© Copyright Martyn Pattison and licensed for reuse under this Creative Commons Licence

© Copyright Martyn Pattison and licensed for reuse under this Creative Commons Licence

| The LSE Growth Commission was launched on 2 November 2016, with the public panel What Next for Growth in the UK?. Speakers: Vince Cable, Alistair Darling, George Osborne and Stephanie Flanders. Check out a video recording of the event below. |

In the intervening years, some of the Commission’s recommendations, notably on infrastructure, were turned into concrete action by UK policymakers. Under David Cameron’s premiership, the coalition government had its “Plan for Growth”, and the Conservative government its “Productivity Plan.”

While these set out many of the issues facing the UK economy, and contained numerous individually sensible policies (some new, and some pre-existing) – a common view was that they did not go far enough. Of course, government resources were constrained during this period due to austerity and associated restrictions on borrowing to finance productive investment. Underlying weaknesses in the UK economy remain, and an overarching and long term growth strategy for the UK is still lacking.

Following the Brexit vote and ensuing change in government, the UK faces new questions about its economic future including its relationship with the EU and the rest of the world, the role of industrial policy, and new developments in labour markets.

The LSE Growth Commission is being re-formed, again with a group of high-profile commissioners chaired by LSE professors Tim Besley, Steve Machin and Lord Nicholas Stern. They will draw on evidence given in public session by business leaders, academics, policymakers and stakeholders; and will be supported by a team of researchers at LSE’s Centre for Economic Performance. The Commission will publish its report in January 2017.

A snapshot of the UK economy

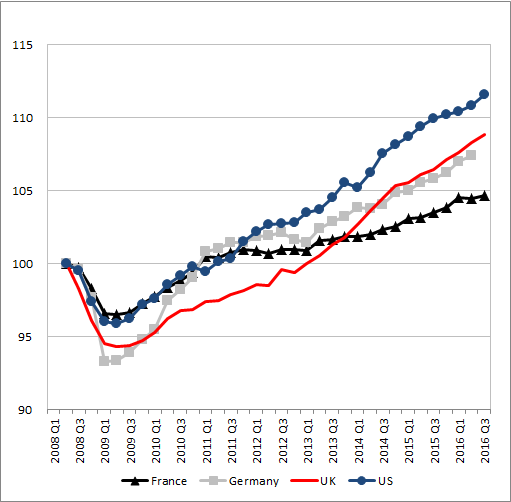

Like other G7 economies, the UK was hit hard by the 2008 financial crisis. Since then, growth has been subdued across the rich world. Relative to its main comparators, however, UK GDP growth has been strong (Figure 1).

Figure 1: GDP (2008 Q2=100)

Notes: Time series of chained volume, seasonally adjusted GDP from national accounts, normalised so 2008 Q2=100. Sources: France: INSEE, Germany: Statistisches Bundesamt, UK: ONS, US: FRED.

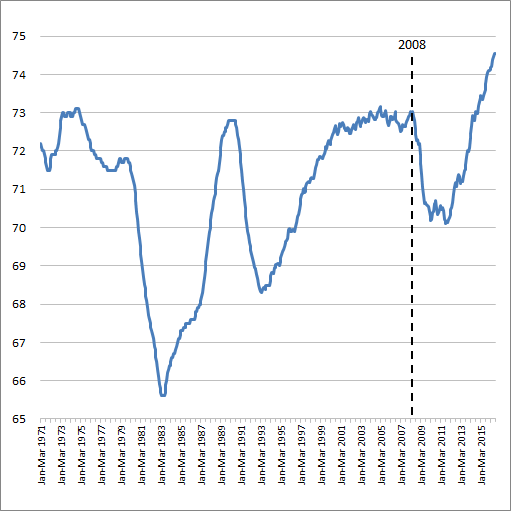

The principal driver of UK GDP growth has been employment. As Figure 2 shows, the employment rate has held up, remaining above 70 per cent since 2008, and is now at 74.5 per cent, an all-time high since comparable records began in 1971.

Figure 2: UK employment rate (%)

Notes: Employment rate. Source ONS, UK Labour Market: October 2016, Statistical Bulletin, Figure 2. UK Employment rates (aged 16 to 64), seasonally adjusted.

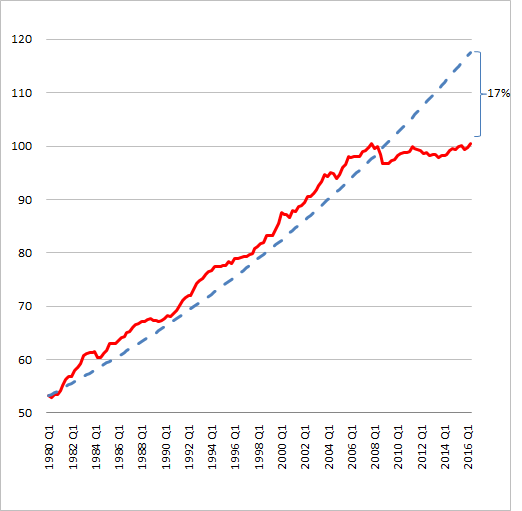

However, sustainable growth in GDP requires growth in productivity, and our performance in this respect has been poor. Growth in output per hour has lagged other countries since the financial crisis and now stands at 17 per cent below its long-run trend (Figure 3).

