By David Arnold (LSE)

By David Arnold (LSE)

The attraction of foreign firms through foreign direct investment has a positive impact on innovative activities of UK regions, writes David Arnold. This effect is particularly pronounced in regions that engage in high levels of research and development. The current approach to Brexit, however, is stirring fears that the UK will become a less attractive destination for investment, leading to the foregoing of these innovation benefits.

There has been much debate over the economic impacts of leaving the European Union (EU) on the UK economy. One of the key topics featured within this debate surrounds the prospects of foreign direct investment (FDI). Estimates predict that Brexit will reduce FDI inflows into the UK by 22% [1] as firms lose access to the Single Market and face rising co-ordination costs. One of the key attractive features of the UK for investment has been the role it plays as a ‘gateway’ for firms to Europe. Through Brexit (and particularly a ‘hard Brexit’), however, many of those ties would be severed, reducing the UK’s attractiveness as a destination for FDI. An imperative for policymakers and firms is to now understand what the impact of a predicted downturn in FDI will have on the UK economy. More specifically, within a ‘knowledge economy’, what will be the impact of a reduction in FDI on UK innovation?

There are a number of potential ways FDI can impact innovation. When foreign firms invest in a host economy domestic firms can be exposed to superior technologies, increased competition can induce innovation in order to remain competitive, knowledge embodied in skilled workers can be circulated through worker mobility, and linkages can occur along different parts of the value chain. However, these can also be restricted, such as through formal intellectual property rights and high wages in foreign firms reducing labour turnover. The ambiguity within these channels suggests an uncertain relationship between FDI and innovation.

Geography of UK innovation and FDI

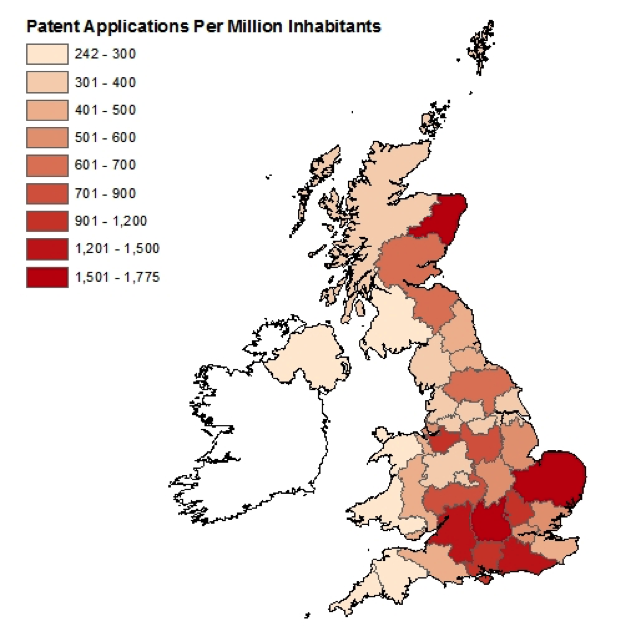

The spread of innovation and FDI is highly uneven across UK regions. Regional innovative activities are difficult to measure because of their complex nature. They are commonly measured by the number of patent applications per million inhabitants. While this cannot capture the full extent of innovative activity, it can indicate an important type of innovation [2]. Using this measure, Figure 1 maps the total innovative activities of UK regions between 2005-2012, showing that innovative activities are highly varied across the UK. The darker the region, the higher its innovation intensity. Innovation hotspots appear in Southern England, such as Oxford, Cambridge, Surrey, Gloucestershire and Bristol/Bath. Inventors in these areas generally file patents in a wide range of technologies including food, clothing, computing, information storage, and electricity. The highly innovative Scottish region of Aberdeen is heavily specialised in technology related to oil drills to serve the oil and gas industry, and houses several research centres and an innovation park. The innovation intensity of London is relatively weak considering the large population. The least innovative regions are found in West Wales, Cornwall, Devon, South Western Scotland, and Northern Ireland.

