The consequences of the post 2006 housing bust disproportionately affected black households; rates of black homeownership are now 26 percentage points lower compared to whites. In new research, Kiat Ying Seah, Eric Fesselmeyer, and Kien T. Le examine some of the causes of this homeownership gap by focusing on socio-economic factors. They find that rather than being due to discrimination and subprime lending, the gap is mostly explained by changes in household income, whether the household earned dividend, interest, or rental income, and by marital status.

The consequences of the post 2006 housing bust disproportionately affected black households; rates of black homeownership are now 26 percentage points lower compared to whites. In new research, Kiat Ying Seah, Eric Fesselmeyer, and Kien T. Le examine some of the causes of this homeownership gap by focusing on socio-economic factors. They find that rather than being due to discrimination and subprime lending, the gap is mostly explained by changes in household income, whether the household earned dividend, interest, or rental income, and by marital status.

The late-1990s through the mid-2000s was a period of expanded homeownership in the United States. According to the US Census, the homeownership rate rose from 64 percent in 1994 to a historical peak of 69 percent in 2004. However, the American Dream did not reach all strata of society during the housing boom: gaps in homeownership rates between white-headed and black-headed households have persisted for decades and remained large at around 24 percent in 2004. The subsequent housing bust in 2006 unraveled the boom-period homeownership gains with elevated foreclosure and delinquency rates that were, disconcertingly, concentrated in minority and low-income neighborhoods. By 2014, the US Census reports a homeownership rate of 64.5 percent and a 26 percentage point difference between white and black homeownership rates.

Mounting concerns that the housing bust precipitated wide disparities in households’ economic well-being along racial lines underscore the importance of understanding the changes in the determinants of the white-black homeownership gap from before and after the housing bust of 2006. In new research using data from the American Community Survey, we analyze white-black homeownership gaps in 2005 and in 2011 and compare the changes in the determinants of these gaps in these two time periods. We find that black households with a medium probability of homeownership have been the most adversely affected by the housing bust, and that the homeownership gap is mostly explained by the widening of the differences in observable socio-economic characteristics between black and white households, rather than the role of racial discrimination, and subprime and predatory lending to low income and minority households.

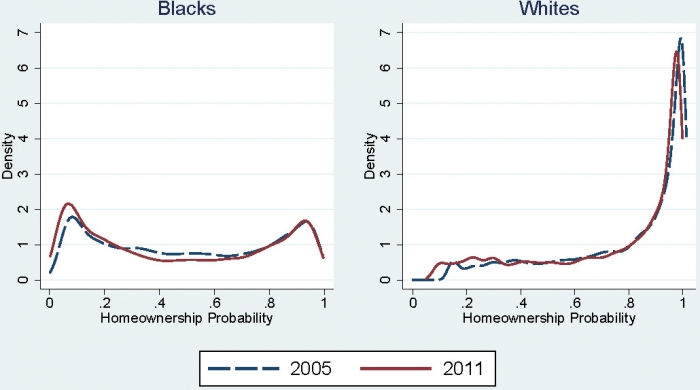

We believe that one should not only look at the average changes in the homeownership gap since what is happening at the mean could mask differential changes at the tails of the homeownership distribution. Figure 1, which contains estimated homeownership probability by race, shows the vast differences in the likelihood of homeownership for black and white households in 2005 and 2011.

Figure 1 – Distribution of Homeownership rates of black-headed households and white-headed Households in 2005 and 2011

Black homeownership probabilities have differed from white homeownership distribution in significant ways. As indicated in Figure 1 by the large mass to the left of the distribution, there were proportionately more black households that had less than a 50 percent likelihood of homeownership. In contrast, the large spike at the right end of the white distribution shows that there were many white households with high probability of ownership.

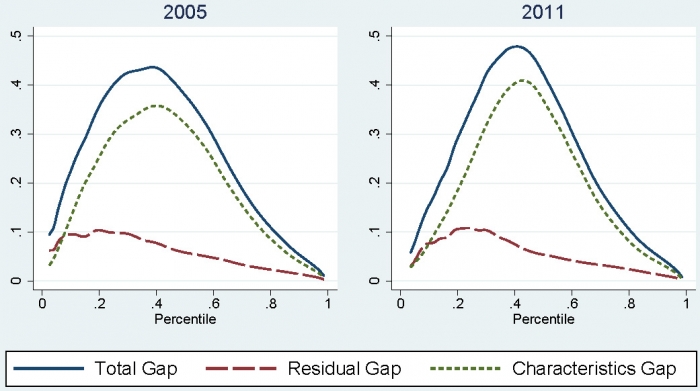

The racial differences in these homeownership probabilities, referred to as the homeownership gap, can be broken down into an observable socio-economic factors component, referred to as the characteristics gap, and an unobservable residual component, known as the residual gap. Socio-economic factors include observed differences in income and wealth as well as differences in household demographics such as marital status, age, and educational attainment. In the housing literature, the residual gap is typically thought to be an amalgamation of the effects of racial discrimination, racial differences in access to credit, credit history, and unobservable household characteristics. In Figure 2, the homeownership gap is represented by the solid blue line, the contribution of the characteristics gap (to the homeownership gap) is represented by a dashed-green line and the contribution of the residual gap by a dashed-red line.

