Perceptions of poverty, wealth, and social mobility underpin policy preferences about redistribution in Mexico and beyond. But Mexicans’ desired level of equality is inconsistent with the contribution that they are willing to offer, especially at the top end of the scale. Instead of being seen as a burden, taxes should be understood as an investment in an inclusive, prosperous, and fair society, writes Alice Krozer (Colegio de México).

Perceptions of poverty, wealth, and social mobility underpin policy preferences about redistribution in Mexico and beyond. But Mexicans’ desired level of equality is inconsistent with the contribution that they are willing to offer, especially at the top end of the scale. Instead of being seen as a burden, taxes should be understood as an investment in an inclusive, prosperous, and fair society, writes Alice Krozer (Colegio de México).

If donating part of your income would instantly do away with poverty and inequality in your country, how much would you be willing to sacrifice? For most Mexicans, the answer to this question seems to be “not a lot”.

According to results from our recent survey on perceptions of inequality and social mobility in Mexico, average willingness to contribute hovers at around just 10% of income, which is significantly lower than in other countries.

However, in the same survey people also indicate that this lack of generosity is diametrically opposed to another of their interests: Mexicans actually want greater equality. Instead of the high-end Gini coefficient of 0.5 that they currently have, they would prefer a more moderate Gini of 0.3 – something like the level in Canada. Half of our participants in Mexico even put their ideal distribution at a level we might find in Finland, which has a Gini score of just 0.2.

These results reveal a paradox: participants don’t like inequality, but neither do they want to pick up the tab for getting rid of it. In other words, Mexico dreams of being like Finland, or at least Canada, but without being Finnish or Canadian. Income “donations” – more commonly referred to as taxes – are one of the most efficient ways of reducing the gap between actual and desired inequality, so it is worth exploring what makes this inclination so weak, especially amongst those whose contributions could make the most difference: the wealthy.

Inequality in Mexico

The context of our study is important. Although inequality is a problem for most countries, Mexico has some of highest levels of income inequality and lowest levels of social mobility in the whole world. Using current household income, the ratio of decile 10 to decile 1 is 18.3. With an income Gini coefficient above 0.5, only 3% of those born in the lowest quintile will move up to the top, and only 2% from the top quintile will end up at the bottom, with little change over time in recent years.

This social rigidity means that most people born into situations of poverty will remain poor throughout their lives, and the same is likely to be true of their children. Conversely, those born into wealth will keep their privilege for generations. Over time, the economic, social, and spatial realities of their respective environments diverge even further. And research has amply demonstrated that context shapes perceptions: where contexts differ, so do perceptions.

This is important because our policy demands and redistributive preferences are shaped by what we believe the aggregate “reality” looks like. This tends to be based on our immediate context, which will not necessarily reflect the truth of the situation. This subjective experience of inequality and social mobility affects political behaviour and policy preferences, which in turn affect objective inequality and social mobility outcomes.

Perceptions of inequality in Mexico

Mexicans’ general perception of poverty and inequality is not too far from observed levels. The average perceived percentage of poor people within the population is 59%, which is higher than the 48.8% registed by official measures (based on a monthly income of less than MXN $2,548/USD $280 at purchasing-power parity, or PPP). Inequality, meanwhile, is estimated to be just above 0.5 Gini points.

The author also presented her research on perceptions of inequality in Mexico as part of the 2021 LSE Festival on Shaping the Post-COVID World

However, Mexicans significantly overestimate the income of the rich, their proportion of the population, and their social mobility. Based on a threshold of MXN $38,248/USD $4,250 PPP per month, the average perceived share of rich people is 35%, but the true percentage of the population above that threshold is only around 0.6% according to household surveys. Social mobility, meanwhile, is also greatly overestimated at 30%.

