How has the COVID-19 pandemic affected African trade, and can a recovery be steered towards a more sustainable model? LSE’s David Luke and Jamie MacLeod examine the latest data and ask what this means for African policymakers seeking to deliver real development.

This post is part of the African trade policy series based on research at the African Trade Policy Programme, hosted by the LSE Firoz Lalji Institute for Africa.

Why trade is so important for Africa’s economic recovery

When a country participates in the global economy, it does so on the basis of foreign exchange inflows and outflows. Even the flow of ideas, in the form of intellectual property rights, entail services trade and foreign exchange. The extent to which exports dominate the inflows of foreign exchange into African countries may be surprising: at $440bn, they eclipse official development assistance ($30 billion), foreign direct investment inflows ($46 billion) and remittances ($84 billion) in pre-pandemic years.

An important metric in Africa’s economic recovery from the COVID-19 pandemic therefore hangs on what happens to its trade.

Africa’s exports of merchandise goods

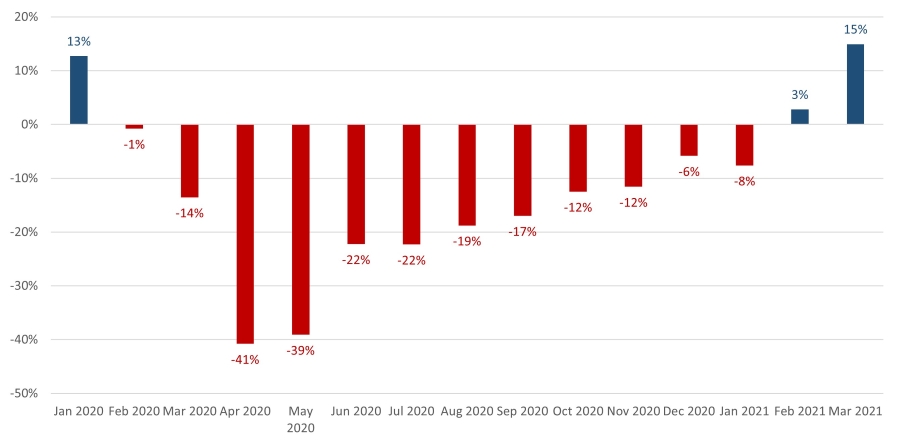

As the economic consequences of the COVID-19 pandemic unravelled across the world, there was no shortage of letter-based descriptors of recovery. Forced into this peculiar nomenclature, the impact on Africa’s formal exports in merchandise goods might be described as ‘J-shaped’. A sharp shock in April and May 2020, at the start of the crisis, gradually gave way to improvements through the year and a return to relatively normal export figures by the start of 2021 (Figure 1).

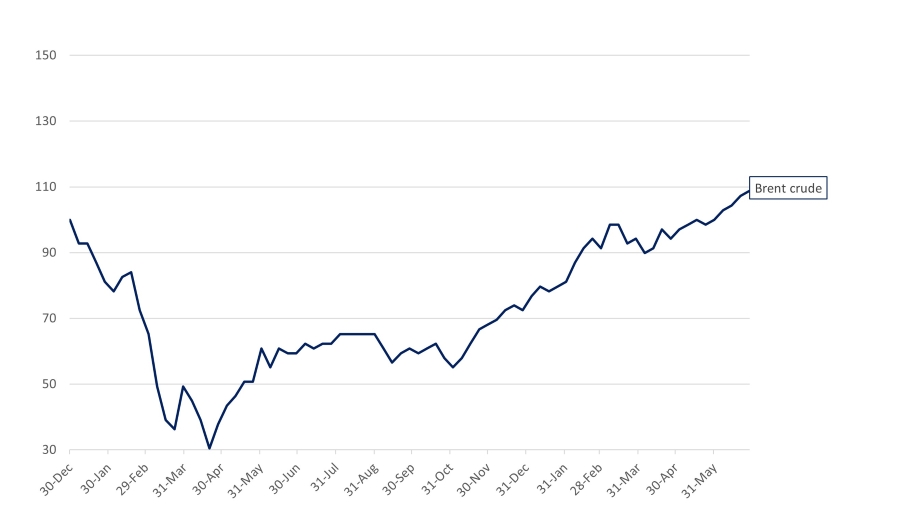

That this ‘J-shape’ replicates the prices of Brent crude oil (Figure 2) over this period is an important reminder that too much African trade continues to be concentrated in petroleum oils (40% in recent years). The impact of COVID-19 is, however, more complex, with prices of other African commodities reaching unprecedented heights by the end of 2020 and supply chain disruptions including historical highs in container freight rates weighing on more complex value chains, such as manufactures. Nevertheless, the most significant indicator of the experience of African countries in 2020 appears to have been whether or not they were major exporters of petroleum oil or gold, with the former group of African countries experiencing a net 40% fall in the value of their exports in 2020 and the latter enjoying an 18% increase, on the basis of available data.