Figure 2 – Components of the Black-White Homeownership Gap

That the residual gap lies very much below the characteristics gap for both 2005 and 2011 means that the contribution of the residual gap is relatively smaller for most of the homeownership distribution. The shape of the characteristics gap mirrors that of the homeownership gap. In other words, the overall changes in the white-black homeownership gap over the sample period are substantively explained by changes in the characteristics gap. In our analysis, the major determinants explaining the changes in the characteristics gap are changes in household income, whether the household earned dividend, interest, or rental income, and marital status, with the extent of their respective influence varying over the homeownership distribution.

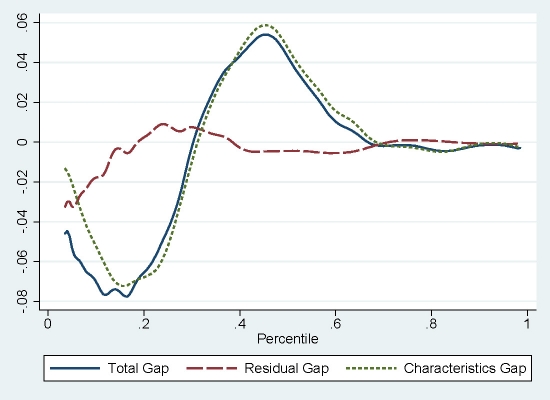

How did the housing bust affect the distribution of the homeownership gap? A clear picture emerges when we graph the 2005-2011 changes in the homeownership gap, the characteristics gap, and the residual gap. In Figure 3, negative values indicate a reduction in a particular gap; conversely, positive values indicate an increase. As can be seen, the housing bust did not affect the homeownership gap uniformly across the distribution. In fact, the homeownership gap decreased for households below the percentile (partly because black household income increased slightly relative to white household income for these low ownership probability households), and then increased substantially for households between the percentile and the percentile.

Figure 3 – Changes in the Homeownership Gap and its components.

The increase in the gap is greatest around the median, indicating that black households with a medium probability of homeownership seemed particularly vulnerable to the housing bust as this segment of households are associated with the greatest increase in the homeownership gap. Changes in the homeownership gap mirror the changes in the characteristics gap indicating that changes in observable household characteristics during the sample period are the predominant determinants driving the dynamics of the homeownership gap. The contribution of changes in the residual gap to changes in the homeownership gap is modest and mostly affected the distribution below the percentile. This part of the distribution experienced declines in both the residual gap and the characteristics gap, resulting in a large decrease in the homeownership gap.

Numerous studies had drawn attention to the roles that subprime and predatory lending played in the disproportionate homeownership loss among low-income and minority households during the Great Recession. In our analysis, the effects of predatory lending, among other unobservable, racially-denominated factors (such as differences in credit history, credit access and discrimination in the housing markets) that effected a change in the homeownership gap, are captured in the changes of the residual gap. A decrease in the residual gap from 2005 to 2011 below the 20th percentile indicates that these unobservable factors, delineated along the racial white-black line, have decreased in importance.

This article is based on the paper, ‘Estimating and decomposing changes in the White–Black homeownership gap from 2005 to 2011’, in Urban Studies.

Featured image credit: Daly City, California Credit: Daniel Hoherd (Flickr, CC-BY-NC-2.0)

Please read our comments policy before commenting

Note: This article gives the views of the author, and not the position of USApp– American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: http://bit.ly/1TT3MbN

______________________

Kiat Ying Seah – National University of Singapore

Kiat Ying Seah – National University of Singapore

Kiat Ying Seah is an Assistant Professor in the NUS Department of Real Estate with expertise in real estate finance and urban economics. Kiat Ying’s research interests range from examining racial differences in housing markets to studying institutional investment in real estate. She teaches courses in Urban Economics and Real Estate Finance.

Eric Fesselmeyer – National University of Singapore

Eric Fesselmeyer – National University of Singapore

Eric Fesselmeyer is a Senior Fellow with the Department of Economics, National University of Singapore. His current research focuses on the differences in white-black housing patterns in the United States and on the Singapore housing market. He has also written several papers on environmental economics.

Kien T. Le – Qatar University

Kien T. Le – Qatar University

Kien Trung Le is an associate professor at the Social and Economic Survey Research Institute (SESRI) Qatar University. He has numerous peer-reviewed articles and book chapters in applied economics and survey methodology. Before joining SESRI, he was a researcher at the Weldon Cooper Center for Public Service, University of Virginia.

in my opinion owners or managers,whatever should lower the rent in houses and apartments especially in south minneapolis in 55404 and 55407.