The U.S. has the most expensive per capita health care system in the world. As such, one of the main goals of the Affordable Care Act (ACA) is to reduce costs for citizens. Morgen S. Johansen and Ling Zhu examine how private, non-profit, and government-run hospitals have responded to local market competition and the ACA. They find that administrators from public, non-profit, and private hospitals prioritize different aspects of care and costs in the face of market competition and that public hospitals are much more responsive to the ACA reforms.

The U.S. has the most expensive per capita health care system in the world. As such, one of the main goals of the Affordable Care Act (ACA) is to reduce costs for citizens. Morgen S. Johansen and Ling Zhu examine how private, non-profit, and government-run hospitals have responded to local market competition and the ACA. They find that administrators from public, non-profit, and private hospitals prioritize different aspects of care and costs in the face of market competition and that public hospitals are much more responsive to the ACA reforms.

On March 23, 2010, President Obama signed the Patient Protection and Affordable Care Act (ACA), which marked the most comprehensive national reform of the American health care system since the Johnson Administration. One major goal of Obama’s national health care reform is to reduce health care costs for American citizens. The Affordable Care Act is a significant piece of legislation for American hospitals, because it adds increasing pressure to manage health care costs under the new law.

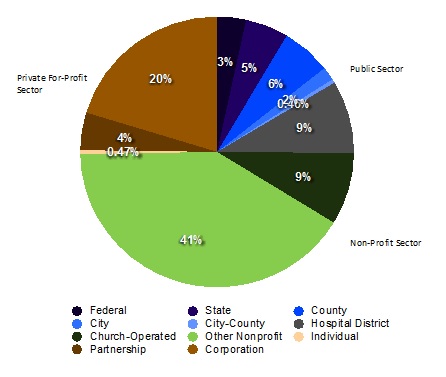

Cutting costs and making health care services more financially efficient are long-standing challenges for the U.S. hospital system. The American hospital system typifies a recurring trend in public service provision in the U.S.—the attempt to deliver services using a mix of public and private organizations. According to the American Hospital Association (AHA), there are more than 6,000 registered member hospitals. Nearly half of AHA member hospitals belong to the non-profit sector. Federal, state, and local governments together own 25% of AHA hospitals; the remaining 25% of American hospitals are private for-profit entities.

Figure 1: Ownership Composition of the AHA Member Hospitals, FY 2010

In such a mixed-ownership system, the government pays public, private and nonprofit hospitals to provide services to elderly and low-income citizens through Medicare and Medicaid programs. Private insurance providers cover the medical costs for most working adults and their families. As such, health care services are rarely managed through direct government administration. Instead, services are provided through public-private partnerships, private contractors and nonprofit organizations. The rationale of using the private and non-profit sectors for service provision is that the introduction of market competition in the provision of services will make these services cheaper and more efficient. An argument in favor of providing services through government owned entities is that they are more responsive to the public, via government laws and policy.

In such a mixed-ownership system, the government pays public, private and nonprofit hospitals to provide services to elderly and low-income citizens through Medicare and Medicaid programs. Private insurance providers cover the medical costs for most working adults and their families. As such, health care services are rarely managed through direct government administration. Instead, services are provided through public-private partnerships, private contractors and nonprofit organizations. The rationale of using the private and non-profit sectors for service provision is that the introduction of market competition in the provision of services will make these services cheaper and more efficient. An argument in favor of providing services through government owned entities is that they are more responsive to the public, via government laws and policy.

Yet, as the national health care reform adds new constraints on Medicare and Medicaid payments and imposes pressures on cutting costs, the question of whether hospitals in different sectors would effectively adapt to and comply with the new law remains unsettled. Many rural and smaller hospitals find it challenging to balance their budget sheets under the expansion of Medicaid coverage. Although under the ACA, more low-income individuals would be covered through the expansion of Medicaid coverage, states usually do not cover all health care costs for Medicaid patients. The recent economic downturn, moreover, has amplified local market competition for some hospitals and increased their financial burdens.

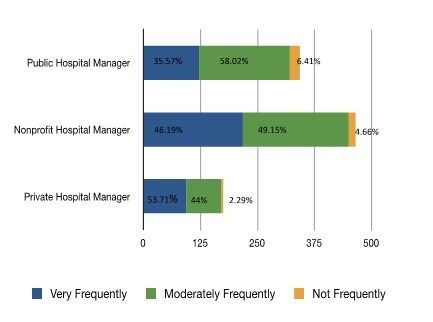

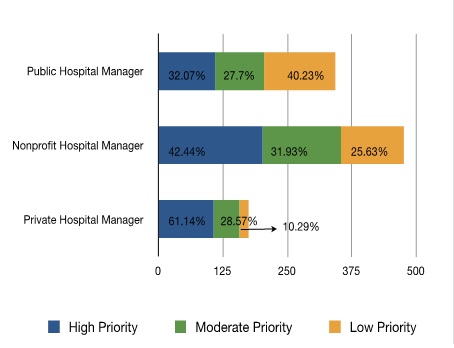

Hospital administrators in the three sectors respond differently to both local market competition and the new health care law. In our recent research, we find public, nonprofit and private hospitals have different economic and political incentives to manage their financial resources and to serve their patients. Facing local market competition, public, nonprofit, and private hospital managers place substantially different priorities on service efficiency and cost containment. According to our mail survey of nearly 1,000 American hospital CEOs, about 58% of public hospital managers manage service efficiency with a moderate frequency, while more than half of the non-profit hospital managers manage service efficiency at a high frequency. Two thirds of non-profit hospital managers see managing per patient cost as a top priority, whereas in both the public and for-profit sectors, there is a lack of managerial priority on cost containment. Only about 32% of public hospital managers place a very high priority on managing per patient cost. 25% of the private hospital managers reported that they do not consider per patient cost as a top management priority.

