What drives investments in EU states? Drawing on a new paper, Mariarosaria Comunale presents an analysis of investments in Lithuania, using a broad set of possible drivers, including EU funds and uncertainty.

Before the Covid-19 outbreak, business investments had almost returned to pre-crisis levels in the euro area, with some differences across countries. In Lithuania, investments were also expected to be buoyant, given the need for modernisation and automation, as well as improvements in the use of EU funds. Investment growth accelerated to an average of 7.7% in 2017-2019 (see Figure 1). The most important contribution to this came from business investment, while public investment had slightly more volatile growth rates and generally relied more on EU funds. Last year, more innovation-oriented investments gained momentum and they now represent 10% of total investments in the country.

Figure 1: year-on-year growth rates in investments

Source: Author’s calculations based on Eurostat and Bank of Lithuania data.

In a recent paper, I looked specifically at Lithuania’s investment performance for business, government, and other types of investments, including Information and Communication Technology (ICT) and Intellectual Property Products (IPP). The aim was to try to disentangle the possible drivers and effects of shocks. A deeper understanding of ICT and IPP investments and their main drivers can also help policy-makers decide what to target to increase these investments, thus contributing to their countries’ further development towards a more innovative and modern economy (Lithuania still ranks 40th in the Global Innovation Index as of 2020).

I made use of a common framework across categories, namely a Bayesian VAR model with data from the first quarter of 1997 to the fourth quarter of 2019, in order to draw meaningful comparisons. In the set of drivers, I included some specific ad hoc factors for Lithuania, such as the amount of EU funding received since joining the EU and a measure of macro-financial uncertainty provided by Yannis Largent and Arne Gieseck, which reflects both international and domestic uncertainty.

As other possible drivers, I included foreign demand, a broad index of Real Effective Exchange Rate (REER) to take into account price competitiveness, domestic private consumption, gross operating surplus (as a proxy for profits), credit impulse (based on loans to non-financial corporations) and real lending rates to non-financial corporations. I included two dummy variables: for 2009 as a shift due to the global financial crisis and co-financing, and a dummy for 2016 due to a new EU funds programme.

Business and public investments

The outcomes of the historical decompositions of total investments were mostly in line with the literature as I found key roles for demand side factors and uncertainty. I did see some crucial differences across types, however, as they are indeed quite heterogeneous in terms of incentives, decision making and financing sources.

Business investments are very much linked to the conditions of demand-side factors (either domestic or foreign) and uncertainty. I did not find very robust results for more supply-related factors. EU funds do feed investments over time, but I see a crowding-out following a shock in the short run (Figure 2). There is a specific accounting characteristic of EU funds which may affect our results: EU funds are accounted in a cash flow way (all together at once), while investments are more continuous and distributed over time; therefore, the periods over which they are accounted are different. At quarterly frequency, this issue can be significant. Secondly, the projects can be co-financed by Lithuanian receivers, for an amount which changes over time.

Figure 2: Impulse responses of business and government investments to a shock in EU funds

Note: The shock is one standard deviation. The confidence bands are at 68%.

EU funds are mainly directed toward government investments. I did find a positive reaction, albeit small, in relation to EU funding shocks. There is also a pro-cyclicality in government investments and a positive correlation with business investments. This “crowd in” process may take place through direct investments in the private domain and the direct encouragement of certain types of private investment that are more productive. In addition to this direct effect of EU funds on public investments, there is also an indirect effect via the Real Effective Exchange Rates. An increase in EU funds makes the country richer via a boost in demand, then increasing inflation and ultimately pushing the Real Effective Exchange Rate up. Therefore, both government investments and competitiveness seem to have a degree of synchronisation with the business cycle.

Innovative investments vs traditional categories

There are some major differences between innovative categories. ICT equipment is more linked to traditional types of investments as it is a sub-category of machinery. IPPs include rather intangible assets (computer software, databases, and entertainment, literary and artistic originals) and a general category of research and development and green economy projects.

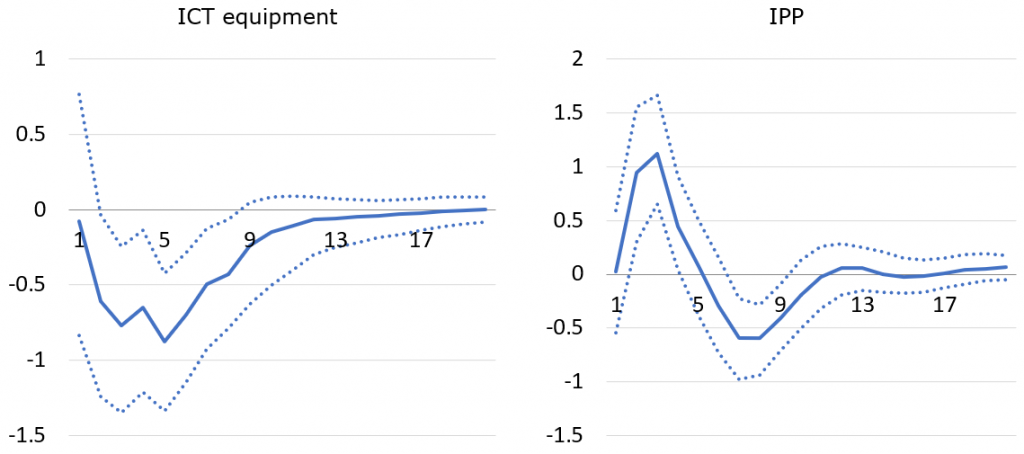

Uncertainty shocks seem to matter positively only for IPPs, suggesting more risk-prone types of investments (Figure 3). When uncertainty is higher, investors can be driven to safer assets and/or to more cutting-edge investments. In Lithuania, it seems rather the latter, with IPP investments benefitting from an increase in macro-financial uncertainty.

Figure 3: Impulse responses of innovative investments to a shock in uncertainty

Note: The shock is one standard deviation. The confidence bands are at 68%.

EU funds contribute positively to both types; however, for ICT, the effect is very small and seen in the medium run, while IPPs show a larger and more significant positive response in the short to medium-run – up to a year and a half (Figure 4). This is also in line with the rationale of the recovery plan, for example, which aims for a quick positive impact. In addition, the IPP investments may benefit even more from a positive shock in EU funds, as there are several programmes for direct funding, in the form of grants or contracts.

Figure 4: Impulse responses of innovative investments to a shock in EU funds

Note: The shock is one standard deviation. The confidence bands are at 68%.

Ultimately, as for more traditional categories, uncertainty and demand factors – alongside profits – are the most important drivers. As for roads, bridges and infrastructures (government-related construction investments), EU funding is definitely an important positive driver. This type of construction, as well as dwellings and transportation, is linked to EU cohesion funding. For instance, there is an ongoing major EU-funded project, Rail Baltica, connecting the Baltics with the European rail network.

Note: This article gives the views of the author, not the official views of the Bank of Lithuania, the ECB, the Eurosystem, EUROPP – European Politics and Policy or the London School of Economics. Featured image: Bank of Lithuania headquarters / Credit: Pofka (CC BY-SA 4.0)