Across European capitals and in Washington DC, economic policymakers are becoming increasingly concerned about the potential for another recession and are considering which monetary and fiscal policy instruments might be used to prevent it. Studying more than 60 years of economic cycles, Eddie Gerba finds that the ‘real’ economy has become inextricably linked to the financial economy in the US and in Europe. Until economists can better engage with the relationship between the financial and real economies, he writes, traditional policies may be ineffective at promoting a renewed period of sustained economic growth.

Across European capitals and in Washington DC, economic policymakers are becoming increasingly concerned about the potential for another recession and are considering which monetary and fiscal policy instruments might be used to prevent it. Studying more than 60 years of economic cycles, Eddie Gerba finds that the ‘real’ economy has become inextricably linked to the financial economy in the US and in Europe. Until economists can better engage with the relationship between the financial and real economies, he writes, traditional policies may be ineffective at promoting a renewed period of sustained economic growth.

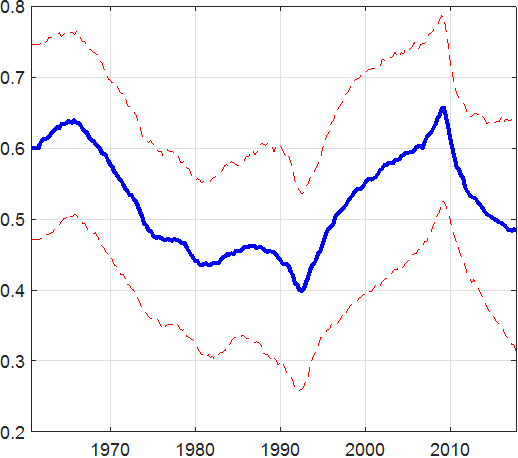

The US economy has undergone remarkable changes in recent years. The financial sector has expanded greatly and has increasingly drawn resources from the rest (or ‘real’) of the economy. This has resulted in an increased interdependence between them. In new research with my colleague Danilo Leiva-León we estimate and examine the degree of interactions between the real and financial economies by using more thorough definitions of macroeconomic and financial cycles. We modelled these cycles by pulling together information from 35 variables on stocks, flows and prices. We then allowed their individual weights to vary over time in such a way so that that the cycles are updated in each time period. We find that the correlation between the cycles for the financial and real economies have increased dramatically since the 1990’s (Figure 1). It grew from 0.4 in the late 1993 to around 0.65 by the onset of the Great Recession in 2008.

Figure 1 – Time-varying correlation between macroeconomic and financial cycles (1960-2018)

Source: Gerba and Leiva-Leon (2018)