Local market competition does have an influence on how hospital administrators weigh their considerations for efficiency and cost containment. We find that non-profit and private hospitals care most about cost containment when there is relatively low market competition. Moreover, when there is extremely high market competition, as is often found in major metropolitan areas, these private and nonprofit hospitals care less about cost containment and place a greater emphasis on improving their hospital facilities, investing in new technology, retaining core personnel, and securing their profit margins.

Figure 2: Managing Service Efficiency

Figure 3: Priority on Managing Per Patient Cost

Figure 3: Priority on Managing Per Patient Cost

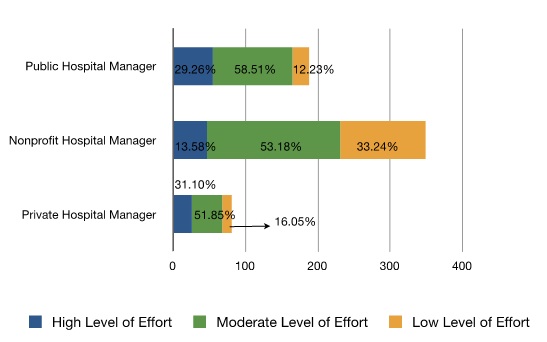

We also compare how the dependence on government medical reimbursement payments influences hospitals’ adaptation to the ACA. Prior to the full implementation of the ACA, we surveyed hospitals managers in all three sectors regarding how much they have adjusted their financial strategies to prepare for national health care reform. We find that hospitals in all three sectors have prepared for the ACA, but at different degrees. A substantial share of non-profit hospitals (33.24%) and private hospitals (16.05%) only put in a low level of effort to prepare for the ACA. Public hospital managers, in turn, are more responsive to the ACA reforms. According to our research, as hospitals rely more on government reimbursement payments, they are more likely to adjust their financial strategies in preparation for the new policy changes. Because of their continuing reliance on public funding, public hospitals are much more responsive to political pressure than private hospitals.

We also compare how the dependence on government medical reimbursement payments influences hospitals’ adaptation to the ACA. Prior to the full implementation of the ACA, we surveyed hospitals managers in all three sectors regarding how much they have adjusted their financial strategies to prepare for national health care reform. We find that hospitals in all three sectors have prepared for the ACA, but at different degrees. A substantial share of non-profit hospitals (33.24%) and private hospitals (16.05%) only put in a low level of effort to prepare for the ACA. Public hospital managers, in turn, are more responsive to the ACA reforms. According to our research, as hospitals rely more on government reimbursement payments, they are more likely to adjust their financial strategies in preparation for the new policy changes. Because of their continuing reliance on public funding, public hospitals are much more responsive to political pressure than private hospitals.

Figure 4: Managerial Preparation for National Health Care Reform

Our research casts doubt on the often proffered solution of privatization and the introduction of market competition to improve efficiency and reduce the costs of public services. We find that high market competition is associated with a decreased concern among private hospitals about efficiency and costs. Even in a regulated market system, public and non-profit hospitals are not particularly sensitive to market competition. This is not surprising given that social service domains such as health care are challenging areas in which to improve efficiency because the financial incentives that the market creates often rely on accurate pricing, and the values of goods and services produced in the health care domain cannot be easily monetized.

Managerial reactions to the new policy changes are mixed, with a large share of non-profit and private hospitals remaining inactive in the wake of the ACA. Increasing service efficiency and reducing health care costs remains a struggle among many American hospitals. Under the reform of the health care system with the ACA, non-profit hospitals will be the ones leading the change due to the large proportion of non-profit hospitals in the American health care system. If we really are to improve health care efficiency and contain health care costs, the solution doesn’t seem to be increased market competition. Rather, a political climate that sets incentives for hospital compliance will pay the largest dividends through the improvement of non-profit hospital performance in the country.

This article is based on the paper “Market Competition, Political Constraint, and Managerial Practice in Public, Nonprofit, and Private American Hospitals,” which appeared in the Journal of Public Administration Research and Theory.

Please read our comments policy before commenting.

Note: This article gives the views of the authors, and not the position of USApp– American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: http://bit.ly/1aHjC4M

_________________________________

Morgen S. Johansen – University of Hawaii

Morgen S. Johansen – University of Hawaii

Morgen S. Johansen is an Assistant Professor in the Public Administration Program and Public Policy Center at the University of Hawaii. Her research focuses on social equity and justice issues, particularly in health care and education.

Ling Zhu – University of Houston

Ling Zhu – University of Houston

Ling Zhu is an Assistant Professor of Political Science at the University of Houston. Her research interests include public management, health disparities, social equity in healthcare access, as well as implementation of public health policies at the state and local level.