The European Central Bank has traditionally presented itself as pursuing a ‘consensual’ approach in which members of the Governing Council work together to reach decisions. Yet as Manuela Moschella explains, this does not mean the institution has been free from conflict behind closed doors. Drawing on a new study, she illustrates some of the key factors that drive disagreements within the ECB.

The European Central Bank has traditionally presented itself as pursuing a ‘consensual’ approach in which members of the Governing Council work together to reach decisions. Yet as Manuela Moschella explains, this does not mean the institution has been free from conflict behind closed doors. Drawing on a new study, she illustrates some of the key factors that drive disagreements within the ECB.

In March, while pledging to fight the economic consequences of the Covid-19 outbreak, ECB President Christine Lagarde emphasised that “there are no limits to our commitment to the euro”. Her comments paved the way for the ECB’s Pandemic Emergency Purchase Programme (PEPP), a temporary asset purchase programme totalling 1.35 trillion euros.

This brought to the surface a deep-seated disagreement in the ECB’s Governing Council. The Austrian central bank Governor questioned the effectiveness of the new ECB interventions, eliciting an official rebuff from Frankfurt. The German and Dutch representatives in the Governing Council displayed similar levels of scepticism.

The political skirmishes have brought back memories of the Eurozone sovereign debt crisis, notably then President Mario Draghi’s announcement in 2012 that the vote over the ECB’s Outright Monetary Transactions (OMT) programme had not been unanimous. Seven years later, the cracks were still there. As Draghi left his position in 2019, the heads of the Dutch and German national banks chastised the outgoing President over a new round of cheap money that the ECB had just adopted to respond to signs of economic weakness in the Eurozone.

Measuring disagreement in the ECB

In a recent study, we systematically examine the political conflicts, such as these, that play out in the ECB’s Governing Council. In particular, we provide a measure of disagreement among Eurozone monetary policymakers and assess the political and economic factors that drive disagreement.

There is an extensive literature exploring the political conflicts that play out in European institutions, like the European Parliament and the European Council. Yet no parallel attention has been devoted to the decision-making that takes place in the ECB. There are good reasons for this. For one, ECB policymakers are legally required to operate independently from any instructions coming from member states. More, importantly, political battles within the ECB are difficult to examine due to a lack of available data. ECB decision-making takes place behind closed doors and voting records and transcripts containing information on national policymakers’ preferences are not disclosed to the public. Since January 2015, the ECB has started publishing the accounts of its monetary policy meetings. However, the accounts do not contain information about the individual preferences of monetary policymakers.

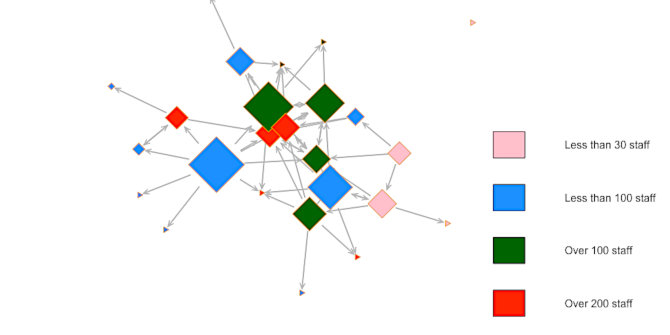

In our analysis, we deal with the lack of voting records by using information contained in public speeches. In particular, we measure disagreement based on the ‘semantic’ distance among the policy opinions publicly articulated by the ECB President and the Governors of the 19 national central banks (NCBs) whose currency is the euro. To achieve this goal, we proceeded in two steps.

