Efforts to tame the COVID19-pandemic continue across the world but slowly and surely some countries have started to plan for a gradual end to the lockdowns imposed to stop the spread of the pandemic. And even though there is great relief at the glimpse of a path to normality, it is tempered by anxiety about what the economic landscape will look like in the weeks, months and years to come. There is no doubt now that the coronavirus crisis has turned into an economic and financial crisis. The question is thus; how long will the decline last and will it stumble into a depression?

Some economists, at least initially, embraced the idea of a “V-shaped” recovery: a sharp contraction in the short-term followed by a quick recovery. Similarly, the UK’s Office for Budget Responsibility forecasts (“reference scenario”) a decline in GDP by 12.8 per cent in 2020 with an expansion of 17.9 per cent in 2021, but those predictions were considered to be too optimistic given the assumptions used. Even more optimistic, in my view, are projections by the IMF, which forecasts a contraction of the UK economy of 6.5 per cent in 2020, followed by an expansion of four per cent in 2021.But, as looks more likely, many developed economies will be falling into a sharp recession, which will be dangerously close to turning into depression.

In this blog, I would like to illustrate a few points, which might explain why we need to be prepared for a worst-case scenario. First, let’s discuss if the lost output will be permanent or temporary. For instance, someone wanting to buy a new home in March had to delay the transaction, which could take place after the “stay at home” rules are lifted. In this case, the sale is not permanently lost, and will show up in the next quarter’s GDP number. But, if someone used to eat out once every week, during a one-month lockdown, the four dinners out are permanently lost, unless the person goes out eight times next month.

The services sector is the most important and accounts for 79 percent of UK’s GDP, with the biggest segments being government, education and health (19 per cent of GDP); real estate (12 per cent); professional, scientific and technical activities and administrative and support services (12 per cent); wholesale and retail trade (11 per cent); and financial and insurance (eight per cent). This suggests that the direct effect of lockdown is substantial on the UK’s economy (even without any model, roughly around 20 per cent of GDP) and, given the general equilibrium effects (“domino” effects), much of the economic fallout will be enormous and will comprise a substantial number of permanent losses, not temporary ones.

Second, another important question is whether UK growth will return to trend or settle on a new path that is below its the pre-pandemic trend. Productivity growth was very low in the UK pre-virus, even compared with its European counterparts. It is also important to note that average growth over the last three years was about 1.5 per cent, so any decline in trend growth would be from an already low base. And, this is where great uncertainty lies ahead, as the result will be driven by policy as well as by psychology.

On the policy side, in situations like this, the standard response is for the central banks to cut rates, which has been implemented by major central banks around the world and has been praised widely as a timely policy response. However, this view is not shared by everyone. Mohamed El-Erian, chief economic adviser at Allianz, says that the US Federal Reserve should have focused on payment system problems and liquidity first but should not have cut rates. The idea is that once the Fed (along with the European Central Bank or the Bank of England), reduces interest rates to zero as it did, it is incapable of cutting rates further, a policy buffer much needed down a long road lying ahead. The Bank of England cut interest to 0.1 per cent on 19 March 2020.

Furthermore, as nominal interest rates went to zero, the question is now whether they will go down below zero. Some central banks had experience with negative nominal interest rates in the aftermath of the 2008 financial crisis. In fact, the ECB’s deposit rate has been already at -0.5 per cent since September 2019. The logic was that with negative interest rates, people and businesses would not hoard money and would spend it so demand would be revived and the economy along with it. Unfortunately, this logic does not work – especially in the current situation we are faced with. If consumers get used to not spending and decide that increased savings and debt reduction are the best ways to prepare for the next pandemic or even to the next wave of the COVID-19, they will start saving even more. The same might happen with banks , which might respond by reducing credit rather than making it.

And this is related to a broader point that psychology and behavioural aspects will play an even more important role in the economic fallout of the pandemic than in the aftermath the 2008-09 financial crisis. As supply shock is turning into a demand shock, we could see a dramatic decline in the velocity of money (its turnover), and growth will be weaker despite huge amounts of newly printed money. That is why policymakers need to be very cautious with immediate actions to re-start economic activity and consequently with who they will bail out and how.

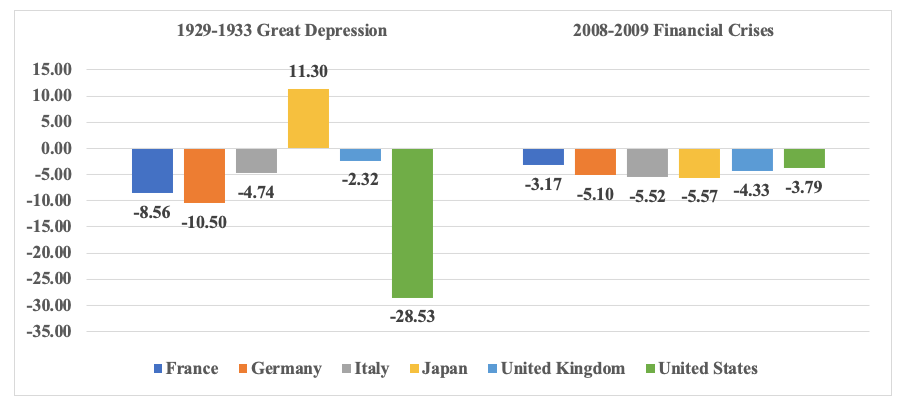

Figure 1. Peak to trough decline in GDP during major recessions

Source: Òscar Jordà, Moritz Schularick, and Alan M. Taylor. 2017. “Macrofinancial History and the New Business Cycle Facts.” in NBER Macroeconomics Annual 2016, volume 31, edited by Martin Eichenbaum and Jonathan A. Parker. Chicago: University of Chicago Press.

♣♣♣

Notes:

- This blog post was originally published by King’s College London on April 17, 2020.

- The author acknowledges the work of Florian Bartsch, third year PPE student at DPE, King’s College London, who provided valuable research assistance.

- The post expresses the views of its author(s), not the position of LSE Business Review or the London School of Economics.

- Featured image by jarmoluk, under a Pixabay licence

- When you leave a comment, you’re agreeing to our Comment Policy

Karlygash Kuralbayeva is a lecturer in economics at King’s College department of political economy. Previously she was a teaching fellow at LSE, a research officer at LSE’s Grantham Research Institute, and a research fellow at the University of Oxford. Her research interests include macroeconomics, development, climate change economics and environmental economics. Karlygash holds a PhD in economics from the University of Oxford.

Karlygash Kuralbayeva is a lecturer in economics at King’s College department of political economy. Previously she was a teaching fellow at LSE, a research officer at LSE’s Grantham Research Institute, and a research fellow at the University of Oxford. Her research interests include macroeconomics, development, climate change economics and environmental economics. Karlygash holds a PhD in economics from the University of Oxford.

Good God. The virus is bad enough. Psychology is adding insult to injury (actually adding pseudo-science to an already scientifically compromised world response).