Africa’s exports of services

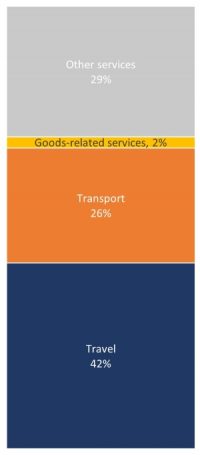

In normal years, Africa’s service exports have accounted for around a quarter of exports of physical goods – slightly more than all African exports of metals, ores and foodstuffs combined. Services trade data is notoriously patchy and a shorter timeseries is currently available across the pandemic period for African countries, yet the emerging picture for Africa is relatively clear. Travel services, which involve expenditure by travellers in an economy such as on lodging and tourism, plummeted 87% in the second quarter of 2020. Transport services, which includes both passenger and freight, fell by about a third. These two service sectors account for 68% of Africa’s services exports in normal year, and have yet to rebound from the impact of COVID-19.

Goods-related services and other services fared better, presumably owing to their reduced dependency on cross-border movements. Such exports have, for a long time, been slated to benefit most from emerging forms of digitalisation that would allow services, such as accounting or business processing activities, to be remotely rendered. Africa has unfortunately lagged in the adoption of the digital technologies that would support such services trade. There is emerging evidence, such as the 51% year-on-year increase in Jumia active customs and of business survey responses, of more rapid digital uptake in Africa stimulated by the pandemic, and this could be an important area of future services trade growth.

Formal intra-African trade

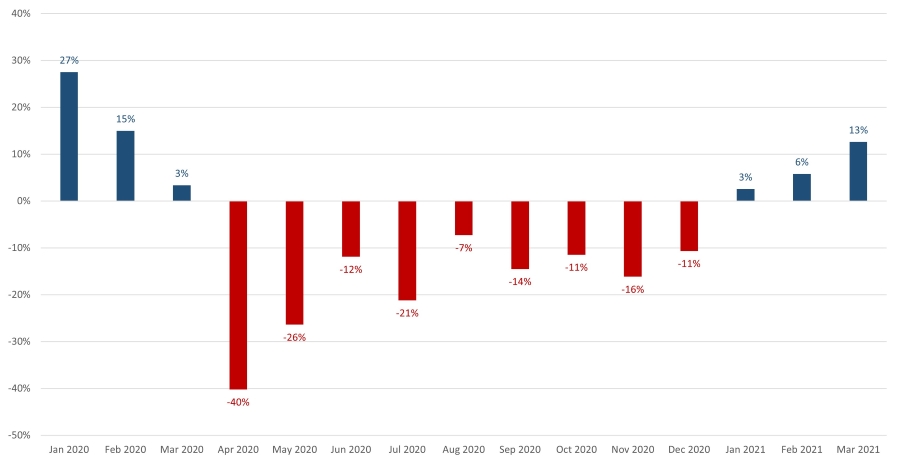

Intra-African trade comprises a smaller share of commodities, and more manufactures, than Africa’s trade with the rest of the world. It is less susceptible to the vicissitudes of international commodity prices, but more dependent on functioning land borders and the economic health of contiguous neighbours. Intra-African trade fell sharply in April 2020, after the imposition of border and movement restrictions, which occurred in late March for the majority of African countries. It then recovered moderately better and slightly faster than exports to countries outside the continent. In the course of 2020, intra-African trade fell by 10% compared to 2019 levels, slightly better than the 16% fall in external exports.

While intra-African exports proved more resilient than exports to the world in total, there was variance across African regions. In Eastern and Southern Africa, intra-African exports suffered more than exports to the rest of the world (Figure 6). In Southern Africa, this likely owes to the severity of the lockdown measures imposed in its largest economy, South Africa.

