“History doesn’t repeat itself, but it often rhymes.” This quote is attributed to Mark Twain who, born in 1835, lived through the turn of the 20th century: an era of great transformation. Likewise, the turn of our decade promises to be an era of great change, most notably due to the way the coronavirus epidemic will reshape our economies and societies. And yet, if we follow Twain, some of the rhyming patterns that took place in the past are still possibly of guidance when trying to predict the way the future will evolve. Economics in this should be no exception.

At the time of writing, we are observing the world economy coming to a screeching halt. The fact that the shock is unprecedented in size, homogeneous in principle, and exogenous has led many governments to resort to their Keynesian playbook, using all their fiscal and monetary firepower to offset the downturn. When the storm is over, we can expect the damage to be large: public debt levels will be very high, potential growth will be lower, and people will be poorer. In particular, the recovery in some countries will prove shallower than in others. When this happens, we can expect economists to brush up their standard toolkit to boost growth. In perfect rhyme with what happened in the aftermath of past crises, from the Eurozone to emerging markets, we can be sure that calls for “more structural reforms” will be part of the package.

When looking at several decades worth of literature on structural reforms, a seeming paradox emerges: while the model-based literature is relatively unanimous in finding a positive impact of structural reforms, the empirical evidence is much more nuanced or even controversial. This begs the question: do structural reforms really boost growth?

In a recent study, we explore this paradox in detail and come to the conclusion that the question itself is ill-posed. To draw a medical comparison, apt for these times of epidemics, looking empirically for the unconditional average impact of a specific type of reform is like wondering what the impact of Aspirin is. The answer will obviously crucially depend on what group is being tested. If it is among people with a fever, it is likely to be positive on average. If it is among people with stomach ulcers, it is likely to be negative. If it is among a random group of the population, it is probably close to neutral or insignificant. Every country faces a different combination of problems and constraints, and as such the key lies in conducting a good diagnostics exercise.

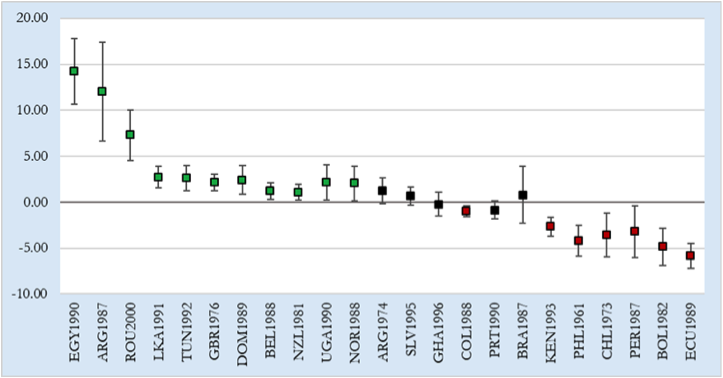

We argue this by showcasing the wide disparity in the growth impact of comparably wide-reaching structural reform packages that took place through time and geographies. While it might be true that a majority of cases display a positive and significant effect, there are also several instances of no- or even negative impact. In the Philippines in the 60s, Chile in the 70s, Ecuador, Bolivia, Colombia and Peru in the 80s, and Kenya in the 90s, large economic reforms failed to deliver their strong economic dividend (Figure 1). Within our setting, this could be due either to a wrong selection of reforms, or poor implementation.

Figure 1. Country-specific average impact of reform packages on GDP growth over the 10 years after reform implementation

Note: This figure displays the average yearly growth rate differential between ‘reform episode’ and ‘synthetic control’ over the period t0 and t+10. Brackets display 95% confidence intervals based on robust standard errors. Green implies positive and statistically significant impact of reform wave, red negative and statistically significant, black statistically insignificant. Source: own calculations based on Marrazzo and Terzi (2017)

Running a different type of analysis, based on Peruzzi and Terzi (2018), we show how out of 135 large growth acceleration episodes that took place between 1962 and 2002 worldwide, almost half (45%) were preceded by at least one sharp structural reform. If we zoom in on Europe only, actually 100% of growth accelerations (or nine out of nine) were preceded by a structural reform shock. These include Portugal in the 1960s, Cyprus in the 70s, the United Kingdom, Portugal and Ireland in the 80s, Poland, Albania, Finland, and Bulgaria in the 90s. However, when turning the question around, and exploring how many times large reforms led to a growth acceleration, nine out of ten times, a sustained change in growth trajectory failed to materialise.

Drawing a conclusion, and going back to a medical parallel, saying ‘countries with low growth potential need structural reforms’ is like saying ‘sick people need treatment’. The key is the diagnostics of the problem and the design of the solution. If chosen well, treatment can be beneficial and lead to healing. If chosen poorly, it can fail to heal or even worsen the condition. Perhaps unsurprisingly, countries displaying growth problems tend to be very different from one another. To quote Lev Tolstoy’s Anna Karenina, “Happy families are all alike; every unhappy family is unhappy in its own way”.

Authors’ note: This article expresses the views of the authors, not necessarily those of the institutions to which they are affiliated.

♣♣♣

Notes:

- This blog post is based on a book chapter in Economic Growth and Structural Reforms in Europe, edited by , , and .

- The post expresses the views of its author(s), not the position of LSE Business Review or the London School of Economics.

- Featured image by Free-Photos, under a Pixabay licence

- When you leave a comment, you’re agreeing to our Comment Policy

Alessio Terzi works on economic policy strategy at the European Commission. Prior to this, he was a Fulbright visiting fellow at the Harvard Kennedy School of Government and an affiliate fellow at Bruegel. He also has work experience at the European Central Bank and BMI Research (Fitch Ratings). His academic research revolves around issues of economic growth. Alessio holds a PhD in political economy from the Hertie School.

Alessio Terzi works on economic policy strategy at the European Commission. Prior to this, he was a Fulbright visiting fellow at the Harvard Kennedy School of Government and an affiliate fellow at Bruegel. He also has work experience at the European Central Bank and BMI Research (Fitch Ratings). His academic research revolves around issues of economic growth. Alessio holds a PhD in political economy from the Hertie School.

Marco Marrazzo is an economist at the European Central Bank in the risk management directorate. Marco holds a Bachelor’s degree and a Master of Science in economics and finance from Bocconi University. During his studies, he spent a semester at EDHEC Business School and at Schulich School of Business. His academic research revolves around issues of financial econometrics and risk management. Marco has work experience at the Bank of Italy in the risk management department and at Innocenzo Gasparini Institute for Economic Research (IGIER) on financial econometrics research projects.

Marco Marrazzo is an economist at the European Central Bank in the risk management directorate. Marco holds a Bachelor’s degree and a Master of Science in economics and finance from Bocconi University. During his studies, he spent a semester at EDHEC Business School and at Schulich School of Business. His academic research revolves around issues of financial econometrics and risk management. Marco has work experience at the Bank of Italy in the risk management department and at Innocenzo Gasparini Institute for Economic Research (IGIER) on financial econometrics research projects.