The inability of developing countries to secure adequate climate financing undermines global commitments to reduce carbon levels and prepare for climate change impacts. Can diaspora contributions to home country projects address this challenge? New research shows a willingness among diasporas to support crisis situations using ‘diaspora bonds’ under the right conditions.

In November 2021, world leaders reached an agreement in Glasgow to reduce global warming after a last-minute change to the text on phasing-out coal power plants. The deal represents a momentous point in the global effort to combat climate change. But for many, the initial reaction was one of disappointment. UN Secretary General Antonio Guterres called the agreement an important step that doesn’t go far enough. Crucially for developing countries, the agreement called for a doubling of funds to support the climate adjustment of developing countries to achieve net zero emissions by the mid-century. This is a significant step in the right direction, but the fear is that these financial commitments, like those made in Copenhagen in 2009 by developed nations, may not materialise. Some have therefore called for developing nations, which bear the biggest brunt of the impact of climate change, to explore alternative financial sources to swiftly implement climate change adaptation measures. The rationale is that adaption to climate change is an existential imperative that simply cannot wait.

One potential source of climate finance for the developing world could be through diaspora bonds – debt instruments issued by a country to raise finance from its overseas diaspora. While the diaspora are non-traditional providers of finance, in recent times they have demonstrated commitments to green projects and a history of support in times of crises. In 2011, Ethiopia successfully issued a diaspora bond – the ‘Renaissance Dam Bond’ – to fund the construction of the Grand Renaissance Dam that most Ethiopians viewed as a critical asset for Ethiopian’s sovereignty, economic security and, most importantly, clean energy.

Within this context, there is potential for diaspora bonds tied to climate finance to contribute to climate change adaptation. Numerous polls show that a growing number of people view climate change as an urgent crisis and want their governments to take decisive measures. Developing countries must re-imagine the role of diasporas as a surplus group who can invest in bonds issued by their countries of origin to fill the climate finance gap. Such bonds could enable the diaspora to make impactful investments while supporting critical mitigation measures including sea defence systems, resilient infrastructures to withstand rising sea-levels and new sources of renewable energy. It could also help shift the focus away from treating the diaspora as ‘gift givers’ to patriotic investors that support a credible global course.

Public attitudes towards diaspora bonds

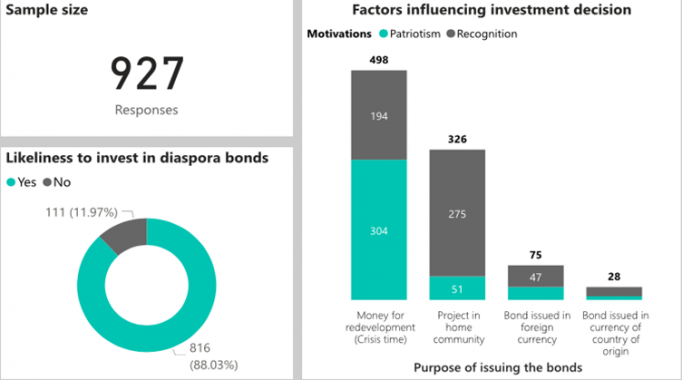

To gauge the feasibility of diaspora bonds tied to climate change mitigation, we conducted a survey to gain insights into factors that motivate migrants to invest in diaspora bonds. Using electronic platforms, as shown in figure 1, we surveyed 927 African migrants from developing economies living in Europe to assess the potential interest in such bonds and how they could be designed. The survey revealed important evidence relating to the economic status of migrants, the connection with their country of origin and a willingness to support during crises, including climate-induced crises such as flooding, water shortages and pandemics.

Figure 1 reveals the results of likely factors influencing the performance of diaspora bonds for our sample. In particular, our analysis of responses shows an 88% likeliness to invest in diaspora bonds when they support a critical national course. Indeed, the findings show that the diaspora is sensitive to the purpose for which the bond is issued, and the majority of the responses are receptive to diaspora bonds that are issued in support of redevelopment during and after crises. This could include addressing shocks related to flooding and other climate-related natural disasters. Given that global warming is viewed as a major crisis the world over, a bond issued in support of climate enhancing projects is suggested as significantly appealing to the diaspora.

We also find that the success or failure of the bond depends on whether the proceeds are to be used for a community project. In other words, there is a moderately higher likelihood that the diaspora will invest in bonds to support a green project at the community level. From figure 1, in the context of social status, we see that the recognition of one’s support plays an important role in the diaspora deciding to invest in diaspora bonds. As shown in figure 2, we found that for these groups of diasporas, bonds with a maturity period of one to three years and a coupon payment frequency of twelve months are most preferred.

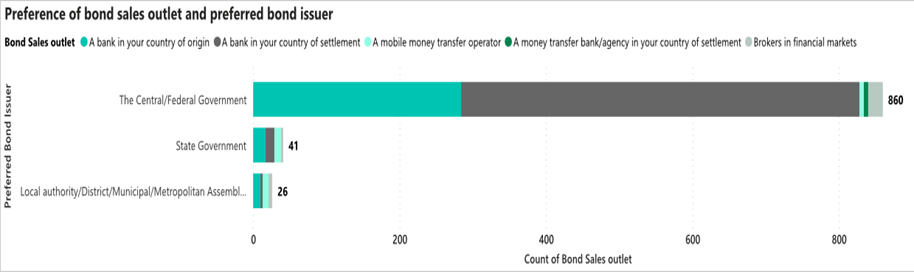

The results in figure 3 show there is a positive link between central government issuers and the success of the bond. This suggests that for sales to be high the bond should be issued by the central government. For sales outlets to sell the bond after issuing on the market, the diaspora preferred issuers to use banks in their countries of settlement as sales points.

To meet the challenges of climate change, finance for climate friendly projects is essential to achieving the COP26 2050 target. Given the poor track record on commitments made in 2009, it is important for policymakers in the developing world to explore innovative options for financing to help meet their commitments made at COP26. In this regard, diaspora bonds could go some way to motivate an underexplored option for filling the climate finance gap.

Photo by Anna Nekrashevich from Pexels.

A well timed and excellently executed piece of scholarly research. Quite insightful and to the point. Useful for academics and policy makers.

Very interesting findings from your survey. This scientific blog and the results on diaspora likeliness to invest in diaspora bonds is interesting to climate finance experts. The findings from your survey should be shared widely to central banks and governments across the sub-region.

This piece is very timely and findings revealing. Climate Change is a global issue that needs a hands-on-deck approach to address because of its dire consequences if we fold our arms or dilly-dally.

If promises made by developed economies to developing countries are not forthcoming, there is the need for the latter to look for other alternatives; and this paper did exactly provide one of the options available to them.