The better performance of intra-African trade has two likely foundations: reduced dependence on fragile commodity prices and impressive coordination steps taken by African countries and their regional economic communities to facilitate ‘safe trade’ as border movements became more difficult. The latter has involved regional guidelines on issues such as border health screening, testing and certification, truck crew sizes, digitalised trade procedures, electronic cargo tracking and information sharing.

Informal cross-border trade

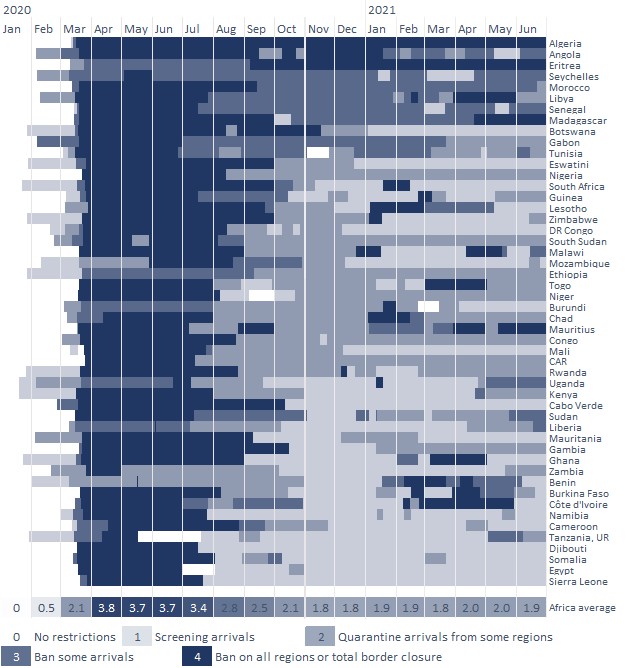

Informal cross-border trade (ICBT), on account of its inherent informality, is notoriously difficult to quantify. However, recent empirical estimates suggest that ICBT accounts for about 7-16% of total formal intra-African exports, equivalent to around $10 billion to $24 billion in pre-pandemic years. ICBT is a vital source of employment and livelihoods in border districts, particularly for low-income women. The micro and small enterprise traders that engage in ICBT rely on the ease of cross-border movement for their profits. They were, therefore, particularly vulnerable to the national and international movement restrictions that were imposed by African countries as they sought to control the spread of COVID-19. These measures, in April through to June, amounted on average to a complete ban on all movements and border closures across all African countries (Figure 7).

ICBT flows collapsed accordingly. Figure 8 shows estimates of informal exports from Uganda virtually disappearing at the start of the pandemic. These results are corroborated in a quantitative survey, by TradeMark East Africa, of 260 women traders across Burundi, DRC, Kenya, Tanzania, South Sudan and Uganda in April and July 2020. It found a near complete collapse of ICBT throughout East Africa in those months. Similar findings are expressed in data from Sauti, an organisation providing mobile market solutions to small and medium-sized enterprise traders in East Africa, which identified a regional decline in cross-border markets in the second quarter of 2020. Their data found female traders to have been hit hardest.

Border restrictions have reduced somewhat in the course of 2020 (Figure 7), and as mentioned above have been eased by ‘safe trade’ facilitative measures, yet remain more burdensome than pre-pandemic. Recent research from the World Bank has found ICBT to have continued to face increased average times at border crossings, a reduction in the number of small-scale traders crossing borders, and a shift to non-controlled crossing points alongside an increase in the cost of trading.

Where we go from here

The major determinants for African commodity exports depend not on what happens in Africa, but elsewhere in the global economy. Expectations of the global recovery will buoy or depress oil prices, likely on the back of how well major economies fend off second and third waves of the pandemic. The extent to which major infrastructural recovery programmes of countries like the US and China are implemented will affect African metal and ore prices.

African policymakers have more agency in shaping a recovery that shifts away from commodity dependency, towards more sustainable models of trade. This would include prioritising intra-African trade in both goods and services, and taking steps to formalise and foster informal cross-border trade. As noted above, intra-African trade continues to be more stable than exports outside the continent, despite considerable border challenges. A key opportunity here, of course, is the effective and timely implementation of the African Continental Free Trade Area. Another is securing vaccinations to support the recovery of travel and transport services. Doing this would help wrestle African trade policy away from merely tracking prices of oil or metals into a lever for delivering real development.

Photo by Tom Fisk from Pexels.