“It’s nice for people to talk about two degrees….but we don’t even have the commitments that are going to keep us below four degrees of warming”. Bill Gates, in The Economist.

Even the most optimistic predictions of the outcome of the Conference of Parties in Paris (COP21) still agree that historical emissions have ‘locked in’ 1.5C of global mean temperature change. Many expect that the 2C limits agreed at the Copenhagen Accord will inevitably be exceeded in the long run, irrespective of what happens at the COP21.

In short, we are going to have to adapt to climate change, whatever it brings. Businesses around the world are going to have to think hard about defensive expenditures (e.g. flood defences), location decisions, adjustments to asset portfolios, precautionary saving, and even what future opportunities look like in a warmer world. These decisions will be made in the face of great uncertainty about precisely how different the future climate will be.

In ‘Better Predictions, Better Allocations’ we show that better information about what the future climate holds in store, in particular knowing the likelihood of catastrophic outcomes, offers huge benefits to society by facilitating better decision making. This means that efforts to refine the climate science and provide better information to those making adaptation decisions remain extremely valuable. Not only might better information guide negotiations on climate change mitigation, but it would also leave society in a better position to prepare for a warmer and more uncertain future. Not just businesses, but also governments, international organisations, and individuals all need to be prepared and coordinate responses. Better information is the key to preparedness and coordination.

A limited view of the businesses affected by climate change would focus on the climate sensitive sectors such as agriculture, fisheries and forestry. But businesses in coastal areas around the world, manufacturing in tropical countries and areas prone to climate disasters need to be properly informed about the likelihood of future states of a warmer world. Due to their global coverage, even fund management will benefit from better predictions. Yet, a major problem in facing up to climate change is that we don’t know how likely catastrophic temperature change is, with more frequent and powerful natural disasters, rising sea levels, as well as social phenomena such as conflict, relative to a future world which is only moderately warmer than today. How greatly would we benefit from knowing these likelihoods with greater precision?

In our article, this problem is presented as follows. Imagine there are two possible states of uncertainty about a future world, a ‘good’ state and a ‘bad’ state. In the bad state of the world catastrophic climate change is much more likely than moderate climate change, compared to the good state where there is only an outside chance of a catastrophic outcome. The problem facing businesses and other decision-makers is that they are uncertain about which future state of the world to expect.

Suppose the best information from climate scientists at the moment is that the good state and the bad state are equally likely, like flipping a coin and shouting “heads” for a good state, and “tails” for a bad state. Would climate-vulnerable businesses benefit from knowing that the likelihood of a bad state of the world is only 1 in 6 rather than 1 in 2, and hence much less likely? Like rolling a dice and getting a six for example. How about the opposite finding, that there is a 1 in 6 chance of a good state and the bad state is now very likely?

The findings of this simple thought experiment are revealing to say the least. Overall, anyone, any business, or any society that already has tendencies to put money aside in preparation for bad events in the future, a characteristic known as prudence in economics, would benefit from knowing more about the likelihood of good and bad states of the future world. The benefits of this information are even higher if entities can invest in adaptation measures, in addition to saving for the future. This benefits result is true whether it turns out that the bad state of the world is more or less likely. The important thing is that we try and find out more and refrain from putting our heads in the sand.

That’s all very well in theory, but where are such improvements in available information possible? There are two broad categories: improvements in the science and predictions, and improvements in the delivery of information.

In terms of the science, improvements are possible in estimating the likely sensitivity of climate to increasing CO2 concentrations, in defining the likelihood of catastrophic outcomes and predicting CO2 emissions trajectories, for instance. Improvements in each case will tell us more about the likelihood of extreme or moderate climate change. Of course, adaptation at the micro level requires more refined predictions, and here too better predictions are possible as we learn more about the spatial effects of climatic change.

