The remarkable recovery in the Irish economy since 2013 has surprised many observers. Having been particularly affected by the international financial crisis of 2007/08, Irish economic activity has grown significantly since 2013, outpacing the rest of the euro area.

The emergence of the “Celtic Tiger” in the mid-1990s had been driven by an increasing reliance on trade. However, a property-related credit bubble saw the construction sector, both residential and commercial, assume a disproportionate influence on domestic economic activity by 2007. In our analysis, we critically appraise the performance of the Irish economy over the period 2008 to 2014, using a DSGE model — a variant of FIR-GEM, which is a small open economy DSGE model for fiscal policy analysis in Ireland (see Varthalitis, 2019). Using a tradable and non-tradable sector, we examine whether the reason for the Irish recovery was due to a rebalancing of the economy, post 2008, away from the disproportionate influence of the construction (non-tradable) sector and back to the more productive tradable sector.

Our results suggest that the financial crisis acted as a rebalancing mechanism for the Irish economy, with the tradable sector contracting less and recovering quicker than the non-tradable sector.

Convergence through trade openness

Irish real cumulative GDP growth summed to 128 per cent from 1988 to 2007 implying an annual average growth of 6.4 per cent. External trade played a significant role in this remarkable performance.

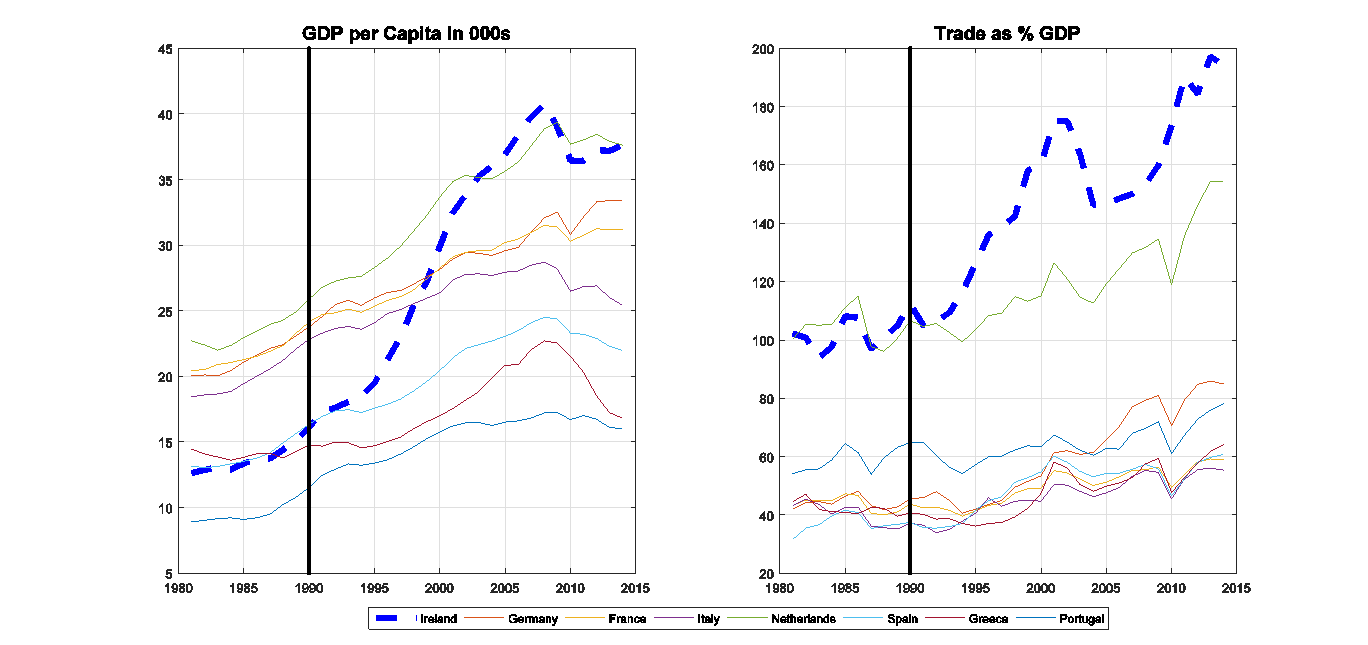

As can be seen in Figure 1, trade as a share of GDP in Ireland had already been among the highest in the European Union since the late 1980s and early 1990s. However, from the early 1990s onwards, external trade accelerated, sharply rendering Ireland one of the most open-to-trade economies in the world. (Much of Ireland’s trade is in electronics, pharmaceuticals, other chemicals and medical instrumentation – see Barry and Bergin (2012) for more details.) In 2001, international trade was 1.7 times Irish GDP, while the analogous figures in EU countries were below 0.8, except for The Netherlands. As an indicator of trade openness, we employ the sum of imports and exports as a share of GDP, which is widely used see e.g. OECD (2011).

Figure 1. Trade openness and GDP per capita of the Irish economy since the 1990s

Source: Eurostat; Notes: Trade is defined as the sum of exports and imports.

The Irish property bubble: 2004 – 2007

The emergence of the “Celtic Tiger” in the mid-1990s resulted in a significant increase in Irish living standards, with real incomes growing considerably. Real Irish house prices grew by nearly nine per cent per annum between 1995 and 2007.

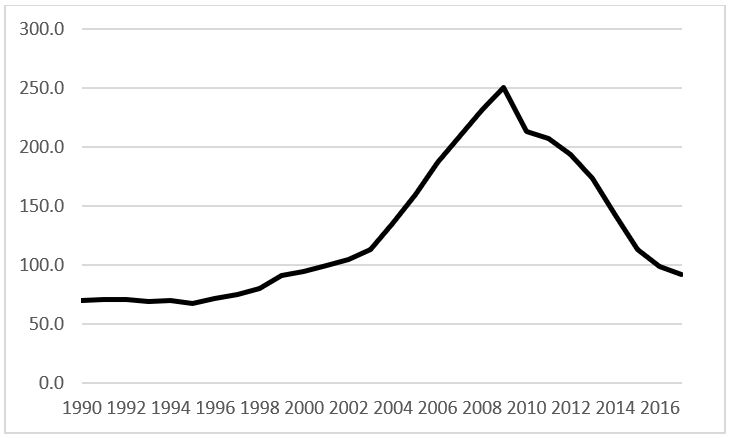

While the initial phase of increased activity in the housing market (1995 – 2003) is typically attributed to developments in underlying fundamentals, the period 2004 – 2007 is characterised by the emergence of a credit-based property bubble (see McCarthy and McQuinn, 2017). The increased ability of Irish financial institutions to borrow from credit institutions abroad, coupled with the easing of credit conditions in the domestic market, saw a significant increase in mortgage and construction credit issued. The dramatic increase in credit vis-à-vis GDP in the Irish economy can be observed from Figure 2.

Figure 2. Credit to gross national income (per cent): 1990 – 2017

Source: CSO and Central Bank of Ireland; Notes: Own calculations.

As a result, with the emergence of a toxic negative feedback loop between the sovereign and the Irish banking sector, formalised by the Irish government guaranteeing the liabilities and assets of the banking sector in September 2008, the economy experienced one of the sharpest contractions among euro area countries. Unemployment went from over four per cent to 14.5 per cent in just three years, while Irish output fell by eight per cent between 2007 and 2009.

