As income inequality has grown in the U.S., so too have movements to increase taxes on the wealthy, such as the addition of the “Buffet Rule” to President Obama’s tax plan. But what drives support for these so-called “Robin Hood” tax initiatives? Using data taken from Proposition 1098, a citizen initiative to impose an income tax on the wealthy, Christopher Witko, along with co-authors William Franko and Caroline Tolbert, find that personal gain is only one motive for supporting these policies; an ideological concern with inequality and allegiance to the Democratic Party are also significant predictors of support.

As income inequality has grown in the U.S., so too have movements to increase taxes on the wealthy, such as the addition of the “Buffet Rule” to President Obama’s tax plan. But what drives support for these so-called “Robin Hood” tax initiatives? Using data taken from Proposition 1098, a citizen initiative to impose an income tax on the wealthy, Christopher Witko, along with co-authors William Franko and Caroline Tolbert, find that personal gain is only one motive for supporting these policies; an ideological concern with inequality and allegiance to the Democratic Party are also significant predictors of support.

Income and capital gains tax cuts that benefit the wealthy are some of the many policies contributing to growing income inequality in America over the last few decades. Economic models predict that during periods of growing income inequality the self-interested public, especially lower income individuals, will demand more redistribution necessitating higher taxes on the wealthy. However, a long line of political science research shows that broader attitudes and values are often a more important determinant of policy preferences than self-interest. This suggests that views on growing inequality may be a more important determinant of redistributive policy preferences than economic self-interest. But existing research questions whether the public is capable of tying its own economic interest or broad attitudes toward inequality and taxation to views on specific tax policy proposals.

Most existing research has focused on abstract attitudes toward tax policy or the determinants of public support for specific tax cuts, simply because proposals to increase taxes on the wealthy have been so rare in America in recent decades. But the decision to support tax increases on the wealthy is actually very different than the decision to support a tax cut. Though recent American tax cuts have heavily benefited the rich in dollar terms, all taxpayers usually receive some tax break, making it difficult to sort out how one’s economic self-interest shapes policy preferences. In contrast, when a tax increase is aimed only at the wealthy, determining the effect of self-interest on tax policy preferences is much easier. We took advantage of one of the rare proposals to raise taxes on the wealthy in recent years—Proposition 1098, a citizen initiative in Washington State—to consider how economic self-interest and attitudes toward inequality shape support for “Robin Hood” tax policies that take money from the rich and put it toward programs that benefit others.

Ignorance is one obstacle preventing citizens from linking their attitudes toward inequality and self-interest with particular policy proposals. But the distributional consequences of proposition 1098 were very clear from the way that the policy was structured. Washington State currently lacks any income tax and 1098 would create an income tax for individuals making more than $200,000 or joint filers making above $400,000. This revenue would be used to fund property tax relief for middle class taxpayers, and provide more money for health and education programs and to reduce some occupational and business license fees. Furthermore, the main supporters of proposition 1098, including Bill Gates Sr. and Bill Gates Jr., explicitly discussed proposition 1098 as a way to combat growing income inequality during the campaign. Opponents of proposition 1098, including the CEO of Amazon.com, portrayed it as a threat to the economy, and as the first step down the slippery slope of creating an income tax for all voters. Both the proponents and opponents of 1098 spent a great deal of money getting their messages out to voters. Overall, the public was exposed to arguments about the distributional aspects of this policy proposal and, because this policy was an initiative and voters could cast a ballot on whether it would be adopted, the public had an incentive to carefully consider their attitudes toward this policy.

How did voters link their self-interest and attitudes toward inequality when the distributional consequences of this redistributive policy were clear and they were motivated to understand the policy? Using a survey of Washington State residents we found that, after accounting for the effect of a variety of other demographic and political factors, those with lower incomes and those more concerned about inequality were more likely to support proposition 1098. Not surprisingly in this highly partisan era, voter’s party affiliation was also a major determinant of support for proposition 1098.

