The Supreme Court’s latest church-state decision opens the door to direct funding of religious institutions. Ursula Hackett argues that this phase merely accelerates a decades-long trajectory: rapid expansion of voucher programmes that offer public funds for private (including religious) schools, and the increasing irrelevance of state constitutional bans on such aid.

The Supreme Court’s latest church-state decision opens the door to direct funding of religious institutions. Ursula Hackett argues that this phase merely accelerates a decades-long trajectory: rapid expansion of voucher programmes that offer public funds for private (including religious) schools, and the increasing irrelevance of state constitutional bans on such aid.

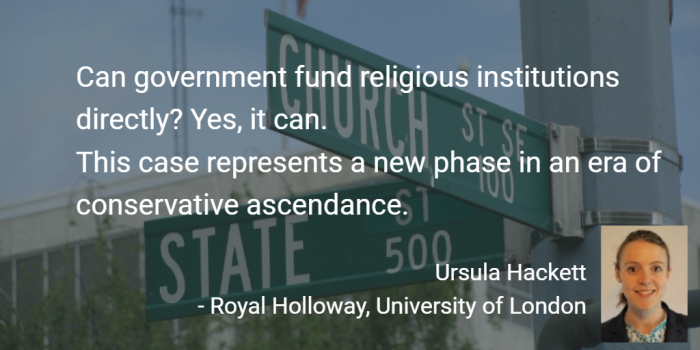

Five years ago a Missouri church was excluded from a state-funded playground resurfacing programme because the Missouri state constitution bars money from the state treasury from going “directly or indirectly, in aid of any church, sect, or denomination of religion” (a “No-Aid Provision”). The church sued on Free Exercise grounds. While the case shuffled through the courts, Missouri elected a Republican governor who changed the state’s position to one in favour of the church. On Monday the church emerged victorious, as a 7-2 Supreme Court majority ruled that churches cannot be denied state grants. The case – Trinity Lutheran v Comer – is a landmark in church-state law. Can government fund religious institutions directly? Yes, it can. This case represents a new phase in an era of conservative ascendance.

Commentators have suggested that this victory will scupper state No-Aid Provisions, which are seen as relics of anti-Catholic prejudice and a “major barrier to school voucher programs that provide taxpayer money to families paying tuition at religious schools”, leading to a wave of school voucher legislation around the country. But these commentators are wrong on all four counts. No-Aid Provisions are surprisingly resilient; they were created for multiple purposes; they are not a barrier to school voucher programmes, and their removal would not necessarily lead to more vouchers. Vouchers are already resistant to challenge.

First, let’s be clear what is meant by a “No-Aid Provision”. Between 1835 and 1959 forty-three US states added No-Aid Provisions or “Blaine Amendments” to their constitutions that prohibit public aid to religious schools. Despite the fact that state No-Aid Provisions date back to the antebellum period they are often (misleadingly) known as “Blaine Amendments” because of their later association with a Senator James Blaine. Senator Blaine introduced a federal Blaine Amendment in 1875 that would have incorporated an aid prohibition into the federal constitution. The federal Amendment failed but No-Aid Provisions survive in forty states today. Using content analysis I calculate a strictness score for state provisions. Some, like Missouri’s, prohibit both direct and indirect aid; others only direct aid. Some provide a lengthy list of bans and are written in strident terms; others are narrower in scope. I find that stronger No-Aid Provisions are more common in the western states, but the overwhelming impression is of diversity (Figure 1: stronger No-Aid Provisions shown in darker shades).

Figure 1: State No-Aid Provisions by strength

No-Aid Provisions represent a “separationist” approach to church-state relations: government and religion should not be entangled and the state should remain “neutral” on matters of belief. By contrast “accommodationists” argue that government should accommodate religion and encourage its free exercise in the public sphere. The current controversy over school vouchers – programmes that provide a sum of government money to parents to spend on their child’s education at private schools, including religious ones – reflects the clash between separationists and their opponents. But No-Aid Provisions are feeble barriers to vouchers. Of the twenty-seven states that currently offer some form of school voucher (including those funded by tax-credits but excluding those which do not incorporate religious schools), twenty-two have No-Aid Provisions. Three of these – Montana, Oklahoma and South Dakota – have very strongly-worded ones.

How do vouchers elude these separationist bans? The programmes pass constitutional muster because government money is given to the parent, not the school directly. The Supreme Court held in Zelman v Simmons-Harris (2002) that the fact almost all voucher money is spent at religious schools is irrelevant. What matters is that the money benefits the child even if it also benefits a religious institution as a side-effect. To help attenuate the connection between government and churches further, newer voucher programmes are typically financed in an indirect fashion: instead of a direct appropriation, policymakers deduct tax from donations to intermediary organisations, which administer the voucher scholarships. Indirect funding helps further insulate the programmes from legal challenge. President Trump’s voucher plans take tax credit form.

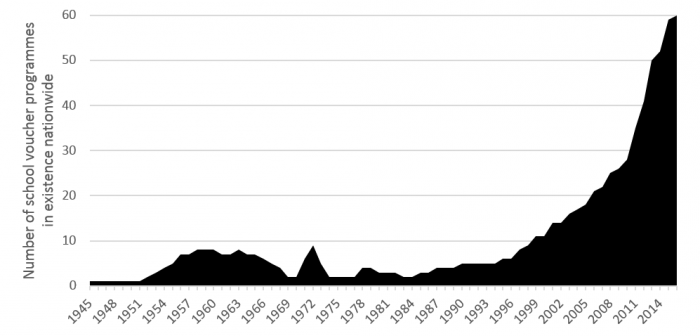

This combination of parental intervention and indirect financing muddies the connection between church and state and helps vouchers pass legal muster. With legal blessing, the number of school voucher programmes has almost tripled since 2008, as can be seen in Figure 2.

Figure 2: Cumulative total of school vouchers in the United States, 1945-2017

Judges have become more sympathetic to voucher and other religious school-aid programmes over time. Republican legislatures pass school vouchers and conservative Republican-appointed justices uphold them as constitutional. Those suggesting Trinity Lutheran will open the door to vouchers are wrong: the horse has already bolted.

The Trinity Lutheran ruling is significant not because it does away with No-Aid Provisions, nor because it improves the chances of school voucher passage, but because it reinforces an accelerating trend toward accommodationism in church-state cases. We can expect greater judicial support for state funding of many types of religious institutions and services, from schools to hospitals and welfare services, which may include those that discriminate against, for instance, disabled students or LGBT individuals. Also, it may no longer be necessary to employ indirect financing to publicly distance government from religious institutions. The Supreme Court supports direct state funding of churches.

The intersection of Church and State by Rachel Patterson is licensed under CC-BY-NC-SA-2.0

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of USAPP – American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: http://bit.ly/2s9kWY6

_________________________________

Ursula Hackett – Royal Holloway, University of London

Ursula Hackett – Royal Holloway, University of London

Ursula Hackett is Lecturer in Politics at Royal Holloway, University of London, and a British Academy Postdoctoral Fellow. She joined Royal Holloway in 2016 as Lecturer in Politics, a post she currently holds in conjunction with a British Academy Postdoctoral Research Fellowship on the politics of vouchers – programmes that transform the state by delegating responsibility for core policy functions to private actors. Her research focuses on American Political Development, federalism, public policymaking, education and religion.