Explaining the recovery

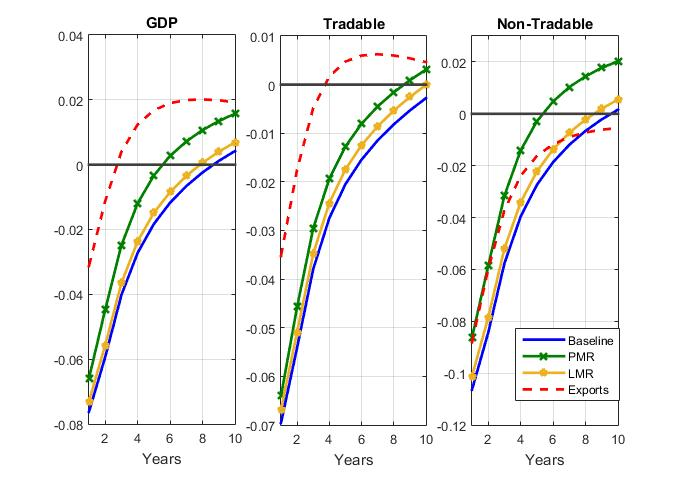

Using a DSGE framework, we attempt to explain the performance of the Irish economy post 2008 using a number of scenarios. Figure 3 presents the simulated implied paths of total and sectoral outputs in the tradable and non-tradable sectors for the Irish economy under these scenarios. The blue solid lines represent the results of a purely fiscal-based baseline scenario, the red dashed lines show the results of an export-based recovery scenario and the green cross and yellow square lines reflect the impacts of structural reforms in product and labour market, respectively.

Figure 3. GDP and sectoral output

Notes: Variables are percentage deviations from their steady state value

Comparing across alternative scenarios, we observe that, in the export-driven recovery scenario, the GDP recession is smaller on impact and the recovery is faster in the aftermath of the crisis. On the other hand, the simulated response functions under the structural reforms in product markets or in labour markets suggest that these reforms are most unlikely to reflect the significant recovery observed in the Irish data. Comparison between product/labour market reforms scenarios with the baseline scenario implies that such reforms could not have substantially mitigated the recessionary effects of the exogenous shocks which impacted the Irish economy.

This is more striking in the short run (over the first three years after the negative shocks) where structural reforms scenarios implied response functions do not deviate substantially from the baseline scenario. Thus, a key message from our model-based simulations is that only the export-driven recovery scenario can mimic the significant recovery in total output.

Final comments

Our simulations indicate that the international, financial downturn of 2007/08 prompted a significant rebalancing within the Irish economy; capital and labour resources, which had been attracted to the bubble driven returns of the construction sector between 2001 and 2007, were subsequently redeployed towards the more productive export sector.

♣♣♣

Notes:

- This blog post is based on the authors’ chapter that is forthcoming in N. Campos, P. De Grauwe and Y. Ji (eds.), Structural Reforms and Economic Growth in Europe, Cambridge University Press.

- This blog post gives the views of its author(s), not the position of LSE Business Review or the London School of Economics.

- Featured image by Eric Jones, under a CC-BY-SA-2.0 licence

- Before commenting, please read our Comment Policy

Kieran McQuinn is a research professor at the Economic and Social Research Institute who works on the quarterly economic commentary (QEC) and housing related projects. His research interests include house prices, economic growth and household finance. Dr McQuinn spent over 11 years working in the Irish Central Bank and before that he worked as an economist with Teagasc, the Irish agriculture and food development authority. He is adjunct professor of economics at both Trinity College Dublin and University College Cork. Dr McQuinn is also a current council member of both the Economic and Social Studies and the Economic and Social Research Institute.

Kieran McQuinn is a research professor at the Economic and Social Research Institute who works on the quarterly economic commentary (QEC) and housing related projects. His research interests include house prices, economic growth and household finance. Dr McQuinn spent over 11 years working in the Irish Central Bank and before that he worked as an economist with Teagasc, the Irish agriculture and food development authority. He is adjunct professor of economics at both Trinity College Dublin and University College Cork. Dr McQuinn is also a current council member of both the Economic and Social Studies and the Economic and Social Research Institute.

Petros Varthalitis is a research officer in macroeconomics at the Economic and Social Research Institute, and adjunct assistant professor at the department of economics at Trinity College Dublin. He works on the macro-modelling at ESRI. His main academic research focus on theoretical and applied macroeconomics. He has published papers on fiscal and monetary policy in DSGE models (open and closed economy), fiscal and currency unions, public and tax reforms and debt consolidation policies in international academic journals.

Petros Varthalitis is a research officer in macroeconomics at the Economic and Social Research Institute, and adjunct assistant professor at the department of economics at Trinity College Dublin. He works on the macro-modelling at ESRI. His main academic research focus on theoretical and applied macroeconomics. He has published papers on fiscal and monetary policy in DSGE models (open and closed economy), fiscal and currency unions, public and tax reforms and debt consolidation policies in international academic journals.