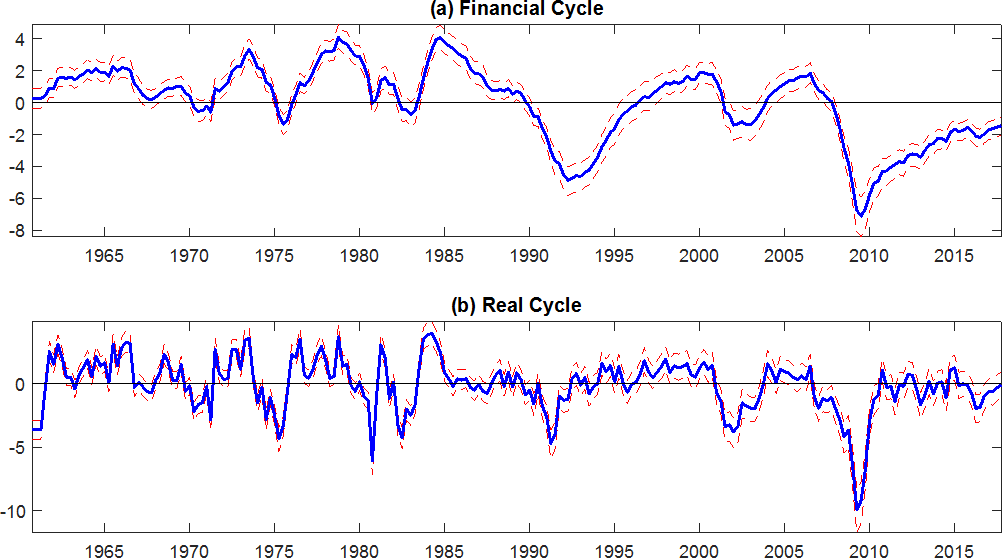

On the other hand, over 30 years prior to this increase, the correlation between the two had fallen by the same amount. This fall between 1965 and 1993, therefore was regained in half the time up to 2008, an increase of 65 percent. Moreover, Figure 2, clearly shows that the financial and real cycles very closely track each other’s movements. Even the post-2010 recovery in the real cycle has been very weak with heavy downward pressures. This is because ever since 2008, the financial cycle has been below the trend which has squeezed the real cycle. Thus, in this environment of highly synchronized financial and real cycles, a full economic recovery will not take place until the financial sector bounces back. Yet, that is still some years away, assuming that the catch-up pattern that began in 2010 continues at the same rate.

Figure 2 – Evolution of EA financial and macroeconomic cycles between 1960-2018

Source: Gerba and Leiva-Leon (2018)

If we take a closer look at the recessions shown in Figure 2, the 2008 slump is historically the biggest, both for the financial and real cycles. In addition, if one considers the total loss in income in both sectors, calculated as the area under the trend (zero-) curve, it is significantly larger than anything we have seen since 1960. The financial cycle of boom and bust has also become more protracted and recoveries more sluggish over time, especially so during the last cycle. We also ran a number of ‘What if?’ exercises and find further evidence for a close relationship between financial- and real sectors. Taken together, this suggests that there is an important feedback loop between the two sectors, which can explain the prolonged current downturn. The initial shock was generated in the financial sector, which caused a severe downturn in the rest of the ‘real’ economy. However, the downturn was so heavy that it sent a prolonged negative disturbance to the financial sector, causing a delay in financial sector’s recovery, and so on.

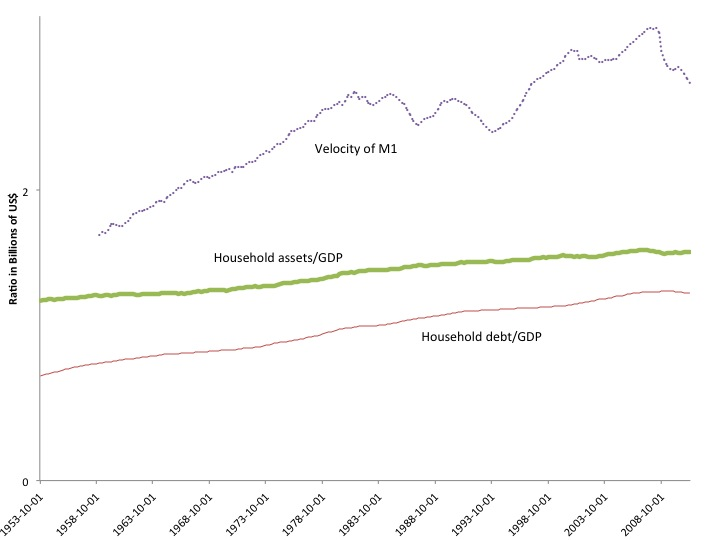

But this is not the whole story. In my 2015 book, I examined a number of economic indicators from the 1950s to the 2010s such as rate that money circulates in the economy, and household’s ratios of asset and debts to GDP. As Figure 3 shows, both assets and debt grew faster than GDP in the post-war period. Second, household total assets were already larger than GDP in 1953. Third and most important, households’ equity has shrunk while indebtedness has increased to such an extent that the wedge between assets and debt had halved to around 20 percent just prior to the Great Recession. Linking this to the fact that consumption during this period grew faster than GDP, it appears that the increase in US private consumption had been achieved through higher indebtedness and not higher levels of net worth or assets as might be otherwise assumed. Thus again we see how financial expansion and transformation has resulted in shifts in the real economy. In this case, however, it appears this has been on the consumer side.