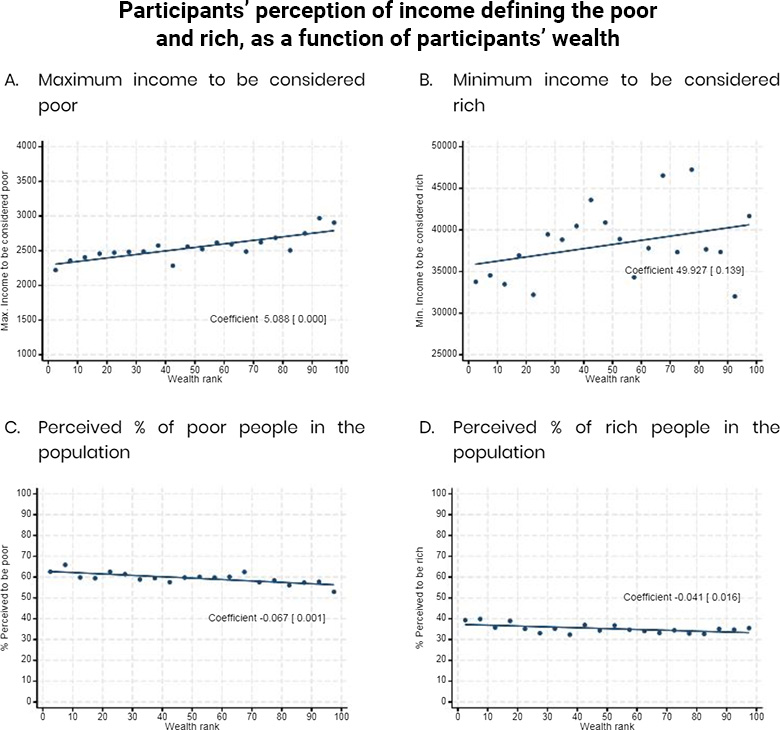

But as the graphs below reveal, these biases are not randomly distributed throughout the population. Poorer individuals estimate higher proportions both of the poor and the rich than do richer individuals. Richer individuals, meanwhile, propose higher thresholds for poverty and especially for wealth. For instance, the “rich” threshold is set below MXN $35,000 by individuals in the first quintile, whereas those in the 65th-80th percentile put it at roughly MXN $47,000. This means that although individuals from both ends of the distribution find inequality to be (too) large, the distributional shape that they perceive is fundamentally different. For the poorer, income is polarised between a huge low-income majority and a relatively large high-income group, whereas the richer describe a more gradual distribution that climbs to a higher level at the very top.

Perceptions of inequality and willingness to contribute

Levels of tolerance towards differences between the rich and the poor (i.e. redistributive preferences) are anchored in popular conceptions of these groupings, and thereby also of inequality. If we map out the shape of inequality as people describe it, we find that perceptions of inequality, desired distribution, and redistribution preferences are heterogeneous across the wealth distribution.

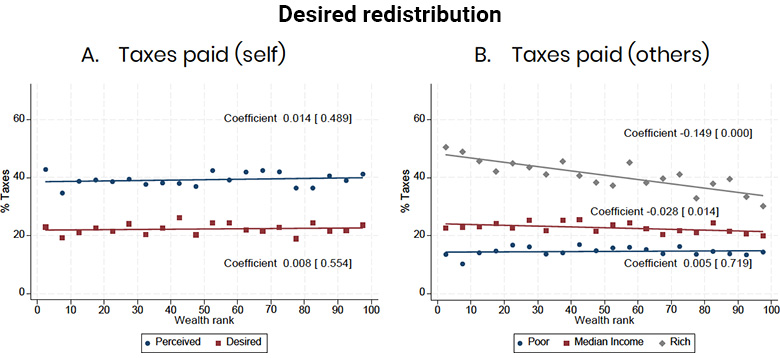

Neither is willingness to take responsibility for the costs of inequality distributed equally. While the poorest say that they would be willing to hand over 15% of their income, the richest offer barely 7.5% of theirs. Beyond the difference vis-à-vis other countries then, what really stands out is the parsimony of those earning incomes worth 25 to 700 times the income of someone on the poverty line, with this richer group willing to pay just half of what those in poverty would be willing to contribute.

The poor are not only more generous, they also want a more progressive system of redistribution than the rich. Independently of their wealth, Mexicans believe that 40% of their income goes on taxes, where in fact the average is half that. Nevertheless, the desired top tax rate exhibits a clear downward slope when plotted against participants’ wealth. And the difference is significant: while the poorest would like to see a 50% top rate, the richest themselves would prefer that the richest pay just 32%.

And if people got what they wanted?

So, is the degree of tax progressiveness that people want – with average desired tax levels of 14% and 41% for low- and high-income earners respectively – consistent with their preferred level of equality? Far from it.

Even before factoring in corruption, the 16% share of public sector income accrued from taxes in Mexico is the lowest level in both Latin America and the OECD, amounting to just half of average amongst members of the latter. But implementing taxes at the desired levels would barely change inequality (decreasing the Gini score to 0.48) due to a vast overestimation of proportion of “rich” people who would be paying at the desired higher rate.

Today, progressive taxes on wealth, inheritance, and capital are non-existent in Mexico. Moreover, the Mexican state’s limited capacity for tax collection and redistribution is compounded by the redistributive weakness of Mexico’s fragmented and hierarchical welfare state. To change this situation, the discourse around taxation needs to be reversed. Instead of seeing taxes as a burden, they must be understood as an investment in an inclusive, prosperous, and fair society.

How much would you be willing to sacrifice for that?

