Besides working in more inclusive policies, Latin America will need to develop better intra-regional trading strategies in which countries converge more regionally, writes Irene Mia (International Institute for Strategic Studies).

Lea este artículo en español

After a devastating 2020, a tentative recovery seems to be taking hold of Latin America. Shortcomings in the prevailing growth and development paradigm and ways to enhance its sustainability and resilience to future shocks are increasingly moving to the centre of the political debate. The coronavirus pandemic was the latest powerful reminder of the need for structural reforms to enhance regional productivity and insertion into value-added supply chains. Covid-19 also highlighted the urgency of more inclusive policies to shrink the large informality pool, expand social security networks and access to basic services, including education and healthcare.

Popular dissatisfaction with the status quo, which had already been simmering across the region, (with a periodical outburst of social unrest) will continue. The devastating socio-economic legacy of the pandemic will pressure governments to act or be voted out in any upcoming election. Trade liberalisation and openness, already under attack amid a certain globalisation fatigue and appetite for inward-looking policies, may well become yet another casualty of the pandemic. Old and new governments may succumb to squarely focusing on domestic challenges and raise barriers to the rest of the world. This, at a time when more trade (especially intra-regional) would be needed to boost recovery and create more competitive and resilient economies. There seem to be some headwinds to trade liberalisation on the region’s horizon, but so are some powerful tailwinds too.

Trapped in a trade war

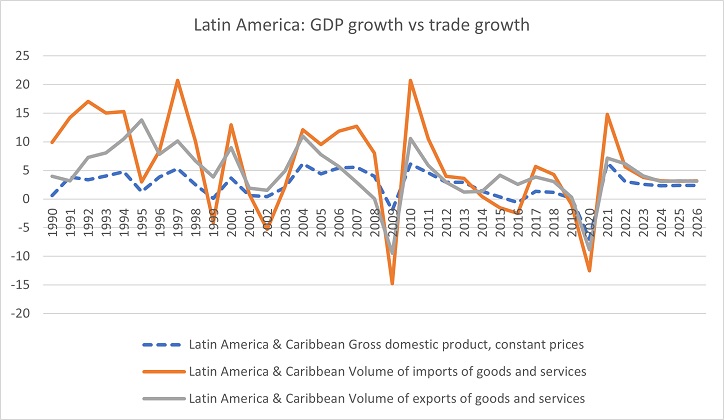

Protectionism was already on the rise globally before the pandemic stroke. Trade volumes barely track GDP growth amid no meaningful major tariff liberalisation in the last two decades, increasing non-tariff barriers (mostly export restrictions and subsidies) being imposed and an accelerating US/China trade war. These trends were also visible in Latin America, as shown in figure 1.

Although global and Latin American trade has recovered from the inflexion point of 2020, the disruptive impact of the pandemic on supply chains, logistics and availability of goods has increased the appeal of on-shoring the production of sensitive goods (especially pharmaceuticals, semi-conductors, and critical raw and technology inputs). Concerns about environmental sustainability could add to this trend, with similar implications on global supply chains and potentially more trade diversion.

The trade and tech war between the US and China continues to loom as another major risk to the trade outlook. Latin America may find itself in a very delicate situation should this further deteriorate considering China’s massive role in the region’s trade and tech infrastructure fabric. China is already Latin America’s first trading partner except for Mexico, and Huawei has been very much involved in the rollout of 4G networks across the region. In an extreme scenario, the world may be forced to develop parallel supply chains for China and the US, with different technology standards. Latin Americain particular may face trade and other sanctions from either China or the US for excluding or refusing to exclude Huawei from its 5G development, with negative implications on trade and investment flows.

Finally, a change in popular mood away from openness to the world and towards domestic issues, coupled with demands for a bigger role of the state, especially post Covid-19, suggest trade liberalisation may not be the major focus for governments going forward.

A recent Ipsos Global Advisor poll clearly highlights the challenge: while Latin American countries are on average more positive than the rest of the world on trade liberalisation, they are also the ones whose approval for globalisation has dipped the most since 2019.

A new appeal for on-shoring

The rapid spread of the pandemic highlighted the downsides of interconnectedness and globalisation, but the response to the latter has similarly made clear their benefits. Developing vaccines in isolation would have taken much longer or been impossible for most countries in the region. Producing and distributing them has required a major global effort to source their components and ensure their timely provision.

The on-shoring or near-shoring trend can also play in favour of the region, considering its geographical closeness to the US market, its competitive labour cost and fairly good business and intellectual property environment. The complex network of regional integration agreements across the region could also facilitate South America’s integration with the Northern American value chains, through Mexico and through links between the Pacific Alliance and Mercosur. Of course, major obstacles stand in the way to closer economic integration between North and South America, including underdeveloped infrastructure, lack of qualified labour force and economic diversification. These are longstanding shortcomings that will need to be addressed anyway to ensure more sustainable growth in the aftermath of the pandemic.

The increasing digitalisation of custom procedures imposed by Covid19-related lockdowns has also resulted in rapid progress in trade facilitation in the region, promoting small and medium enterprises (SMEs) participation and helping trade flows going forward.

“Smart” trade liberalisation

Trade will be an important pillar of the region’s economic recovery and more notably, strategic trade liberalisation and integration could boost Latin America’s competitiveness and provide solid foundations for a more inclusive and resilient economic model. This would entail a bigger focus on intra-regional trade, which is key for the region’s economic and export diversification away from commodities given its high manufacturing intensity. Economic diversification would in turn facilitate insertion into North American supply chains. Lastly, intra-regional trade’s higher-than-average participation of small and medium enterprises makes its promotion strategic for overall microeconomic efficiency and better income distribution.

Since 2014, Intra-regional trade has been on a declining trend, falling to 12% of total regional trade in 2020, even less than the registered in the early 1990s amid a fragmentation in regional integration efforts, infrastructure deficiencies and a bigger focus on extra-regional trade, particularly with China. The latter is dominated by commodities exports, therefore less conducive to a competitive transformation of Latin American economies. The very little trade interdependence between Brazil and Mexico, the two biggest economies in the region is a particular concern. Therefore convergence between the Pacific Alliance and Mercosur would be important to reinforce regional value chains and trade. And so it would competitiveness enhancing policies (including in education, innovation and further cutting red tape) and increasing (public and especially private) investment in connectivity from the current dismal levels (1.3% of GDP according to ECLAC).

The current Covid-19 socio-economic crisis, coupled with an increasingly popular discontent with the status quo, may just be the right incentive for radical change. Given the shrinking room for manoeuvre of cash-strapped governments across the region, a strategic agenda focusing on competitiveness and “smart” trade liberalisation may offer the best probabilities of success.

Notes:

• The views expressed here are of the authors rather than the Centre or the LSE

• Please read our Comments Policy before commenting

• Banner image: Larry Syverson (CC BY-SA 2.0)