Brian Bell, Nick Bloom, Jack Blundell, and Luigi Pistaferri estimate how the ongoing pandemic may impact earnings by age group, gender, and firm size. The data suggests that young men working in small firms could see earnings losses of 8-9%, with older women in large firms seeing little or no change.

Brian Bell, Nick Bloom, Jack Blundell, and Luigi Pistaferri estimate how the ongoing pandemic may impact earnings by age group, gender, and firm size. The data suggests that young men working in small firms could see earnings losses of 8-9%, with older women in large firms seeing little or no change.

The Covid-19 pandemic is turning into a global recession – probably the biggest drop in economic activity since the Great Depression of the 1930s. The latest forecasts put UK and US GDP both down by about 10% in Q2 2020 (40% on an annualized basis). GDP is an important measure of economic wellbeing, but the key way workers feel aggregate fluctuations is through their pay packets. In this piece, we will draw on our ongoing work on the impact of aggregate shocks on individual workers to analyse the likely effects of the current crisis on aggregate earnings, and most importantly to identify groups of workers who are most exposed to aggregate risk.

Our analysis is based on over 3 million earnings observations drawn from more than 400,000 UK workers between 1975 and 2016. We estimate a set of ‘exposure parameters’, which are essentially estimates of how earnings of different type of workers are impacted by changes in GDP. These figures are similar to those estimated in the US and other countries, so these results are broadly applicable.

We assume a plausible year-on-year GDP decline of 10% and predict how the current crisis will affect workers. We stress that this is a period of immense uncertainty and one in which unprecedented policy responses make forecasting difficult. However, we argue that in terms of understanding which types of workers bear the brunt of aggregate fluctuations, it is instructive to investigate past fluctuations in GDP.

On aggregate, feeding a 10% decline in nominal GDP through our GDP sensitivity estimates, we estimate a fall in real weekly earnings of about 3.5%. This would be a significant shock to household incomes. But, as will be shown below, this is very unevenly spread across different workers.

The impact is likely to be worse for younger workers in smaller firms

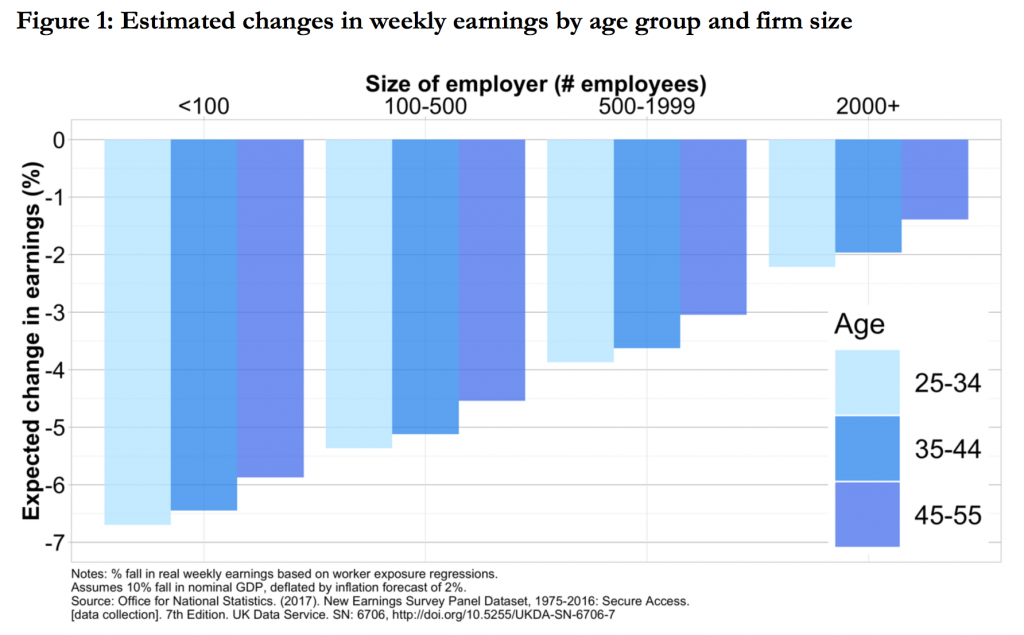

In Figure 1 we plot the estimated changes in weekly earnings by age group and firm size. There is a clear age profile in earnings responses to GDP changes. The earnings of workers under 35 are the most responsive. For these younger workers, on average a 10% drop in nominal GDP corresponds with a 3.8% fall in real weekly earnings. For those aged 45-55, the fall is 3%. Younger workers typically see higher wage growth than older workers, but here we see that this is very much dependent on economic conditions. Even more concerning for the youngest workers is the substantial literature demonstrating a lifetime penalty from entering the labour market in a recession.

