In March 2018, the Ministry of Housing, Communities and Local Government published the report The Incidence, Value and Delivery of Planning Obligations and Community Infrastructure Levy in England in 2016-17. LSE London’s Christine Whitehead was one of the authors alongside Alex Lord, Richard Dunning, Bertie Docerill, Gemma Burgess, Adrian Carro, Tony Crook and Craig Watkins. The cohort of authors was made up of academics from various UK universities.

The report is the fifth in a series of assessments of the revenues achieved through S106 planning agreements and now the Community Infrastructure Levy (CIL). Together these make up the system of developer contributions used to secure funding for community services, notably affordable housing, and infrastructure and to offset any costs to the community of the development.

The study had four specific objectives: 1) update the evidence on the current value and incidence of planning obligations, 2) investigate the relationship between CIL and S106, 3) understand negotiation processes and delays to the planning process, and 4) explore the monitoring and transparency of developer contributions. The findings have been instrumental in determining changes in the revised National Planning Policy Framework (NPPF) (which is due to be published this month) and will impact on decisions around development contributions to be made in the Autumn 2018 budget.

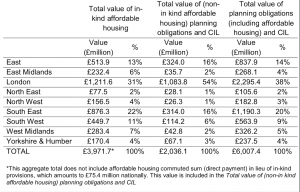

The figures in this report show, against many commentators’ expectations, a significant increase in the value of developer contributions since the last valuation in 2011/12: up 61% from £3.7bn to £6.0bn (an increase of 50% after adjusting for inflation). The £6.0bn figure is significant when compared to other sources of government income: e.g., vehicle excise duty (£5.5bn); the climate change levy (£2.1bn); and air passenger duty (£3.2bn). These contributions vary greatly across regions being heavily concentrated in London and the South East where nearly 60% of the revenues were concentrated. At the other extreme the North accounts for little more than 5% of all revenues (see Table 1 for specific figures by regions). Developers understand that their contributions are a cost of doing business but note that there is wide variability in how the system is applied, even between neighbouring LPAs. The qualitative evidence suggests the scale of the ‘take’ is indeed mainly to do with the extent to which an authority clarifies exactly what will be required in the local plan and their capacity to monitor and enforce delivery.

The two most important distinctions between S106 and CIL are (i) that S106 for affordable housing only applies to residential development and is generally more important for larger sites while CIL in principle applies to all developments; and (ii) that S016 is a site specific negotiated contractual agreement between the local authority and the developer, while CIL is a tax charged at a defined rate which pays towards a list the infrastructure investments which will be delivered in due course. In principle therefore CIL looks to be more certain from the point of view of the developer bidding for land. However the rate can change many times during a large development while it is uncertain when the developer will see the infrastructure necessary for the development. From the local authority’s point of view CIL is easier to implement but there are so many exemptions (e.g., custom build; charitable developments including most affordable housing) it is often felt not to be worthwhile. More generally CIL works better on smaller sites while S106 is seen as necessary for large sites where site specific issues dominate. CIL and S106 together have provided some LPAs with greater flexibility to adapt to the local context, as is reflected in Greater London where CIL has been effective in generating large increases in revenues. But equally there is little evidence that it has helped increase revenues in lower demand areas especially in the North.

The report concludes by stressing the importance of greater communication with the local community who is often all too aware of the costs to them of new development but who rarely have much idea of the benefits. The concern that planning and the processes by which planning obligations are delivered acts as a block to development may in part be addressed by better information dissemination efforts that make the development and planning processes easy to understand. Overall, this report helps to clarify the role of planning in creating appropriate conditions for development and, through policies on developer contributions and provides evidence on how better to harness the power of the development industry to produce stable and sustainable communities.

Click here to download the report from the Housing, Communities and Local Government Committee.

1 Comments