risk and Finance who has put more effort into her application, and she’ll probably get the role instead of you. For you, getting a “back-up job offer” will be difficult precisely because you’re treating it as a back-up. You won’t be able to compete at 50% when someone else is giving their full effort, and even if you do get that Plan B job, would that really make you happy?

To overcome this trap: stop pursuing the jobs you’re only pretending to be interested in.

Your goal is the dream job right? Give it the attention it deserves! Each sector of finance has a different set of song-and-dance to master to show interviewers that you understand the barely-perceptible-but-really-seriously-important-qualities-that-makes-the-job-unique. It takes time and energy to dance that dance convincingly. Read the news on that industry, talk to people in that industry, improve your cover letter, get your story straight, brush up on your technicals – there are a ton of things you should be doing for your Plan A to improve your chances.

Remember, if you fail to get a job by December, there is another six months to figure out an alternative action plan before you even graduate. So keep your eye on the prize and recruit for your Plan A. You worked really hard to get here, don’t settle before even giving your best try.

Trap 2.1: applying to Investment Banking because “everyone else is”

Why this is a trap

It’s no doubt that the LSE’s excellent investment banking outcomes in the past creates a virtuous cycle and attract the best aspiring investment bankers of the future. Unfortunately, this also materializes in an unhealthy level of reverence for the investment banking internship.

More than any other types of finance grad positions, you’ll find that a good portion of people recruiting for investment banking have pinned this as their ultimate goal out of this programme. Yet, despite being the most competitive role, so many people approach IB recruitment with a “maybe I’ll throw this application in and see what happens” mentality. If you go for investment banking – and you should absolutely consider it – just make sure you’re giving it your all and instead of deluding yourself into thinking that this is a good diversification strategy. People who get these offers are the ones who work for it.

Overcome this trap by:

- Ask yourself: why investment banking?

- If you have a convincing reason for why this is a good route for you personally, go for it!

- If you can’t find a good reason, it’s absolutely normal to still be tempted to apply to investment banking, but you will most likely sound like a robot to interviewers. I suggest going back to step 1

This may sound obvious and even ironic right now, but remember that you are not throwing your life away by saying NO to investment banking.

Trap 3: Letting (the inevitable) rejections affect you

For one typical finance job opening, companies receive 50-100 applications. If you were a random applicant, success rate from application to job offer is 1-2%. You’re not a random applicant, of course, and your success rate is [and this is probably slightly optimistic] about 5 times higher. That is still a 90-95% rejection rate. This is why applying to around 15-25 places is a relatively accepted norm, and even though it takes effort, these applications – and subsequent rejections – are an unavoidable part of the process.

Where the trap lies

As in life, in recruitment we tend only to see the glamorous side of our classmates and friends as they one-by-one celebrate their acceptance into fulfilling and fabulous futures. While you feel like you’re getting rejected by 110% of the firms you have applied to. These feelings are simply not reflective of reality. Still, what makes this problem uniquely LSE is that you have most likely come from a lifetime of self-identifying as a high-achiever, and getting rejected left and right will come as a shock.

I applied to 20 companies, was rejected by more than half of them before even meeting a real human on the other side. Everyone I’ve spoken to have experienced the same thing. What a “successful” recruitment season looked like from inside

To overcome this trap: blow it off as you would for an online dating match gone wrong.

So what if you never got the job that you thought was your #1 choice? You probably didn’t even know who the CEO was 2 months ago, let alone talked to a single person from the company. It is going to seem like you’ve invested your soul and each rejection is going to hurt in kind, but the closeness of the situation and uncertainty of the outcome is distorting your sense of investment. If you were serious about recruitment, you’ve spent probably 5-10 hours on each application – that’s including company presentations, reading their website, tailoring a cover letter, asking people out for coffees, voicing your worries to equally-anxious classmates, and random daydreaming about how awesome it would be to finally have a job and stop recruiting. When you get that job, 5-10 hours does not even span a single workday.

In the grand scheme of things, it’s the equivalent of signing up for online dating, matching with someone, and for them to suddenly go cold on you after you’ve sent a few agonizingly thoughtful text messages. It sucks, but it shouldn’t crush you.

What this all means

Most of our lives, we were told that if we do X we will get Y. If we study then we will get into a good school. If we eat our dinner then we will get dessert. If we buy the latest iPhone we will finally be happy. On the contrary, nothing is guaranteed in recruitment. The inherent randomness, high failure rate, and the massive potential payoff makes the whole situation frustratingly difficult to approach with a level-mindedness that is necessary. Like any type of risk-taking, the winners often approach the problem with rationality and rigorous optimization. I can’t tell you how many applications to send in, that depends on your risk tolerance, but there are some extremes that are neither optimal nor risk-free, so beware of the traps.

Wherever you started from, just keep going and you will get far.

What a fine post! A great contribution to your fellow students (with an attractive sense of humor).