Figure 3: Output per hour (2008 Q2=100)

Notes: Whole Economy GDP per hour worked, seasonally adjusted. ONS Statistical bulletin, Labour Productivity, Q2 2016, release date 6 October 2016. (Q2 2008=100). Note: predicted value after Q2 2008 is the dashed line calculated assuming a historical average growth rate of 2.2%.

This poor performance has been labelled the “Productivity Puzzle” because economists have been unable to fully account for it. Some have argued that the fall represents a permanent “Secular Stagnation”, others that it is temporary, relating to the cycle – it is likely that a combination of factors is at work. While the puzzle is to some extent international, on the whole our main peers have fared better and therefore the longstanding gap in productivity levels has become ever wider: UK GDP per hour is now 30 percentage points below the US.

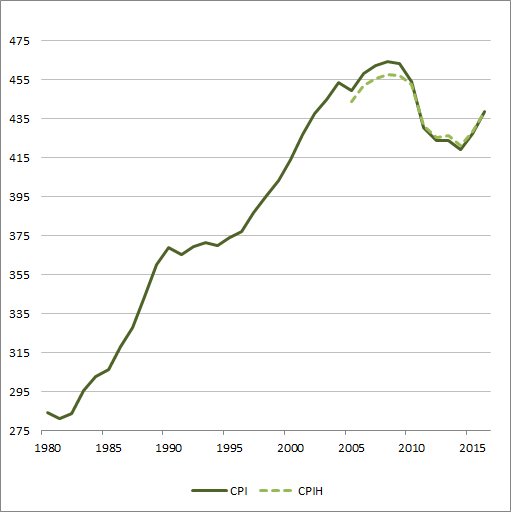

Over the long run, there tends to be a relationship between productivity and pay. Reflecting this poor productivity performance, wage growth has also been weak, with the median worker pay 4-5 per cent lower than its pre-crisis peak (Figure 4). This corresponds to almost a 20 per cent drop relative to the trend in real wage growth from 1980 to the early 2000s.

Figure 4: Median worker pay

Notes: Median real weekly earnings, 2015 prices. Source: Annual Survey of Hours and Earnings (ASHE) weekly earnings numbers, deflated by CPI and CPIH (from 2005).

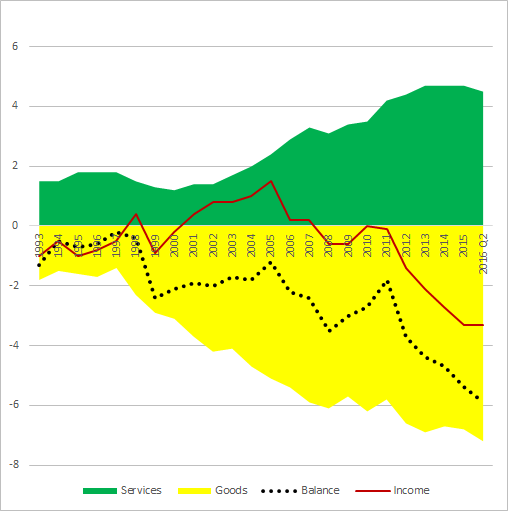

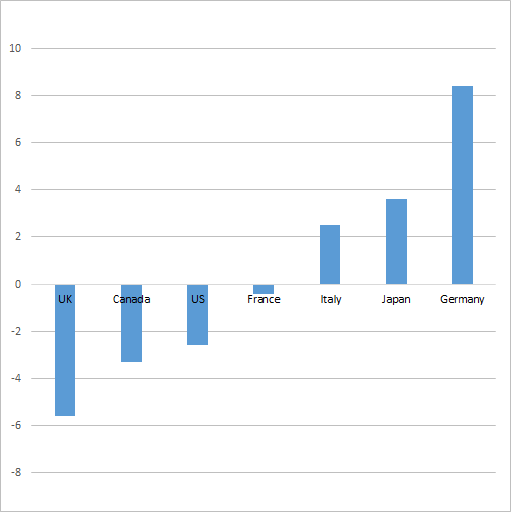

Alongside these worries about productivity and pay, there are three other key concerns. First, The UK balance of payments looks odd from a historical perspective, with a very large current account deficit compared to the past (Figure 5) and other G7 economies (Figure 6).

Figure 5: UK current account (% GDP)

Notes: Balance of Payments data from the ONS, release date: 30th September 2016.