Notes:

• The views expressed here are of the authors rather than the Centre or the LSE

• This post draws on Alice Krozer’s co-authored research paper Perceptions of Inequality and Social Mobility in Mexico (Agence Française de Développement, 2020)

• You can watch the author’s presentation on this topic at the 2021 LSE Festival on Shaping the Post-COVID World via LSE’s YouTube channel

• Please read our comments policy before commenting

I disagree with the spirit of the article, based on both hard data and personal experience living in Mexico.

“Mexico dreams of being like Finland, or at least Canada, but without being Finnish or Canadian.”

This statement seems to suggest that being Finnish or Canadian is analogous to being generous or caring, and that Mexicans are too stingy to help themselves. And it seems this viewpoint is supported solely based on the fact Mexicans would only be willing to part with 10% of their income to improve poverty and social mobility. 10% is considered low by comparing to percentages from other countries, presumably Finland and Canada being examples.

This logic is flawed in that 10% of income for a Mexican is far more critical than 10% for Finnish or Canadians – Mexicans don’t _have_ more than 10% of disposable income. 90% of Mexicans earn less than 20k pesos per month. To compare apples to apples, looking at PPP, Canada and Finland are both around $50k per capita. Mexico is below $20k. If an average Mexican gives 10%, they’re now living at the level of a Canadian or Finn giving 60%. Taking any more money and we’re now talking about your average citizen not being able to pay for basic needs on their own.

The comparison by percentages of income here are absurd. And the suggestion that Mexicans don’t care, are stingy, or are somehow lesser than Canadians and Finland, or wish they could be like them, is misplaced. Mexican society is far less materialistic than its northern neighbors and European friends, they are minimalistic. Most people are happy to live without excess here. People take care of one another, and the majority of that comes from direct social interaction, not a bureaucratic society funding a big government.

What are some other metrics of generosity and care for the community, that may be more accurate than % of income people are willing to give towards building equality? Well, perhaps, how little buying power is one willing to live with to ensure a more fair society (my premise above)? Or how about homelessness and suicide rates? Opiate use?

Suicide Rate/100k pop

———————

USA 14.5

Finland 13.4

Canada 10.3

France 9.7

Germany 8.3

UK 6.9

Mexico 5.3

Israel 5.2

Opiate use (annual %):

——————–

USA 1.04

UK .73

France .52

Canada .4

Israel .4

Germany .22

Finland .1

Mexico .1

Homeless/10k pop | ave annual temp C

————–

Germany 81.9 | 8.4

UK 57.2 | 8.45

France 45 | 10.7

Sweden 36 | 2.1

Mexico 35.4 | 21.0

Israel 29 | 19.2

USA 17.7 | 8.55

Canada 10 | −5.35

Finland 8.8 | 1.7

“Even before factoring in corruption, the 16% share of public sector income accrued from taxes in Mexico is the lowest level in both Latin America and the OECD”. So, the suggestion is that Mexicans ought to pay more taxes? In the hopes that their said corrupt government will perhaps improve the metrics above more than what people are already managing on their own, with their own money and time? I disagree with advocating for increased government funding _before_ decreasing systemic corruption. In my personal opinion, the best way to limit corruption is to limit its funding.

Looking at the broader picture, there’s a strong case that Mexicans really have no need to envy Canada or Finland. In my experience, most people here truly don’t.

Hi Kevin,

Thanks for the additional viewpoints and information.

I was thinking of sharing this article with my Mexican partner, since we both discuss inequality and taxes a fair bit. I agree the article could come across as a bit patronising. I like to think I would’ve worded the article more carefully.

I think a key point is that people are not willing to pay more in taxes when they don’t believe their taxes will be spent in line with their preferences. People in countries like Finland have greater trust that their tax money will be spent on society. In my experience, people in countries like Mexico have very little trust in this happening. They feel it will go to line the pockets of politicians.

I think this last point is a really important consideration, which you made in your comment. However, I would say it’s a bit defensive to respond with a list of very loosely related stats (suicide rates), in what appears to be an attempt to find flaws in the Western systems (and the weather, too). The topic of the article is redistribution, and if you try to map redistributive policies to Suicide rates globally – there is no consistent trend.

Lastly, I would say ‘envy’ is a really strong word you use. I know many Mexicans, and I can say comfortably that some jump at the opportunity to move to places like Canada, while some do not. In my experience, the 0.1%ers I know who have luxurious lifestyles in Monterrey (and holiday annually in Aspen) don’t intend on leaving. It’s usually people concerned with: 1. Sexism or 2. Security or 3. Homophobia or 4. People who don’t have luxurious lifestyles, who very much consider leaving. Here, I’m referring to my friends who are straight women, gay men, or not fabulously rich.

There are many wonderful things about Mexico, but unfortunately Mexico is not endowed with a state that enables social mobility, and there are certainly (of those able to do so) many who intend on leaving.

Thanks for providing information is very useful to explore the blog about taxes so that people can be aware of all types of returns.