Figure 3 – Great macro-financial ratios (1953-2014)

Source: Gerba (2015)

Other developments

Simultaneously a number of other long-run transformations have occurred in the US and most other advanced economies. While they are not novel insofar that they have unexpectedly appeared at a particular point in time, they have only just recently been covered by the academic literature. These transformations include: a decline in productivity, reductions in the size of the labor force and a rise in the aging population, labor crowding out, and a deterioration in income growth for the vast majority of the population. These developments are contributing to a currently weaker-than-expected recovery, especially when you take into account the extraordinary expansionary monetary-, fiscal-, and financial policies that have been implemented since 2008. Hence, they should be viewed as additional hazards to future growth, and not as substituting for the core effects from anaemic financial recovery and the spillovers to real economy.

Photo by Rick Tap on Unsplash

Implications for policy

Most of the policies proposed in by academics to tackle the challenges of low growth are structural – such as labor market reforms – which mean that their effects will only be measurable in the medium-to-long run. Yet, the current literature is silent on how monetary policy should adapt to the new environment. Although it is highly likely that central banks will not reverse Quantitative Easing and reduce their balance sheets in the foreseeable future, I strongly believe that this will not be enough to counteract the imbalances and respond to the structural changes that have emerged over the past two decades. First, despite some deleveraging over the past years, the amount of debt in the economy is still a problem. Unconventional quantity-based instruments will still be required in order to support further corrections in the balance sheet of the private sector while reducing non-performing loans or other ‘bad debt’. This needs to be well tailored in order to ensure good and stable transformation of the private sector balances. Second, consumption and consumer expectations remain weak despite all the expansionary policies implemented so far. Unlike previous episodes, the Fed will need to do more to give them a boost and to kick start solid income and consumption growth.

More fundamentally, serious considerations should be given to re-formulating monetary policy in terms of objectives, targets, and instruments. The current consensus on conventional monetary policy was built during the Great Stagflation of the 1970s and the reintroduction of volatility resulting from the collapse of Bretton Woods. But the challenges today are very different. The ‘new monetary policy’ should be much more considerate of low growth prospects, interplay between macroeconomic-and financial cycles, private sector balance sheets, and interaction with other policies, in particular financial policy. In this new economic environment, it is important for monetary authorities to have at their disposal a number of instruments, a number of clearly defined and consistent objectives, and most importantly, to engage more broadly with the financial sector and understand the currents and developments within it in real time. Now more than ever do I believe that monetary phenomenon has become a financial phenomenon. Therefore, creative insights from financial-monetary theory will be necessary to guide future monetary stance.

- A version of this article focusing on Europe has also been posted at our sister blog, LSE EUROPP.

- This article is based on the European Parliament Monetary Dialogue, ‘Monetary policy implications of transitory vs. permanently subdued growth prospects (“secular stagnation”)’

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of USApp– American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: https://bit.ly/2URFnYs

About the author

Eddie Gerba – LSE Visiting Fellow

Eddie Gerba – LSE Visiting Fellow

Eddie Gerba (PhD) is a Visiting Fellow at LSE, Distinguished Affiliate of CES Ifo Munich, and an Advisor to European Parliament on Monetary Affairs. His research interests lay in the fields of macroeconomics and quantitative finance, in particular the interactions and linkages between financial markets and the macroeconomy. In 2015, he published the book, ‘Financial Cycles and Macroeconomic Stability: How Secular is the Great Recession?‘ The book includes both a theoretical and an empirical analysis of the US macro-financial developments over the past 60 years. Likewise Eddie conducts research on monetary, fiscal, and macroprudential policy, and holds experience advising on these matters.