The Covid-19 crisis has led to a surge in donation and reward based crowdfunding campaigns aimed at supporting those affected by the pandemic. Drawing on evidence from France, Alix Moine and Daphnée Papiasse assess the extent to which crowdfunding can function as an alternative financial safety net in times of crisis.

The Covid-19 crisis has led to a surge in donation and reward based crowdfunding campaigns aimed at supporting those affected by the pandemic. Drawing on evidence from France, Alix Moine and Daphnée Papiasse assess the extent to which crowdfunding can function as an alternative financial safety net in times of crisis.

There has been an impressive upsurge in the number of Covid-19 donation and reward based crowdfunding campaigns launched by a variety of actors (including citizens, businesses, charities, foundations and trusts) across the European continent. In the current context, these crowdfunding campaigns aim to provide additional financial and non-financial support to healthcare professionals and vulnerable populations, as well as financial support to small businesses and individuals in financial distress.

In light of these developments, we set out to investigate unfolding patterns in crowdfunding activity across three major donation and reward based crowdfunding platforms in France: Leetchi, KissKissBankBank and Ulule. Our research covered a total of 245 donation and reward crowdfunding projects in the country from 21-22 April. While the rapidity of Covid-19 developments and daily (and even hourly) changes in donations, pledges, project launches and deadlines on crowdfunding activity inherently limit the scope and generalisability of our observations, we hope that our work may provide a preliminary working base for future research on crowdfunding patterns of activity across European crowdfunding markets in the wake of the pandemic.

Has there been an upsurge in crowdfunding activity in France during the Covid-19 pandemic?

As reported by crowdfunding platforms themselves, in the last two months, there has been an incredible upsurge in solidarity across France’s top three donation and reward-based crowdfunding platforms. By the end of March, Leetchi catalogued 10,000 campaigns, reaching a total of 6 million euros in the wake of the pandemic.

To give an order of comparison, following the fire of Notre Dame, France’s cherished national treasure, Leetchi observed that an unprecedented number of campaigns intended to provide funds for its restoration had been launched in a single night: 2,500 campaigns. The Covid-19 pandemic has thus generated almost four times as many crowdfunding campaigns, thereby suggesting a more pronounced and sustained contribution of the ‘crowd’ to a diverse range of Covid-19 related projects. A similar upward trend in crowdfunding activity was apparent on KissKissBankBank (KKBB) in terms of the total amount of funds collected and ‘donors’: as of 22 April, more than €1,087,000 had been collected thanks to 16,660 individuals. This represents 23% of total amounts collected in 2020.

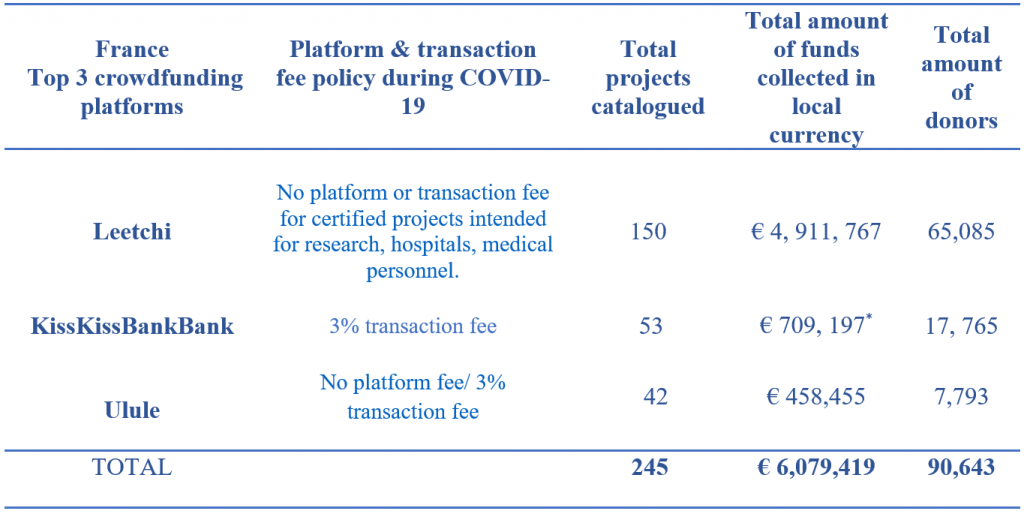

Table 1: Summary of data collected on the top three crowdfunding platforms in France

Note: Estimates based on authors’ own interpretations from data collected on 21-22 April 2020. While all crowdfunding campaigns publicly available on the Ulule and KissKissBankBank websites were catalogued to the best of the authors’ ability, data collection for Leetchi was limited to the first 150 published crowdfunding campaigns. All projects were catalogued using key search terms ‘coronavirus’ and ‘Covid-19’ on the websites of each crowdfunding platform. * Notwithstanding crowdfunding campaigns on KissKissBankBank that consist of pre-sales.