Figure 6: Current account (% GDP, latest)

Notes: Source: The Economist

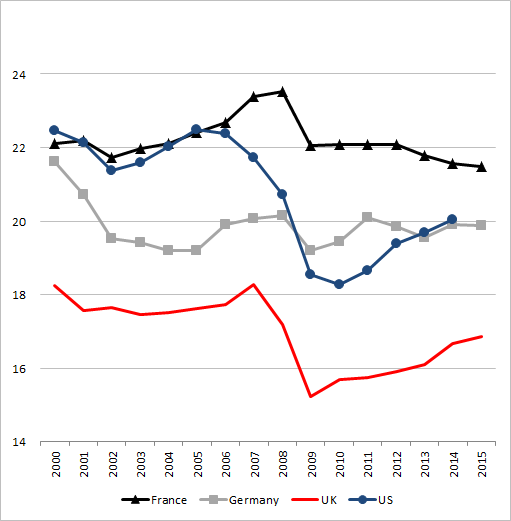

Second, Investment is weak in the UK. Gross fixed capital formation as a share of GDP has been consistently lower in the UK than its main peers (Figure 7). The same is true for investment in R&D: both privately and publicly funded.

Figure 7: Investment % of GDP

Notes: : Gross Fixed Capital Formation, percentage of GDP, series in constant prices, national base year. Source: OECD Dataset: GDP, extracted on 24 October 2016

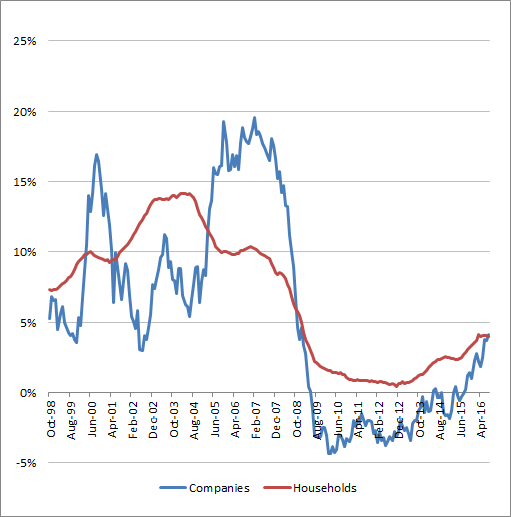

Finally, there are worries that the supply of finance to the real economy is still impaired following the financial crisis: lending to business has been slower to recover than lending to households (Figure 8). SME finance has been a particular concern, prompting a number of government initiatives including the establishment of the British Business Bank.

Figure 8: Growth in lending

Notes: Year on year growth rates based on break adjusted series LPMBC57 (PNFC) and LPMBC44 (households), from Sectoral Analysis of M4 Lending. Source: Bank of England…

What next for growth in the UK?

The referendum on the UK’s membership of the EU should be seen in light of these challenges. Brexit is likely to impact on a number of pre-existing weak spots in the UK economy. Analysis from the LSE has shown that under different Brexit scenarios, trade and foreign direct investment (both of which contribute to productivity growth) are likely to suffer. Given the skill shortages already faced by many firms in the UK, restricting the movement of labour from the EU is likely to have a negative impact on productivity – both directly through firms finding it harder to fill vacancies, but also indirectly through the impact on innovation if our innovative firms, universities and research labs are less able to attract and retain international talent. Moreover, the Brexit vote has highlighted the impact of inequality in income and opportunity on communities, and how policy makers should place more prominence on the distribution of growth, in addition to growth itself.

The Commission has therefore decided to focus its 2017 report on key questions in the following four areas:

- Openness. What is the best relationship for the UK to pursue with the EU to ensure the flow of exports, imports and FDI? And beyond Brexit, what are the implications for trading with other countries, for example China?

- Finance and the City. To what extent is the UK’s financial system set up to promote growth? How will the City be impacted by Brexit? What policies are needed to ensure stable and safe credit supply?

- Industrial policy. What type of industrial strategy should the UK pursue? Can lessons be learned from other countries?

- Labour markets. Has the UK’s employment success come at the expense of low pay? Is there a way to ensure pay continues to rise so that growth is both sustainable and inclusive?

The Commission will draw on evidence given in public evidence sessions by business leaders, academics, policymakers and stakeholders in the UK economy.

Watch the LSE Growth Commission Public Panel discussion here:

♣♣♣

Notes:

- Contributions are welcomed from the public—please write to lsegrowth@lse.ac.uk.

- The post gives the views of the author, not the position of LSE Business Review or the London School of Economics.

- Before commenting, please read our Comment Policy.

Anna Valero is an Economics PhD candidate at the LSE, a Research Economist at the Centre for Economic Performance and a member of the LSE Growth Commission Secretariat. Her work is focused on firm organisation and workforce skills, and their effects on productivity and innovation. More generally, Anna is interested in understanding UK economic performance, the drivers of growth and implications for policy. Before resuming her studies, Anna was at Deloitte for a number of years where she was a Manager in the Economic Consulting practice and qualified as a Chartered Accountant.

Anna Valero is an Economics PhD candidate at the LSE, a Research Economist at the Centre for Economic Performance and a member of the LSE Growth Commission Secretariat. Her work is focused on firm organisation and workforce skills, and their effects on productivity and innovation. More generally, Anna is interested in understanding UK economic performance, the drivers of growth and implications for policy. Before resuming her studies, Anna was at Deloitte for a number of years where she was a Manager in the Economic Consulting practice and qualified as a Chartered Accountant.

Brilliant news… but hopefully this time the LSE Commission will especially address the imperatives of inclusive growth? The UK needs more than yet more London growth.