In 2010, the US government extended unemployment insurance benefits to a maximum of 99 weeks. This extension was rolled back in 2012 and 2013, and now no state has benefits available beyond the normal duration (26 weeks in general). In new research, Henry S. Farber, Jesse Rothstein, and Robert G. Valletta examine the impact of the extension and subsequent rollback of unemployment insurance. They find that the unemployment insurance extension did not substantially reduce the rate at which people found jobs, but did keep them as active labor force participants for longer.

In 2010, the US government extended unemployment insurance benefits to a maximum of 99 weeks. This extension was rolled back in 2012 and 2013, and now no state has benefits available beyond the normal duration (26 weeks in general). In new research, Henry S. Farber, Jesse Rothstein, and Robert G. Valletta examine the impact of the extension and subsequent rollback of unemployment insurance. They find that the unemployment insurance extension did not substantially reduce the rate at which people found jobs, but did keep them as active labor force participants for longer.

The duration of U.S. Unemployment Insurance (UI) benefits was expanded to an unprecedented degree in the Great Recession, reaching a maximum of 99 weeks in many states by 2010. These expansions were then rolled back in 2012 and 2013. Since January 2014, no state has had UI benefits available beyond the normal duration (26 weeks in all but two states). In new research, we find that despite fears about large distortionary effects on job search behavior, the main impact of the extensions and their rollback was on labor force attachment, or duration of active job search, rather than rates of job finding. Moreover, these effects differed little between the period of historically weak labor market conditions when the extensions occurred (2008-11) and the subsequent period of labor market recovery when the extensions were rolled back and eventually terminated (2012-14).

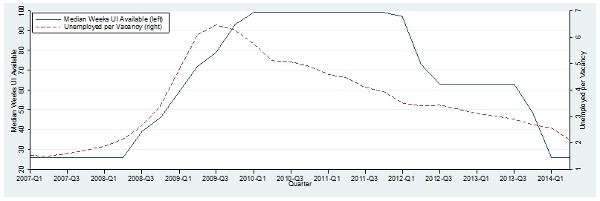

The changes in UI availability in recent years created a unique environment for examining the effects of extended UI. Figure 1 contains plots of median weeks of available UI, quarterly since 2007, along with a measure of labor market slack or weakness, the ratio of unemployment to job openings. This figure shows the run-up of UI availability in the Great Recession, from the basic 26 weeks early in 2008 to the maximum of 99 weeks in late 2009, followed by a decline beginning in early 2012. The benefit extensions came during a period of sharply increasing slack, but by the time of the rollbacks the labor market was substantially tighter. Most importantly, the timing and extent of these changes in UI availability varied substantially across states, creating the conditions necessary for a carefully controlled (“quasi-experimental”) statistical analysis of their labor market effects ( for further details, see the above link and also our earlier work).

Figure 1 – Weeks of UI Available and Unemployed/Vacancies, Quarterly, 2007-2014Q2

Note: UI weeks available is the median across states, weighting states by the number of UI-eligible unemployed (authors’ tabulations of weighted CPS microdata). Unemployed per vacancy computed from BLS tabulations of CPS and JOLTS data (seasonally adjusted). Quarterly data are calculated as monthly averages within each quarter.

Estimating the impact of the UI extensions on job search behavior

To analyze job search behavior, suitable information on individual unemployment experiences is available from the U.S. Current Population Survey (CPS) microdata. The CPS is the large monthly household survey used to construct official U.S. labor force statistics such as the unemployment rate. The analysis samples cover January 2008 to June 2014 and include individuals ages 18-69 who have been unemployed for at least 3 full months and report job loss as the reason, and hence are likely eligible for normal and extended UI benefits.

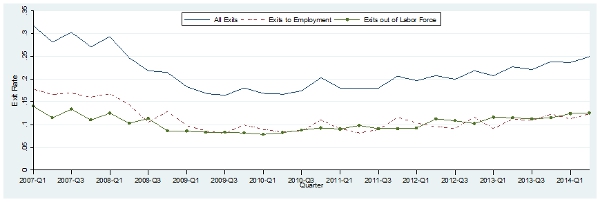

Figure 2 contains plots of monthly exit rates from unemployment (seasonally adjusted and averaged by quarter), shown separately for all exits, for exits to employment, and for exits out of the labor force. Total exits and exits to employment fell sharply in 2008 as the recession deepened. Both reemployment and labor force exit rates rose gradually after the recession ended in mid-2009. There is no visible change in the rates of increase as extended benefits were phased out in 2012 and 2013.