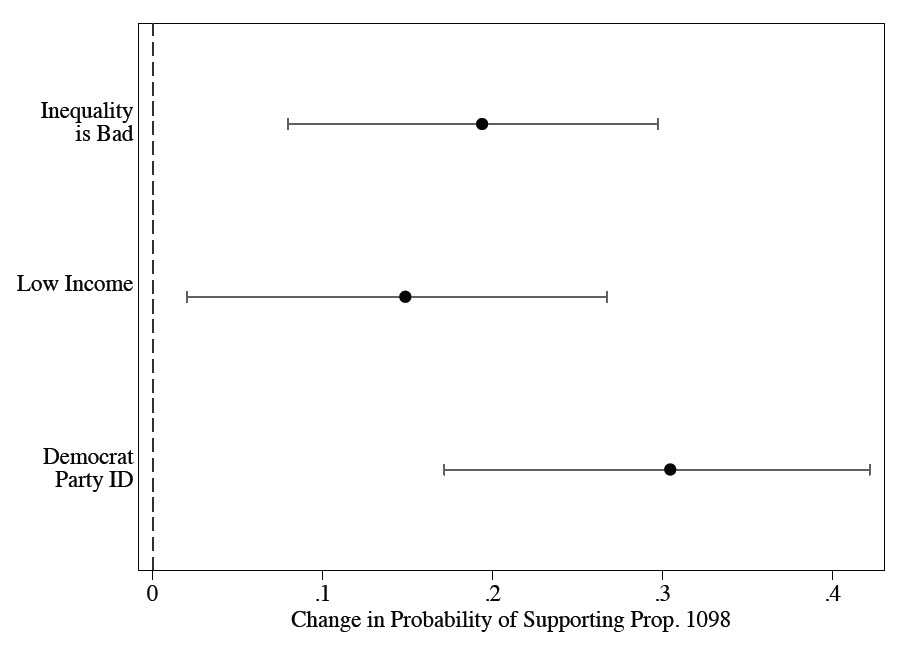

Figure 1 – Probability of supporting proposition 1098 and views on inequality

Figure 1 above shows the expected change in the probability of supporting proposition 1098 based on whether a respondent thought inequality was bad (rather than not bad), whether the person was low income (defined as making less than approximately the median family income in Washington State) and a Democrat (rather than a Republican), while holding other factors (e.g. sex, age, education, whether one was a homeowner) constant. The dot shows the estimated change in probability and the bar shows the margin of error surrounding that estimate. Democrats, those with low income, and those more concerned with inequality, were all substantially more likely to support proposition 1098. Clearly one’s party affiliation is an important predictor of support for this redistributive policy, since people with more pro-redistribution attitudes are more likely to be Democrats. But even controlling for this party affiliation we find that self-interest (i.e. one’s income group) and attitudes toward inequality increase the probability of supporting proposition 1098 by 0.15 and .20 points, respectively. This contrasts with research showing that neither self-interest nor attitudes toward inequality influence support for tax cuts that benefit the wealthy most.

It is quite puzzling that Americans have not demanded more redistribution as inequality has increased, but on the other hand there have been very few opportunities to support more redistribution because tax increases on the wealthy are almost never on the policy agenda. In the vote we examined, even if many taxpayers would have benefited from doing so, Washington voters were ultimately unwilling to create the first income tax in the history of the state. However, in the 2012 election voters in the state of California supported a very similar initiative (proposition 30) that raised existing income tax rates on the wealthy to fund education, health and other programs. The adoption of this proposal avoided even more drastic budget cuts and helped create the current budget surplus in that state, which is estimated to be over $2 billion. Most states are not as liberal as California and many states lack the citizens’ initiative. Additionally it will probably remain difficult to enact an income tax where one does not already exist. But our research suggests that when “Robin Hood” tax increases are on the agenda and the distributional consequences are a main feature of the policy debate, many people can link their self-interest and attitudes toward inequality to the congruent policy position, sometimes leading to the enactment of redistributive tax policies.

This article is based on the paper, “Inequality, Self-Interest, and Public Support for ‘Robin Hood’ Tax Policies,” by William Franko, Caroline Tolbert and Christopher Witko which appears in the December 2013 edition of Political Research Quarterly.

Please read our comments policy before commenting.

Note: This article gives the views of the authors, and not the position of USApp– American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: bit.ly/1aRiXXH

_________________________________

Christopher Witko – University of South Carolina

Christopher Witko – University of South Carolina

Dr. Christopher Witko is an Associate Professor of Political Science and Director of the Masters of Public Administration program at the University of South Carolina. His teaching and research focuses on American politics and public policy.