We also find that the earnings effect is largest for those employed in smaller companies and it declines substantially with firm size. The pattern is striking but perhaps unsurprising, given that larger firms are likely to have greater access to the liquidity required to smooth over temporary shocks. Workers at smaller firms already tend to earn lower wages. This suggests the ‘large firm wage premium’, the earnings advantage accrued by working at a larger employer, could be set to grow. The firm size effect dominates the age effect, so that even older workers at the smallest firms will see large earnings losses. Taken together, this evidence suggests that a younger worker in a small firm will see earnings fall by about 6.7%, compared to 1.4% for an older worker in a large firm.

Male earnings are typically more cyclical, but this time could be different

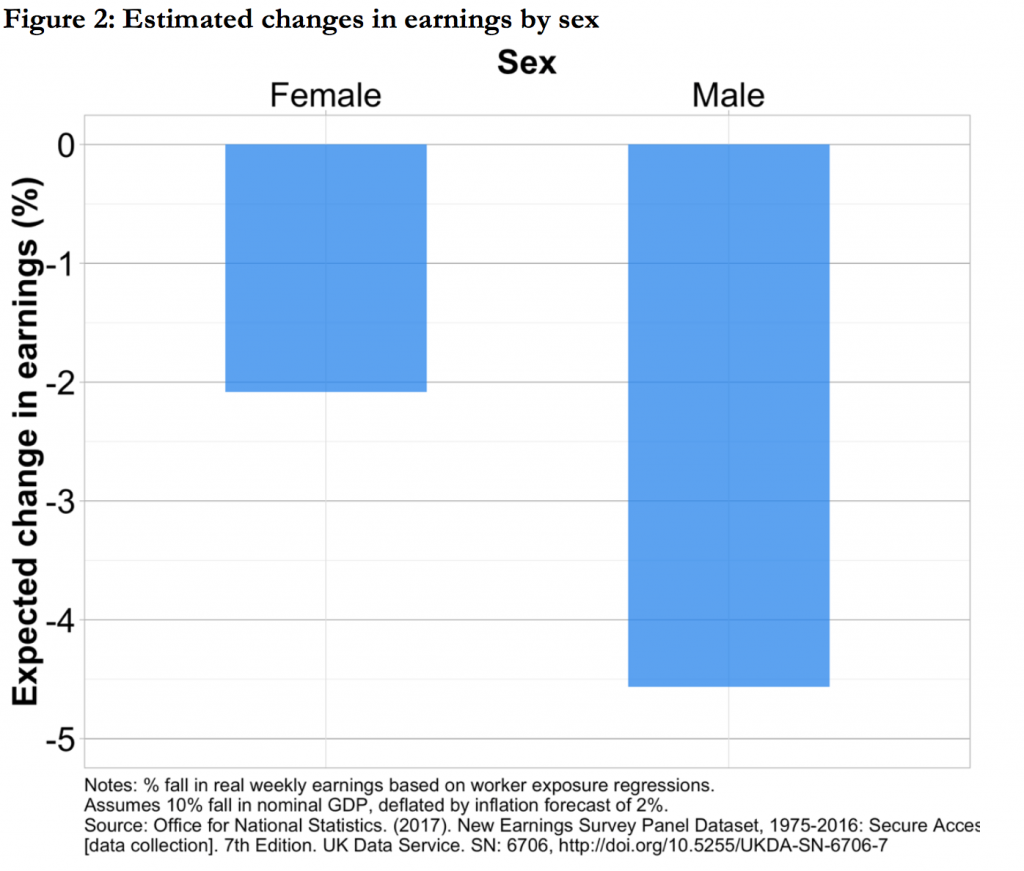

Men and women tend to work in different industries and occupations, work different hours, and are found at different employers. Therefore, it is not surprising that aggregate shocks have different effects by gender. In Figure 2 we demonstrate that historically, female earnings have been less impacted by fluctuations in GDP, in part since they are more likely to work in sectors that are typically less exposed to GDP fluctuations, such as the public sector or the food preparation sector. For men, a 10% drop in nominal GDP corresponds to a 4.6% fall in weekly earnings compared to a 2.1% drop for women.