Figure 2- Monthly Exit Rates from Unemployment, 2007-2014Q2 (seasonally adjusted)

Note: Quarterly averages of monthly exit hazards, computed from weighted analysis sample of UI-eligible individuals unemployed for at least three full months.

Precise estimates of the effects of extended Unemployment Insurance availability can be obtained through more formal statistical models of exits from unemployment that rely on interstate variation in exit rates and the availability of extended UI at a point in time in addition to variation over time. These models yield results for overall exits and also exits through the separate routes of job finding and labor force withdrawal, with separate estimates for 2008-2011, when UI durations were expanding or stable, and for 2012-June 2014, when they were contracting. Large effects on job finding would suggest important economic efficiency costs of UI extensions. By contrast, effects on labor force attachment have little or no implication for economic efficiency.

The results indicate that the availability of extended UI benefits significantly reduced the probability of exit from unemployment (for complete results, see Table 1, here). The estimated reduction in the probability of exit is about 3.5 percentage points in 2008-2011 and 2.7 percentage points in 2012-2014. With an average monthly exit probability around 20 percent (Figure 2), these imply that the availability of extended benefits reduced the monthly exit rate from unemployment by about 15 percent. Estimates for the separate routes of exit to employment and exit from the labor force imply that the UI effect on overall exits is primarily driven by a reduction in labor force exit rather than by a reduction in the job-finding rate. The effects of extended UI benefits on the job-finding rate and the labor force exit rate are of similar magnitude in the early (slack labor market) period and the later (stronger labor market) period.

UI extensions did not substantially affect labor force participation rates or labor market efficiency

One implication of these results is that the expiration of extended UI benefits may have caused some individuals to drop out of the labor force, putting downward pressure on the labor force participation rate in 2012 and after. However, this effect is small. Even in 2014, less than 15 percent of the unemployed (and well under 1 percent of the population) would have received UI benefits had extended UI not been rolled back, and prior to that the availability of benefits reduced their likelihood of exiting the labor force each month by under 2.5 percentage points (or around 10 percent). A rough calculation that combines these figures and cumulates over the time since the benefits were rolled back indicates that the extended UI rollbacks reduced the labor force participation rate in mid-2014 by at most 0.1 percentage point, and likely less. The phase-out of extended UI therefore is not important for explaining why labor force participation has remained low during the recovery.

A stronger implication of the results is that the UI extensions have not substantially reduced unemployed individuals’ efforts to find a job, either during the worst period of the Great Recession or during the subsequent recovery. The estimates indicate a near-zero effect in each period, and their statistical precision is high enough to rule out any quantitatively important impact. This suggests that the UI extensions around the Great Recession had very limited impacts on labor market efficiency.

This article is based on the paper ‘The Effect of Extended Unemployment Insurance Benefits: Evidence from the 2012–2013 Phase-Out’, in the American Economic Review: Papers & Proceedings 2015.

Featured image credit: photologue_np (Flickr, CC-BY-2.0)

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of USAPP – American Politics and Policy, nor the London School of Economics, nor the Federal Reserve Bank of San Francisco nor the Federal Reserve System.

Shortened URL for this post: http://bit.ly/1P6YHr7

_________________________________

Henry S. Farber – Princeton University

Henry S. Farber – Princeton University

Henry Farber is the Hughes-Rogers Professor of Economics and an Associate of the Industrial Relations Section at Princeton University. In addition to his faculty position at Princeton, Farber is a Research Associate of the National Bureau of Economic Research (NBER) and a Research Fellow of the Institute for the Study of Labor (IZA). Farber’s current research interests include unemployment, liquidity constraints and labor supply, labor unions, worker mobility, wage dynamics, and analysis of the litigation process.

Jesse Rothstein – University of California, Berkeley

Jesse Rothstein – University of California, Berkeley

Jesse Rothstein is Professor of Public Policy and Economics and the Director of the Institute for Research on Labor and Employment (IRLE) at the University of California, Berkeley.His research focuses on education and tax policy, and particularly on the way that public institutions ameliorate or reinforce the effects of children’s families on their academic and economic outcomes.

Robert G. Valletta – Federal Reserve Bank of San Francisco

Robert G. Valletta – Federal Reserve Bank of San Francisco

Robert Valletta is a Vice President in the Economic Research Department at the Federal Reserve Bank of San Francisco. His research is primarily in the field of labor economics, including topics such as long-term unemployment, job mobility and job security, income inequality and poverty, and the effects of public assistance programs and employer-provided health insurance on labor market outcomes.