A large share of US corporate profits come from overseas, while foreign firms operating in the US tend to be unprofitable. In new research, Mona Ali examines why it is so profitable for US firms to go abroad. She finds that this enhanced profitability stems from increasingly sophisticated tax avoidance schemes by large companies and the declining wage-share of workers employed overseas despite their increasing productivity.

A large share of US corporate profits come from overseas, while foreign firms operating in the US tend to be unprofitable. In new research, Mona Ali examines why it is so profitable for US firms to go abroad. She finds that this enhanced profitability stems from increasingly sophisticated tax avoidance schemes by large companies and the declining wage-share of workers employed overseas despite their increasing productivity.

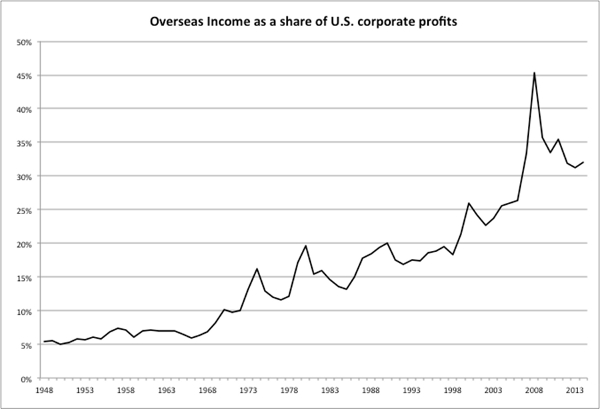

An increasingly large proportion of US corporate profits originate overseas. As Figure 1 shows, at its peak, income earned overseas contributed to almost half of all US profits in 2008. Foreign direct investment (FDI)—investment in the foreign subsidiaries of US multinational corporations—comprises the majority of these US incomes generated abroad (about 61 percent in 2012).

Figure 1 – Increasing Reliance of US Profits on Foreign Income

The growing reliance of US corporations on foreign income suggests that it is very profitable for US firms to go abroad. But why is going overseas so advantageous for American firms? (In contrast, foreign firms in the US are remarkably unprofitable.) Recently, some economists attempted to answer this question. Hausmann and Sturzenegger argued that US FDI’s remarkable profits are rooted in intangible assets or ‘dark matter’. Daniel Gros claimed that the US is the economic equivalent of a ‘black hole’ in which the profits of foreign firms mysteriously ‘disappear’. Curcuru, Thomas and Warnock suggested that the apparently low returns to foreign firms in the US maybe driven by tax avoidance strategies.

To assess these contesting claims, I compared the profits and characteristics of the foreign subsidiaries of US multinationals against those of the US-located subsidiaries of foreign multinationals. (I also analyzed these two direct investment portfolios against US based industries (which include foreign firms located in the US).

My findings revealed that US-owned subsidiaries were much more profitable than foreign-owned subsidiaries in the US. The former’s rates of return were between 16 percent pre-tax to 10 percent post-tax above the latter. Contrary to the risk-return tradeoff in which high profits are associated with higher risk investment, American investment overseas was also less risky compared to foreign-owned investment in the US.

I also found that research and development (R&D) expenditures were twice as great for US firms overseas compared to foreign firms in the US. While this finding may appear to bolster Hausmann and Sturzenegger’s ‘dark matter’ thesis, to rely on relatively higher R&D expenditures as a proxy for ‘dark matter’ is problematic. For one, foreign firms in the US might choose to locate their R&D expenditures in their home countries. Moreover, intangibles—such as human capital, brand equity and reputation—may be inadequately captured by this proxy measure.

Is tax avoidance partially responsible for the apparently low profits of US-based industries (note that these industries include foreign firms located in the US)? It is clear that taxation is an important consideration in determining where multinational corporations locate their foreign subsidiaries. Modes of tax avoidance have become increasingly complex. Current strategies include extracting royalties and management fees—thereby stripping income from profits—from subsidiaries in high-tax zones or re-locating a firm’s assets to special-purpose entities in tax havens. Larger companies with more extensive transnational networks are more advantaged compared to smaller ones. The current ‘tsunami’ of US firms engaged in corporate inversions—whereby firms reduce their global tax bill by shifting their corporate headquarters overseas when merging with a smaller foreign rival—suggests the skillfulness of US firms at tax avoidance.

Given the confidentiality of firm-level data, it is difficult for tax authorities and statisticians to figure out which modes of ‘tax planning’ are at work. Using industry data, I found that the effective corporate tax burden (corporate income as a share of pre-tax income) was fairly similar for US investment overseas (20 percent) compared to foreign investment in the US (18 percent). However the tax burden for US based firms (which includes foreign firms located in the US) was remarkably lower – around 5 percent. This finding backs Kleinbard’s claim that US-based firms are leaders in tax avoidance. It is worth noting that foreign investment in the US is overwhelming acquired through mergers and acquisitions (M&A). Here profits might be artificially suppressed through amortization of goodwill effects and M&A tax avoidance strategies.

It is plausible that the higher profitability of US FDI compared to FDI located in the US may be rooted, among else, in superior proprietary assets (‘dark matter’); the power of American multinationals over their foreign competitors; and, possibly, greater tax avoidance as well. However the influence of these factors on profits is difficult to establish empirically. Easier to identify is how imbalanced capital-labor dynamics bolster profits, particularly for US FDI.

We may think of income generated from production as being split into three shares: the share of income paid to employees (the wage share), the share of income that employers keep (the profit share) and the share that is paid out in taxes. Standard economic theory argues that the more efficient a worker (measured by her ‘labor productivity’ or the output produced by that worker in a given hour of work), the more likely it is that her wages will rise. I found that US firms located overseas exhibited the lowest wage-share, the faster decline in wage-share, and the fastest growth in labor productivity. While workers were becoming more and more efficient, their wage-share were actually declining! US based firms also exhibited the same tendencies but at a slower pace.

My study did not include firms subcontracted by US multinationals (such as Apple contracting out the production of its iPads and iPhones to the Taiwanese multinational Foxconn). The separation of ownership in subcontracting relationships allows for an even greater off-loading and off-shoring of the risks involved in manufacturing (exemplified by the Foxconn case). In other words, these ‘race to the bottom’ effects would have been magnified.

I also found a dissonance between the successes of US multinationals abroad and domestic economic outcomes. For the period examined, US based output did not generate net gains in employment whilst US-owned foreign investment exhibited the fastest growth in output, employment, investment and tax revenues overseas.

The industrial dynamics mapped here suggest the intensification of international competition and its transmission—in complex, uneven ways—by modern multinationals. The ‘race to the bottom’ is no longer just about old-fashioned labor exploitation but also about cross-border tax minimization.

This article is based on the paper, “Dark matter, black holes and old-fashioned exploitation: transnational corporations and the US economy” in the Cambridge Journal of Economics.

Please note that this article is published under a Standard Licence, and does not fall under USAPP’s standard Creative Commons licence. Please contact us for reposting information.

Featured image credit: Stephen Cannon (Flickr, CC-BY-NC-SA-2.0)

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of USAPP – American Politics and Policy, nor the London School of Economics.

Shortened URL for this post: http://bit.ly/1lRiSQE

_________________________________

Mona Ali – State University of New York at New Paltz

Mona Ali – State University of New York at New Paltz

Mona Ali is an assistant professor of economics at the State University of New York at New Paltz. She teaches courses in international trade and finance, multinational corporations, and asymmetries in the global economy. Her research centers on understanding the place and privilege of the US in the global economy. At present, she is working on a long-run study comparing US and UK balance of payments and its implications for monetary hegemony and hegemonic transition.