The massive expansion of online services and mobile applications in recent years means that many of Europe’s traditional telecoms operators must reassess their business structures to remain viable. Jonathan Liebenau, Silvia Elaluf-Calderwood and Patrik Kärrberg look at the challenges now faced by telecoms operators in Europe, and argue for both operators and regulators to look further into new economic and pricing models based on emerging relationships with alternative content delivery networks.

The massive expansion of online services and mobile applications in recent years means that many of Europe’s traditional telecoms operators must reassess their business structures to remain viable. Jonathan Liebenau, Silvia Elaluf-Calderwood and Patrik Kärrberg look at the challenges now faced by telecoms operators in Europe, and argue for both operators and regulators to look further into new economic and pricing models based on emerging relationships with alternative content delivery networks.

In recent years, the European telecommunication sector’s business structure has experienced significant challenges, and the future viability of this structure is under threat. These challenges come from four directions: first, a significant shift in revenue sources (driven by the expansion of the Internet, especially mobile applications); second, the increase in EU and national service expectations (e.g. Digital Agenda for Europe 2020 and national broadband plans) which require significant investment that affect shareholders’ dividends; third, the major change in users and patterns of digital services and products; and fourth, the formation and evolution of interrelated digital platforms for services. Until now, the industry has addressed these areas separately, with the consequence of a high level of fragmentation between business strategies and approaches from political economy.

The sector now needs to deal with these challenges by assessing two areas: the strategic problems of the current business layout, and what the sector needs to define, provision and achieve to continue being competitive. The drive to shift from legacy copper connections to high capacity optical fibre creates challenges for investment returns and pricing policies that are highly controversial. Many European incumbent companies are facing this sort of upgrade expense for the first time since the privatisation and liberalisation moves from the EU that began in 1998. Until that time, infrastructure policy as well as investment was publicly led. Now, there is impetus for public policy initiatives to meet EU and national goals for widespread high bandwidth access, but the expectation is that the investment will be at least 90 per cent privately funded.

In the European context, the diversity of telecom providers’ ownership (ranging from wholly privately owned companies to semi-privatised firms) and the goals of service defined in the statutory formation of these companies (e.g. service to rural areas, quality of service requirements, universal service obligations, etc.), present a serious difficulty when coming to define policies based on the economics of the industry. These, in turn, have generated a variety of regulatory regimes that have diverging effects on different elements of the overall network. Some of these regimes have created regulatory options that preserve elements of self-regulation, some are intended to provide general guidelines for parts of the industry, and others are intended to correct for specific instances of market failure, as with certain price setting constraints. The risk associated with not providing a sustainable platform for the development of the future European telecommunications industry will not only mean in real terms the end of the current prevailing business model, but could seriously affect GDP growth and the labour market through job losses, as previous research has suggested. It will also affect European technology innovation cycles to which telecom operators contribute significantly with their research and development budgets.

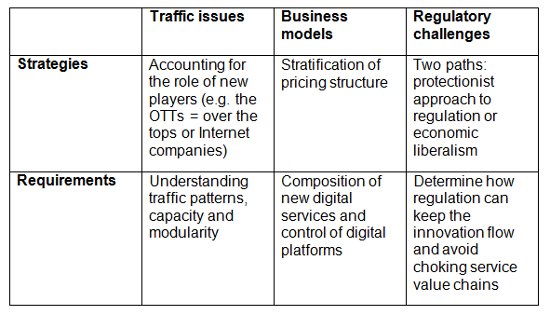

The complexity of the problem to be overcome by telecom operators is presented in Figure 1 below:

Figure 1: Digital infrastructure challenges to telecommunication companies

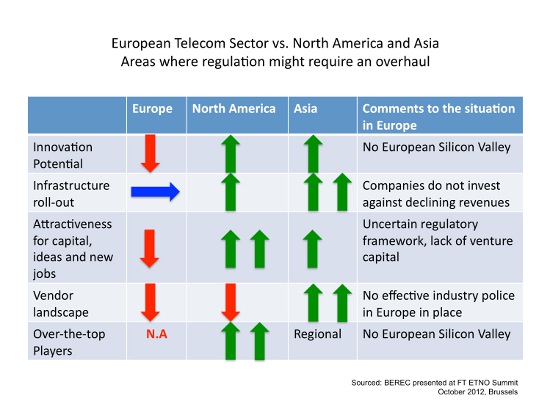

The three areas of research that may be able to provide some positive answers to this problem are traffic, business models and regulation. Europe is in a position of disadvantage in relation to the rest of the world in terms of innovation as we can see from Figure 2 below.

Figure 2 – European Telecom Sector situation in relation to the rest of the world

In the telecommunications sector, the study of traffic and its relationships with business models should help to develop an understanding of how the emerging agents and platforms can conduct effective business with the telecom operators in the provision of digital services. These agents are able to juggle in a very effective manner the strategies and requirements for the development of the digital provision of products and services.

The combination of traffic demand, business models and regulatory aspects influencing the European sector of telecommunications in the analysis can also provide models of possible new pricing structures and economic propositions. By focusing this analysis on type of traffic, we can move away from the “just pipe” approach to the provision of digital services that some telecom operators have adopted. This has required a revision of the traditional view of the telecom sector that focuses on market concentration, barriers to entry, interconnection pricing, availability and take-up of broadband access.

Content delivery networks (CDNs) are becoming increasingly important as alternative creators of business models, and they have an impact on the pricing structures of the physical infrastructure which supplies the bandwidth for the digital services they supply. Furthermore, as CDNs strengthen their business operations, they will be able to benefit from the missteps of the telecommunications operators. There are multiple issues with the current approaches of telecom operators to the migration of services to new digital infrastructures; this is tangible when carrying out an analysis of business practices. The next task is to define a new discourse for the discussion of the telecommunications agenda beyond regulation as a pivot for sustainability and innovation.

If in the past telecommunication operators could afford to ignore the rise of the Internet around them, this is no longer the case, and they need to react quickly to the transition to a more competitive digital market for products and services that overcomes their structural, contextual, governance and managerial or organisational status.

Note: A longer version of this article was presented at the Wharton Business School of Management Workshop “End of the Phone System” in May 2012, and has been accepted for publication at the Journal of Information Policy.

Readers may also be interested in the new LSE Network Economy Forum Blog; an European forum for dissemination and debate about telecommunications and internet policy research.

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of EUROPP – European Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: http://bit.ly/SoVWsE

_________________________________

Jonathan Liebenau – LSE Management Department

Jonathan Liebenau – LSE Management Department

Dr Jonathan Liebenau is a Reader in Technology Management, LSE. He Specializes in fundamental concepts of information, and the problems and prospects of ICT in economic development. Previously worked in academic administration, technology policy, and the economic history of science-based industry, all positions in which he has emphasised the use of information in organizations. He is the author or editor of a dozen books and over 70 other major publications. He has provided consultancy services to leading companies and strategic government agencies, including Dell, BT, IBM, Microsoft, TCS, Nortel, EDS, Lloyd Thompson, and in the UK Government, the Office of Science and Innovation, the Department of Trade and Industry and the Home Office.

–

Silvia Elaluf-Calderwood – LSE Management Department

Silvia Elaluf-Calderwood – LSE Management Department

Dr Silvia Elaluf-Calderwood is a Research Fellow at the LSE Department of Management. She holds wide experience in the telecommunications industry in the UK and the Netherlands, and has a technical and managerial background in the Internet and Telecoms business.

–

Patrik Kärrberg – LSE Management Department

Patrik Kärrberg – LSE Management Department

Dr Patrik Kärrberg is a Research Fellow and program director for the Network Economy Forum within the LSE Department of Management. His research focuses on telecom service delivery innovation and converging industries in Asia and Europe.