Our data broadly reflects this upsurge with more than 6 million euros collected across 245 crowdfunding campaigns on KKBB, Leetchi and Ulule (see the table above). Moreover, our data suggests that this upsurge appears to be genuinely altruistic: donation-based crowdfunding platforms (e.g. Leetchi) have generated enormous amounts of funds compared to mixed crowdfunding models (donation and reward based). This observation was equally corroborated on mixed crowdfunding platforms: donation campaigns generate more funds than reward campaigns, even when reward campaigns mimic donation campaigns (e.g. when the proposed reward consists of a simple thank you). On Ulule for example, we calculated on the basis of our data that a donation project attracted on average €92.50 per contributor versus €36.47 per contributor for a rewards-based project.

To view this upward trend through a ‘crowdfunding industry’ perspective, available data on total annual funds collected by (donation and reward based) crowdfunding in France in normal times show that France collected €81.5 million in funds in 2018. From a summary calculation of average monthly collected funds on crowdfunding platforms, we found that the total of Covid-19 projects catalogued in our research reached 100% of France’s normal monthly target of crowdfunding activity. Stated differently, Covid-19 projects represent the bulk of current crowdfunding activity. From our data, therefore, transpires a notable acceleration in crowdfunding activity (volumes transacted), which corresponds with the duration of the pandemic as well as the extensive impact of the pandemic on businesses, individuals, hospitals and other areas. If crowdfunding activity continues to accelerate at current rates in France, we may expect to see a record, albeit crisis-induced, increase in crowdfunding activity.

In spite of the limitations to our data collection, we found that platforms that have not waived their transaction fee, even on a conditional basis, have launched a smaller number of Covid-19 campaigns than platforms that have done so. Indeed, it is apparent that Leetchi has launched an unprecedented number of campaigns, a far greater amount than Ulule and KissKissBankBank combined. Potential explanations for the popularity of Leetchi may well go beyond its platform and transaction policy (e.g. previous ‘crisis-experience’ in relation to events such as Notre Dame, or its impressive outreach). Nonetheless, modifications in crowdfunding platform and transaction policies have been the first and most visible changes in crowdfunding policies since the beginning of the pandemic.

What kind of projects attract the most donations and donors?

The vast majority of funds from France’s top three crowdfunding platforms aim to provide a wide range of support to hospitals, emergency services and medical staff, from providing funds to finance the acquisition of ventilators, masks and other medical instruments, to providing cab services and food for all medical personnel, or the production of sterilised and re-usable masks. This pattern in crowdfunding activity broadly reflects current trends in French public opinion: according to a recent Odoxa-MNH survey for Le Figaro Santé and France Info, 90% of people surveyed consider the medical profession to be “competent, courageous, caring and passionate” and 80% believe that the medical profession is not being sufficiently rewarded and protected during the pandemic.

Nonetheless, there are variations in crowdfunding activity across platforms: donation and reward-based crowdfunding platforms differ with regards to the allocation of funds and popularity of project types. The question that we asked ourselves was thus the following: does the Covid-19 pandemic alter or reinforce platform specificities? Our data suggests that the effects of a pandemic on a crowdfunding platform’s core business model may inherently vary.

