New trade deals for the UK will be an important part of the Brexit negotiations, not only with the EU but also with the rest of the world. But Steven Brakman, Harry Garretsen and Tristan Kohl argue that the UK has no trade-enhancing alternative to an agreement with the EU that essentially mimics its current situation as an EU member. A gravity model predicts that the negative impact of Brexit would be only marginally offset by a bilateral trade agreement with the US, and even in the case of trade agreements with all non-EU countries, the UK’s value-added exports would still fall by more than 6%.

New trade deals for the UK will be an important part of the Brexit negotiations, not only with the EU but also with the rest of the world. But Steven Brakman, Harry Garretsen and Tristan Kohl argue that the UK has no trade-enhancing alternative to an agreement with the EU that essentially mimics its current situation as an EU member. A gravity model predicts that the negative impact of Brexit would be only marginally offset by a bilateral trade agreement with the US, and even in the case of trade agreements with all non-EU countries, the UK’s value-added exports would still fall by more than 6%.

The principles of Brexit are outlined in the White Paper of 2 February 2017, which states that the UK aims to “forge a new strategic partnership with the EU, including a wide reaching, bold and ambitious free trade agreement…” and that “we will forge ambitious free trade relationships across the world”.

From an international trade perspective, the choice of the UK to leave the EU is remarkable. Leaving a large free trade area like the EU will most likely be trade- and welfare-reducing for the UK. Without a new trade agreement, relative trade barriers will change such that trade with the EU will become relatively more expensive, resulting in trade diversion away from the EU and trade creation with the non-EU world. The balance between these developments will most likely be trade- and welfare-reducing, as trade barriers between the UK and the EU – the largest trading block in the world – increase. This gloomy evaluation is corroborated by almost all trade analyses of Brexit. The estimates range between roughly a 1.5% reduction in GDP to more than 7%, depending on the assumptions made on how Brexit will take shape. Only ‘Economists for Brexit’ have produced a positive estimate, but this is a clear outlier in the available estimates (see David Miles 2016 for a survey).

The need to strike new trade deals for the UK seems obvious. This begs the question: what kind of trade deal? Does the UK really has a viable alternative to its current membership of the EU, like the ‘Global Britain’ strategy advocated by the May government? A few options come to mind when considering this issue, such as a US-UK trade partnership or a trade deal with all non-EU countries. On a more pessimistic note, one could not look at Brexit in isolation but also consider the consequences of the present anti-trade or anti-EU sentiments, such as a collapse of the EU following a possible ‘Frexit’, or even the most extreme anti-globalisation scenario, a total collapse of all trade agreements, and analyse how a Brexit scenario would play out if the overall international trade climate (further) worsens.

Predicting the consequences of these scenarios is of course difficult – because we do not know what future trade arrangements might look like – but based on past experience with trade agreements, one can approximate the size of the trade effects. In a new paper, we analyse a few of these options for the UK with the help of a gravity model. A gravity model explains bilateral trade flows by looking at the economic size of countries (GDP) and the trade barriers (distance, membership of a trade agreement) between countries. The logic of the model says that the larger the trading partners and the smaller the trade barriers, the larger the volume of trade. The calculations of alternative trade scenarios are relatively simple. First, one estimates the model for the world as it is, including all existing trade agreements. Alternative scenarios can then easily be implemented by turning a specific trade agreement on or off and recalculating the (hypothetical) trade flows. This gives a reasonable indication of the static trade effects, though underestimates the possible effects of a Brexit as we do not include long-term effects on innovation, productivity, or migration.

Brexit scenarios

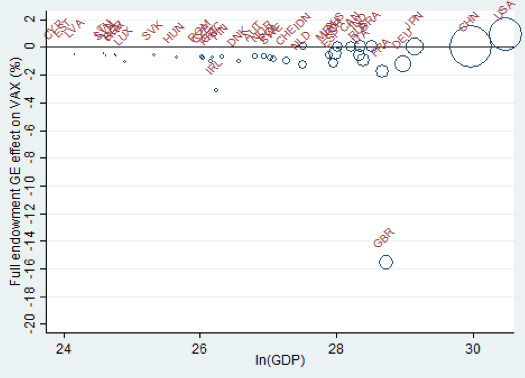

The benchmark for the alternative scenarios is Brexit itself. The trade effects on the global economy in the case of a hard Brexit – that is, the UK leaves the EU and all trade agreements that the EU has with the rest of the world – are depicted in Figure 1. On the horizontal axis, countries are ranked according to their GDP per capita, and on the vertical axis the percentage change in value-added exports (VAX). (We use ‘value-added exports’ (VAX) because changes in value-added trade are more directly linked to the income and welfare of the countries involved than gross exports; these data also include domestic (non-tradable) services that are used in the production of tradable goods.)