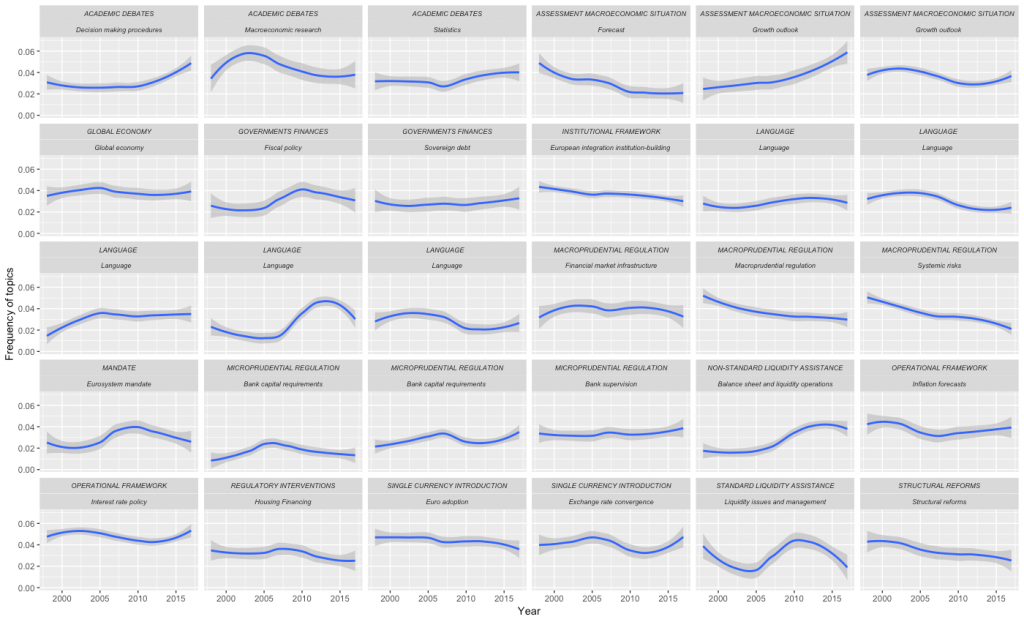

First, we applied automated text analysis on all publicly available speeches issued by the Presidents of the ECB and the Governors of the NCBs from 2001 to 2017. In doing so, we identified the main topics that ECB policymakers deal with in their public stances. As Figure 1 shows, in the period under investigation, ECB policymakers focused on topics related to the central bank’s legal mandate (including monetary policy and financial stability-related topics) as well as to issues related to the functioning of the monetary union (including issues related to member states’ macroeconomic and structural policies).

Figure 1: Topics in ECB policymakers’ public speeches, 2001-2017

Note: For more information, see the author’s accompanying paper in European Union Politics

Second, we developed an index of disagreement among members of the Governing Council. Specifically, we measured disagreement as the ‘semantic’ distance between the speeches delivered by the ECB Presidents and the Governors of the NCBs by topic, year and country. Disagreement increases as a function of the difference in the policy stance and of the salience assigned to each issue by the NCB with respect to the ECB.

What drives disagreement?

Our analysis assesses the drivers of disagreement. We tested whether national political and economic variables affect the stance of the national Governor vis-à-vis the ECB stance. In particular, we tested whether partisanship, public opinion, and economic and financial conditions increase the level of disagreement of the national Governors.

Our results suggest that political – more than economic – factors are a significant driver of disagreement among members of the ECB Governing Council. The distance of national central bankers from the positions articulated by the ECB President increases the more left-wing and anti-EU the orientations of the domestic governments are. Domestic public opinion does not significantly shape political battles in Frankfurt, instead. Eurozone monetary policymakers continue to be largely insulated from European citizens’ attitudes and demands.

The politics of the ECB

Since its creation, the ECB has traditionally presented itself as a ‘consensual’ institution by carefully minimising the display of disagreement among its members and asserting that only Euro-area economic conditions are considered in policy deliberations. Appearances are often deceptive, though. The ECB is a ‘political’ institution where important political battles play out.

Identifying the political conflicts that run through this institution is not only a matter of scholarly debate. The ECB has become increasingly key to the functioning and existence of the single currency, as ongoing monetary interventions to cope with the economic consequences of Covid-19 vividly attest. If we wish to understand how long the ECB can continue performing this critical role, the political battles among its policymakers are the place to look at.

For more information, see the author’s accompanying paper in European Union Politics (co-authored with Nicola M Diodati)

Please read our comments policy before commenting.

Note: This article gives the views of the author, not the position of EUROPP – European Politics and Policy or the London School of Economics.

_________________________________

Manuela Moschella – Scuola Normale Superiore

Manuela Moschella – Scuola Normale Superiore

Manuela Moschella is an Associate Professor of International Political Economy at the Scuola Normale Superiore.