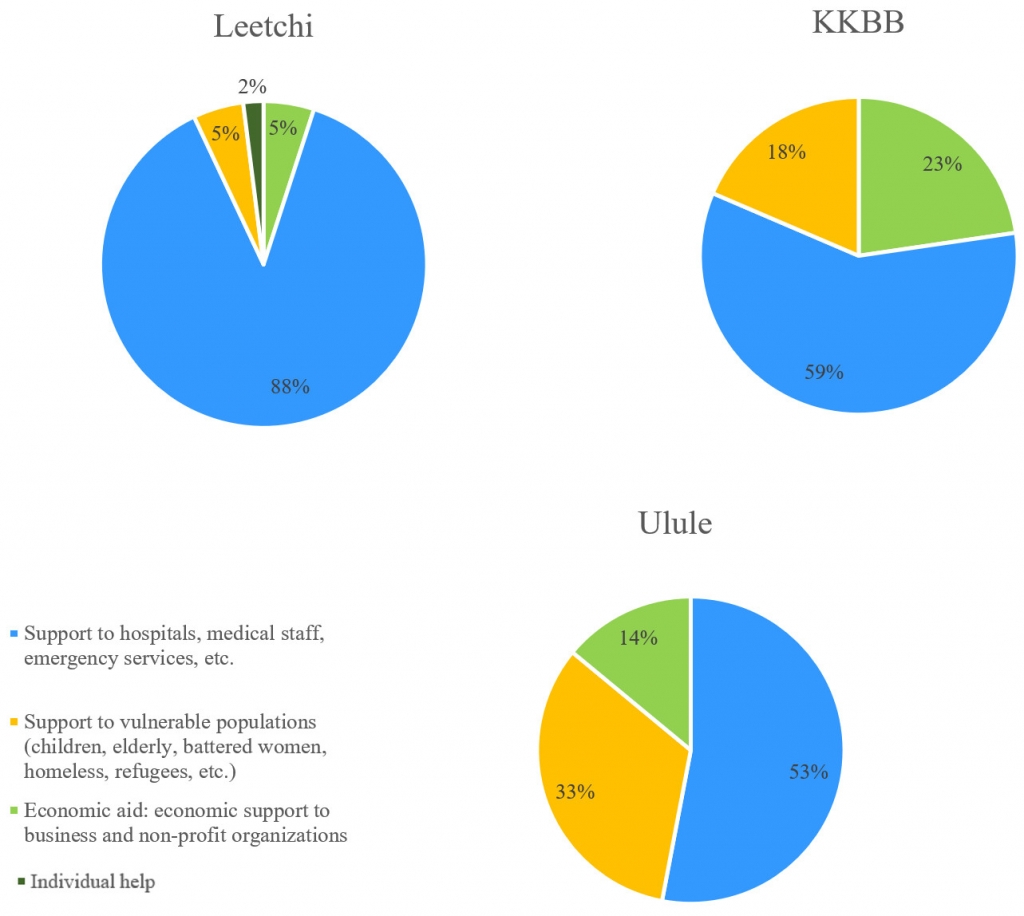

Figure 1: Allocation of funds on the top three crowdfunding platforms in France and the UK (estimates based on data collected)

Note: Compiled by the authors.

In the wake of the pandemic, Leetchi has seen a decisive turn towards solidarity projects which has effectively (but perhaps momentarily) reversed its historical focus on providing a platform for joint presents, holidays, and similar items and activities. This is reflected in our data: in relative terms, and for the time being, 88% of total funds collected on 150 Leetchi crowdfunding campaigns are intended to provide funds to hospitals, medical staff, and similar recipients, versus 10% of total collected funds allocated to support vulnerable populations (homeless, elderly, children, victims of domestic violence) and economic aid to small businesses and non-profit organisations. A grave observation must equally be related here: Leetchi has more recently attracted projects intended to provide families with financial support following the death of a loved one. It is sadly no longer uncommon to see individual calls to help to cover the costs of a funeral.

While KKBB and Ulule have equally experienced an upsurge in medical related crowdfunding projects, they nonetheless appear to enjoy a more balanced distribution of funds across the three main types of Covid-19 related projects. Two reasonable explanations of this phenomenon can be put forth. Firstly, it is entirely possible that there is a carry-over effect resulting from the exponential number of medical projects carried out on Leetchi. In other words, project launchers may be looking to initiate their projects on other platforms with a view to ensuring that their project is not ‘lost in the crowd.’ Secondly, and building on the previous point, KKBB and Ulule have been historically more diversified (the Ulule manifesto is a case in point as it pledges to “defend diversity”) and enable the creative and entrepreneurial participation of the project launcher in providing support to a cause.

Who organises the most crowdfunding projects?

With regards to the breakdown in project creator profiles (e.g. the question of who launches crowdfunding projects), our data suggests that companies are major drivers of crowdfunding activity: projects launched by companies raised 56% of total collected funds on France’s top three crowdfunding platforms and attracted 21% of total donors. While associations (NGOs, collectives of artists, and so on) have attracted 27% of total donors, they have raised only 14% of total collected funds, followed by hospitals with 10% of total collected funds and, finally, private citizens and schools respectively with 9% of total funds. This pattern is broadly reflected in the breakdown of KKBB and Leetchi project profiles, while Ulule crowdfunding activity was driven up to 53% by associations followed by companies at 36%.

Interestingly enough, at a more granular level, although companies are driving crowdfunding activity, the recipients of crowdfunding campaigns launched by companies are not typically companies themselves but hospitals and other medical facilities. On Leetchi for example, 99% of projects we catalogued that were launched by companies were destined to provide help to hospitals, thereby suggesting an active and supportive corporate mobilisation in favour of the French healthcare system. Finally, we would equally like to note the active and impressive mobilisation of football and other various sports club: from the football team of Toulouse to the rugby team UBB of Bordeaux, sports clubs have rapidly mobilised their supporters to donate funds to local or regional hospitals, in exchange for participation in a draw to win a signed football jersey.

