The rise of globalization in recent decades has brought about greater trade and other linkages between nations. While this increase in trade has brought major benefits, many are also concerned about its effects on workers’ wages as foreign goods affect local production. Pravin Krishna and Mine Zeynep Senses examine the effects of trade on the volatility of changes to workers permanent incomes, finding that the risk to these incomes has increased in the past two decades. They argue that these effects are significant, and that a sizeable social safety net may be needed to insure workers against this risk.

The rise of globalization in recent decades has brought about greater trade and other linkages between nations. While this increase in trade has brought major benefits, many are also concerned about its effects on workers’ wages as foreign goods affect local production. Pravin Krishna and Mine Zeynep Senses examine the effects of trade on the volatility of changes to workers permanent incomes, finding that the risk to these incomes has increased in the past two decades. They argue that these effects are significant, and that a sizeable social safety net may be needed to insure workers against this risk.

While global international trade continues to grow through globalization, many still call for measures to restrict the amount of imports entering into countries. However, import protection can stifle access to a greater variety of goods, raise prices and hinder the efficient allocation of resources. Moreover, if the major trading nations were to engage in retaliatory protection against each other, the impact on world growth would be devastating. Despite these facts, heightened public concerns regarding globalization remain, and not without justification; greater trade may induce reallocation of workers across sectors and firms and in the process expose workers to the possibility of income losses and unemployment.

The impact of trade on wages has been the subject of a rich body of research. Up to now the focus has mostly been on the average effect of trade on wages of different categories of workers. In our recent research, we have studied a different dimension of the labor market experience and focused on the effect of increased trade on the risk to income (the variance of unpredictable changes to income) experienced by workers in the US.

These unpredictable changes to worker incomes may be transitory or permanent. During the adjustment process following trade liberalization, workers may experience temporary job loss resulting in a short-term loss of income. Alternately, individuals moving across sectors may see permanent income losses since their work experience may not be valued—and thus not rewarded—in their new sector. When faced with temporary income shocks workers can borrow or use their own savings to maintain their previous consumption levels. However, this is clearly not feasible when income shocks are permanent. As a result, highly persistent income shocks will have a far more significant effect on the well-being of workers compared to transitory ones.

Focusing therefore, on permanent income shocks, we asked two questions: what is the magnitude of income risk faced by workers? And, to what extent is the risk faced by workers associated with the sector’s exposure to international trade, as measured by import penetration (the value of imports to the domestic economy)? To answer these questions, we use longitudinal data on individuals from the 1993–1995, 1996–1999 and 2001–2003 panels of the Survey of Income and Program Participation (SIPP). Each panel of the SIPP is designed to be a representative sample of the US population and surveys thousands of workers. Interviews are conducted at four-month intervals over a period of up to four years, collecting data on earnings and labor force activity for each of the preceding months.

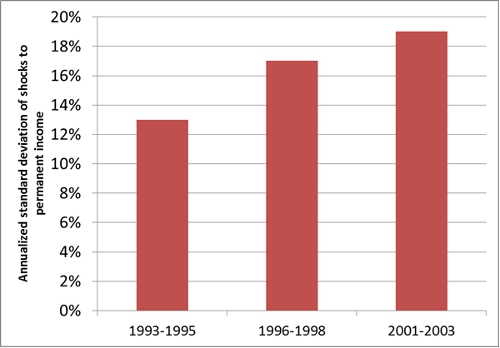

Figure 1 shows our estimates of permanent income risk averaged across industries in the manufacturing sector for each panel. Our estimates suggest that the annualized standard deviation of shocks to permanent income (which, roughly speaking, measures the spread in income growth rates across individuals) is rising over time.

Figure 1 – Income risk over time

Higher import penetration is associated with increased income risk

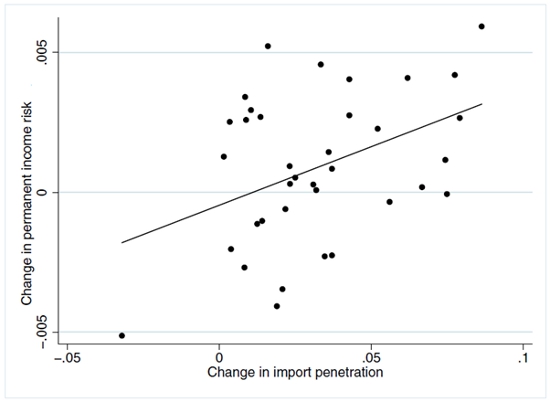

Figure 2 plots the changes in the estimated permanent income risk against changes in import penetration for each industry. The relationship is strongly positive. An increase in import penetration by 10 percent of its initial (1993) level raises the standard deviation of shocks to income by around 23 percent. Formal statistical analysis confirms this positive association between trade and income risk, while also allowing us to control for the influence of other factors such as exports, skill-biased technological change, offshoring, unionization, and productivity that might otherwise bias the results.

Figure 2: Changes in Permanent Income Risk and Changes in Import Penetration

Next we analyzed the link between income risk and welfare. Our goal here is not to provide a complete assessment of the effects of international trade on welfare, taking into account all possible channels, but rather to obtain suggestive estimates of the effect of trade on welfare due to income risk. We estimate that the rise in permanent income risk associated with a 10 percent increase in import penetration is equivalent to a reduction in lifetime consumption of between 2 and 6 percent. These effects are economically significant and suggest that a sizeable social safety net maybe necessary to insure workers against this risk.

Our results suggest that increased import penetration has a statistically and economically significant effect on labor income risk in the US manufacturing sector. We emphasize that our analysis has focused exclusively on the links between trade exposure and income risk. Our finding of economically significant negative effects through income risk does not suggest that the gains from trade are negative overall. Therefore, this research should not be viewed as a call for protection, or support for anti-globalization arguments. Instead, our results indicate that the income risk channel should be considered seriously when evaluating the costs and benefits of trade and trade policy reform. One implication from our findings is the need for a social safety net to insure workers against the risks of increased exposure to trade.

Featured image credit: Bernard and Myrtha Garon (Creative Commons BY NC ND)

This article is based on the paper “International Trade and Labor Income Risk in the US” which appeared in the Review of Economic Studies.

Please read our comments policy before commenting.

Note: This article gives the views of the authors, and not the position of USApp– American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: http://bit.ly/1j47HBs

_________________________________

About the authors

Pravin Krishna – Johns Hopkins University

Pravin Krishna – Johns Hopkins University

Pravin Krishna is the Chung Ju Yung Distinguished Professor of International Economics and Business at Johns Hopkins University, where he is jointly appointed in the School of Advanced International Studies (SAIS) in Washington DC and the Department of Economics in the Zanvyl Krieger School of Arts and Sciences (KSAS) in Baltimore. Professor Krishna is also Co-Chair of the Bernard L. Schwartz Globalization Initiative at SAIS and a Research Associate at the National Bureau of Economic Research (NBER). Professor Krishna’s areas of research interest include international economics, international political economy, economic development and the political economy of policy reform.

Mine Zeynep Senses – Johns Hopkins University

Mine Zeynep Senses – Johns Hopkins University

Mine Zeynep Senses Is an Assistant Professor of International Economics at Johns Hopkins University. Her research interests include international trade, labor markets, and foreign investment.