by Ahmed Tabaqchali

A report in a major US publication that the US Treasury Department and the Federal Reserve Bank of New York banned 14 Iraqi banks from conducting cross-border dollar transfers rekindled misconceptions, and conspiracy theories that the Central Bank of Iraq (CBI)’s ‘Foreign Currency Selling Window’ is facilitating the siphoning of dollars to Iran, money laundering, and currency smuggling.

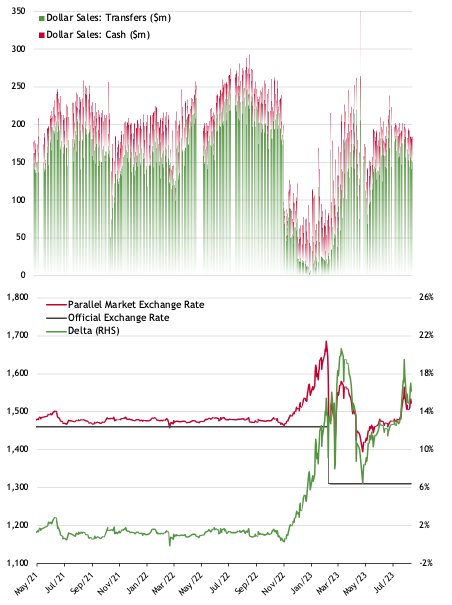

In almost a replay of the dollar supply-demand mismatch following the introduction of the CBI’s enhanced beneficiary disclosure requirements for cross-border dollar transfers in November 2022, the parallel market premium (delta henceforth) over the official exchange rate of the US dollar ($, dollar henceforth) versus the Iraqi dinar (IQD, dinar henceforth), widened from the 13 percent at which it had stabilised in recent weeks (Figure 1). Unlike then, dollar sales at the ‘Foreign Currency Selling Window’, better known as the ‘Dollar Auction’ (auction henceforth), did not drop meaningfully, indicating somewhat different dollar supply-demand dynamics at play. This was mainly because the 14 banks that were banned from the auction by the CBI on July 20th, following audits of their cross-border transfers in 2022 (pre-November), have played only a limited role in the auction since then.

Figure 1: Volumes in the Auction and Dollar/Dinar Exchange Rate

The dollar supply-demand mismatch and the increase in the delta, were technically caused by the enhanced beneficiary disclosure requirements and the CBI’s banning from the auction of four banks in November and the 14 banks in July. But, are fundamentally a consequence of the structural imbalances in the economy necessitating the auction’s role as a supplier of dollars for the payment of the private sector’s imports, and the issues that arise from the nature of a largely informal economy whose consumption of goods and services is mostly met by imports. These are addressed in an upcoming research paper entitled ‘A Fistful of Dinars: Demystifying Iraq’s Dollar Auction’.

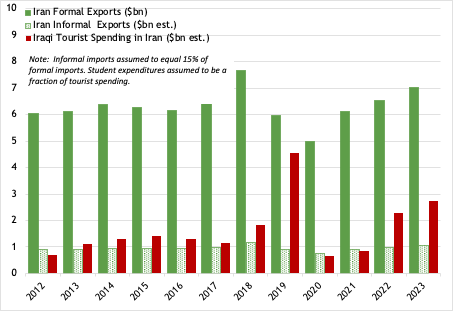

This article, in a similar vein, addresses the payments for Iraq’s private sector’s – people, merchants, and businesses – imports of goods and services from Iran, in which the goods component averaged $6.3 billion a year in 2012–22. The controversy over the supposed ‘siphoning of dollars’ to Iran doesn’t factor-in the payments of these imports, which hinders both informed debate and evidence-based policy making. To boot, the private sector’s imports and payments are often mixed and confused with Iraq’s official imports, and payments for gas and electricity.

Private Sector’s Imports of Goods and Services from Iran

Iraq’s private sector imports of goods from Iran consists of formal imports of goods (solid green bars, Figure 2), followed by informal imports of goods, that are neither reported nor measured, taking place either as smuggled goods or goods bought directly by Iraqi merchants in their travels to Iran (referred to locally as ‘suitcase merchants’ or “تجار الچنطة”) (dashed green bars, Figure 2). While Iraq’s private sector imports of services from Iran are mostly the spending by Iraqi tourists (solid red bars, Figure 2) who accounted for about 32 percent of total tourists to Iran in 2012–21. Other service imports are expenditures of Iraqis studying in Iran’s universities and in its religious seminaries, with reports of 75,000 Iraqi students in Iran’s universities in March 2023, and 60,000 in July 2022.

Figure 2: Iraq’s Imports of Goods and Services from Iran 2012–22

All travelling Iraqis are allowed to exchange a set amount of dinars into physical dollars at the official exchange rate through the auction, accessed at retail counters of banks and money exchange houses. However, some of these physical dollars find their way back to the domestic market. In late 2018, the CBI prohibited all commercial transactions with Iran in dollars, including the sale of physical dollars to Iraqis travelling to Iran. Subsequently, Iraqi tourists and suitcase merchants would pay for their expenditures in other currencies such as the euro or dinar, or in physical dollars acquired domestically at the parallel market rate. Other informal imports would have settled their trade in cash too.