Here, however, we might expect to see a difference between previous patterns and those stemming from the current crisis. As recent research emphasized, many of the most affected industries in the short-run by the Covid-19 shock, such as hospitality and travel, contain a high proportion of female workers. This stands in sharp contrast to previous downturns, where male-dominated industries such as finance, construction, and manufacturing have borne the brunt of the decline in output. There is also a long-standing literature suggesting that mothers have systematically higher childcare responsibilities than fathers, which can in part explain gender differences in the labour market. With the majority of children now taken out of school, it is possible that this asymmetry could amplify the impact of the crisis on female workers.

Adding it all up

With the above caveats in mind, combining the differences by sex with the firm-size and age results, this suggests that young male workers at small firms could see earnings losses of 8% to 9%, with older women at large firms seeing little or no change in their earnings. While our sensitivity estimates are based on UK data, similar work for the US finds similar qualitative patterns and, if anything, larger magnitudes.

The patterns described above are based on historical data going back 40 years, and do not account for any of the dramatic policy responses being taken today. It is possible that the various forms of government policy responses could have a large influence on the earnings effect of Covid-19. This crucially depends on how credible employers believe support to be, and how easy they find it to access. This is particularly true for small firms, who will likely be forced to reduce wages or lay off workers in the short run, exacerbating the patterns shown above on employer size.

We should note that our data omit self-employed, who could be particularly badly hit – for many have already seen their earnings fall to zero. Moreover, while earnings are important, we do not discuss unemployment effects here. Recent data on Universal Credit claims in the UK and unemployment insurance claims in the US suggest there has been a massive spike in unemployment, so many employees have lost all their earnings.

Finally, traditionally we think of firms insuring workers against large shocks – indeed a large literature in economics shows how firms insulate their employees against market fluctuations. But with a shock as large as the Covid-19 recession this is unlikely to be possible – when firms are facing bankruptcy they may be forced to pass the economic costs onto their employees.

In short, we fear the Covid-19 recession is creating a crisis of inequality: it was large already, it will most likely be even larger by the time the Covid-19 shock runs its course.

_________________

Brian Bell is Professor of Economics at King’s Business School.

Brian Bell is Professor of Economics at King’s Business School.

Nick Bloom is the Eberle Professor in the Department of Economics at Stanford University. He is also the Co-Director of the Productivity, Innovation and Entrepreneurship program at the National Bureau of Economic Research, a fellow of the LSE’s Centre for Economic Performance, and of the Stanford Institute for Economic Policy Research.

Nick Bloom is the Eberle Professor in the Department of Economics at Stanford University. He is also the Co-Director of the Productivity, Innovation and Entrepreneurship program at the National Bureau of Economic Research, a fellow of the LSE’s Centre for Economic Performance, and of the Stanford Institute for Economic Policy Research.

Jack Blundell is an Economics PhD student at Stanford University.

Jack Blundell is an Economics PhD student at Stanford University.

Luigi Pistaferri is Professor of Economics at Stanford University, a research fellow of the National Bureau of Economic Research, CEPR and IZA, the Ralph Landau Senior Fellow at SIEPR.

Luigi Pistaferri is Professor of Economics at Stanford University, a research fellow of the National Bureau of Economic Research, CEPR and IZA, the Ralph Landau Senior Fellow at SIEPR.

All articles posted on this blog give the views of the author(s), and not the position of LSE British Politics and Policy, nor of the London School of Economics and Political Science. Featured image credit: by Fabian Blank on Unsplash.

The distribution is very plausible, but I wonder if the impact on wages might be greater than suggested from past experience. WERS suggested firms suggested that firms used wage cuts and freezes rather than job cuts more extensively in the downturn of 2008-2009 than in previous recessions. The government subsidy schemes may have much the same impact to the extent that some employees will be on 80 per cent of normal wages while still being on the books, though it is a little ambiguous on whether they will be counted as employed in the statistical surveys.