Data: Eurostat

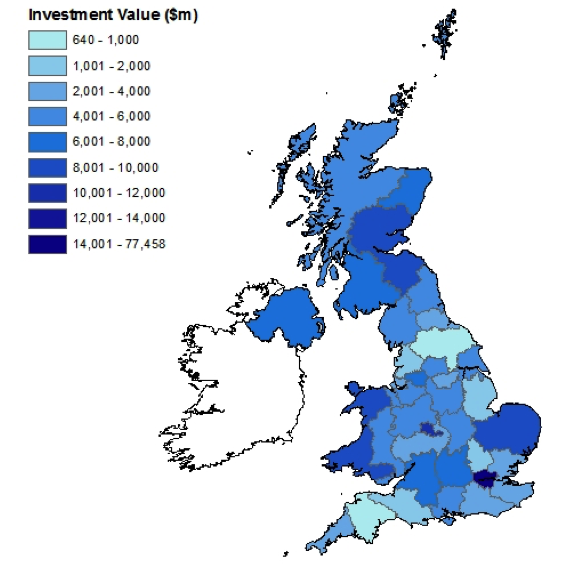

Figure 2 displays the geographical spread of total inward FDI between 2005-2012 (darker areas represent higher levels of FDI inflows). London is a large investment magnet attracting around 30% of total inward FDI. The West Midlands is the next biggest recipient of FDI as foreign firms locate manufacturing and financial services activities in Greater Birmingham. Large FDI flows also go to Eastern Scotland, West Wales and East Anglia. Parts of South Western and Northern England are largely cut off from FDI flows with North Yorkshire and Devon receiving very little investment.

Data: fDi Markets

The mixed geographies of innovation and FDI suggest varying abilities of regions to produce new ideas and to attract foreign firm investment. This begs the question: can regions use the attraction of FDI as a means to become more innovative? The answer to this question lies in estimating the overall regional impact FDI has on innovative activities.

Impact of FDI on innovation

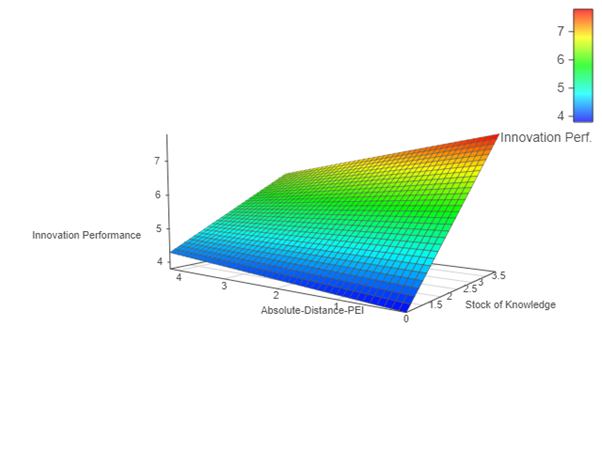

Looking at a data set spanning 36 UK regions between 2005 and 2012, one can shed light on whether FDI has an important impact on the innovation of UK regions. The regional level is an appropriate level at which this relationship should be explored as many knowledge exchanges require local interactions [3]. Through conditional correlation analysis, three key insights emerge:

First, regions that invest in R&D and skills development and are more sectorally specialised have stronger innovative capabilities than other regions, while the extent of agglomeration in a region is not correlated with the innovative activities of a region. These regional characteristics can provide some explanation as to why innovative performance varies so much across UK regions.

Second, after considering the regional characteristics, regions that receive more FDI tend to be more innovative. As foreign firms invest in regions and locate subsidiaries, there are certain mechanisms through which knowledge is exchanged, leading to a greater amount of innovation being produced in the region. The conditional correlations show that the presence of foreign firms may positively influence the regional innovative capacities. This could be through any of the channels previously mentioned, such as the mobility of skilled workers from foreign firms to domestic firms, or the demonstration effect as domestic firms are exposed to and learn from the technological capabilities of foreign firms.

Third, FDI appears to have an even greater impact on innovation in regions with mid- to high-intensity research and development (R&D). Regions with greater R&D expenditure are thus more conducive to the positive effects that come from FDI that will boost innovation, as these regions are likely to be equipped with technological capabilities that maximise the gains from FDI. No other regional characteristics appear to augment or diminish the impact of FDI on innovation.

Key lessons

Regions have different innovative capabilities. By attracting FDI, regions can improve their innovativeness and develop innovative capabilities. Moreover, FDI boosts innovation to a greater extent in regions with strong levels of R&D. Regions, particularly those with high R&D intensity, should therefore be open to foreign sources of knowledge and technology. This goes beyond traditional policy tools of R&D and skills upgrading to improve the innovativeness of a region. Whilst these are important, there is also a significant role to be played by foreign firms that invest in UK regions.

As uncertainty continues to develop over the UK’s future relationship with the EU, and as the rhetoric of a ‘hard Brexit’ remains prevalent, the recent Brexit vote poses a threat to the UK ‘knowledge economy’. Regions in the UK experience innovation benefits as foreign firms invest. Many of these benefits are likely to be foregone if the predicted reductions in FDI inflows become the reality. It is therefore evermore paramount that the UK continues to compete for investment. That starts by opening the door, not closing it.

This post is based on a leading dissertation from the MSc Local Economic Development programme at LSE. It represents the views of the author and not those of the GILD blog, nor the LSE.