Iraqi private sector’s formal imports of goods from the Iranian private sector, cannot take place without making and receiving payments; as the Iran-Iraq Chamber of Commerce pointed out in early July; ‘The private sector has no problem getting its money from Iraq. Our debts from Iraq are mainly related to government institutions, gas and electricity debts’ The CBI’s 2018 prohibition on using dollars in all transactions with Iran, shifted most payments to the euro, dinar and rial and some were conducted as barter trades. Irrespective of the currency used, the dollar likely was the medium of currency conversion, and such payments were unlikely to have been made via the banking system given the isolation that Iranian banks operate under. Therefore, an alternative opaque payment structure would have been used, however, there are two ways in which this structure could be made more transparent. The first is through the statement by Iraq’s prime minister, his economic advisor, and the CBI’s officials, which shed light on some of the workings of wire-transfers in the auction, and which essentially imply: (1) most wire-transfers were based on false invoices between a sender and a recipient of funds, made possible by complicit local banks, and therefore did not meet the new enhanced beneficiary disclosure requirements; and (2) the high premium of the parallel market exchange over the official exchange rate (around 13 percent at the time) is due to the domestic demand for physical dollars to finance trade with Iran, which cannot meet the enhanced beneficiary disclosure requirements. The second way is the lightly regulated Hawala system, as used by private sector dealings with Iranian counterparts since sanctions increasingly isolated Iran’s banking system.

Under such a hypothetical payment structure, an importer pays dinars (equivalent to dollars at the parallel market rate) to a Hawaladar (hawala broker) in Iraq, who in turn instructs a Hawaladar counterparty outside Iraq (not necessarily in Iran) to pay the Iranian exporter in equivalent local currency. This is recorded as a debit and credit accounting entry between the Hawaladars, who would eventually settle this and other similar transactions, by transferring funds via the auction. This would be by creating a fictitious import-export invoice, followed by the Iraq based Hawaladar depositing dinars in a local bank, who in turn deposits them at the CBI. These are then processed as a dollar wire-transfer transaction in the auction exchanged at the official exchange rate. Subsequently, the dollars are deposited into the local bank’s account held at a bank outside Iraq, and further transferred to the counterparty Hawaladar in equivalent local currency or in dollars. Essentially, this transfer of dollars though the auction is between the Hawaladars, and not between the Iraqi exporter and Iranian importer who settled their transaction earlier.

Conundrums

The introduction of the new CBI measures in November effectively closed the door for such wire-transfers in the auction, and as a result, for some time physical dollars will likely be sought within Iraq to pay for the private sector’s imports from Iran, keeping the delta high. This is, however, not a viable solution, as the volumes of cash funded imports – due to the logistics of sourcing and transporting cash – would be much smaller than the hawaladar route funded exports, and would also be costly given the high delta. The high delta will similarly deter dollar cash transactions for Iraqi tourists and suitcase merchants, and the same likely applies for the informal trade.

On the hand, the lopsided nature of Iraq’s trade balance with Iran – especially in goods with Iraq’s exports to Iran accounting for fraction of its imports from Iran (in 2022: Iraq exported about $0.2 billion to Iran, and imported about $9.9 billion) – means that Iraq cannot use the dinar or the rial to settle its trade with Iran as it started doing in yuan in settling its trade with China in late February. Consequently, a third currency is the only means of conducting cross-border trade in goods and services between the two.

The condunrum, is that Iraq’s infinitesimal traded goods and services sector, and thus its overwhelming dependence on oil exports implies that oil exports are its major source of a third currency. Implying that while these are traded in dollars, that dollars –directly or converted to other currencies– are the means with which Iraq settles its imports of goods and services from the outside world.

Final Thoughts

While sanctions continue to isolate Iran’s banking system from the rest of the world, and the high cost of the delta as well as the CBI’s intensified measures against the abuses in the parallel cash market, mean that Iraq’s imports of goods and services will either drop materially, or an alternative route is found.

An alternative that might emerge in time, is the adoption of a third currency other than the dollar to settle transactions. But that route is long and fraught with the conundrums of the need for both of Iraq and Iran to firstly have their own balanced trading relationship with the third’s currency’s trading partner; and secondly that these balanced trading relationships should generate balanced surpluses to allow the two to use the third currency in their own transactions in goods and services.

Finally, as an unintended or an intended consequence, the enhanced beneficiary disclosure requirements and the CBI’s new requirements for banks to significantly increase their capital, has closed the rent-seeking opportunities for those who have access to the preferential exchange rate to the detriment of those who do not.

Updated in March 2024: Recent upcoming work by the author on the subject, was helped by the availability of more granular data from The Islamic Republic of Iran Customs Administration (IRICA), that while mirroring the data used as provided Tehran Chamber of Commerce, Industries, Mines and Agriculture (TCCIMA), yet provides far more granular data such as descriptions of exported items, and monthly export data. This allowed the removal of gas imports form the figures, that were inserted with other goods (as will be explained in the upcoming piece) and thus the updated data reflects just the private sector imports which is the subject of this blog.

[To read more on this and everything Middle East, the LSE Middle East Centre Library is now open for browsing and borrowing for LSE students and staff. For more information, please visit the MEC Library page.]