Figure 1 Hard Brexit: The UK terminates its EU membership and membership of all other EU-based trade agreements

Note: Bubbles are proportional to countries’ value-added exports in 2014.

As Figure 1 shows, a hard Brexit scenario has a strong negative impact on the value-added exports of the UK, decreasing these exports by almost 18%, mainly because trade with the (remainder of the) EU becomes more expensive. So what about the alternatives, such as a US-UK trade deal or a trade deal between the UK and the rest of the world? Figures 2 and 3 give the answer.

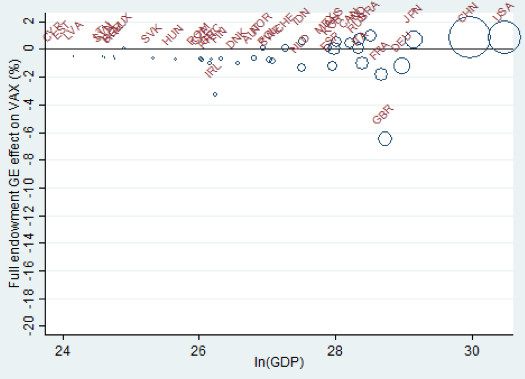

The main effect of the trade agreement between the UK and the US is that it increases the value-added exports for both countries by approximately 2%. For the UK, this implies that the negative impact of Brexit is only marginally offset by a bilateral trade agreement with the US (compare the -18% in Figure 1 with the -16% in Figure 2). Easier access to the US market compensates the trade loss of Brexit to some extent, but within the logic of the gravity model the US is further away and thereby less attractive and relevant as a trade partner.

Figure 2 Hard Brexit followed by a trade agreement between the UK and US

Note: Bubbles proportional to countries’ value-added exports in 2014.

What happens if the UK goes for a hard Brexit but at the same time manages to strike a trade agreement with all other countries outside the EU in our sample? As Figure 3 shows, this scenario would indeed provide a boost for the value-added exports of the UK and many other countries. For the UK, it is still the case that the impact of a combination of hard Brexit with a true Global Britain scenario is negative to the extent that its value-added exports fall by more than 6%. The main reason is distance – although the ‘rest of the world’ is large, it is also distant to the UK, not just in the sense of actual distance (compared to the EU) but also with respect to cultural, institutional, legal, and other differences that act as impediments to trade. The net effect of more access to the rest of the world and a hard Brexit is such that it is hard to see how Global Britain can be a viable alternative to or substitute for the UK’s current EU membership.

Figure 3 Hard Brexit followed by the UK joining trade agreements with all countries in the world except EU members

Note: Bubbles proportional to countries’ value-added exports in 2014.

Figures 2 and 3 still describe relatively optimistic scenarios, where it is possible to negotiate new trade deals. However, it is not impossible that the Brexit will be part of larger anti-EU wave that possibly results in the dissolution of the EU itself. Many current national elections offer voters the option to cast an anti-EU vote. In some EU countries, these parties are popular, increasing the likelihood of another exit. The trade effects of such an extreme situation are much more dramatic than those depicted in Figure 1; it is not only the UK that would experience a significant reduction of international trade, but all other countries as well (see our paper for these additional scenarios).

Conclusion

The UK government states that it is aiming to replace the UK’s membership of the EU by other, broad trade agreements. However, at this stage it is not clear what these new trade agreements will look like and which countries could be involved. What are the alternatives for the UK government? A US-UK trade deal? A more extreme worldwide trade deal? If the UK government aims to compensate for the large negative trade shock of Brexit, the options seem limited. Based on existing empirical evidence on trade agreements, our conclusion is simple. If the UK wants to limit the negative trade effects of Brexit, the UK has no trade-enhancing alternative to an agreement with the EU that essentially mimics the situation in which the UK is a member of the EU.

This post represents the views of the authors and not those of the Brexit blog, nor the LSE. It first appeared at VOX, CEPR’s policy portal.

Steven Brakman is Professor of International Economics at the University of Groningen.

Harry Garretsen is Professor of International Economics and Business at the University of Groningen.

Tristan Kohl is Assistant Professor of Global Economics and Management at the University of Groningen.

Making assumptions on trade deal that still under discussion and not negotiated yet

These analyses all seem to rely on the gravity model of trade. Can we have an article explaining why this model is appropriately applied to a services-based economy with a uniquely global pattern of cultural connections, please?

It is rather counter-intuitive to me, at least, that (assuming trading conditions are equal) it would be easier for Britain to sell services to France than the US, despite the former being so close you can see it.

I can see how the gravity model might be plausible for countries whose historic international relations has mostly been with their neighbours and whose economy focuses on goods. And I’m not saying that the model necessarily wouldn’t be applicable to Britain. As I said, I’d like further information.

But, honestly, when applied to Brexit, and to a layman, this gravity model just sounds like the economic version of Sarah Palin’s “I can see Russia from my house!”