Can crowdfunding function as an alternative financial safety net?

Although it is apparent that current circumstances have led to an upsurge in crowdfunding activity across France, it is too early to say whether crowdfunding can be collectively regarded as a form of credible (alternative) financial safety net. One thing is for sure, though, crowdfunding platforms across France appear to be proactive in accompanying emergency demands and ensuring that projects are successfully launched and completed.

In the global race for funds, governments are equally putting their seal of approval on crowdfunding platforms’ strategies to meet the demands generated by Covid-19. In France, a cautious attitude has been adopted, with several ministries and government departments issuing early warnings against the increased possibility of fraud on donation and reward based platforms. However, the French Ministry of Finance has recently contemplated enabling online lending platforms to benefit from the state guarantee for the loans they distribute.

However, the question remains as to whether crowdfunding platforms have the capacity to face such increased demands, additionally with reduced income as a result of decreased or waived platform and transaction fees. Furthermore, increased flexibility in platform conditions should not be a panacea in times of crisis: platforms need to balance the need for flexibility with security. Indeed, in the last few weeks, there have been increased risks of fraud on crowdfunding platforms which may ultimately hinder their capacity to deliver emergency funds.

Similarly, regulators and policymakers should equally be vigilant of instances where individuals and businesses launch fake crowdfunding campaigns with the express intention of profiteering from current emergency circumstances. In situations of emergency, instilling trust in financial and alternative finance markets is of even greater importance if we want to avoid further disruption and negative externalities. As such, notwithstanding proactive efforts by crowdfunding platforms themselves (e.g. Leetchi), ensuring some form of emergency regulatory oversight of donation and reward based crowdfunding activities in the current situation would not be entirely remiss.

While there may be evidently more pressing issues to analyse in the current circumstances, in an accelerating race to unlock emergency funds, making sense of Covid-19 crowdfunding dynamics may prove insightful for individual donors, crowdfunding platforms and policymakers alike. Indeed, notwithstanding citizens’ familiarity or knowledge of crowdfunding, the diversity of crowdfunding campaigns may be inherently difficult to navigate for individual and corporate donors. Ultimately, this may constitute a non-negligible obstacle to donation pledges at a time when funding needs are most urgent and uncertainty high.

Moreover, better knowledge of crowdfunding dynamics could enable crowdfunding platforms to better identify current funding needs and unlock flexible and secure options for crowdfunding participants and campaigners. At present, not all donation and reward based crowdfunding platforms across Europe have waived their platform fees and/or decreased their transaction fees, as well as provided flexible timeframes for the collection of funds.

While it is perfectly understandable that there are increasing pressures on crowdfunding platforms in the face of mounting demand, and that they are looking to maintain their own cash flow, donation and reward based crowdfunding platforms should nonetheless look to coordinate the crowdfunding industry’s efforts at providing facilitative conditions for Covid-19 campaigns with a view to ensuring a continuous, generous and secure flow of funding in the wake of the pandemic. Policymakers, in this respect, would equally do well to be mindful of current dynamics, as they help to better understand the extent of Covid-19 funding needs, collective anxieties, as well as behavioural responsiveness to the current crisis.

The pandemic has exerted incredible pressure on our healthcare systems; our analysis shows that the current upsurge in crowdfunding in France is bringing a response to this. For the past 3-4 weeks, our observations of crowdfunding activity across France and the UK have led us to recognise the extent to which the pandemic has brought to the surface new issues, problems and needs, as well as magnified old ones.

As exemplified by the increasing number of campaigns for families in mourning and notably campaigns to provide support for women suffering from domestic abuse, the story that emerges from crowdfunding activity in France may appear bleak. But it is equally one of hope and resolve: from students creating masks for hospitals with 3D printers, to campaigns intended to provide the customary lily of the valley on 1 May to hospital personnel. To turn a quote by Francis Bacon on its head, if hope is bad supper, it remains nonetheless a very good breakfast.

Please read our comments policy before commenting.

Note: This article gives the views of the authors, not the position of EUROPP – European Politics and Policy or the London School of Economics.

_________________________________

Alix Moine

Alix Moine

Alix Moine holds a Master’s Degree in Urban Planning & Development from the University Paris Nanterre and is currently a Junior Programmes Officer for a registered French Social Landlord.

Daphnée Papiasse

Daphnée Papiasse

Daphnée Papiasse is a PhD student in the LSE’s European Institute working on Fintech Regulation in the European Union. Her research interests range from alternative finance to European financial regulation and governance.