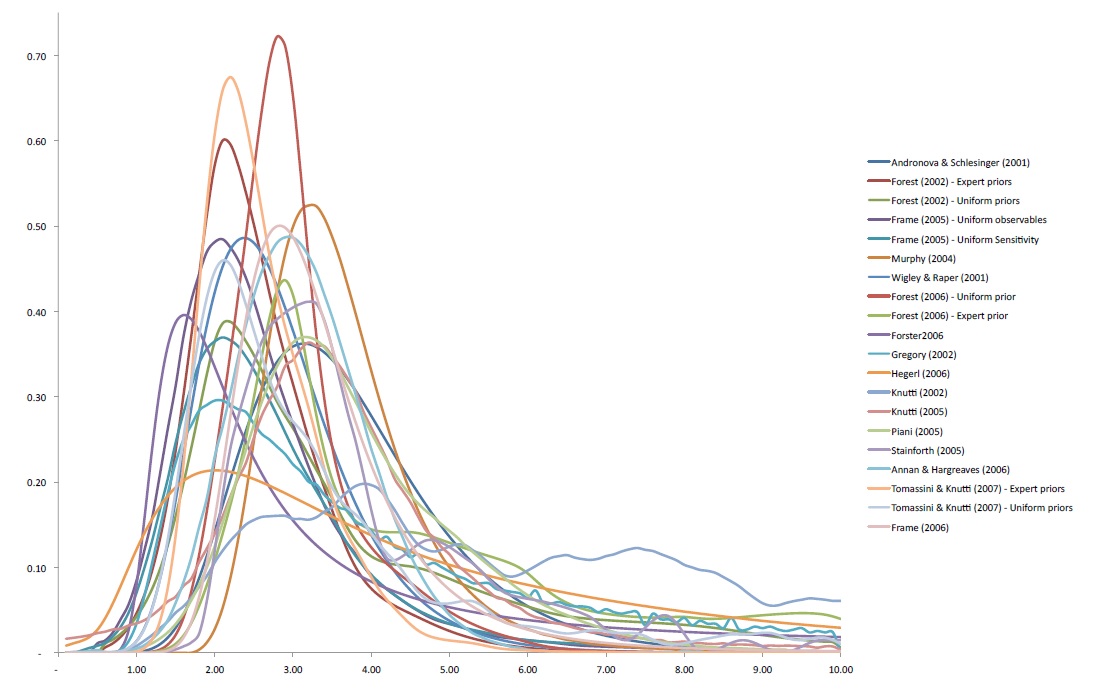

To say these advances in information are possible is not to say they are likely, however. Estimates of climate sensitivity have not become more precise for over 30 years now (See figure 1). Yet better delivery to decision-makers of the most up-to-date information, information that we already have, on the likelihood of good or bad states of the world would also have a beneficial effect. Flood probability maps in the Netherlands, localised weather forecasts and climate predictions, and clearer information on global trends, are all good examples of how better information can help preparedness and adaptation. Huge benefits are already being realised from better information about the El Nino/La Nina phenomenon, for instance.

Figure 1- Estimates of Climate Sensitivity Probability Densities over the Years.

Millner A, Dietz S, Heal G (2013) Scientific ambiguity and climate policy. Environmental and Resource Economics, 55, pp 21-46

So, the message is, whether you are a government, a farmer, a business or a fund manager, better predictions can lead to better outcomes when it comes to preparedness for a warmer world. We should neither put our heads in the sand nor keep people in the dark about what we already know. We should continue to find out more and deliver the best information to those making the inevitable decisions on how to adapt to climate change. Climate scientists should carry on their good work, and let us know all about it.

Watch the video of the Philosophical Transactions of the Royal Society A about their special issue Responding and adapting to climate change: uncertainty as knowledge.

♣♣♣

Notes:

- This article is based on the authors’ paper Better predictions, better allocations: scientific advances and adaptation to climate change in the 12 October 2015 special issue of Philosophical Transactions of the Royal Society A 2015 373 20150122; DOI: 10.1098/rsta.2015.0122.

- This post gives the views of its authors, not the position of LSE Business Review or the London School of Economics.

- Featured image credit: Thames flood defences, low-tide Jack Torcello CC-BY-SA-2.0

Mark Freeman is Professor of Finance at Loughborough University, the Academic Leader for the University research challenge of “Secure & Resilient Societies”, and Co-Director of the Centre for Post-Crisis Finance. Mark’s research focusses on long-term problems in capital budgeting and financial market investment. His work has been published in well recognised journals in the field. M.C.Freeman@lboro.ac.uk

Mark Freeman is Professor of Finance at Loughborough University, the Academic Leader for the University research challenge of “Secure & Resilient Societies”, and Co-Director of the Centre for Post-Crisis Finance. Mark’s research focusses on long-term problems in capital budgeting and financial market investment. His work has been published in well recognised journals in the field. M.C.Freeman@lboro.ac.uk

Ben Groom is an Associate Professor of Environment and Development Economics at LSE and Director of the MSc in Environmental Economics and Climate Change and the PhD in Environmental Economics. Ben has served as a consultant for numerous international organisations, including the World Bank, the Asian Development Bank, the Organisation for Economic Cooperation and Development and the World Wide Fund for Nature (WWF). He has also advised government in the USA, UK, The Netherlands, Norway, China and Pakistan on various aspects of environmental and economic policy. b.groom@lse.ac.uk

Ben Groom is an Associate Professor of Environment and Development Economics at LSE and Director of the MSc in Environmental Economics and Climate Change and the PhD in Environmental Economics. Ben has served as a consultant for numerous international organisations, including the World Bank, the Asian Development Bank, the Organisation for Economic Cooperation and Development and the World Wide Fund for Nature (WWF). He has also advised government in the USA, UK, The Netherlands, Norway, China and Pakistan on various aspects of environmental and economic policy. b.groom@lse.ac.uk

Richard Zeckhauser is the Frank P. Ramsey Professor of Political Economy at Harvard University’s Kennedy School of Government. He is an elected fellow of the Econometric Society, the Institute of Medicine (National Academy of Sciences), and the American Academy of Arts and Sciences. In 2014, he was named a Distinguished Fellow of the American Economic Association. His contributions to decision theory and behavioral economics include the concepts of quality-adjusted life years (QALYs), status quo bias, betrayal aversion, and ignorance (states of the world unknown) as a complement to the categories of risk and uncertainty. His recent coauthored books are The Patron’s Payoff: Conspicuous Commissions in Italian Renaissance Art (2008), and Collaborative Governance: Private Roles for Public Goals (2011). Apart from academics, Zeckhauser is a Senior Principal at Equity Resource Investments, a real estate private equity firm. Richard_Zeckhauser@hks.harvard.edu

Richard Zeckhauser is the Frank P. Ramsey Professor of Political Economy at Harvard University’s Kennedy School of Government. He is an elected fellow of the Econometric Society, the Institute of Medicine (National Academy of Sciences), and the American Academy of Arts and Sciences. In 2014, he was named a Distinguished Fellow of the American Economic Association. His contributions to decision theory and behavioral economics include the concepts of quality-adjusted life years (QALYs), status quo bias, betrayal aversion, and ignorance (states of the world unknown) as a complement to the categories of risk and uncertainty. His recent coauthored books are The Patron’s Payoff: Conspicuous Commissions in Italian Renaissance Art (2008), and Collaborative Governance: Private Roles for Public Goals (2011). Apart from academics, Zeckhauser is a Senior Principal at Equity Resource Investments, a real estate private equity firm. Richard_Zeckhauser@hks.harvard.edu